A Trillion-Dollar Shift Unfolds

We are witnessing the rise of a completely new computing era. Within the next decade, a trillion-dollar-plus data center business is poised for transformation, powered by what we refer to as extreme parallel processing (EPP)—or as some prefer to call it, accelerated computing. While artificial intelligence is the primary accelerant, the effects ripple across the entire technology stack.

Nvidia sits in the vanguard of this shift, forging an end-to-end platform that integrates hardware, software, systems engineering, and a massive ecosystem. Our view is that Nvidia has a 10-to-20-year runway to drive this transformation, but the market forces at play are much larger than a single player. This new paradigm is about reimagining compute from the ground up: from the chip level to data center equipment, to distributed computing at scale, data and applications stacks and emerging robotics at the edge.

In this Breaking Analysis we explore how extreme parallel computing is reshaping the tech landscape, the performance of the major semiconductor players, the competition Nvidia faces, the depth of Nvidia’s moat, and how Nvidia’s software stack cements its leadership. We will also address a recent development from CES—the arrival of so-called “AI PCs”— with data from ETR. We’ll then look at how the data center market could reach $1.7 trillion by 2035. Finally, we will discuss both the upside potential and the risks that threaten this positive scenario.

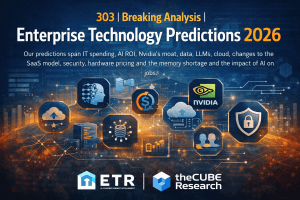

Optimizing the Technology Stack for Extreme Parallel Computing

Our research indicates that every layer of the technology stack—from compute, to storage, to networking, to the software layers—will be re-architected for AI-driven workloads and extreme parallelism. We believe the transition from general-purpose (x86) CPUs toward distributed clusters of GPUs and specialized accelerators is happening even faster than many anticipated. What follows is our brief assessment of several layers of the data center tech stack and the implications of EPC.

Compute

For over three decades, x86 architectures dominated computing. Today, general-purpose processing is giving way to specialized accelerators. GPUs are the heart of this change. AI workloads like large language models, natural language processing, advanced analytics, and real-time inference demand massive concurrency.

- Extreme Parallelism: Traditional multicore scaling has hit diminishing returns. By contrast, a single GPU can contain thousands of cores. Even if a GPU is more expensive at the packaged level, on a per-unit-of-compute basis it can be far cheaper, given its massively parallel design.

- AI at Scale: Highly parallel processors require advanced system design. Large GPU clusters share high-bandwidth memory (HBM) and require fast interconnects (e.g., InfiniBand or ultra-fast Ethernet). This synergy among GPUs, high-speed networking, and specialized software is enabling new classes of workloads.

Storage

While storage is sometimes overlooked in AI conversations, data is the fuel that drives neural networks. We believe AI demands advanced, high-performance storage solutions:

- Anticipatory Data Staging: Next-generation data systems anticipate which data will be requested by a model, ensuring that data resides near the processors ahead of time to reduce latency and address physical limits as much as possible.

- Distributed File & Object Stores: Petabyte-scale capacity will be the norm, with metadata-driven intelligence orchestrating data placement across nodes.

- Performance Layers: NVMe SSDs, all-flash arrays, and high-throughput data fabrics play a significant role to keep GPUs and accelerators saturated with data.

Networking

With mobile and cloud last decade we saw a shift in network traffic from a north south trajectory toward an east west bias. AI-driven workloads cause massive east-west and north south traffic within the data center and across networks. In the world of HPC, InfiniBand emerged as the go-to for ultra-low latency interconnects. Now, we see that trend permeate hyperscale data centers, with high-performance Ethernet as a dominant standard which will ultimately in our view prove to be the prevailing open network of choice:

- Hyper-scale Networks: Ultra-high-bandwidth and ultra-low-latency fabrics will facilitate the parallel operations needed by AI clusters.

- Multi-directional Traffic: Once dominated by north-south flows (user to data center) and more recently east-west (server-to-server), advanced AI workloads now spin off traffic in every direction.

Software Stack & Tooling

OS and System Level Software

Accelerated computing imposes huge demands on operating systems, middleware, libraries, compilers, and application frameworks. These must be tuned to exploit GPU resources. As developers create more advanced applications—some bridging real-time analytics and historical data—system level software must manage concurrency at unprecedented levels. The OS, middleware, tools, libraries, compilers are rapidly evolving to support ultra parallel workloads with the ability to exploit GPUs (i.e. GPU aware OSes).

Data Layer

Data is the fuel for AI and the data stack is rapidly becoming infused with intelligence. We see the data layer shifting from an historical system of analytics to a real time engine that supports the creation of real time digital representations of an organization; comprising people, places and things as well as processes. To support this vision, data harmonization via knowledge graphs, unified metadata repositories, agent control frameworks, unified governance and connectors to operational & analytic systems will emerge.

The Application Layer

Intelligent applications are emerging that unify and harmonize data. These apps increasingly have real time access to business logic as well as process knowledge. Single agent systems are evolving to multi-agent architectures with the ability to learn from the reasoning traces of humans. Applications increasingly can understand human language (NLP), are injecting intelligence (i.e.AI everywhere) and supporting automation of workflows and new ways of creating business outcomes. Applications increasingly are becoming extensions to the physical world with opportunities in virtually all industries to create digital twins that represent a business in real time.

Key Takeaway: Extreme parallel computing represents a wholesale rethinking of the technology stack—compute, storage, networking, and especially the operating system layer. It places GPUs and other accelerators at the center of the architectural design.

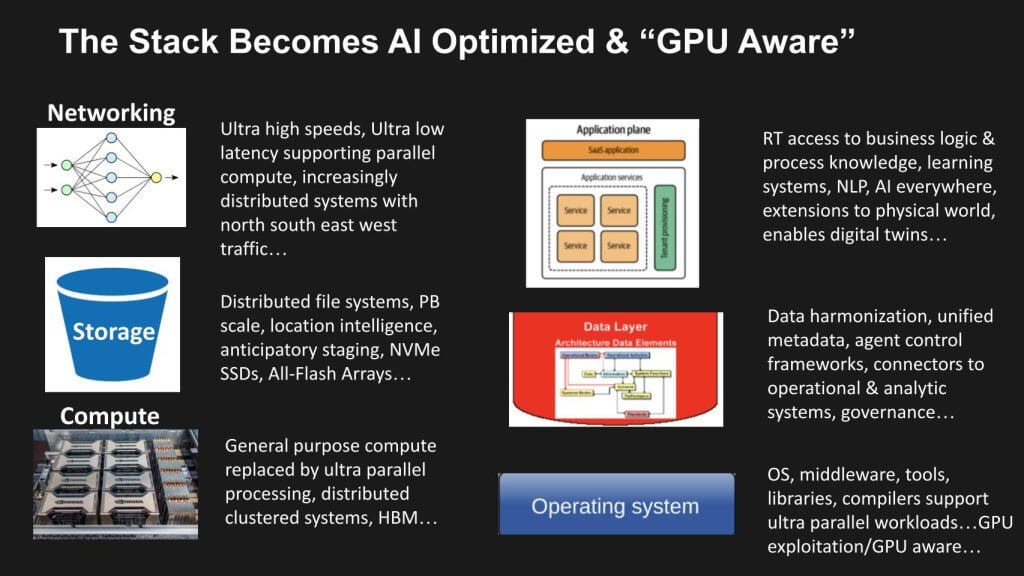

Semiconductor Stock Performance: A Five-Year Lens

The above graphic shows the five-year stock performance of major semiconductor players, with the “AI zone” shaded starting in late 2022—roughly coinciding with the initial buzz around ChatGPT. Until that timeframe, many were skeptical that large-scale GPU-accelerated AI would become such a powerful business driver.

- Nvidia: Broke away from the pack amid the AI enthusiasm and soared to become the most valuable public company in the world.

- Broadcom: Our data continues to support Broadcom as a strong next-best AI play in silicon, particularly for data center infrastructure. It provides critical IP to cloud giants for custom ASICs and next-generation networking, including Google, Meta and ByteDance.

- AMD: Has been beating Intel in the x86 market, but that segment is declining, so AMD is accelerating its push into AI. We see AMD attempting to replicate its successful x86 playbook—this time against Nvidia’s GPUs. Nvidia’s competitive moat and software stack will be harder for AMD to undermine without major misteps by Nvidia.

- Intel: Intel’s foundry strategy remains a major headwind. As outlined in our plan for Intel’s foundry, we see insufficient volume to catch TSMC as capital constraints pile up. We believe Intel will be forced to divest its foundry business this year which will make us more optimistic on Intel’s formidable design business, enabling the company to unlock innovation again and become a viable AI player.

- Qualcomm: Remains focused primarily on mobile, edge, and device-centric AI. While not a direct threat to Nvidia in the data center, future expansions into robotics and distributed edge AI could bring these players into occasional contention.

In our view, the market has recognized that semiconductors are the foundation of future AI capabilities, awarding premium multiples to companies that can capture accelerated compute demand. This year, the “haves” (led by Nvidia, Broadcom, AMD) are outperforming, while the “have-nots” (in particular, Intel) are lagging.

The Competitive Landscape: Nvidia and its Contenders

Nvidia’s 65% operating margins have enticed investors and competitors to enter the AI chip market in droves. Both incumbents and new entrants have responded aggressively. Yet the market potential is so large and Nvidia’s lead is so substantial that in our view, near-term competition will not negatively impact Nvidia. Nonetheless, we see multiple angles regarding Nvidia’s challengers, each with its own market approach.

Broadcom and Google

We align these two leaders because: 1) Broadcom powers custom chips such as Google’s Tensor Processing Units (TPUs); and 2) We believe that TPU v4 is extremely competitive in AI. Broadcom’s IP around SerDes, optics, and networking is best-in-class and together with Google represents in our view the most viable technical alternative relative to Nvidia.

- Potential Volume Play: A longshot scenario is that Google could eventually commercialize TPUs more aggressively, turning from a purely internal solution to a broader market offering. But in the near term, the ecosystem around Google’s TPUs remains captive and is currently a closed market limiting adoption to internal Google use cases.

Broadcom and Meta

Importantly, Broadcom also has had a long term relationship with Meta and powers its AI chips. Both Google and Meta have proven that AI ROI in consumer advertising pays off. While many enterprises struggle with AI ROI, these two firms are demonstrating impressive return on invested capital (ROIC) from AI. Both Google and Meta are leaning into Ethernet as a networking standard. Broadcom is a strong supporter of Ethernet and a leading voice in the Ultra Ethernet Consortium. Moreover, Broadcom is the only company other than Nvidia with proven expertise on networking within / across XPUs and across XPU clusters, making the company an extremely formidable competitor in AI silicon.

AMD

AMD’s data center strategy hinges on delivering competitive AI accelerators—building on the company’s track record in x86. While it has a serious GPU presence for gaming and HPC, the AI software ecosystem (centered on CUDA) remains a key obstacle.

- Two Angles: Some believe AMD will take meaningful market share in AI, at least enough to sustain revenue growth. Others foresee only modest gains because AMD must match not only Nvidia’s hardware but also its software stack, systems exepertise and developer loyalty.

AMD has made aggressive moves in AI. It is aligning with Intel to try and keep x86 viability alive. It has acquired ZT Systems to better understand end-to-end AI systems requirements and will be a viable alternative of merchant silicon, especially for inference workloads. Ultimately we believe AMD will capture a relatively small share (single digits) of a massive market. It will manage x86 market declines by gaining share against Intel and make inroads into cost sensitive AI chip markets against Nvidia.

Intel

Once the undisputed leader in processors, Intel’s fortunes have turned amid the shift toward accelerated compute. We continue to see Intel hampered by the massive capital requirements of retaining its own foundry.

- Vertical Integration vs. Scale: Vertical integration can be advantageous for companies like Apple, Nvidia, Oracle and Tesla, which combine hardware and software in a single system. But in Intel’s case, we believe the foundry business is draining critical resources and management attention. Intel in our view risks further damage if it doesn’t shed its foundry business this year.

- Possible Outcomes: Our widely held position is that Intel should spin off its foundry operations to focus on design and partnerships, similar to how AMD shed its fab operations. Another scenario is that Intel continues to invest, eventually regains process leadership, and competes head-on. However, the probability of this outcome is extremely low (less than 5% in our view).

AWS and Marvell: Trainium and Inferentia

Amazon’s custom silicon approach has succeeded with Graviton in CPU instances. Its acquisition of Annapurna Labs is one of the best investments in the history of enterprise tech. And certainly it’s one that is often overlooked. Today, AWS works with Marvell and is applying a Graviton-like strategy to GPUs with Trainium (for training) and Inferentia (for inference).

Dylan Patel’s take on Amazon’s GPU sums it up in our view. Here’s what he said on a recent episode of the BG2 pod:

Amazon, their whole thing at reinvent, if you really talk to them when they announce Trainium 2 and our whole post about it and our analysis of it is like supply chain wise, this is looks you, you squint your eyes. This looks like a Amazon basics TPU, right? It’s decent, right? But it’s really cheap, A; and B, it gives you the most HBM capacity per dollar and most HBM memory bandwidth per dollar of any chip on the market. And therefore it actually makes sense for certain applications to use. And so this is like a real shift. Like, hey, we maybe can’t design as well as Nvidia, but we can put more memory on the package.

[Dylan Patel’s Take on Amazon Trainium]

Our view is that AWS’s offering will be cost-optimized— and offer an alternative GPU approach within the AWS ecosystem for both training an inference. While developers ultimately may prefer the familiarity and performance of Nvidia’s platform, AWS will offer as many viable choices to customers as it can and will get a fair share of its captive market. Probably not the penetration it sees with Graviton relative to merchant x86 silicon but a decent amount of adoption to justify the investment. We don’t have a current forecast for Trainium at this time but it’s something we’re watching to get better data.

Key Takeaways

- Value vs. Performance: Some workloads do not require Nvidia’s premium capabilities, and those might migrate to lower-cost AWS silicon. Meanwhile, the NVIDIA stack will remain the top choice for complex, large-scale deployments and developer convenience.

- AWS Backend Infrastructure – Our research at re:Invent indicates that AWS has been working for years on building out its own AI infrastructure to reduce reliance on Nvidia’s full stack. Unlike many companies that require Nvidia’s end-to-end systems, while AWS can offer such a solution to customers, it can also offer its own networking and supporting software infrastructure further lowering costs for customers, while improving its own margins.

4.5 Microsoft & Qualcomm

Microsoft has historically lagged AWS and Google in custom silicon, though it does have ongoing projects (e.g., Maia). Microsoft can offset any silicon gap with its software dominance and willingness to pay Nvidia’s margins for high-end GPUs. Qualcomm is a key supplier for Microsoft client devices. Qualcomm as indicated competes in mobile and edge, but as robotics and distributed AI applications expand, we see potential for more direct clashes with Nvidia.

Emerging Alternatives

Firms like Cerebras, SambaNova, Tenstorrent, and Graphcore have introduced specialized AI architectures. China is also developing homegrown GPU or GPU-like accelerators. However, the unifying challenge remains software compatibility, developer momentum, and the steep climb to dislodge a de facto standard.

Key Takeaway: While competition is strong, none of these players alone threatens Nvidia’s long-term dominance—unless Nvidia makes significant missteps. The market’s size is vast enough that multiple winners can thrive.

Inside Nvidia’s Moat: Hardware, Software, and Ecosystem

We see Nvidia’s competitive advantage as a multifaceted moat spanning hardware and software. It has taken nearly two decades of systematic innovation to produce an integrated ecosystem that is both broad and deep.

Hardware Integration & “Whole Cow” Strategy

Nvidia’s GPUs employ advanced process nodes, including HBM memory integration, and specialized tensor cores that deliver huge leaps in AI performance. Notably, Nvidia can push a new GPU iteration every 12-18 months. Meanwhile, it uses “whole cow” methods—ensuring that every salvageable die has a place in its portfolio (data center, PC GPUs, or automotive). This keeps yields high and margins healthy.

Networking Advantage

The acquisition of Mellanox put Nvidia in control of InfiniBand, enabling it to sell comprehensive end-to-end systems for AI clusters and get to market quickly. The integration of ConnectX and BlueField DPUs extends Nvidia’s leadership in ultra-fast networking, a critical component for multi-GPU scaling. As the industry moves toward the Ultra Ethernet standard, many see this as a threat to Nvidia’s moat. We do not. While networking is a critical component of Nvidia’s time to market advantage, we see it as a supporting member of its portfolio. In our view the company can and will successfully optimize its stack for Ethternet as the market demands; and it will maintain its core advantage which comes from tight integration across its stack.

Software Integration & Platform Approach

Nvidia’s software ecosystem has grown far beyond CUDA to include frameworks for nearly every stage of AI application development. The net result is that developers have more reason to stay within Nvidia’s ecosystem rather than seeking alternatives.

Ecosystem & Partnerships

Jensen Huang, Nvidia’s CEO, has frequently underscored the company’s emphasis on building a partner network. Virtually every major tech supplier and cloud provider offers Nvidia-based instances or solutions. That broad footprint generates significant network effects, reinforcing the moat.

Key Takeaway: Nvidia’s advantage does not hinge on chips alone. Its integration of hardware and software—underpinned by a vast ecosystem—forms a fortress-like moat that is difficult to replicate.

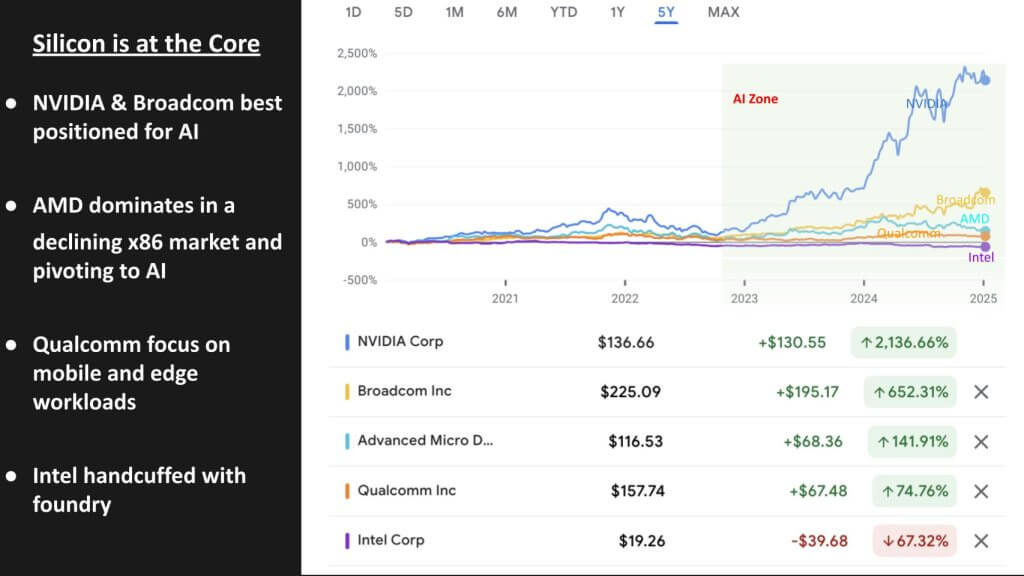

Drilling Down into Nvidia’s Software Stack

CUDA rightly dominates the software discussion, but Nvidia’s stack is broad. Below we highlight six important layers: CUDA, NVMI/NVSM (here denoted as “NIMS”), Nemo, Omniverse, Cosmos, and Nvidia’s developer libraries/toolkits.

CUDA

Compute Unified Device Architecture (CUDA) is Nvidia’s foundational parallel computing platform. It abstracts away the complexities of GPU hardware and allows developers to write applications in languages like C/C++, Fortran, Python, and others. CUDA orchestrates GPU cores and optimizes workload scheduling for accelerated AI, HPC, graphics, and more.

NIMS (Nvidia Inference Microservices)

NVIDIA NIMS are a set of inference microservices designed to simplify and accelerate the deployment of foundation models on any cloud or data center.

NeMo

NeMo is an end-to-end framework for developing and fine-tuning large language models and natural language applications. It provides pre-built modules, pre-trained models, and the tooling to export those models into other Nvidia products, helping speed time-to-insight for businesses that want to leverage NLP and large language models.

Omniverse

Omniverse is a platform for 3D design collaboration, simulation, and real-time visualization. While originally showcased for design engineering and media, Omniverse now extends into robotics, digital twins, and advanced physics-based simulations. It leverages CUDA for graphical rendering, combining real-time graphics with AI-driven simulation capabilities.

Cosmos

Cosmos is a platform that helps developers create world models for physical AI systems. It’s used to accelerate the development of robotics and autonomous vehicles (AVs).

Developer Libraries & Toolkits

Beyond the core frameworks, Nvidia has developed hundreds of specialized libraries for neural network operations, linear algebra, device drivers, HPC applications, image processing, and more. These libraries are meticulously tuned for GPU acceleration—further locking in the developer community that invests time to master them.

Key Takeaway: The software stack is arguably the most important factor in Nvidia’s sustained leadership. CUDA is only part of the story. The depth and maturity of Nvidia’s broader AI software suite forms a formidable barrier to entry for new challengers.

Brief Tangent from the Data Center: AI PCs Emerge

Although this Breaking Analysis focuses on data center transformation, we would be remiss not to discuss AI PCs briefly. At CES this year, multiple vendors announced laptops and desktops branded as “AI PCs,” often featuring NPUs (neural processing units) or specialized GPUs for on-device inference.

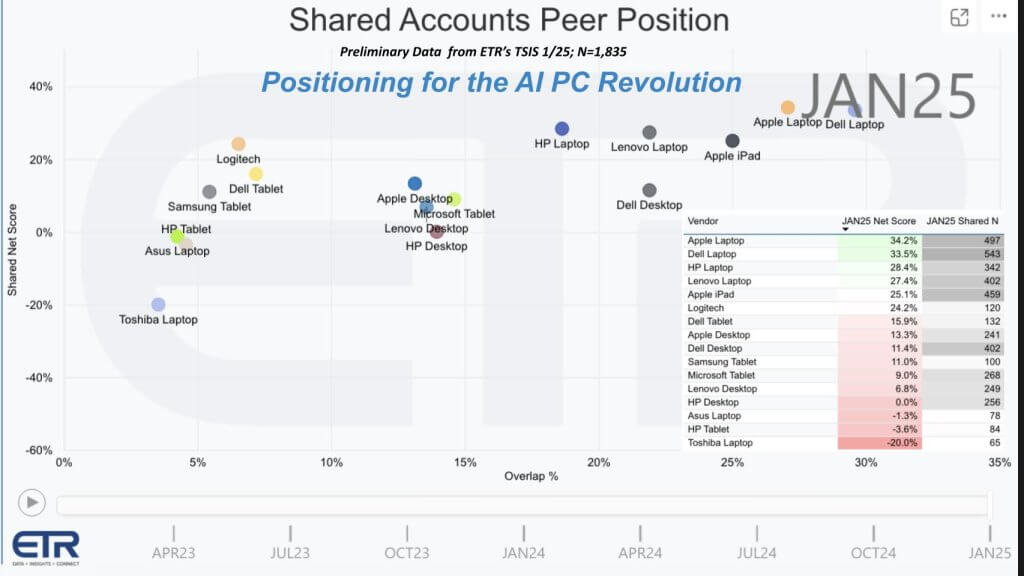

ETR Data on Client Devices

Survey data shown above is from ETR in a survey of approximately 1,835 IT decision makers. The vertical axis is Net Score or spending momentum and the horizontal axis is Overlap or penetration within those 1,835 accounts. The table insert shows how the dots are plotted (Net Score and N). It shows Dell laptops at the top of the share curve with 543 N, with strong spending momentum across Apple, HP, and Lenovo. The plot reveals healthy spending momentum for leading PC suppliers.

- Dell: Introduced AI laptops and has signaled collaboration with multiple silicon partners, including AMD, Intel, and Qualcomm. We believe it could integrate Nvidia solutions as well.

- Apple: Has shipped NPUs for several years in its M-series chips, benefiting battery life and local inference. Apple remains a force in vertical integration.

- Others (HP, Lenovo, etc.): Each is testing or releasing AI-focused endpoints, sometimes with dedicated NPUs or discrete GPUs.

Role of NPUs in PCs

Currently, the NPU often sits idle in many AI PCs because software stacks are still not fully optimized. Over time, we expect more specialized AI applications on client devices—potentially enabling real-time language translation, image/video processing, advanced security, and local LLM inference at smaller scales.

Nvidia’s Position

We believe Nvidia, with its track record in GPUs, can offer AI PC technology that is more performant than typical NPUs on mobile or notebooks. However, the power consumption, thermals, and cost constraints remain significant challenges. We do see Nvidia using salvaged “whole cow” dies and building them into laptop GPUs with reduced power envelopes.

Although this section deviates from the data center focus, AI PCs could drive developer adoption. On-device AI makes sense for productivity, specialized workloads, and specific vertical use cases. This, in turn, may reinforce the broader ecosystem transition to parallel computing architectures.

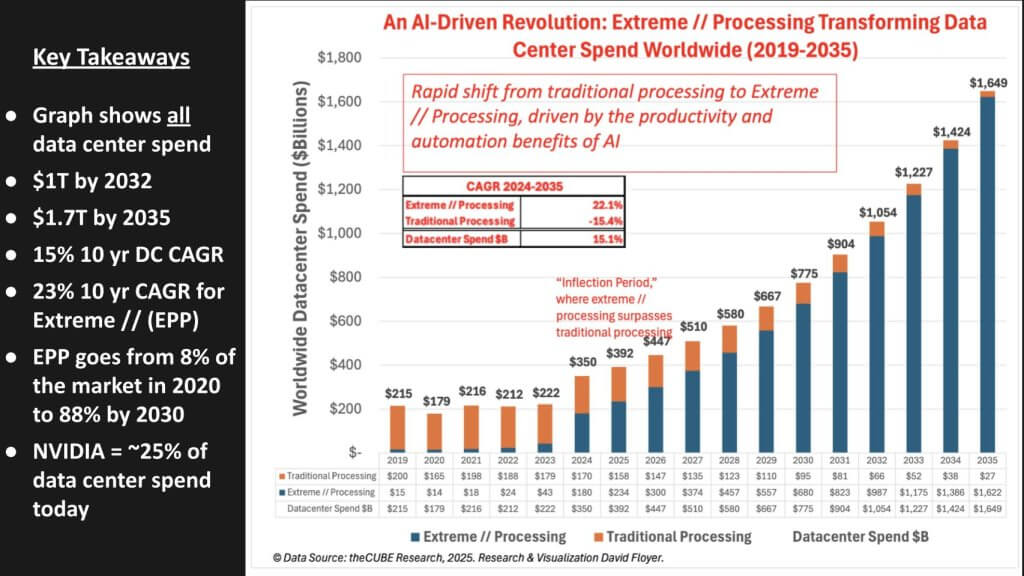

Market Analysis: Data Center Spending and EPC Ascendancy

We have modeled the entire data center market—servers, storage, networking, power, cooling, and related infrastructure—from 2019 through 2035. Our research points to a rapid transition away from traditional general-purpose computing toward extreme parallel computing.

8.1 Data Center TAM Growth

- The total data center market is projected to surpass $1 trillion by 2032 and expand to $1.7 trillion by 2035.

- From 2024 onward, our baseline model shows an overall CAGR of 15%—considerably higher than the historical single-digit growth rate for enterprise IT.

8.2 Extreme Parallel Computing Growth

We categorize “extreme parallel computing” as the specialized hardware and software for AI training, inference, HPC clusters, and advanced analytics.

- The EPC portion is growing at a 23% CAGR over the same period, ultimately dwarfing the once-dominant share of standard x86-based systems.

- In 2020, EPC represented roughly 8% of data center spend. By 2030, we project it will exceed 50%. By mid-2030s, advanced accelerators could represent the overwhelming majority (80–90%) of data center silicon investments.

8.3 Nvidia’s Capture of EPC Spend

Currently, we estimate that Nvidia accounts for roughly 25% of the entire data center segment. Our view is that Nvidia will retain that leading share throughout the forecast period—assuming it avoids unforced errors—despite intense competition from hyperscalers, AMD, and others.

8.4 Drivers of Growth

- Generative AI & LLMs: ChatGPT-like models demonstrate the power of accelerated computing for natural language, coding, search, and more.

- Enterprise Agent Models: Firms worldwide will embed AI in business processes, requiring heavier data center workloads.

- Robotics & Digital Twins: Over time, industrial automation and sophisticated robotics will demand large-scale simulations and real-time inference.

- Automation ROI: The drive to reduce costs and labor dependencies often produces immediate returns when combined with accelerated AI.

Key Takeaway: The anticipated shift toward accelerated compute forms the foundation of our bullish stance on data center growth. We believe extreme parallel computing ushers in a multi-year (or even multi-decade) supercycle for data center infrastructure investments.

Conclusion and Risks to Our Positive Nvidia Scenario

Summary of the Premise

We assert that a new trillion-dollar-plus marketplace is emerging, fueled by AI. The data center—as we have known it—will transform into a distributed, parallel processing fabric where GPUs and specialized accelerators become the norm. Nvidia’s tightly integrated platform (hardware + software + ecosystem) leads this transition, but it is not alone. Hyperscalers, competing semiconductor firms, and specialized startups all have roles to play in a rapidly expanding market.

Key Risks to the Scenario

Despite our positive assessment, we acknowledge several risks:

- Reliance on TSMC & Supply Chain Fragility

- Nvidia relies heavily on TSMC for fabrication. Potential disruption from geopolitical events, notably involving China and Taiwan, is a critical vulnerability.

- AI Overhype or Economic Downturn

- AI may struggle to deliver near-term returns as quickly as some expect. A macroeconomic pullback could dampen spend on expensive infrastructure.

- Open-Source Alternatives

- Numerous communities and vendors are working on open-source frameworks to bypass Nvidia’s software stack. If these become sufficiently mature, they could erode Nvidia’s grip on developer mindshare.

- Antitrust, Regulation and Jensen Succession Planning

- Governments worldwide have AI in their crosshairs, from ethics to competition policy. Regulatory pressure could constrain Nvidia’s ability to bundle hardware and software or expand through acquisitions.

- Jensen is the single most important force providing strategic direction, clear communications and massive influence in the industry. If he were no longer in a position to lead Nvidia that would change the dynamic. Succession planning discussions haven’t been disclosed but it remains an unspoken risk.

- Alternative Approaches

- Quantum computing, optical computing, or ultra-low-cost AI chips might eventually disrupt GPU dominance, especially if they offer superior performance at lower cost and wattage.

Final Word: Nvidia’s future looks bright, in our view, but it cannot be complacent. The company’s best defense remains relentless innovation in both hardware and software—a strategy that has carried it to where it is today and will likely drive its continued leadership in this new era of extreme parallel computing.