Introduction

Wikibon looked at the state of the art for hybrid clouds in a recent research posting called “Beyond Virtualization: from Consolidation to Orchestration and Automation”. The general conclusions were that:

- Hybrid cloud adoption is a strategic imperative that enables enterprise IT to deploy apps on private clouds, while providing the option to deploy workloads better suited for public cloud (such as Big Data or the Internet of Things) on those platforms. Moreover the goal is to facilitate seamless migration from private “to-and-from” public clouds as well as between public clouds. Currently, hybrid cloud is early in the development cycle and is at a very early stage of adoption.

- The key business driver behind a hybrid cloud strategy is increasing the value of applications to the end-user and the business. As a consequence, hybrid cloud projects require:

- Buy-in and leadership as business-led initiatives, with an application focus;

- Clear strategic milestones and goals for each stage, with an expectation of in depth pre-planning and constant re-evaluation.

- Overall, virtualization and orchestration and automation (O&A) are the essential elements of an effective migration strategy. Wikibon believes that, today, storage presents the biggest challenges for hybrid cloud (virtualization of servers with hypervisors and containerization is advanced, and the virtualization of networks is technically simpler than storage). As such, Storage orchestration and automation is especially critical to hybrid cloud success.

As a result of our findings, we have focused our new research on evaluating:

- The strategies of the main IT players who are developing hybrid cloud solutions, focusing especially on storage enablement.

- The ability of those strategies to assist enterprises where VMware is a key component of their infrastructure to migrate to a hybrid cloud.

VMware Hybrid Cloud Strategy

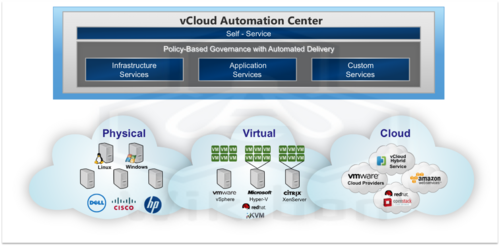

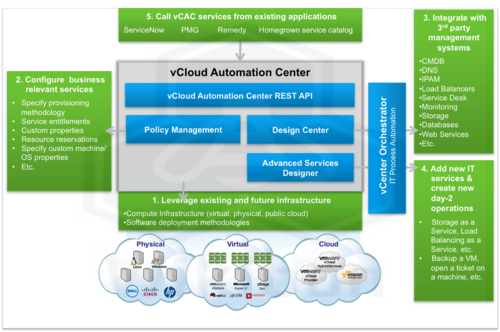

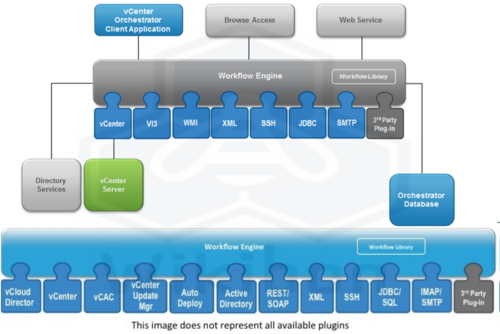

- Hybrid Cloud Offerings – VMware’s hybrid cloud strategy is built on the widely adopted vSphere, vCenter, vCloud & other VMware products. VMware vCloud Air (a rebranding of VMware vCloud Hybrid Services (vCHS)) is VMware’s public cloud offering, both as a direct service and for service providers. Professional services are often used to create customized O&A solutions instead of easier-to-use application templates. Diagrams illustrating the components of VMware Hybrid Cloud, Orchestration & Automation, and Operations are shown in the footnotes (Tables Footnote-1 to Footnote-4). A table of the new branding of VMware cloud software and the historic names are given in Figure Footnote-1.

- Approach – VMware in general focuses its hybrid cloud strategy on VMware as both the private and public clouds. There is very limited functionality to VMware private clouds front-ending OpenStack and other cloud offerings such as AWS, Google Cloud Platform Live, Microsoft Windows Azure, OpenStack and other cloud offerings. vVols appears to be the key to VMware’s future storage strategy. VMware has led a strong drive for VMware service providers (especially in Europe), as a base for common O&A framework and interface across private and public clouds and ease of on-ramping and off-ramping applications and workloads.

- OpenStack – VMware has announced a limited access to OpenStack under the management and control of VMware’s cloud. Wikibon believes this is an interesting but expensive way to manage OpenStack hardware resources through VMware, but it may be a useful approach for initial migration to OpenStack.

VMware is building a strong product based on its virtualization of processors, networking, and storage. Wikibon believes the relatively high cost of the VMware ecosystem software may be justified for mission-critical workloads, but there are many workloads where lower cost infrastructure hardware and software will be adequate.

Hybrid Cloud Strategies – IT Vendors

Wikibon consulted with all the major infrastructure vendors about their hybrid cloud strategies in general, but drilled down specifically for their VMware-related offerings. We found that there was significant commitment for hybrid cloud from all the vendors, and that enterprise IT should be confident that hybrid clouds will available from multiple sources. The following is a snapshot of the hybrid cloud status of each vendor interviewed as of October 2014. Wikibon plans to update this section as new capabilities and strategies are unveiled.

Dell

- Hybrid Cloud Offerings – Dell is taking a “drop-down approach”, with less emphasis on orchestration – a suitable approach for the mid-sized marketplace. It is focusing on vSphere and vCenter, and the potential of VMware vVols & VSAN. Dell Cloud Dedicated is a private cloud based on a VMware virtualized environment with a private, single-tenant cloud infrastructure. Dell also offers Cloud-On-Demand through the Dell cloud partner ecosystem, allowing enterprise IT to migrate or deploy applications in the public cloud. Dell provides this ecosystem with servers, networking and storage suitable for VMware, OpenStack and Open Compute Project infrastructures. Dell can provide services for the integration of an enterprise-specific template support for different applications.

- Approach – Apart from using VMware as a base, Dell has not articulated a clear orchestration and automation strategy that will bridge both private and public clouds.

- OpenStack – For higher-end enterprise customers and service providers, Dell is focused on providing hardware & software for OpenStack and Open Compute Project.

Wikibon believes that Dell is focusing investment in basic midrange private cloud hardware and software, and volume hardware for enterprise and general public cloud consumption. Wikibon believes that Dell still has time to define a clear hybrid cloud strategy.

EMC

- Hybrid Cloud Offerings – EMC has built its hybrid cloud offering on VMware’s orchestration & automation components as part of the EMC Federation. EMC has a strong installed base of data protection products (Data Domain, Avamar, NetWorker, RecoverPoint, etc.) and they have integrated support for these products and the procedures and ecosystem around them into VMware O&A as part of their hybrid cloud strategy. EMC has focused on building templates for integrating applications directly into the EMC hybrid cloud.

- Approach – EMC recognizes that vVols is the endgame for VMware’s storage strategy and is investing heavily in enabling an abstraction layer as a bridge to this new storage paradigm of utilizing existing storage arrays, data protection products and vVols by means of ViPR. While VMware has focused on enabling cloud service providers with a VMware product set that enables a common hybrid interface, EMC is focused on providing broader hybrid links to AWS, Microsoft Azure, OpenStack and other public platforms.

- OpenStack – EMC’s ViPR initiative is also key to utilizing existing storage arrays on OpenStack as well as VMware and other public cloud offerings.

Wikibon believes that EMC has developed a strong hybrid cloud strategy based on VMware’s private and public cloud products, and has shown significant innovation in bring it to market. At the same time, EMC has realized that greater flexibility of public cloud access is required and has made significant extensions to VMware software to enable access to AWS, Azure, and other clouds. EMC’s ViPR strategy enables the use of existing storage and data protection services. However, EMC’s approach is a high cost/high value and they may have difficulty gaining traction growth areas such as Big Data, the Internet-of-Things (Industrial Internet), and other data-rich environments without significantly lowering costs.

Wikibon believes that vVols is a significant innovation. However, if EMC and/or VMware tries to extract software revenue or strategic positioning with this intellectual property, it will doom the market to fragmentation and slow down system sales for EMC and the market. Wikibon recommends senior executives insist EMC embraces truly open API standards. Wikibon believes that such EMC leadership will allow the industry and itself to resume growth through economies-of-scale.

Overall, Wikibon believes that EMC has invested well and has a clear lead of one-to-two years in providing a framework to a hybrid cloud that meets the imperative of being competitive with best-of-breed cloud services providers.

HP

- Hybrid Cloud Offerings – HP’s cloud strategy is build around OpenStack for both public & private clouds. While they eschew VMware as an orchestration and automation foundation, they offer good support for hardware (servers and storage) in traditional VMware installations. HP has a good data-protection orchestration and automation strategy based on its own data protection products. It does not have strong offerings for the cloud integration of existing non-HP data protection appliances. Helion (built on OpenStack) is HP’s strategic public cloud offering.

- Approach – HP has recently announced its intention to acquire Eucalyptus, which uses the AWS APIs to create private and public AWS-compatible services. This will extend HP’s capability to provide direct competition to AWS by means of emulation. However, this strategy brings the risk of AWS modifying and protecting (or threatening to) its API intellectual property.

Wikibon believes HP’s cloud strategy is aggressive and low-cost. HP will need to provide easy migration from VMware and other infrastructure platforms to OpenStack, and will need to develop data-protection orchestration and automation strategies which allow the migration of existing non-HP data protection services. HP will also need to internationalize its current US-centric approach and provide more fail-over capabilities within regions.

IBM

- Hybrid Cloud Offerings – IBM’s hybrid cloud storage offering, Storage Integration Service (ISIS), has many strengths. IBM is focusing on the XIV storage array as the flagship for cloud storage because of the very low operational costs. IBM’s ultimate goal to make private & public clouds completely transparent. IBM has strong orchestration & automation products enterprise-wide (TSM, TPC, VSC, etc.) and is fostering choice for any virtualization platform, containers, or bare metal.

- Approach – IBM claims large cloud service providers and an outsourcing installed base, and the ability to drive a multi-national multi-region strategy to ensure both availability of data and ensuring that data is geographically where it is needed or legally required.

- OpenStack – IBM strongly supports OpenStack, cloud Foundry, and other initiatives.

IBM’s biggest strengths include the size of its data center installed base and a combined open source and proprietary software strategy. It also has best-of-breed development and infrastructure software. Open source projects are the equivalent of new standards bodies which will be proven out by adoption. IBM could put forward system-wide standards. Wikibon believes IBM’s biggest challenges are cross-divisional synergy and time-to-market execution.

NetApp

- Hybrid Cloud Offerings – NetApp’s strategy differs from other vendors in that it claims to be “not just waiting for VMware”. The NetApp strategy is focused on enabling hybrid cloud, orchestration, and automation for mega-datacenters, enterprise customers, and service providers (especially within mega-datacenters like Equinix, for instance) by providing end-to-end services for NetApp storage on-site. NetApp has a strong Workflow Automation (WFA) product as a base for general orchestration and automation and will use this tool within VMware enterprises.

- Approach – NetApp provides (and is planning to provide) both software and hardware storage service products to service providers based on ONTAP, as part of NetApp’s software-defined storage strategy (SDS). NetApp believes (as Wikibon does) that storage is “heavy”, so they provides a number of innovative techniques to avoid/minimize data transfer (e.g., data-transfer free migration from VMware to KVM/Hyper-V, from one cloud to another using NetApp storage). NetApp believes that service providers & ISVs should provide templates for workloads and applications, based on NetApp tools, software and hardware for both private and public clouds. As such, NetApp believes that the storage vendor is not the correct source to provide these templates.

Wikibon believes NetApp has a clear vision of how it can contribute to orchestration and automation in hybrid clouds, has contributed innovation, and has an ambitious plan to execute. Wikibon believes NetApp can and should invest in providing one-click templates for Oracle and Microsoft SQL (for instance) databases and utilize the correct blend of snapshots, backup and recovery orchestration, and automation according to the capabilities of the NetApp storage and storage services. This would improve time to value for users. ISVs, service providers and enterprise professionals can always provide feedback and improve these templates.

Wikibon Research Into Vendor VMware Hybrid Strategies

In addition to characterizing the overall offerings and strategies of the hybrid cloud storage vendors, Wikibon sharpened its focus by examining the components and specific capabilities that each vendor offers to meet the requirements for a successful VMware IT shop implementation of hybrid cloud. These capabilities include enabling:

- Ability to meet the business imperative to be competitive with public clouds on cost and agility;

- Earlier adoption by building on current investments in VMware software and existing infrastructure and storage;

- The use of the same orchestration and automation framework for private and public clouds;

- The incorporation of non-VMware public and private clouds.

Operationalizing these capabilities, mapping them across products, and grading the offerings is clearly challenging. Wikibon proceeded in the following manner to complete this task.

- Establishing the Framework – Wikibon began by formulating a detailed inventory of approximately 100 product features based on vendor discussions and our own research. Each individual feature was grouped according to one of three overall Capability Segments – Storage Management as a Service, Storage as a Service (Storage Integration), and VMWare Orchestration and Automation Interfaces.

- Establishing the Value/Importance of each Individual Feature – Some features are more or less important for effective Hybrid Cloud implementation than others. Wikibon established a relative importance weighting (0-not at all important to 5-very important) for each.

- Overall Scoring Approach – Given that it is still early days in this market, and we were looking for general guidance, we developed the following overall philosophy regarding how to evaluate each vendor’s status.

- Wikibon took an overall vendor view rather than a product or array view – if the vendor has a solution on any product, that was sufficient; migrating proven functionality to other platforms can be done on a clear timeline;

- If a product feature was firmly in plan, it was marked as available;

- Although some vendors (e.g., IBM, HP) take a broader view to include network, server, and storage, Wikibon assumes that storage is the most significant hybrid cloud challenge to overcome;

- There is a focus on the ability to utilize existing VMware and storage investments;

- Both high-end and midrange enterprise solutions were included, which worked to the disadvantage vendors such as Dell with a more midrange-focused approach.

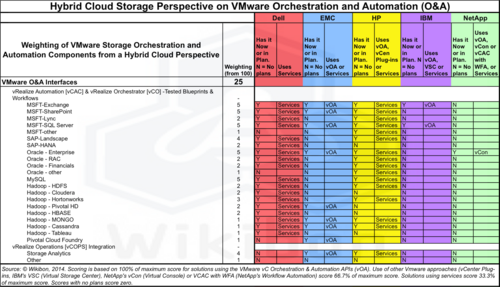

- Detailed Scoring Approach – Wikibon had multiple discussions with each of the vendors concerning their detailed VMware-related Hybrid Cloud and storage offerings. Each vendor was graded on each feature as follows:

- 100% – Vendor can deliver feature and uses vOA, vCon, vCen or vCAC with/without external workflow or services to deliver it (we called this the vOA case).

- 66.7% – Vendor can deliver feature using other, non-vOA VMware functionalities (i.e. plug-ins or other tools). In these cases, the rating was lower because of the customized nature of the solution which would make it difficult to move workloads seamlessly from the VMware private to public cloud.

- 33.3% – Vendor can deliver the capability via custom services-based implementation.

- 0% – Vendor can’t provide it today and has no plan to do so by 2015.

- Weighting of the Functional Areas – We organized all the detailed features into three over-arching functional areas to show where the vendors were strong and weak. Each of the three groups was weighted for their relative importance to effective hybrid cloud implementation, with the total sums of the weights equaling 100 total possible points. The groups were:

- Storage Management-as-a-Service (Max 45 Points);

- Storage-as-a-Service (Storage Integrator) (Max 30 Points);

- VMware O&A Interfaces (Max 25 Points);

An example from Table Footnote-3 is for the VMware O&A Interfaces group (Max 25 Points) illustrates the scoring process. The items from the example are:

| VMware O&A Interface Component Group | VMware O&A Interface Component | Importance(Scale 1-5) |

| vRealize Automation [vCAC] & vRealize Orchestrator [vCO] Tested Blueprints & Workflows |

||

| MSFT-Exchange | 5 | |

| MSFT-SharePoint | 5 | |

| MSFT-Lync | 2 | |

| MSFT-SQL Server | 5 | |

| MSFT-other | 1 | |

| SAP-Landscape | 4 | |

| SAP-HANA | 2 | |

| Oracle – Enterprise | 5 | |

| Oracle – RAC | 2 | |

| Oracle – Financials | 2 | |

| Oracle – other | 1 | |

| MySQL | 5 | |

| Hadoop – HDFS | 2 | |

| Hadoop – Cloudera | 2 | |

| Hadoop – Hortonworks | 3 | |

| Hadoop – Pivotal HD | 2 | |

| Hadoop – HBASE | 2 | |

| Hadoop – MONGO | 1 | |

| Hadoop – Cassandra | 1 | |

| Hadoop – Tableau | 1 | |

| Pivotal Cloud Foundry | 1 | |

| vRealize Operations [vCOPS] Integration | ||

| Storage Analytics | 4 | |

| Other | 1 | |

| Total Maximum Score | 59 |

If a vendor offered full vOA (100%) VMware O&A Interface for every feature on the list, they could achieve a maximum score of 59. We took each vendor’s actual score for the O&A Interface segment and divided it by 59 to derive their raw percentage score for the VMware O&A interface category. If a vendor had 40 points out of a possible 59, their raw score would be 67.8% of the VMware O&A Interface segment. Since the weighting of the overall VMware O&A interface segment for the entire analysis was 25 points at most, the vendor’s score for this segments would be 67.8% of 25 or 16.9 points. This process was repeated for each of the three overall segments to derive the final scores. The factors leading to the scores are listed in Table Footnote-1, Table Footnote-2 and Table-3 in the Footnotes below, for all the five vendors interviewed.

The results of the analysis are shown in Figure 1 in the next section.

Wikibon Findings And Conclusions

Wikibon’s assessment of Storage Vendor VMware Orchestration & Automation from a Hybrid Cloud Perspective is shown in Figure 1 below.

Source: © Wikibon, 2014. Scoring is based on the methodology outline in the section above, and on the information given by the vendors and tabulated in tables Footnote-1,-2 & -3 in the Footnotes below. Scoring is based on 100% of maximum score for solutions using the VMware vC Orchestration & Automation APIs (vOA). Use of other Vmware approaches (vCenter Plug-ins, IBM’s VSC (Virtual Storage Center), NetApp’s vCon (Virtual Console) or VCAC with WFA (NetApp’s Workflow Automation) score 66.7% of maximum score. Solutions using services score 33.3%. Scores with no plans score zero. The scores are normalized to a maximum score of 100.

Figure 1 shows that EMC is currently leading the charge in meeting VMware shop hybrid cloud requirements with a score of 66% of maximum and is on a firm path to provide a VMware hybrid cloud with the ability to utilize existing infrastructure. EMC’s main area for improvement would be in providing more functional workload and application templates. NetApp with 42% scores well in the Storage Management as a Service and Storage as a Service (Storage Integration) sections, with good innovative features that will work well with service providers in mega-datacenters. Wikibon believes NetApp should take a greater role in providing application and workload templates. HP(29%) and IBM(20%) have put greater emphasis on other platforms and other virtualization hypervisors, and less on VMware. Time will tell if this strategy works well, since VMware is the key infrastructure framework for many enterprise IT installations. Wikibon would recommend their applying a higher level of resource to this area. Dell scored 24% with a focus on using simpler vCenter plug-ins and pull-down menus – an approach that is very viable for the small and medium IT shops.

Wikibon would emphasize that we are early in the game, and that infrastructure executives should evaluate the importance of the elements in this analysis for their own installation. Enterprises that want to look at their relative weighting and importance scores for their implementation are welcome to contact Wikibon about running a personalized enterprise evaluation.

Action Item: Wikibon believes that infrastructure executives should put in place as a strategic imperative a hybrid cloud strategy, with the ability to migrate workloads and applications between private and public clouds, and between alternative public clouds. The persistent storage component of hybrid cloud is the most important area for executive focus.

Although it is early in the game, many vendors are committed to providing different strategies and solutions. VMware is well served in this emerging hybrid cloud market, with the EMC federation investing early and strongly.

Wikibon would also recommend that other lower-cost hybrid solutions should be evaluated for workloads with less stringent performance and availability requirements.

Footnotes: Tables Footnote 1,2 & 3 are below, and are the source for the evaluation scores in Figure 1 above. Table Footnote 4 shows the new terminology that VMware is now using to rebrand its cloud strategy, together with the more familiar original names.

Source: © Wikibon, 2014. Scoring is based on 100% of maximum score for solutions using the VMware vC Orchestration & Automation APIs (vOA). Use of other Vmware approaches (vCenter Plug-ins, IBM’s VSC (Virtual Storage Center), NetApp’s vCon (Virtual Console) or VCAC with WFA (NetApp’s Workflow Automation) score 66.7% of maximum score. Solutions using services score 33.3% of maximum score. Scores with no plans score zero.

Source: © Wikibon, 2014. Scoring is based on 100% of maximum score for solutions using the VMware vC Orchestration & Automation APIs (vOA). Use of other Vmware approaches (vCenter Plug-ins, IBM’s VSC (Virtual Storage Center), NetApp’s vCon (Virtual Console) or VCAC with WFA (NetApp’s Workflow Automation) score 66.7% of maximum score. Solutions using services score 33.3% of maximum score. Solutions with no plans score zero.

Source: © Wikibon, 2014. Scoring is based on 100% of maximum score for solutions using the VMware vC Orchestration & Automation APIs (vOA). Use of other Vmware approaches (vCenter Plug-ins, IBM’s VSC (Virtual Storage Center), NetApp’s vCon (Virtual Console) or VCAC with WFA (NetApp’s Workflow Automation) score 66.7% of maximum score. Solutions using services score 33.3% of maximum score. Solutions with no plans score zero.

Figures Footnote-1 to 4 are diagram to help explain the positioning of VMware’s orchestration and automation software components.