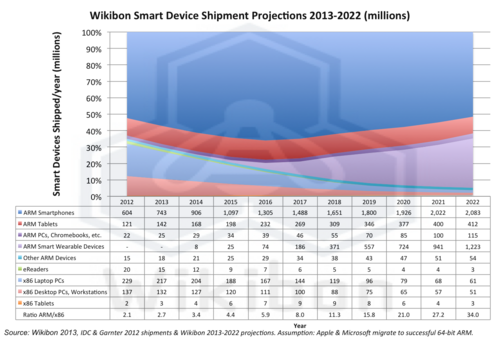

In January 2013 Wikibon projected that Intel would decline from over 30% of the smart device market to less than 5% by 2022. Two subsequent events have changed the forecast:

- Wearable devices such as glasses and watches have burst on to the scene and will be another major market very unlikely to include Intel.

- ARM Holdings & TSMC announced the tape-out of the 64-bit A57 Cortex on Target.

- On April 2 2013 ARM Holdings and TSMC announced the tape-out of the ARM Cortex A57 processor. The new chip will use TSMC’s 16nm FinFET technology. The overall design will bring up to three times the processor power of current ARM chips for the same power consumption, or up to five times power reduction when set to the same performance as current ARM processors.

- This keeps ARM on target for licensees to deliver 64-bit devices in volume in early 2014.

- This will enable ARM processors to compete directly with Intel at the high end of smart devices such as 64-bit PCs.

- Longer term, this will allow ARM to compete in the server market place.

- The architecture of the ARM Cortex A57 processor is highly sophisticated.

The revised projection as a 100% stacked area chart is shown in Figure 1. It shows that by the year 2022, Intel will have less than 3% of Smart Device shipments.

Source: Wikibon 2013, based on IDC and Gartner 2012 shipment estimates projected by Wikibon to 2022

Assumptions: Assume successful shipment of 64-bit ARM processors and migration to ARM by Apple and Microsoft

The assumptions underlying the long term forecast in Figure 1 below were:

- Successful volume introduction of 64-bit ARM processors in 2014,

- Apple migrating its PC OS from Intel to 64-bit ARM in 2015,

- Microsoft migrating Windows from Intel to 64-bit ARM in 2017.

Wikibon correctly projected that Microsoft Windows 8 Pro would have little impact on PC shipments and little impact on the ARM tablet market. What has become clear is that 64 bit Windows 8 Pro is a reasonable upgrade for the traditional Windows knowledge worker, and the touch capability has created some application niches for Intel X86-based tablets. However, most day-to-day function can be done better and much more cheaply on Apple and Android-based devices, together with access to many more high quality applications. The bottom line is that from Intel’s x86 point of view, the Windows 8 Pro X86-based tablets are mainly competing with PCs, and are not additive to the market.

Wikibon believes that both Apple and later Microsoft will migrate their PC operating systems to ARM, leaving behind specialized very high-end devices on Intel. The revised timescale and projection of these events are shown in Figure 2.

Source: Wikibon February 2013, based on IDC and Gartner 2012 shipment estimates projected by Wikibon to 2022

Assumptions: successful shipment of 64-bit ARM processors and migration to ARM by Apple and Microsoft

In November 2011, HP announced Project Moonshot, which brought together technologies to deliver ARM-based servers. A major constraint to the development of Project Moonshot was the lack of a 64-bit processor, as most server applications assume a 64-bit environment. With the availability of 64-bit ARM-based processors, Wikibon believes that HP and others will aggressively develop an alternative platform based on Linux. One area of immediate potential is the hyper-scale market, where closer packing for low-power processors will allow more total performance in a rack.

Intel will need to treat the PC chip market as a cash cow, and focus on:

- The higher margin x86 server market. In particular, Intel has to shore up the low-end of its x86 server market with aggressive innovation and price action if it is to avoid a repeat of the displacement of Unix servers by Intel servers from the bottom up from 1990-2000.

- If feasible, Intel should focus on the ultra-small device/sensors with embedded non-volatile storage and attempt to come in under the ARM processors and move upwards.

Action Item: The probability that smart devices will migrate rapidly from x86 architecture to ARM-based architectures has increased as a result of the on-time 64-bit processor tape-out by ARM. CIOs and CTOs will need to include smart wearable devices in their strategic thinking, and include them in the security and authentication BYOD processes. For the next five years, IT organizations will probably consume 64-bit ARM-based servers as part of cloud service offerings, rather than implementing them directly in the data center.