We believe the prevailing narrative that Broadcom and NVIDIA are locked in a zero-sum battle for AI data center dominance is misleading. The reality is these companies are playing very different games. NVIDIA has built a vertically integrated compute and software platform that has become the engine of the AI factory era. Broadcom, by contrast, has constructed a durable business model around connectivity, custom silicon, and high-margin software. The strategies overlap but are not mutually exclusive. We believe the real story is how these firms are carving out complementary positions in the most important technology cycle since the dawn of the Internet.

In this Breaking Analysis we examine the different strategies of Broadcom and NVIDIA and explain why the success of one doesn’t necessarily mean dilution to the others’ prospects.

NVIDIA’s Platform Play: Owning the AI Factory

NVIDIA’s strategy is straightforward in concept but extraordinarily difficult to replicate. The company builds a full-stack platform that starts with GPUs and extends across the system. Jensen Huang has repeatedly emphasized that the unit of competition is no longer the chip, but the system or what NVIDIA coined as the AI factory. NVIDIA has positioned itself as the indispensable supplier for anyone looking to stand up these factories.

At the core of NVIDIA’s stack are GPUs such as Hopper and Blackwell, paired with NVLink/NVSwitch interconnects to form tightly coupled compute domains. These “pods” scale to 72 GPUs, creating high-bandwidth, low-latency islands optimized for extreme parallel processing workloads such as AI training.

NVIDIA extends these pods outward using InfiniBand, a proprietary network technology it captured from its Mellanox acquisition. In addition, NVIDIA leverages its Spectrum-X Ethernet, a purpose-built Ethernet fabric designed to handle AI traffic deterministically.

On top of the hardware sits its CUDA software stack and hundreds of libraries that represent the software glue that makes these systems programmable and highly tuned. NVIDIA’s software moat is deep, with tens of thousands of developers locked into its ecosystem and wide supporting a virtually infinite number of use cases.

In addition, the company offers systems and services such as DGX, NIMS inference microservices, and Omniverse for simulation and digital twins, further solidifying its position as a platform, not just a chip supplier.

The cadence of innovation is relentless. Each year, NVIDIA launches new architectures that deliver better performance per watt and higher utilization of the cluster. This annual rhythm turns capital spending into a recurring monetization cycle. The result, when power is a constraint and systems are under-utilized, is customers spend more, generate more tokens per watt, and reduce unit cost at scale.

Broadcom’s Franchise Model: Durable, Open, Profitable

Broadcom’s approach is significantly different from that of NVIDIA. Hock Tan and Charlie Kawwas are not chasing GPUs or building giant AI systems. Instead, Broadcom’s playbook is to identify durable franchises – markets with a decade or more of runway – establish technology leadership, and run them with intense operating discipline. Some investors have shied away from Broadcom citing it as a “commodity player.” In our view this narrative is misguided and lacks an understanding of the engineering investments required to deliver the products Broadcom produces, including in its wireless portfolio.

In semiconductors, Broadcom has staked its claim in connectivity. Its Tomahawk and Jericho families dominate merchant Ethernet switching. It has also secured custom silicon design wins with Google, Meta, and likely ByteDance, embedding Broadcom deep into the hyperscale AI buildout. These are multi-billion dollar, long duration deals that are highly strategic. The company just announced it closed another $10B custom chip deal, widely known to be with OpenAI, which, like the hyperscalers, is designing its own chips to reduce its reliance on NVIDIA.

On the last earnings call, Hock Tan had what appeared to be an inadvertent and ironic “tell” saying the following:

Today’s AI rack scales up a mere 72 GPUs at 28.8 terabit per second bandwidth using proprietary NVLink. On the other hand, earlier this year, we have launched Tomahawk 5 with Open AI — with open Ethernet, sorry, which can scale up 512 compute nodes for customers using XPUs.

This slip of the tongue came right after he announced the most recent $10B custom chip deal, leading many observers, including us, to conclude that OpenAI was clearly embedded (in a good way) in Hock’s head space.

Charlie Kawwas’ mantra is “OSP.” It stands for Open, Scalable, Power Efficient and frames Broadcom’s philosophy. The company bets that open standards like Ethernet and PCIe will ultimately win out over proprietary approaches such as InfiniBand and NVLink. History suggests this is a good bet, which is why NVIDIA has also embraced Ethernet.

In software, Broadcom has reshaped VMware around VMware Cloud Foundation (VCF), announcing VCF 9.0 claiming the integration of all those disparate VMware software modules was achieved with thousands of engineers creating the bundle. Broadcom’s strategy to force customers into higher-value contracts, while controversial, has driven operating margins above 70% and gross margins over 90%, substantially better than other SaaS gross margins. Moreover, VMware has become the most robust on-prem alternative to public cloud and represents the most mature private cloud offering on the market in our view.

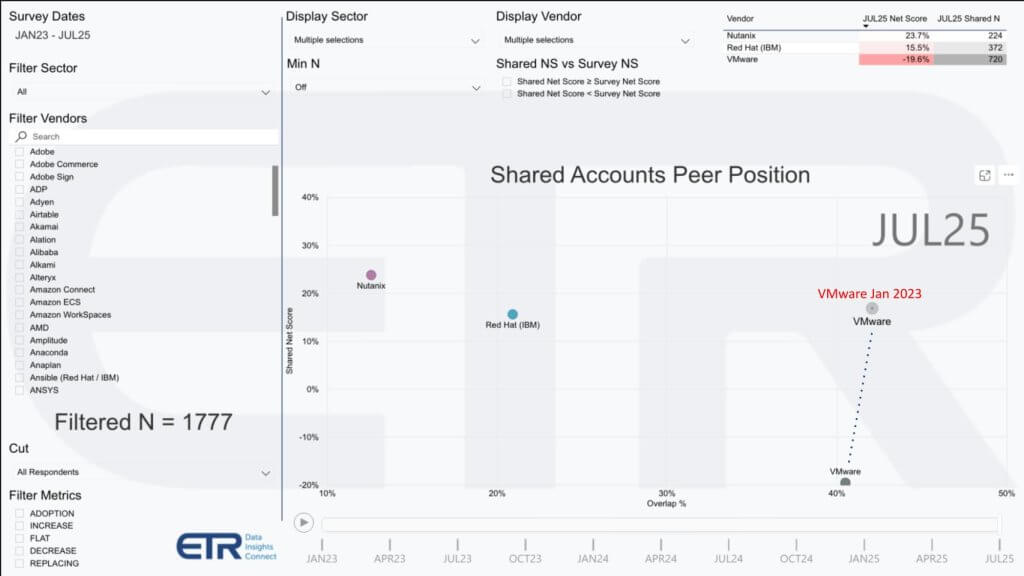

The quirk of Broadcom’s VMware strategy is that alternatives such as Hyper-V, Nutanix, Red Hat, etc. have gained momentum, where previously they were shut out as virtualization plays. Broadcom doesn’t want the customers unwilling to pay up for the full VCF stack but alternative players that don’t have nearly the profitability profile of Broadcom are happy to take the business.

VMware’s Misleading Account Spending Profile

The graphic below shows ETR’s Net Score methodology for the virtualization market. The vertical axis (Net Score) represents the Net percent of customers spending more on each platform and the horizontal axis shows penetration into the data set. The data would lead one to believe that VMware is struggling, noting its precipitous drop from January 2023. But the methodology doesn’t capture amount of spend. As such it misses the fact that Broadcom’s strategy has been to more narrowly focus its efforts on those high value customers willing to spend on the whole VCF bundle to lower TCO.

This is a classic Broadcom move. It only competes in markets where it can dominate. In the case of VMware, it’s not the number of logos that matters, rather its the number of customers that willing to absorb price increases and buy the full bundle. Contrary to many misguided narratives, Broadcom invests heavily in engineering and surrounds its platform with critical technologies that drive clear ROI. This is why (for example) even NVIDIA buys networking technologies from Broadcom.

The bottom line is Broadcom doesn’t need to win in GPUs head-to-head with NVIDIA to thrive. Instead, it supplies the glue — SerDes, NICs, optics, and switches — that make large AI systems possible. In Kawwas’ words, Broadcom doesn’t make GPUs, it makes the stuff that makes XPUs and HBMs work. In addition, it has secured multi-billion dollar, long duration contracts to build custom AI chips for some of the top companies in the world, including Google, Meta, ByteDance and now OpenAI.

Scale vs. Performance: The Technical Trade-offs

A major flashpoint between the two companies is the question of scale. On Broadcom’s most recent earnings call, Hock Tan de-positioned NVIDIA’s NVLink 72 as “scaling up a mere 72 GPUs at 28.8 terabits per second,” contrasting it with Broadcom’s Ethernet fabrics that can connect 512 nodes using Tomahawk 5. At face value, this makes NVIDIA’s approach sound limited. But the comparison is misleading in our view.

The way we interpret NVIDIA’s use of the “scale up, out across” terminology is as follows:

- Scale-up = tightly coupled nodes in a single rack (NVLink/NVSwitch).

- Scale-out = cluster across racks (InfiniBand/Ethernet).

- Scale-across = spanning data centers.

Broadcom, in Tan’s remark, appears to have used “scale up” more loosely to mean “supporting larger clusters than 72 GPUs.” But technically, connecting 512 compute nodes with Ethernet is a scale-out fabric, not scale-up. In particular, scale-up is generally thought of as making a single logical system bigger by tightly coupling components. Think symmetric multiprocessing in a single box.

In our view, Tan was de-positioning NVLink’s rack-level island (72 GPUs) as small, contrasting it with Broadcom’s Ethernet-based ability to connect hundreds of nodes. In doing so, he takes liberty with the terminology, calling Ethernet’s cluster expansion “scale up,” when in fact in classic parlance it’s scale-out.

In contrast, NVIDIA’s 72 GPUs refers to a tightly coupled NVLink domain where HBM pools are shared across GPUs, enabling highly efficient parallel operations. Broadcom’s 512 nodes really refers to the scale-out capability of Ethernet fabrics. It is not an apples-to-apples comparison. The two approaches solve different problems. NVLink maximizes performance within a rack, while Ethernet extends clusters across racks and rows.

The trade-off is NVLink delivers peak performance per GPU, Ethernet delivers estate-level scalability and economics. In practice, operators use both – NVLink for high performance compute islands, Ethernet for stitching those islands together.

Financial Profiles: Both Exceptional

The financial models of NVIDIA and Broadcom underscore their different strategies. On the surface, both companies post extraordinary results, but the way they get there is different.

NVIDIA today is running at a revenue pace of roughly $187 billion annually, up an impressive 56% year-over-year. Despite moderating from the triple-digit growth rates of prior quarters, this remains one of the fastest growth profiles of any mega-cap. Margins are equally impressive: 73% gross, 65% operating, and 33% operating cash flow. With a market capitalization north of $4 trillion and a 22x run rate revenue multiple, NVIDIA is being valued as a once-in-a-generation growth company, not a traditional semiconductor provider. In our view, this reflects investor conviction that NVIDIA’s full-stack AI factory strategy has years of runway left, with annual cadence upgrades, CUDA software lock-in, and hyperscaler demand elasticity sustaining momentum. And an economic value proposition that is compelling when power is the limiting factor and utilization / efficiency improvements can be achieved with rapid tech refreshes.

In its recent earnings call, NVIDIA stressed the ramp of Blackwell, with NVLink 72 deployents showing 10× efficiency gains on reasoning workloads compared to Hopper. Management highlighted that inference is now a meaningful revenue stream, alongside training. In terms of ROI, elasticity (Jevons Parodox) is allowing NVIDIA to cut price per token while still growing revenue.

Broadcom, by contrast, is delivering exceptional results with a different playbook. The company is operating at an annualized revenue run rate of about $64 billion, growing a solid but more measured 22% year-over-year. This past quarter its non-AI semiconductor offerings were a headwind but they’re expected to grow sequentially. Broadcom’s gross margin of 67% is lower than NVIDIA’s, but Broadcom shines in cash generation, with 45% operating cash flow margin – a remarkable figure given the scale of the business. Operating margin sits at 37%, well below NVIDIA’s, but consistent with Broadcom’s blend of semiconductors and infrastructure software. Its valuation, at roughly $1.6 trillion market cap and a 25x revenue multiple, is notable. Investors are waking up to Broadcom, not for its hyper-growth, but for its durability, discipline, and strategic positioning as the connective tissue for AI infrastructure, the go-to firm for custom AI chips and the value creator of its VMware asset.

Broadcom’s recent earnings highlighted Tomahawk 5’s ability to scale clusters well beyond the NVLink pod size. We note the caveats to Tan’s statements as cited earlier. Tan reiterated that VMware Cloud Foundation adoption is ahead of schedule, with software margins approaching 70%. AI silicon revenue run-rate hit ~$16B, anchored by custom hyperscaler wins and an exciting $10B deal widely reported to be with OpenAI.

In our opinion, these financial metrics underscore NVIDIA as a hyper-growth platform company trading at a premium for its velocity, while Broadcom is a durable compounder valued for its consistency, cash flows, and long-term franchises. Both models are exceptional, both companies are fundamental to the AI movement, but they reflect entirely different philosophies of how to capture value in the AI era.

Market and Investor Implications

We believe the implications of these strategies are meaningful in the sense that:

- It’s not zero-sum. Both companies can thrive. NVIDIA dominates accelerated compute, Broadcom dominates connectivity and software monetization, securing highly valuable, long-term relationships with some of the largest and most important platforms in the AI era.

- The system is the unit of competition. Efficiency knobs are performance per watt and utilization. NVIDIA drives these inside pods, Broadcom across fabrics. While both companies embrace standards, NVIDIA has built a proprietary moat around silicon, software, libraries, full systems and an ecosystem. Broadcom is leveraging an open ecosystem and its moat is engineering and technical leadership applied to create really hard to develop products that are critical to make full systems work.

- Risk profiles. NVIDIA faces demand elasticity, hyperscaler insourcing/exposure, supply constraints and public policy headwinds (i.e. China markets in particular). Broadcom faces similar demand risks related to AI, balancing VMware profit objectives with customer backlash and highly concentrated custom chip customers.

- Investor perspective. NVIDIA trades as a hyper-growth momentum stock. Broadcom trades as a durable compounder with a high margin profile. Both companies trade at a premium relative to the broader market but given their profitability profiles and growth rates investors have rewarded both companies and will continue to do so as long as AI momentum continues.

Conclusion

In our opinion, the market should stop framing Broadcom and NVIDIA as rivals in a zero-sum contest. Moreover, the idea that Broadcom is a commodity play, as posited by some pundits, is absurd in our view. NVIDIA and Broadcom are playing different games, both of which are essential to the AI era. NVIDIA builds the compute engines and software platforms that drive new workloads. Broadcom ensures those engines can scale, interconnect, and operate profitably over a decade-long horizon.

Our research suggests that as AI moves from cloud to enterprise to real-world systems, both NVIDIA and Broadcom will expand their moats in very different, but highly synergistic ways. The real battle is not between them, but between this new architecture and the legacy compute stack it is replacing.