Microsoft’s new financial disclosures include changes to the way it reports Azure metrics. The company said the change was to better align Azure with consumption revenue and by inference, more closely aligning with how AWS, the leader in cloud computing infrastructure, reports its metrics. The accounting change removed certain mature, slower growth revenue streams and consequently raised the growth rates for Azure. It also had the effect of increasing the AI services contribution within Azure. While this was reported and often applauded in the media and financial circles, what wasn’t widely discussed is that while such a change increases growth rates, by definition it reduces the size of the Azure business and its resulting revenue market share. Regardless, in our view, Microsoft is comfortable that the future AI revenue contribution within Azure combined with both higher growth rates and a greater AI contribution will foster greater investor confidence and enthusiasm over time. They’re probably correct.

In this Breaking Analysis we review the changes Microsoft made to its financial reporting with a special focus on Azure impacts. We share how it affects our cloud data and we’ll share some thoughts on Microsoft’s AI reporting.

Microsoft Announces Major Changes in its Reporting Metrics

By way of review, on August 21, of this year, Microsoft released its Form 8-K which included a link to an investor presentation.

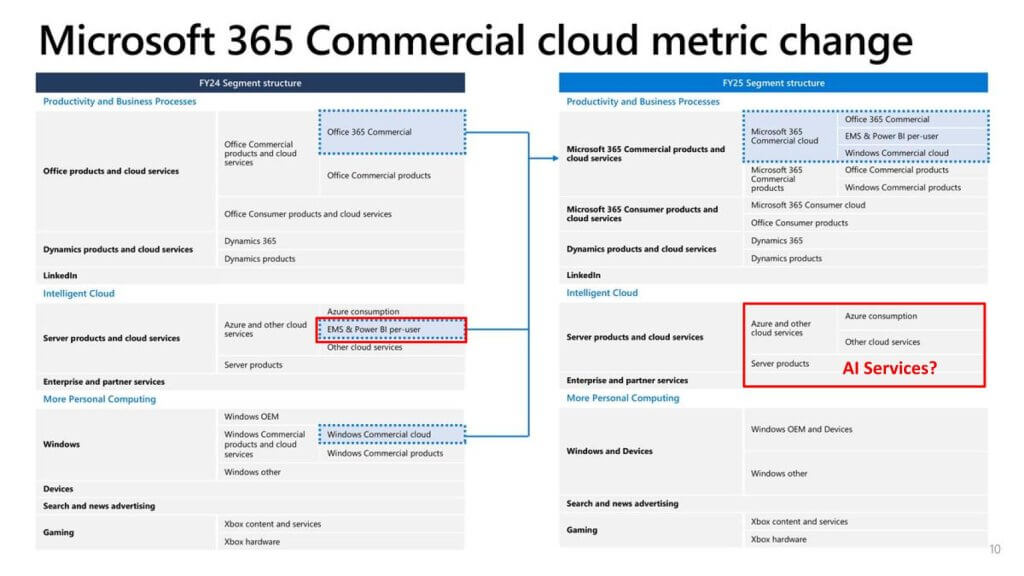

In the aforementioned investor presentation, Microsoft revealed some significant changes to its reporting metrics. Our interest for today is on the Azure portion of Microsoft’s business, highlighted in red.

Microsoft made two important disclosures in this new mapping as it pertains to Azure. First, it is removing EMS which stands for Enterprise Mobility and Security and also Power BI per-user pricing. Previously, as shown on the left hand side of this chart, these products were included in Azure. On the right hand side is the new reporting. Now we highlight AI Services because it’s missing. And later in this discussion you’ll see specific new guidance around AI Services and its contribution to Azure. So while certain AI services have always been included in Azure, Microsoft on its earnings calls specifically identifies the contribution within Azure of AI Services. So we felt it useful to shine a light on this fact.

The New Metrics Raise Azure Growth Rates and AI Contribution

And by Implication Lower Azure’s Baseline Revenue

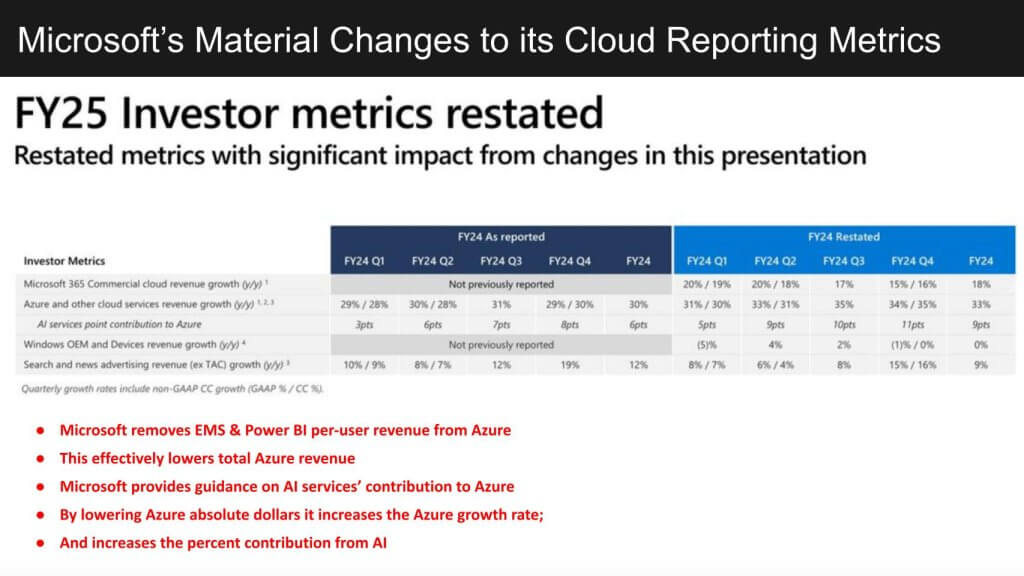

These changes are material to Azure as shown below.

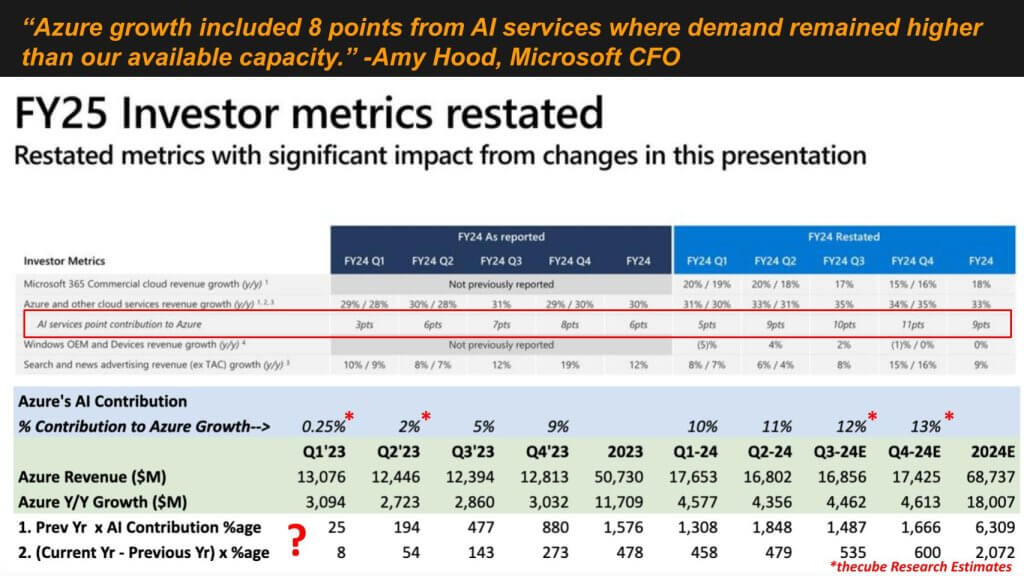

In particular, by removing EMS and Power BI per user revenue from Azure, its resulting growth rates increase. Note the second row under investor metrics “Azure and other cloud services y/y revenue growth.” The line shows revenue and revenue in constant currency for FY 24 in dark blue and the restatement in lighter blue. Microsoft’s fiscal year ends in June by the way. But note that, for example, the quarterly growth rates in FY Q1 jump from 29/28% to 31/30% respectively. And in FY Q4 account for a 5 point increase in Azure growth.

And note in the next line “AI services point contribution to Azure,” which jumps from 3, 6, 7, 8, 6 pts on the left to 5, 9, 10, 11 and 9% on the right. The last numbers on each side – 6 and 9% represent full year averages.

Now as we said at the top, investors are excited by this new disclosure because it shows higher growth rates and a larger contribution from AI. But it also serves to lower Azure’s overall revenue because it removes those items we mentioned before.

So Azure estimates and its consequent market share reported by most analysts have been overstated.

Leaked Court Documents Lower Azure Revenue and Potentially Better Align with the New Metrics

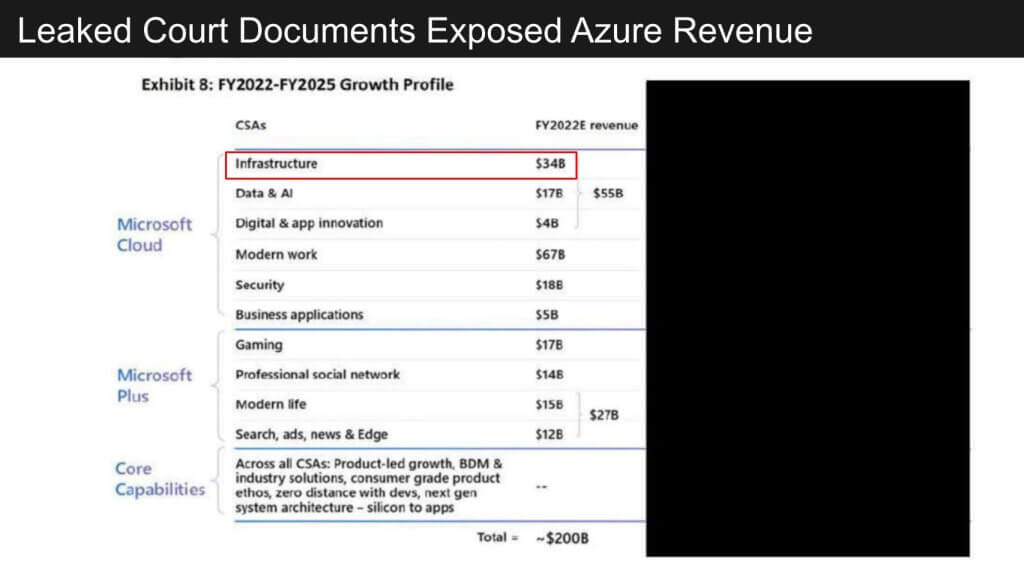

For those paying close attention, including theCUBE Research and others, let’s go back to June of 2023. Leaked court documents from the Activision trial suggested that Microsoft’s IaaS business was significantly lower than people realized. Shown here as $34B for the FY 2022, ending in June of 2023.

Many media outlets reported on this fact but few firms adjusted their numbers to reflect this change.

theCUBE Research Cut its Azure Estimates to Align to the $34B Leaked Revenue Figure

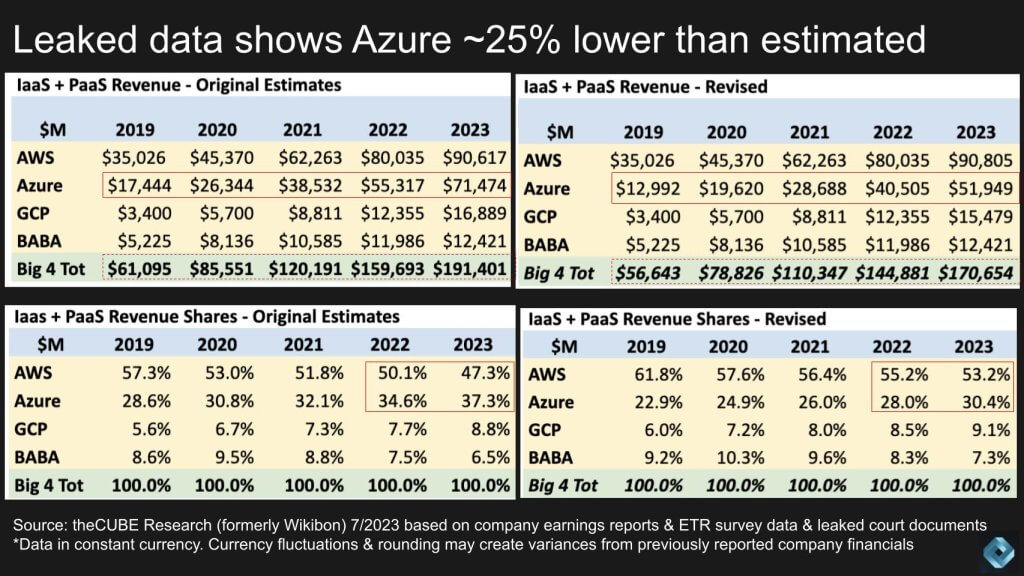

You may recall that in July of that year, we dramatically lowered our Azure estimates and the resulting revenue share to reflect these changes. The reduction was significant, resulting in a 25% decrease in some years as shown here, highlighted in the red boxes.

Revisions Lower Azure Revenue and Market Share

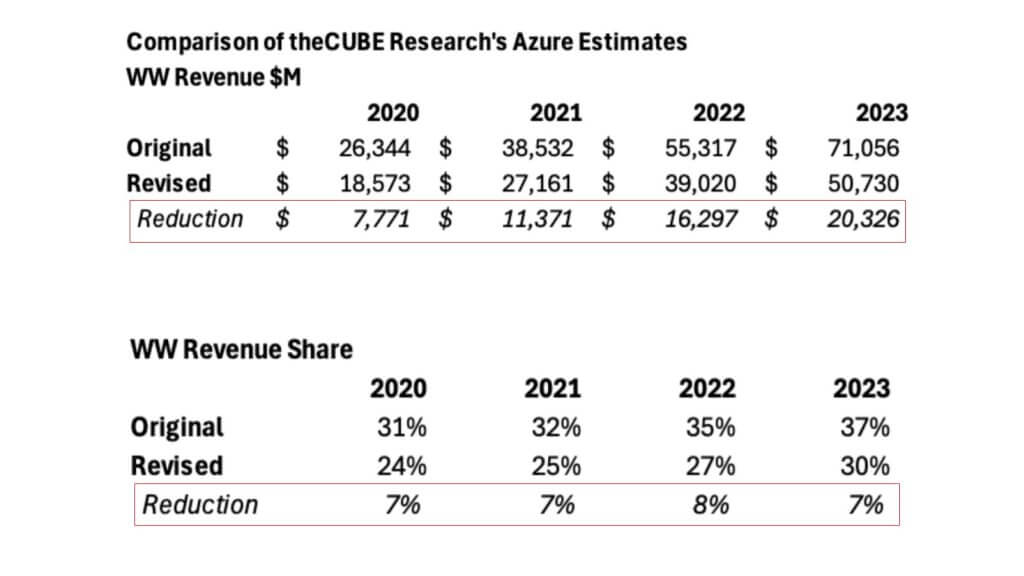

The impact over time of these changes was significant as shown below.

For example, it took our historical Azure estimates from 2020 (which have been revised somewhat since last July), down nearly $8B and our 2023 figures down by more than $20B. This had the effect of lowering Azure’s market share by 7-8 points and by extension, increasing AWS’ lead.

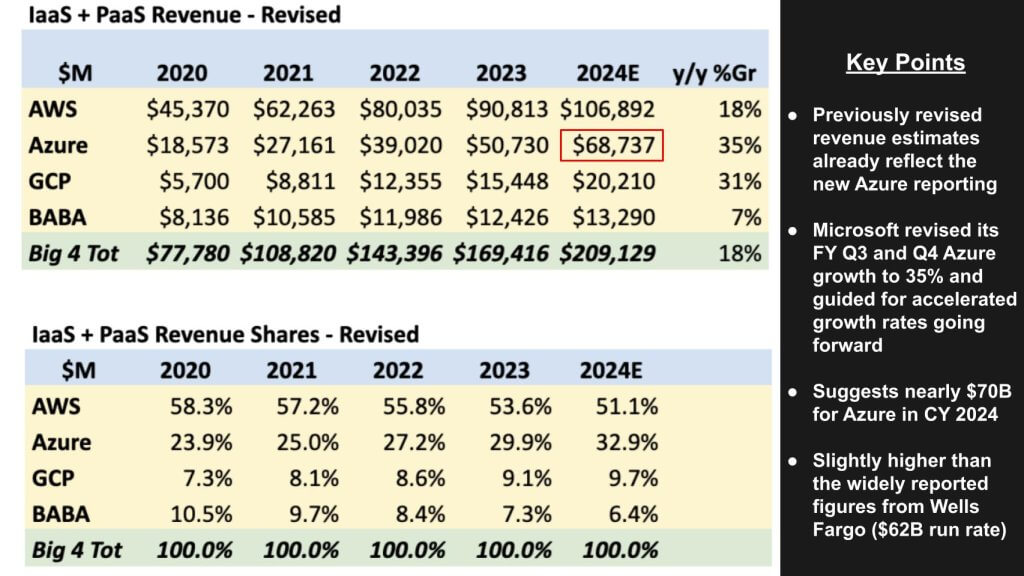

New Forecasts Show Azure Approaching $70B in CY 2024 with 33% Market Share Among the Big 4

So when you look at this from a summary perspective you can see that Azure is now the fastest growing of the big four clouds. These figures reflect the revised metrics Microsoft provided in its disclosure including its expectation for accelerated growth in the second half of its fiscal year. This puts our Azure estimates at nearly $69B, higher than the Wells Fargo report which had Azure’s run rate at $62B.

So let’s zoom out a bit and think about the impact here. Microsoft has removed some legacy businesses which juices its growth rates. We know that Azure is the engine of Microsoft’s platform with AI making an increasingly important contribution to both its revenue and market capitalization. You may recall at one point we estimated that nearly $1T of Microsoft’s market cap was AI related.

Azure and OpenAI Dominate in Account Penetration

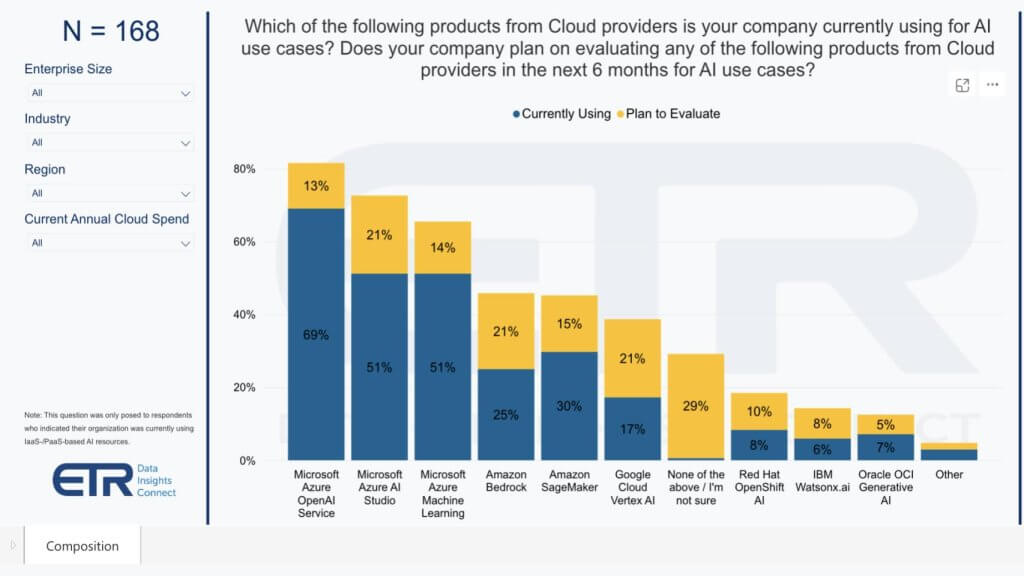

So let’s look at some ETR data which measures account penetration of AI.

Above we show the major cloud players and their AI penetration within 168 accounts. Microsoft has a commanding lead with respect to account penetration. More than two thirds are using the Azure OpenAI Service and more than half are using the Azure AI Studio and the Azure ML service. These three outpace all others. Amazon Bedrock is showing penetration that is rapidly catching up to Sagemaker in terms of accounts using the product in this sample with a notable 21% planning to evaluate Bedrock. Google’s Vertex AI is also showing strong intentions for evaluation at 21% and overall we see Google’s AI momentum closing the gap with AWS. This is largely due to the quality of its AI and data story. IBM is showing up in the survey with OpenShift AI and watsonx with Oracle also showing strength.

Quantifying Microsoft’s AI Contribution in Azure

Why is this important? It’s because AI is what’s driving valuations right now and Microsoft’s reporting is both highlighting its AI contribution to Azure and its accelerated growth rates. We believe this will continue to be an increasingly important metrics in the coming quarters.

But as is always the case with company reporting generally and Microsoft specifically, it’s unclear what its reporting really tells us. Let’s unpack that a bit.

Above a chart that quotes Microsoft’s CFO Amy Hood on the last earnings call. She says that “Azure growth included 8 points from AI services where demand remained higher than out available capacity.” So we have two reactions: 1) The contribution from AI at nearly 10% is becoming meaningful; and 2) What exactly does that mean?

So we highlight here the AI services point contribution to Azure. Note that this update came after the last earnings call. We highlight in red the changes that we discussed earlier. Notice they are significant and in the quarter ending June 2024 accounted for 11% of Azure’s growth.

But the question is how to interpret that. So we took a stab at a couple of scenarios shown in the bottom of the chart.

The % contribution to Azure growth is shown in the blue. The next line shows the quarters and the full year (these are calendar years not fiscal). That’s followed by the Azure revenue estimates by quarter. Then we show the Y/Y growth by subtracting the previous year’s revenue from the current year.

We then tested two scenarios. #1 is we took the prior year’s number and applied the AI contribution to the figure to derive the Azure AI revenue – 25, 194, 477, etc.

The next line uses a second method which takes the current year minus the previous year and applies the AI percentage. Both are potentially valid calculations but notice the difference in absolute dollars. In scenario #1, Azure’s quarterly AI contribution crossed $1B in the March quarter. In scenario #2 it doesn’t hit $1B until potentially next year.

And there may be other ways to interpret this statement from Amy Hood. We’ve requested a clarification from Microsoft Investor relations but haven’t heard back yet. You know us…we’ll keep asking.

Looking Ahead – AI Continues to Drive Valuations

So just summarizing what we’re looking out for in the coming months and quarters ahead…

Earnings season is coming, the big three clouds all report around the same time. I believe it’s early November this year. So we’ll be looking for Amazon, Google, and Microsoft, not necessarily that order. Alibaba comes later. And so once we get that data in, we’ll update all of this and report back to you.

Microsoft’s reporting is going to force, we think, other vendors to disclose particularly the AI revenue. This is where Microsoft’s basically laying down the gauntlet saying, “We are the leader in AI. We got out first with gen AI, and we’re going to maintain that lead with our OpenAI investments and our partnerships. ” And this will force other vendors’ hands to disclose what their AI looks like. And of course, guidance, that AI guidance is going to be a key indicator of interest for investors and customers. And as always, those definitions are going to be varied and fuzzy, but it’s really important because that’s what’s driving valuations in many cases. So we’re going to use survey data and anecdotal conversations to guide our estimates and then we’ll report back to you. Okay, that’s it for now. How do you see Microsoft’s Azure business? What do you make of the changes? Do they mean anything to you? And if so, what? And what about the contribution from AI? How do you interpret Microsoft CFO’s statements? Let us know.