Welcome to this special Breaking Analysis, where we look back and grade ourselves on our 2025 enterprise technology predictions.

This is the time of year when we get a flood of predictions from PR firms and other thought leaders. As you know, we publish predictions every January: theCUBE Research does a set, we do a set with the Data Gang (Tony Baer, Sanjeev Mohan, and the crew), and Eric Bradley and I do our Breaking Analysis predictions. We’ll do those again in January after the new ETR data comes out.

But today is about grading our 2025 calls.

Below we show all of our 2025 enterprise tech predictions in one slide. They range from tech spending (we always do one there), to agentic AI, to cloud, and then markets, data, and AI.

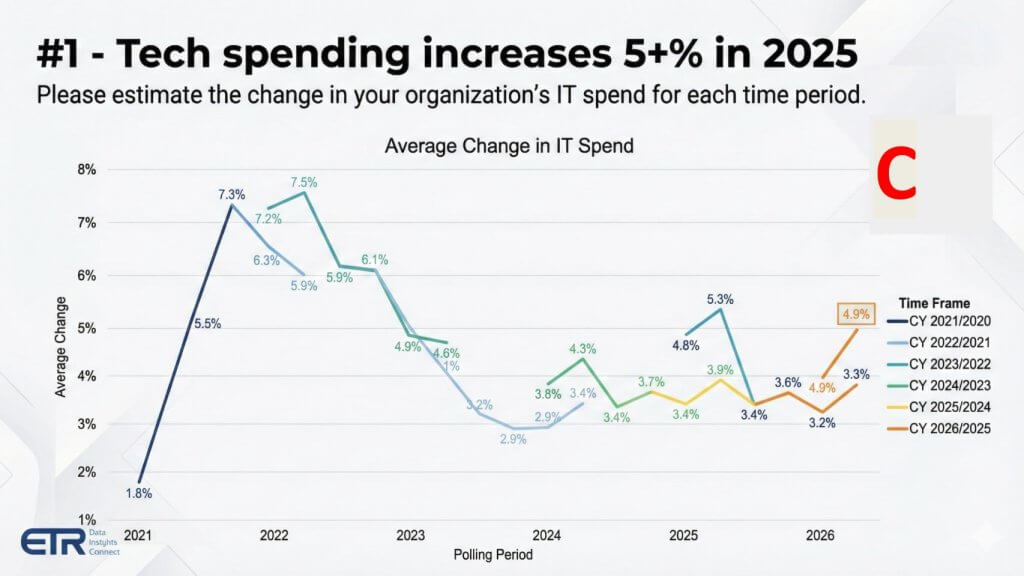

Prediction 1: Tech spending increases 5% in 2025 (Grade: C)

Our prediction was that tech spending increases 5% in 2025. We entered the year with IT decision makers expecting 5.3% growth. But throughout 2025—amid tariff concerns and economic uncertainty—we saw a pretty sharp drop to around 3.4%. Expectations bumped up to 3.6%, then back down, and basically stayed in the 3% range.

Now we’re entering 2026 with expectations around 4.9% or 5%. But we give ourselves a C here because we missed. Generally speaking, we think IT spending—budgets, as reported by IT decision makers—will come in at low single digits, roughly 3% to 4%.

When you look at IDC numbers, you’ll hear double-digit growth, but that includes all the CapEx going into the data center build. That is not IT spend. Here, we track IT spending in the sense of budget increases reported by IT decision makers. And if you look at what happened post-COVID, expectations were over 7%. As interest rates rose, tech spending expectations dropped—pretty clearly inversely proportional.

So: C.

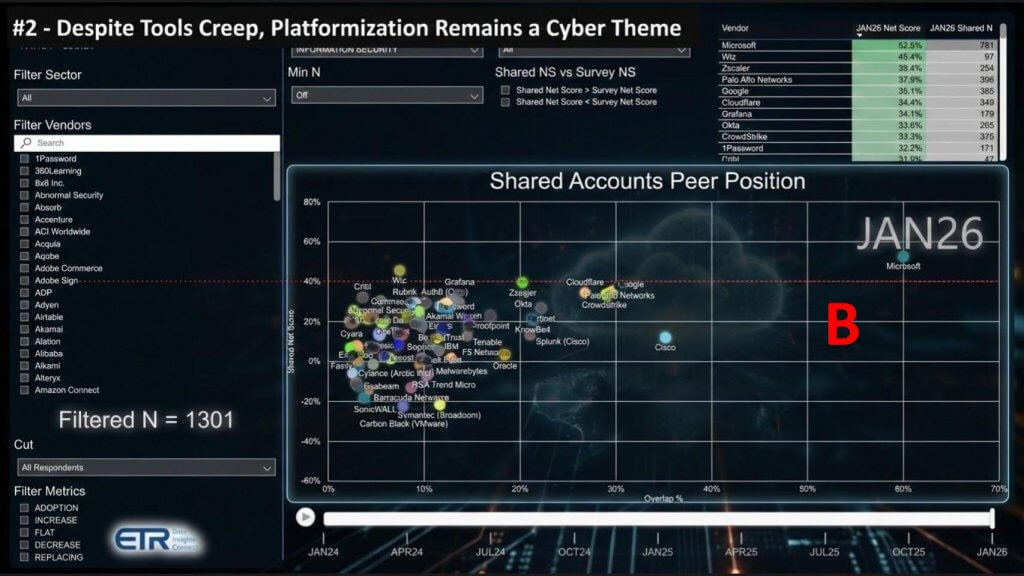

Prediction 2: Despite tools creep, platformization remains a cyber theme (Grade: B)

We gave ourselves a B here.

This is a quick snapshot from the January 2026 survey—preliminary data. The reason to focus on it is that the red dotted line is at 40%. Last year, more companies were above that 40% line—Zscaler, Palo Alto, I think, and even Cloudflare. Now they’re below it. Only Microsoft and Wiz are above that 40% line today.

That suggests some consolidation. The Wiz acquisition is another indicator. Palo Alto Networks and CrowdStrike are clearly having success with consolidation and what Nikesh Arora at Palo Alto calls “platformization” in security.

At the same time, practitioners still keep bringing in new tools. This week, we had Obsidian Security on with Hasan Imam, the CEO, and we discussed why the market “needs another security company.” They’re focused on agentic within SaaS—securing agents inside SaaS platforms—which is growing. That’s a niche the major platforms may not fully attack today, so the need for additional tools remains.

Net: signs of consolidation, but not to the degree we originally predicted. B.

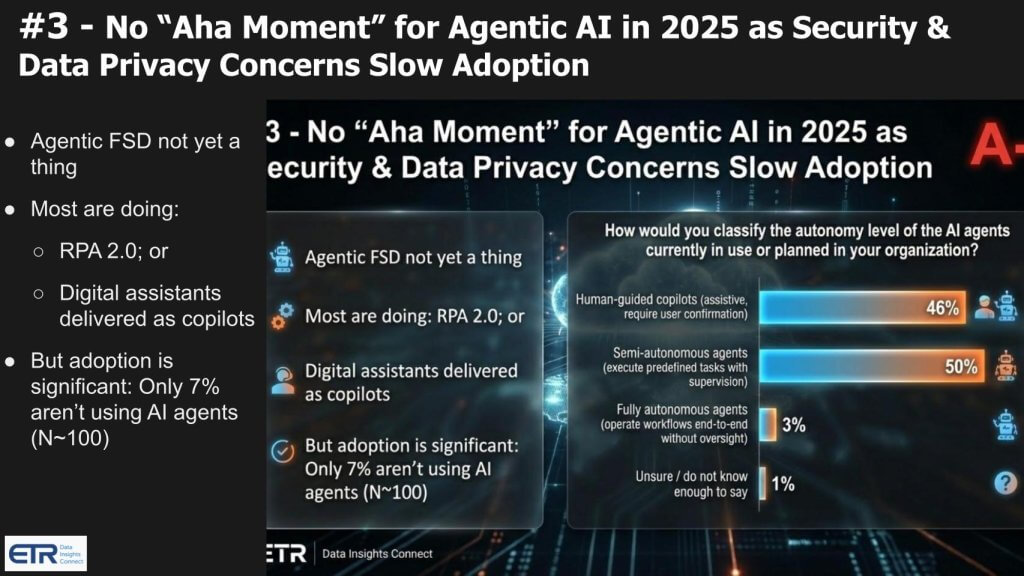

Prediction 3: No “a-ha” moment for agentic AI in 2025 as security and data privacy concerns slow adoption (Grade: A-)

We gave ourselves an A-minus here.

This is new ETR data on autonomy levels for AI agents. The reality is: it’s still mostly human-guided copilots and semi-autonomous agents. Copilots—Microsoft especially—are the big deployment story. Fully autonomous agents operating end-to-end workflows are very limited.

“Full self-driving” agentic isn’t a thing yet. Most of what’s happening is closer to RPA on steroids—RPA 2.0—digital assistance as copilots, rather than true “systems of agency.”

Adoption is significant (in a previous survey, only 7% weren’t using AI agents), but the way they’re being used is still often quasi-deterministic. We said last year that this would be the year of agent-washing more than true agentic usefulness. George Gilbert jokes that there are more agent chatbots than fleas on a camel’s back. We’ll take the A-minus.

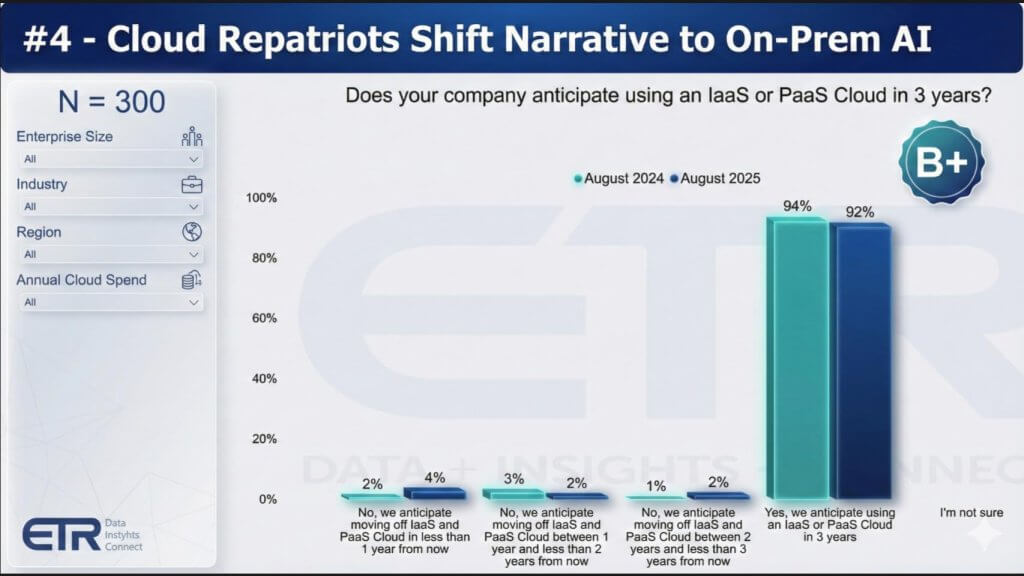

Prediction 4: Cloud repatriates shift their narrative to on-prem AI (Grade: B+)

We gave ourselves a B-plus.

We still don’t see repatriation as a major trend—it remains single-digit in terms of its popularity among shops. If you look at the percentage of customers investing in IaaS and PaaS, it continues to grow and continues to outpace on-prem.

ETR did a drill-down survey of 140 respondents: thinking about total workloads at your company, irrespective of deployment location, how has the number changed, and how will it change? Cloud workloads continue to grow, and people aren’t decreasing them.

B-plus.

Prediction 5: AI inference at the edge shows real revenue (Grade: C+)

C-plus is probably generous.

We said that edge computing would be a significant trend in 2025. The narrative is definitely there. We’re seeing some deals—like NVIDIA with Nokia at GTC DC. John Furrier has talked about hyperconverged at the edge and new architectures processing data closer to the source for latency. There’s a lot of talk about robotics and physical AI.

But it hasn’t taken off to the extent we hoped. The silicon players are all talking about it, but the real revenue still isn’t quite there. So: C-plus.

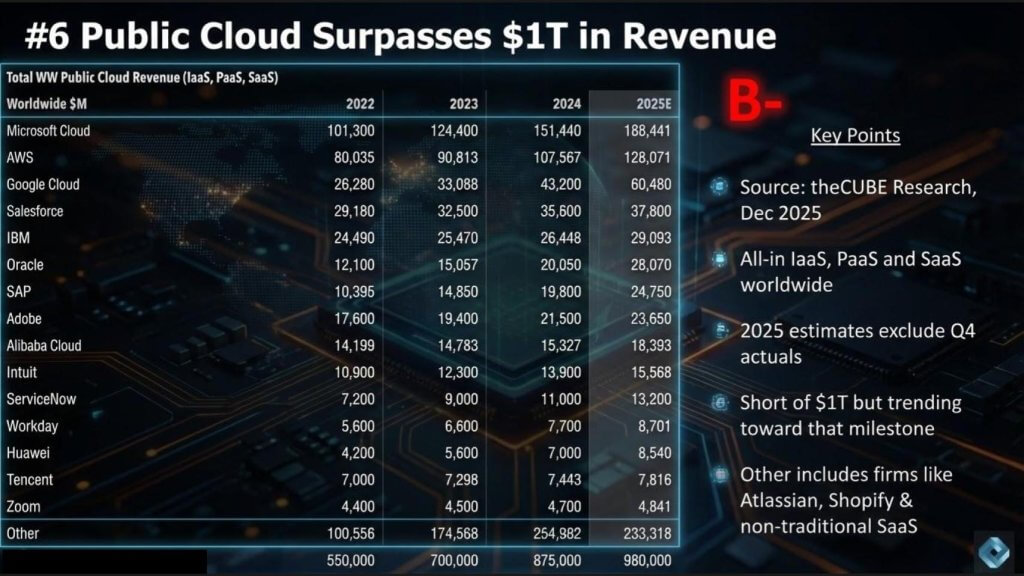

Prediction 6: Public cloud surpasses $1 trillion in revenue (Grade: B-)

These are our preliminary estimates for IaaS, PaaS, and SaaS. We have Microsoft leading the cloud with $188B in 2025—higher than many forecasts, but we think they can get there when you add it all up.

This is theCUBE Research data, excluding calendar Q4 2025 actuals. We’re at about $980B—short of the trillion. “Other” is big and includes companies such as Shopify and Atlassian, as well as other non-traditional SaaS, which is why it’s so large.

We didn’t get to $1T, but we’re close. B-minus.

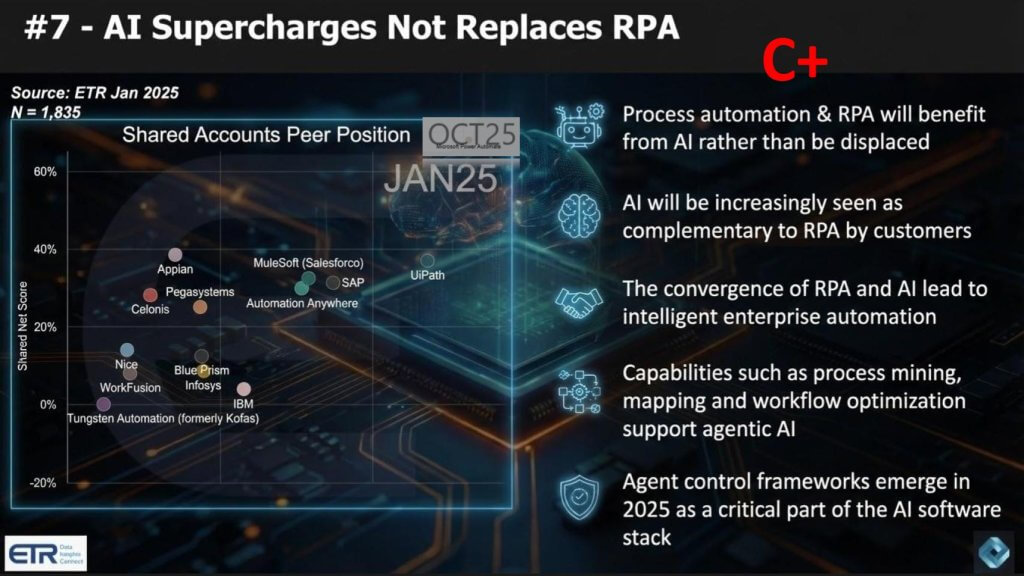

Prediction 7: AI supercharges, not replaces, RPA (Grade: C+)

Our thinking was that the plumbing of RPA would be advantageous as core infrastructure for AI. In general, it didn’t really happen in a broad-based way.

We gave ourselves a C-plus because there is some evidence. It makes logical sense that AI is complementary, and customers (for example, at UiPath events) definitely see it that way. But it was not widespread.

We also felt parts of the prediction were directionally right: agent control frameworks are emerging as a critical part of the AI software stack. There’s early activity around process mining, mapping, and workflow optimization supporting agentic AI. Celonis is pushing this hard, and we’ve seen work from Salesforce and Palantir. Still, this wasn’t a direct hit. C-plus.

Prediction 8: IPOs slowly ramp in first half, pick up in second half into 2026 (Grade: A)

We nailed this one.

The IPO market was tepid in the first half. Activity picked up in the second half, with plenty of crypto activity. We’ve also had conversations like the one with Veeam, which we expect to go IPO (not calling the exact timing yet). Companies such as Snyk and Veeam are in the conversation. We’ll see about Databricks and Anthropic—there’s a lot of talk, but we’ll judge that in our final predictions post.

In general, this one was right on.

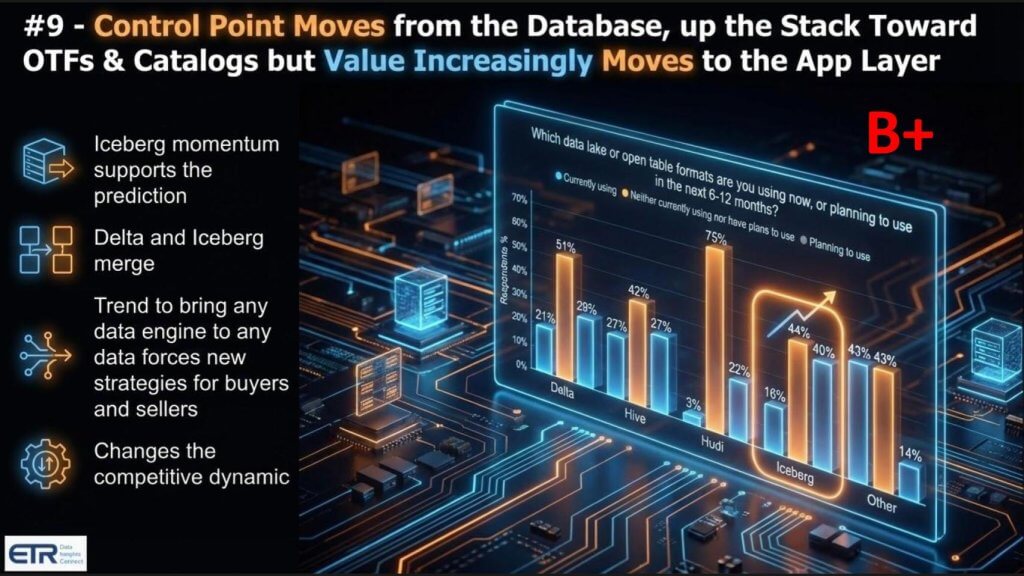

Prediction 9: Control point moves from the database, up toward open table formats and catalogs, but value increasingly moves to the application layer (Grade: B+)

We gave ourselves a B-plus.

ETR flash survey data: which open table formats are you using now or planning to use in the next 6–12 months? Iceberg is the big winner. We called that.

But we have not seen value move to the application layer as fast as we expected, even as we saw a slow Delta and Iceberg convergence. There’s still a lot of talk around it, but it may be taking longer.

The idea of bringing any data engine to any data is clearly happening in buyer sentiment, and it changes competitive dynamics. We’re also seeing some collaboration around open table formats and semantics, which is positive.

Decent call, not a home run. B-plus.

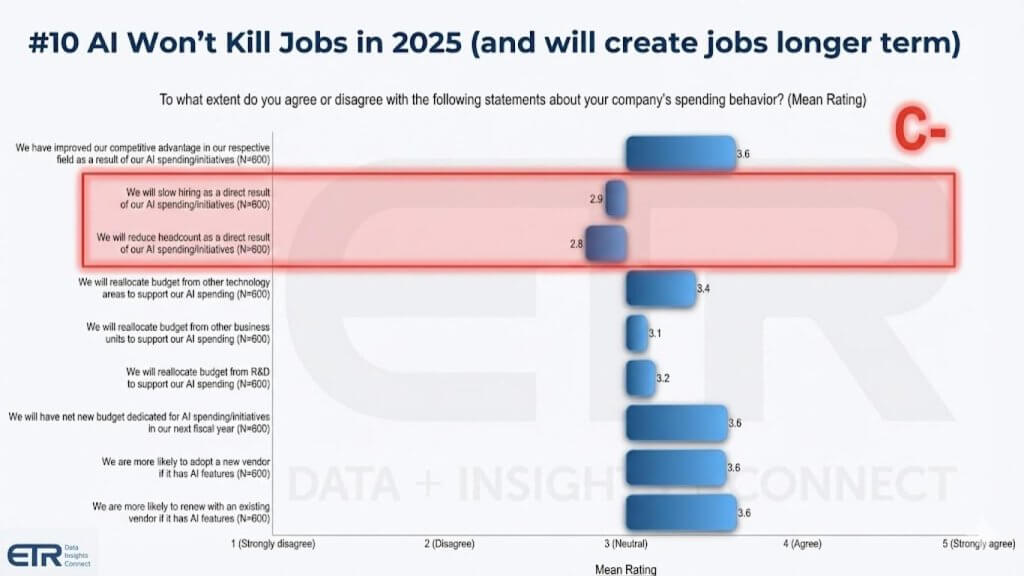

Prediction 10: AI won’t kill jobs in 2025; it will create jobs longer term (Grade: C-)

Longer term remains to be seen.

ETR survey results show small percentages saying they’ll slow hiring or reduce headcount as a direct result of AI spending. That was the expectation.

We gave ourselves a C-minus because there’s clearly a narrative in the industry that AI is taking jobs—especially entry-level jobs not being filled by recent college grads, purportedly because of AI. Whether that’s true is up for debate, but headlines certainly suggest it. Rebecca Knight and I debated this at an event (I think it was UiPath Fusion). She called it a crisis, and many people believe it is.

Recent college graduate unemployment is higher than the overall unemployment rate. You could argue AI is indirectly a factor—if nothing else, via sentiment—companies may be using AI as an excuse or simply trying not to over-rotate on hiring the way they did during COVID. We’ve seen tech companies, including hyperscalers, reduce staff, and Amazon in particular, overhire during COVID.

Direct or indirect, it’s not a clear-cut call. So we graded ourselves tougher: C-minus.

Overall grade: B-

Overall, we give ourselves a B-minus for our 2025 predictions—better than the C-plus we got last year.

When we do these predictions, we try to identify things that can be quantified or determined on a binary basis: “Yes, it happened,” “No, it did not.” We do give ourselves extra credit in certain cases.

That’s it for today. Thanks for watching, and look for our 2026 predictions in January. Eric Bradley and I will do our enterprise predictions, I’ll do data predictions with the Data Gang, and the theCUBE Research team will publish theirs as well.

Thanks for reading and watching. This is Dave Vellante for Breaking Analysis. We’ll see you next time.