Oracle Corporation is seeing renewed business momentum powered by a combination of an entrenched database business, years of investment in cloud infrastructure, an integrated application suite and AI technologies that are being infused throughout its product line. This includes its autonomous database, 23ai, Exadata/Exascale, other Oracle infrastructure and its vast applications portfolio. Oracle has a highly differentiated strategy that is hitting on most if not all cylinders. And it appears the best is yet to come. It’s one reason that, year to date, the stock is up 54%, compared to the Nasdaq which is up 19% as of the recording of this recording.

In this Breaking Analysis, we share our analysis of Oracle CloudWorld, held this week in Las Vegas. We’ll explore highlights from the event, examine the firm’s differentiated stack and look at some survey data from ETR that supports our thesis.

Oracle’s Earnings Momentum

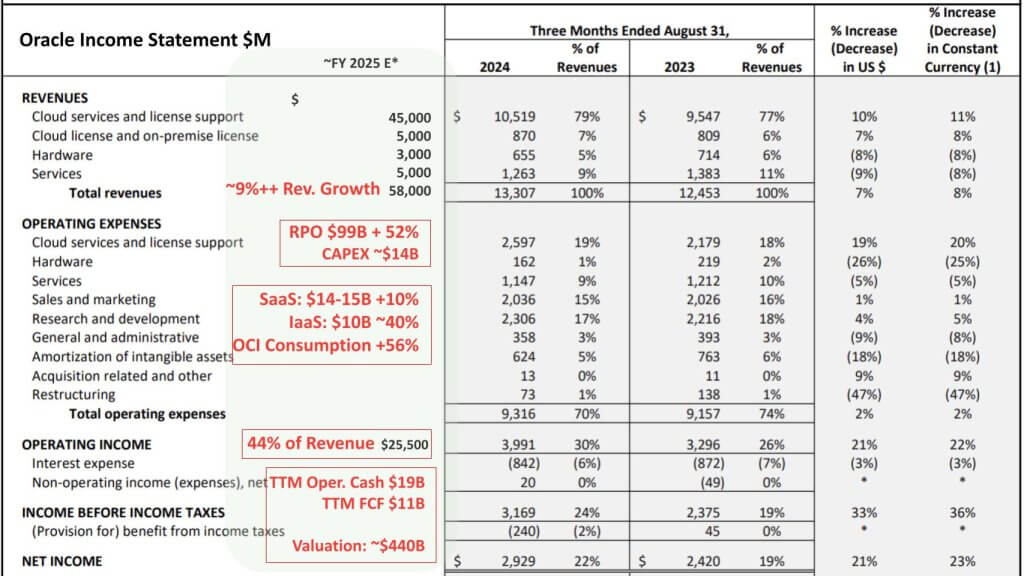

First let’s take a snapshot of Oracle’s earnings from the quarter ending August 2024.

Below is a screenshot of the company’s income statement from last quarter with our rough estimates of what the full fiscal year will look like. CEO Safra Catz was very proud of the fact that Oracle’s first fiscal quarter ended on August 31st and they released earnings, with guidance, on Tuesday September 10th. That’s five business days after the quarter ended, which is quite remarkable and best in class.

++Note: At its financial analyst meeting from CloudWorld, Oracle increased its FY 26 revenue growth rate to the mid teens, generating $66B. As well it increased its FY 2029 revenue goal to $104B, which would give it a valuation by today’s metrics closing in on $1T.

We won’t go through all this data in detail but we do want to highlight a few points. Oracle’s top line revenue came in at just over $13B for the quarter at an 8% growth rate relative to last year’s Q1. We estimate that their business is accelerating and they’ll end up doing $58B in revenue this fiscal year, growing 9% overall relative to FY ‘24. And the reason is shown in red with a remaining performance obligation (RPO) of $99B, up 52%. This combined with a CAPEX spend of $14B, primarily for data center buildouts, is what is giving investors such enthusiasm for the future.

Moving into some of the critical line items of the business…We see Oracle’s cloud SaaS business coming in at between $14-$15B this year and an IaaS business at $10B, growing in the ~40% range. Last quarter, Oracle said it’s OCI consumption revenue increased 56%, down from the mid 60’s last quarter with continued expected high rates throughout the year.

For context, an IaaS business of $10B puts Oracle just behind Alibaba and at about 10% the size of Amazon’s IaaS business. But if you include SaaS + IaaS, it’s a business that’s about $25B compared to Google’s combined IaaS and SaaS at about $40B this year. So in that sense it’s getting pretty sizable. Still a distance from the Big hyperscalers but closing in with a faster growth rate.

What’s frankly more interesting is not the comparison with other clouds, but rather the profitability of its business. We expect Oracle will finish its FY with around a 44% operating margin. This is Microsoft level operating margin. It’s trailing twelve month cash flow is at $19B on an operating basis with $11B in free cash flow.

All this leading to a valuation over $440B as of this episode’s recording. Oracle has built an incredible business. We have little doubt that Larry aspires to get to a $1T valuation and is investing to do so.

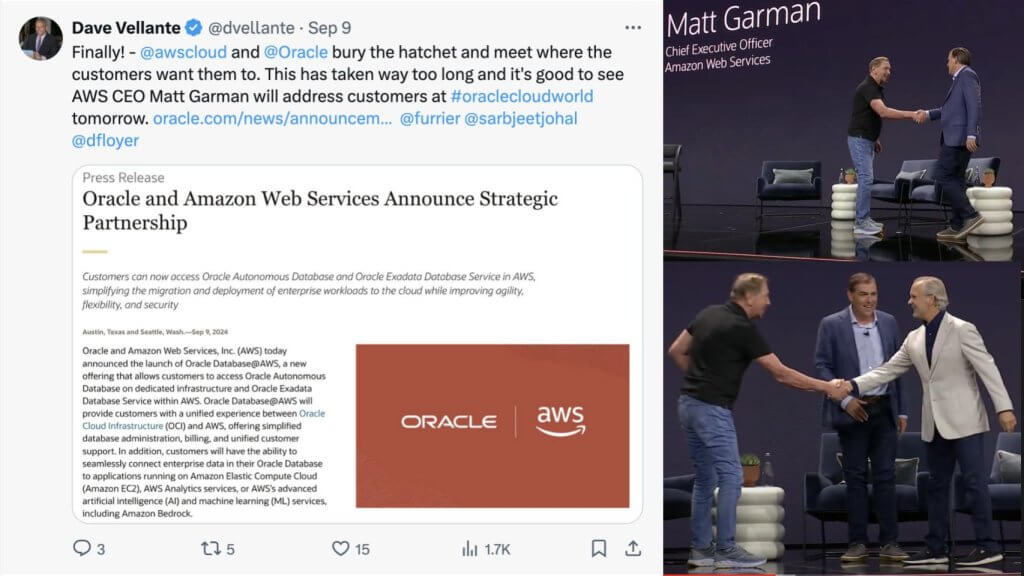

A Packed CloudWorld Features a New Posture on Partnerships

There were more than 20,000, perhaps 25,000 attendees this year. The big news was the AWS partnership, which we’re depicting below. Oracle had AWS CEO Matt Garman on stage with a joint customer, the CTO of State Street.

Larry: “The Multi-Cloud Era Starts Now”

After this love in with Matt Garman, Larry declared the start of the multi-cloud era. This is classic Larry. He loves to take a trend that has been around for a while, reimagine it, then put forth a highly differentiated strategy and declare that the thing is now real, i. e. he created it. But his multi-cloud strategy is unique, and in our view, one of the strongest, if not the strongest in the infrastructure cloud business.

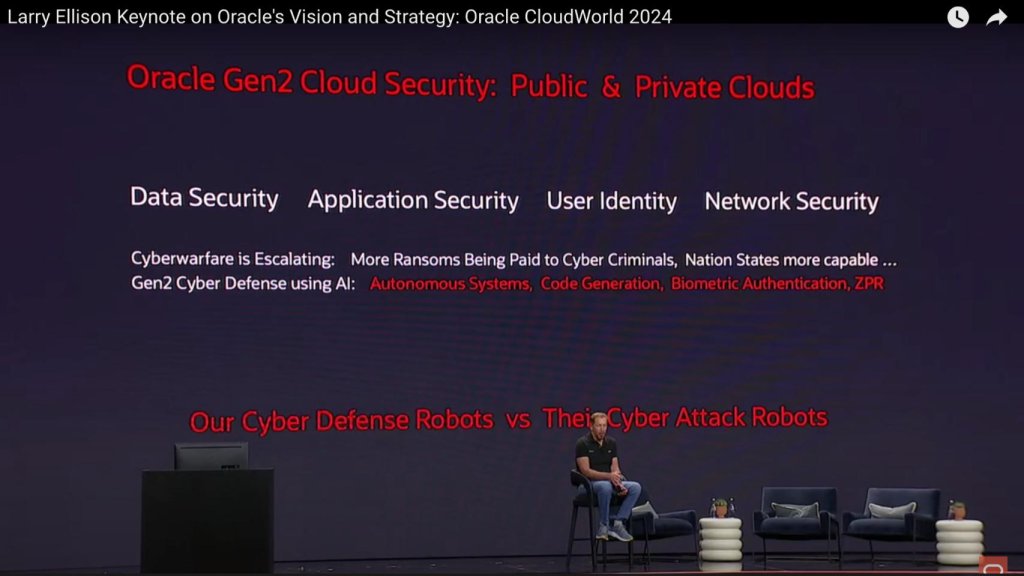

Multi-Cloud + Security

Beyond Multi-Cloud, Larry focused on security. His message resonated. He said the following:

Let me tell you, we’re done with passwords. The idea is utterly ridiculous. They’re easily hacked. The more difficult they are to remember, the more likely you are to write them down, the more likely they are to be stolen. Everything done to make passwords better has made them worse. It’s a terrible idea. So we’re getting rid of passwords entirely. This is the way you’re going to log on to work. I’m going to type in Larry.ellison@oracle.com. The computer’s going to look at me and say, ‘Okay, hi Larry. We’re done.’ Why would I type? Safra can recognize me, my kids can recognize me. You’re telling me a computer can’t recognize me and log in? This is ridiculous.

Not only was this hilarious…it rings true.

Ellison discussed his point of view around four pillars of security: Data, application, user identity and network. He stressed that you can’t have great security without full automation.

Multi-Cloud Strategy and Infrastructure Leadership

The following additional points summarize our views of Oracle CloudWorld. We believe the event was a critical moment in emphasizing the evolving narrative around multi-cloud. While multi-cloud as a concept has been discussed for years, in our view, Oracle’s particular strategy diverges by leveraging its unique legacy as a systems vendor, most notably with the acquisition of Sun Microsystems and its pivot to engineered systems. The company’s focus on infrastructure, underscored by solutions like Exadata and Exascale, positions Oracle as a key player in the next-generation hyperscaler ecosystem.

In our opinion, the company has effectively addressed long-standing customer concerns by presenting a clear message that reflects an engineering-driven culture. Importantly, unlike many past events, Oracle avoided the pitfalls of over-hyping capabilities, particularly as it highlighted its partnerships with AWS, Google and Microsoft. Rather than taking an aggressive posture as a competitor, the tone of the conference underscored its growing collaboration with hyperscalers.

Key takeaways include:

- Strong focus on the multi-cloud era, with particular attention to the concept of “optionality” in building next-gen applications.

- The company’s efforts to unlock the value of data residing in its database ecosystem, with a particular emphasis on enhancing usability.

- Commitment to pursuing a different growth trajectory from traditional hyperscalers such as Amazon, Google, or Azure, positioning itself as an alternative for enterprise customers.

- Impressive show of support from a diverse range of partners, including GSIs and other vendors focusing on dedicated regions and Alloy (embedded OCI), signaling the company’s expanding influence in the multi-tenant cloud space.

In our view, Oracle’s commitment to completely homogenous infrastructure (same:same), whether on-prem or in the cloud, puts the company in a novel position relative to infrastructure firms without a cloud. Relative to the hyperscalers, Oracle’s on-premises legacy confers additional advantage giving customers maximum flexibility.

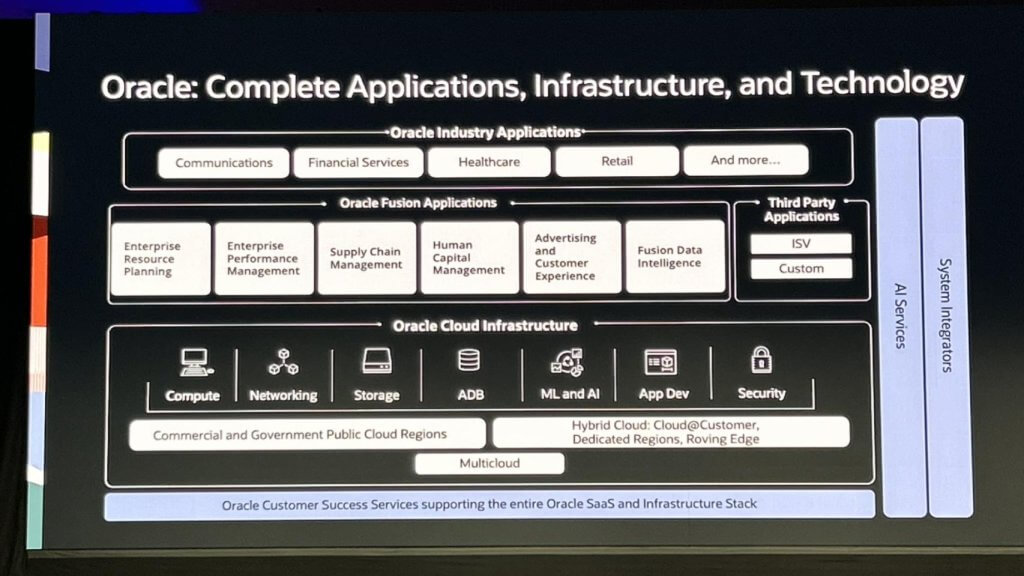

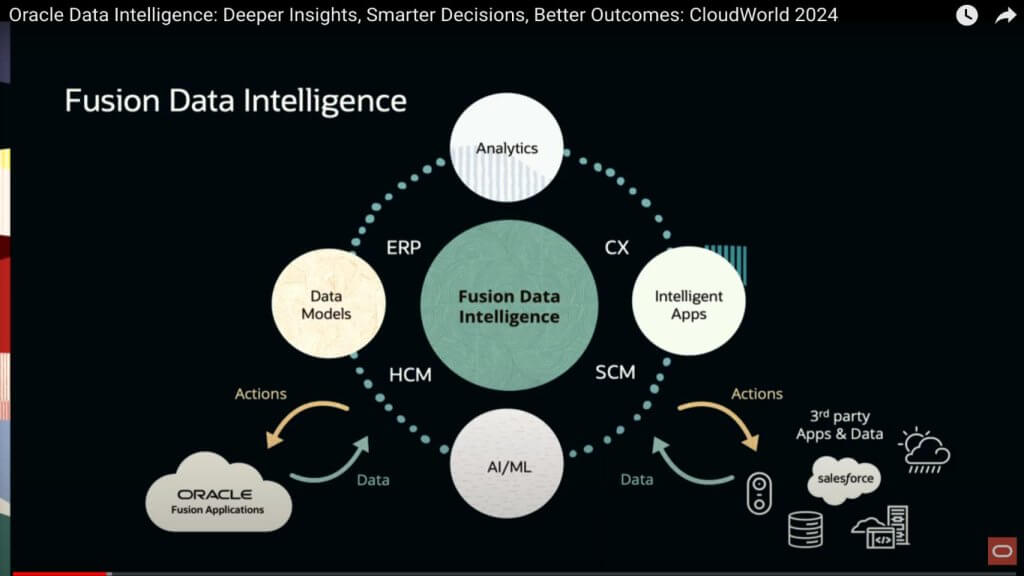

Oracle’s Opinionated Stack and Differentiation

In our view, Oracle’s “opinionated stack” offers a distinct competitive edge, particularly in the multi-cloud era. Their portfolio, which spans from infrastructure with Oracle Cloud Infrastructure (OCI) to mission-critical applications, presents an integrated approach that is uncommon in the industry. Oracle’s ability to tightly integrate its Fusion Applications with both first- and third-party services positions them as a leader in this space. Notably, Fusion Data Intelligence and the acquisition of Cerner, infused with AI, underscore Oracle’s commitment to embedding intelligence into its portfolio.

Specifically, Oracle’s vertical integration of AI from infrastructure through the application layer is particularly compelling. Oracle claims its integration is designed to be agnostic from the customer’s perspective. For example, whether Oracle swaps out one AI foundation model for another does not impact the end user experience according to the company and it remains focused on providing accurate, secure, and private infrastructure.

Key differentiators include:

- AI integration from the ground up: Oracle has embedded AI throughout its stack, ensuring that its solutions are both scalable and fine-tuned to meet specific customer needs.

- Strong security focus: Oracle’s commitment to security, particularly for mission-critical applications, positions it strongly against competitors like AWS, Google, and Microsoft, which either lack enterprise apps or are less integrated in their offerings.

- Acquisitions driving portfolio strength: Oracle’s strategic acquisitions, including early acquisitons like PeopleSoft, dozens of industry-focused assets and most recently Cerner, have been crucial in building out its comprehensive portfolio.

In our assessment, Oracle’s emphasis on vertical integration and its focus on mission-critical enterprise applications differentiate it from the likes of Microsoft, AWS, SAP, and IBM. While competitors may have strengths in certain areas, Oracle’s holistic approach, supported by a robust ecosystem of GSIs like Accenture and Deloitte, puts it in a unique position to drive value in enterprise IT environments.

Larry’s Perspective on AI…It’s Embedded not an Add-on

Everyone is trying to get AI right. There are a lot of questions right now about embedded AI or bespoke and, ‘When are we going to see the payback?…What’s the ROI and when are we going to get a return on all this CapEx investment?’ Ellison summed it up on the earnings call this week as shown below.

We believe Oracle’s approach to integrating AI within its applications is the sensible path for firms with a large portfolio. Unlike competitors such as Google and Microsoft/OpenAI, which are heavily invested in developing large language models (LLMs) and need to recoup their significant investments, Oracle has chosen a different path. Oracle’s current posture to not focus on building LLMs, underscores its pragmatic approach to AI. Instead of engaging in an arms race over AI development, Oracle is more focused on embedding AI where it adds direct value for customers.

This approach sets Oracle apart in several key ways:

- Embedded AI strategy: Oracle’s decision to provide AI as part of its applications, without passing along the costs to customers, enhances the value proposition of its Fusion Apps suite.

- Competitive differentiation: By not investing heavily in building its own LLMs, Oracle avoids the cost structure that burdens companies like Google and Microsoft. This positions it to offer AI-infused services more efficiently, without needing to monetize AI through separate charges.

- Focus on application integration: Rather than focusing on standalone AI models, Oracle is embedding AI across its entire application stack, which we believe is more aligned with the needs of enterprise customers looking for practical, integrated solutions.

In our view, Oracle’s embedded approach to AI development reflects a strategy that prioritizes immediate, tangible benefits for its customers. This differentiates Oracle from some competitors, which are focused on recouping large investments in AI research.

Oracle’s Strategic Expansion in Cloud Infrastructure – It’s all About the Regions

Oracle’s Clay Magouyrk, the EVP of OCI provided a deep dive into OCI at both the keynote and in private analyst sessions. Our thoughts follow.

Oracle’s aggressive expansion of Oracle Cloud Infrastructure (OCI) illustrates its commitment to establishing a robust global presence in the cloud market. Clay in his keynote said that Oracle has 59 regions planned, and live while Larry on the earnings call said Oracle now has 85 cloud regions live and another 77 planned with more to follow.

Let’s go with Larry’s numbers– we’ll let you count to fact check the graphic above. With 85 live cloud regions and further expansion planned, Oracle is keen on outpacing its competitors in terms of regional availability. Larry Ellison’s mini masterclass on data center construction in the last earnings call—highlighted plans for a gigawatt data center and the use of nuclear energy, which underscores Oracle’s ambition and technical capability in scaling its infrastructure.

Key elements of OCI’s strategy include:

- Dedicated Regional Development: Oracle’s ability to offer dedicated regions, even in smaller configurations, reflects a versatile approach to cloud deployment. This flexibility is critical for catering to specific geographic or regulatory needs.

- Partnerships and Integration: Collaborations with major players like Fujitsu, and integration with other cloud ecosystems like Azure and Google Cloud, enhance OCI’s appeal by offering a seamless hybrid cloud experience. This strategic alignment extends Oracle’s reach and functional compatibility across different platforms.

- Focus on Core Strengths: Oracle continues to leverage its longstanding expertise in databases and enterprise applications, integrating these strengths with its IaaS offerings. This integration is particularly evident in its handling of high-demand services like AI training, where its NVIDIA partnership plays a crucial role.

- Innovative Hybrid Cloud Solutions: Oracle was a pioneer in delivering a truly homogeneous hybrid cloud experience, ensuring that on-premise deployments are identical to their public cloud counterparts. This homogeneity simplifies management and scalability for Oracle’s clients.

In our view, Oracle’s strategic investments and innovative approach position it uniquely in the cloud market, potentially offering the most integrated and scalable infrastructure solution available today. This approach not only caters to current enterprise needs but also sets a foundation for future cloud engagements across various industries.

Oracle’s Database Innovation: Duality and HeatWave Breakthroughs

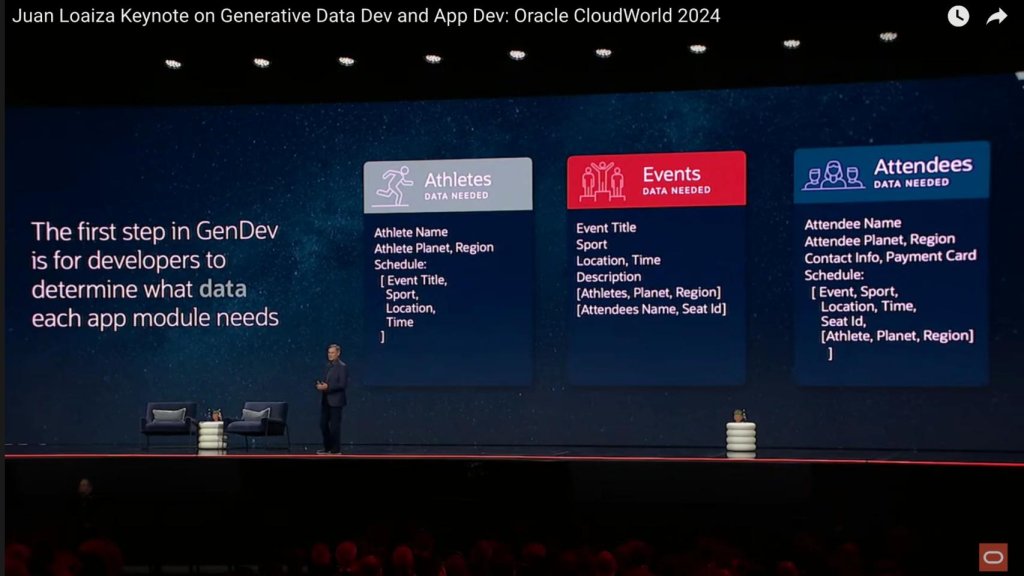

Oracle continues to demonstrate leadership in the mission-critical database space, particularly with its advancements around the concept of “duality.” In our view, the ability to unify SQL, JSON, and graph data within a single platform represents a pivotal development in how enterprises handle complex, multi-format datasets. As Juan Loaiza highlighted in his keynote, Oracle’s focus on harmonizing distinct data types, such as SQL for structured data, JSON for document-oriented data, and graph for relationships, positions the company at the forefront of database innovation.

In his keynote presentation, shown below, Loaiza gave the example of a gaming application that required three distinct data types around athletes, events and attendees, all requiring different data with different formats that needs to be harmonized.

Oracle’s approach is designed to simplify the developer experience, offering what they call “duality views,” which allow organizations to change underlying data formats without disrupting the application logic. This functionality reduces the need for extensive data re-engineering, enabling faster, more efficient development of data-driven applications. In our assessment, this is a significant time saver for organizations building complex applications, as it hides much of the complexity involved in managing diverse data types.

This innovation is perhaps even more significant than the AWS partnership announcement as it sets a technical foundation for the AI-native enterprise. More specifically, harmonized data enables swarms of intelligent agents to operate together creating a digital representation of an organization, in real time.

Key insights include:

- Unified data platform: Oracle’s 23ai database integrates vector, graph, and other data types, providing a seamless API interface to JSON, a core need for modern applications.

- Efficient data management: The introduction of duality views simplifies how organizations manage and interact with their data, minimizing the need for manual data reengineering while enhancing flexibility.

- Developer-friendly architecture: With its focus on developers, Oracle’s GenDev approach and the introduction of AI-driven capabilities, like those in APEX, promise to make data management more intuitive and accessible.

Furthermore, Oracle’s MySQL HeatWave continues to innovate, pushing performance boundaries and delivering breakthroughs that extend its leadership in the database space. By bridging various data types and integrating them with Oracle’s autonomous database technologies, HeatWave acts as an evolving piece of the puzzle to enhance the overall performance and scalability of enterprise applications.

In our view, Oracle’s innovations in duality, Autonomous Database, 23ai and HeatWave represent important steps forward in enterprise database management. These advances not only address the growing complexity of data ecosystems but also position Oracle as a leader in delivering next-generation data solutions that align with the needs of modern developers and enterprises.

Oracle’s Data Analytics and Data Lake Strategy

Oracle’s approach to data analytics and its emerging data lake strategy presents both strengths and areas where improvement is needed. In our view, the company’s focus on embedding analytics within its “Red Stack”—fully integrated with its databases, Fusion Apps, and development environment (APEX)—provides a unified data and metadata model. This integration is a competitive differentiator, especially with the recent addition of Salesforce integration, reflecting Oracle’s ability to leverage both internal and third-party data sources seamlessly (notwithstanding that Salesforce runs on Oracle making integration more facile).

However, there are noticeable gaps in Oracle’s data lake strategy. While the company has announced support for open data formats like Iceberg, Delta, and Hudi, the data lake itself remains in preview mode, with a general availability (GA) release not expected until 2025. We believe this delay puts Oracle behind other players like Databricks and Snowflake, who are more aggressive in their data lake offerings and adoption of open-source governance movements.

Key insights include:

- Embedded Analytics: Oracle’s strength lies in its tightly integrated analytics, which allow data from its applications and external sources like Salesforce to be harmonized. This seamless integration is crucial for leveraging AI and simplifying the exploration of data across the Oracle ecosystem.

- Open Data Format Adoption: Oracle’s acknowledgment of open data formats such as Iceberg and Delta signals a move toward interoperability, though actual user adoption remains to be seen.

- Data Governance Strategy: Oracle aims to position itself as a “catalog of catalogs,” similar to Microsoft Purview, with plans to integrate governance across various platforms like Snowflake and Databricks. However, there is skepticism about whether Oracle can effectively manage metadata across multiple platforms, and this area remains a work in progress.

- Partner Ecosystem: Oracle’s partnerships with companies like Informatica show its openness to working with ISVs and maintaining an ecosystem approach, even as competitors like Databricks and Snowflake increasingly lean on proprietary stacks.

In our view, Oracle’s unified data strategy has the potential to simplify complex data landscapes for enterprises. However, its delayed data lake strategy and uncertain market forces around governance present challenges that the company must address to compete with the more advanced offerings from Databricks and Snowflake.

Oracle’s Multi-Agent Strategy: Driving Productivity and Automation

Oracle’s emphasis on building multi-agent platforms represents a significant evolution in how enterprises will leverage AI to enhance productivity. As discussed in Steve Miranda’s keynote, the company is focused on deploying over 50 distinct agents by next year, each designed to automate specific business tasks that have historically required human intervention. This marks a shift from the common industry focus on copilots and single-task agents to a broader, more integrated system of agents working in concert, driven by high-level business goals.

The value of this approach lies in its ability to create a fully connected and governed application ecosystem, where data from across Oracle’s portfolio—such as Fusion Apps, financial systems, and CRM solutions—can be harmonized to drive real-time, data-driven decision-making. By unifying data and operational analytics, Oracle enables enterprises to build a digital representation of their business, akin to an “Uber app for the enterprise,” where digital entities can respond dynamically to changing conditions.

Key insights include:

- Multi-Agent Platforms: Oracle’s agents, such as ledger agents for financial tasks or order import assistants, automate highly defined processes. This collection of agents is capable of working in coordination, performing tasks that span departments and functions, ultimately enhancing operational efficiency.

- Focus on Defined Business Outcomes: Unlike general-purpose AI assistants, Oracle’s agents are purpose-built to handle specific workflows, such as financial reporting, price change management, and project coordination. This precise focus ensures that AI is integrated directly into mission-critical processes.

- Foundation for Future Innovation: Oracle’s investment in building AI from the ground up—including infrastructure such as GPUs, storage, and foundational models—provides a solid base for future AI innovation. This gives Oracle a competitive edge in the development of more complex, autonomous workflows.

- Customer Value and NPS Scores: Despite criticisms of Oracle’s pricing strategies, customer feedback shows that enterprises continue to derive significant value from Oracle’s AI-driven innovations. With high NPS scores and clear use cases for automation, Oracle’s AI agents are positioned to significantly improve productivity across industries.

In our view, Oracle’s multi-agent strategy positions the company as a leader in enterprise automation. By leveraging its existing infrastructure and applications, Oracle provides a compelling proposition for organizations looking to streamline operations, reduce costs, and achieve 10 to 20X improvements in productivity, as suggested by Larry Ellison.

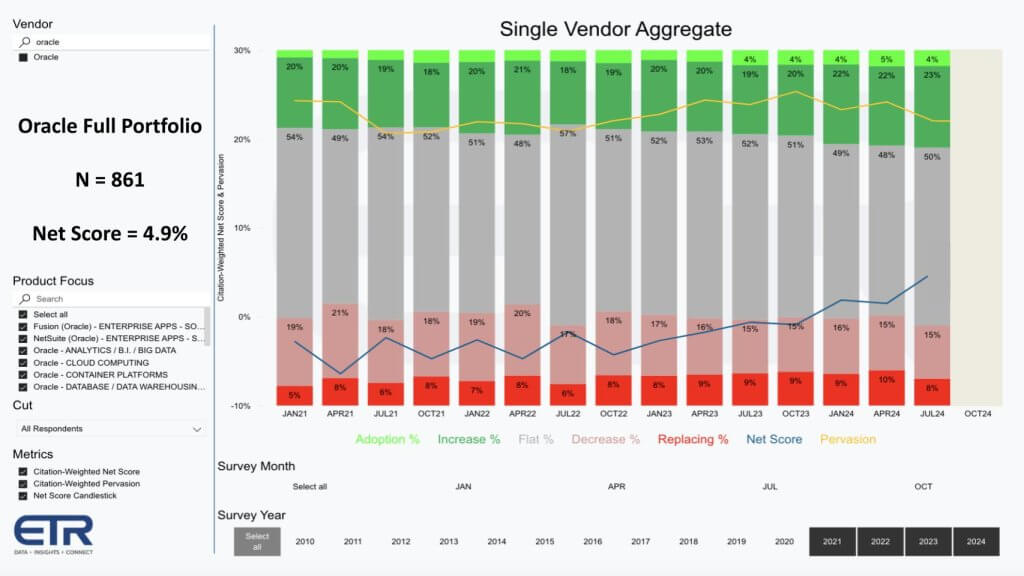

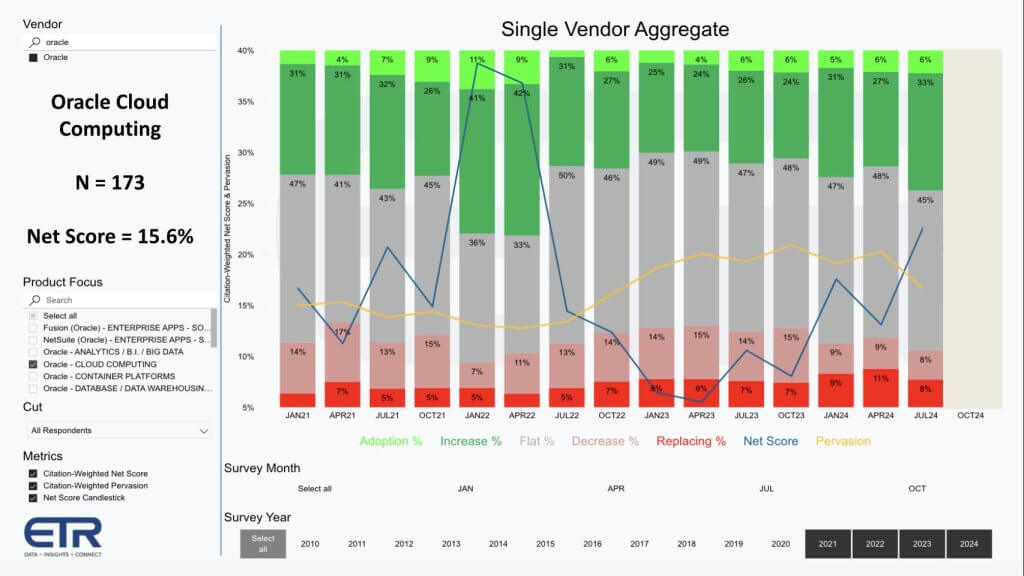

Understanding ETR’s Net Score and Oracle’s Overall Spending Momentum

Net Score is a measure of spending momentum within a platform and represents a core component of the analysis conducted using data from ETR (Enterprise Technology Research). The methodology is straightforward as shown below: It subtracts the percentage of customers reducing their spending (reds) from the percentage of customers either adding or increasing their spending (greens), offering a single metric that reflects the overall momentum of a technology vendor. This method uses the following categories:

- Adding new: The percentage of customers that are newly adopting the platform (lime green).

- Spending more: The percentage of customers who are increasing their spending on the platform (forest green).

- Spending flat: Customers whose spending remains flat, within a 5% range (gray).

- Spending down: Customers who are reducing their spending by more than 6% (pink).

- Churn: The percentage of customers leaving the platform entirely (bright red).

The Net Score is calculated by subtracting the “spending down” and “churn” percentages (reds) from the “adding new” and “spending more” percentages (greens). For Oracle, the total customer base in this survey is a large sample of 861, which represents a significant portion of the overall ETR survey pool of approximately 1,800 respondents.

In the broader survey across Oracle’s entire portfolio—including Fusion Apps, NetSuite Analytics, OCI, and other services—Oracle achieved a Net Score of approximately 5%. While lower than some competitors, this score is typical for a legacy vendor, given the higher percentage of customers with flat spending (gray), which can penalize Net Score calculations. However, when isolating Oracle’s cloud services (OCI), the Net Score rises to nearly 15.6%, reflecting stronger momentum in the cloud space as shown in the following graphic.

Key takeaways include:

- Positive spending momentum: Although the majority of Oracle’s spending base remains flat, the green segments, representing customers adding or increasing their spending, are showing a consistent upward trend.

- Strong cloud growth: The survey highlights strong growth in OCI adoption, reflecting Oracle’s ability to compete in a crowded cloud marketplace, with OCI’s third-generation services helping drive that growth.

- Enterprise stickiness: Oracle’s large customer base, particularly among existing enterprise clients, continues to drive stable performance. The company’s focus on service providers and sovereign cloud offerings—demonstrated by Fujitsu’s partnership—further solidifies its presence in key markets.

Conclusion: Building on Positive Momentum

In our view, the data suggests that Oracle has successfully positioned itself to maintain and grow its share of enterprise spending, particularly in the cloud computing sector. With a growing list of use cases, partners, and regional cloud deployments, Oracle is providing compelling reasons for customers to revisit their Oracle investments. The company’s continued investment in OCI, coupled with its broader ecosystem of applications and cloud services, ensures that Oracle remains a critical player for enterprises with existing spending commitments.

We continue to research Oracle’s place in the enterprise IT ecosystem. Often maligned but always entertaining, founder-led Oracle is paving a new path toward the next era in the company’s long history.