In a competitive AI marketplace where tens of thousands of companies compete, building a standout brand becomes essential for survival and sustained growth. This paper reveals how to master AI-optimized (AIO) discovery, explaining how LLMs determine which brands to highlight in their responses. You’ll learn how to deploy a brand builder’s secret weapon, along with credible, multi-channel content to feed AI systems and secure a spot on buyers’ critical “day-one list,” which influences 85% of B2B purchases. By examining the shift from traditional SEO to AIO, this brief provides tech firms with strategies to succeed in the emerging “zero-click” world of B2B buyer journeys.

Note: Watch the podcast at the end of this article

Why Brand Build?

In the fast-moving world of enterprise technology, many companies struggle with the same paradox: they have groundbreaking products, talented teams, enough funding, and strong market-to-product fit, but still fail to generate sustained market demand and growth.

A common reason? They’ve skipped the brand-building stage. Jumping straight to demand generation tactics or isolated sales motions, without concurrently building brand visibility, credibility, and trust. This is like shouting into a crowded room where no one knows who you are or why they should care. Even worse, you’re likely getting outshouted by countless competitors. In an era where visibility and trust determine who gets considered, one truth stands out:

“Brand is the gateway to demand!”

As one of the immutable laws of marketing, especially in enterprise AI markets where competition is fierce and buyer trust is hard-earned, the key to long-term success begins with brand equity. Successful software businesses build their brand around their unique story, purpose, credibility, and differentiation in a way that attracts the ideal customer.

In today’s AI-driven marketplace, brand equity is a strategic necessity, not just a marketing exercise. Winning brands start with a unique, authentic story that cuts through the noise, defining a clear purpose and strategic direction that unites teams and signals long-term vision. Trust is earned through executive visibility, success stories, and thought leadership that build credibility and buyer confidence. Differentiation follows, not only in features, but in positioning, voice, and unique value. With these elements in place, demand generation shifts from chasing leads to attracting the right ones. Your brand becomes your magnet, which grows in attraction as your visibility expands.

This is the compounding power of brand equity: it aligns identity with impact, making everything from sales velocity to customer loyalty stronger over time. The brand-building lifecycle can be understood as a series of strategic imperatives, each one essential in the journey from obscurity to market leadership:

- Tell Your Unique Story: Craft a strategic narrative that makes you memorable and meaningful. Your story is more than a tagline; it’s the lens through which the market understands who you are, what you stand for, and why you exist. In a noisy market, storytelling sets the emotional tone that makes a brand relatable and distinct.

- Define Your Purpose & Direction: Align mission, positioning, and go-to-market strategy with a clear North Star. Without it, even great technologies struggle to gain traction. Clarity unifies internal teams and signals ambition to the market, while thought leadership cements your advantage.

- Build Credibility & Confidence: Earn trust through proof, presence, and consistency. Buyers want evidence, success stories, expert validation, leadership visibility, and disciplined execution. Credibility is earned by showing up and delivering results.

- Differentiate Your Value: Own a position competitors can’t ignore or replicate. Features aren’t enough; communicate what sets you apart in outcomes, philosophy, or approach. Differentiation should be meaningful, requiring explanation.

- Attract Your Ideal Customer: When story, purpose, credibility, and value are visible, leads come to you. Brand-led companies draw the right audience, creating a cycle of resonance, conversion, and loyalty.

In high-tech marketplaces, where every category is crowded and buyer skepticism is high, brand is no longer a soft asset. Investing in your brand isn’t a detour from growth; it’s how lasting growth begins.

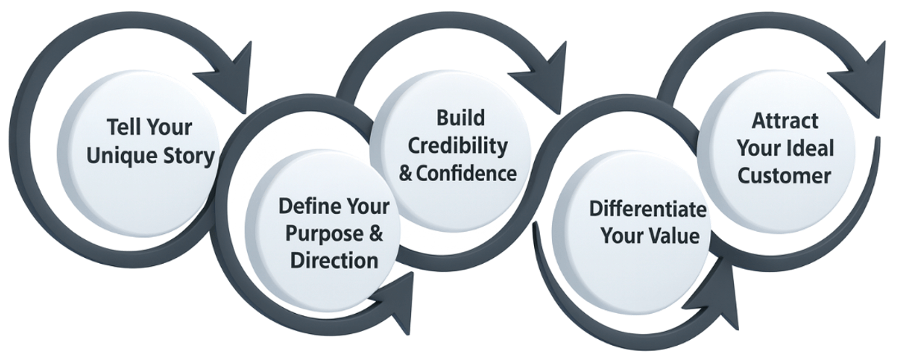

Consider, for example, that Ascendix reports that 70,000 AI companies exist worldwide as of 2024, with 17,500 based in the USA. This market is expected to accelerate the growth of new GenAI and Agentic AI startups, or spin-off companies from larger businesses, creating even greater competition in the years ahead.

Given the surge of companies competing for a chance to engage possible buyers, enabling your “signals” to emerge from the noise of the marketplace has never been more critical. If your company can’t cut through the noise, nothing else matters.

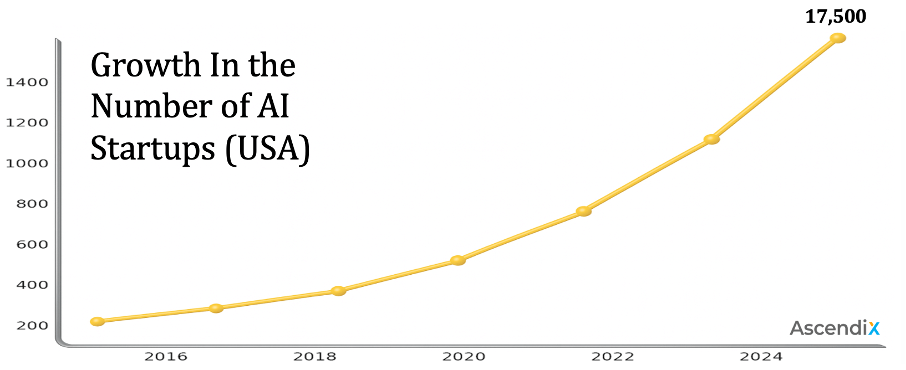

Consider a recent InBox B2B survey, which showed that 88% of B2B buyers trust a brand more if they receive valuable insights from that vendor. Additionally, 75% of decision-makers place greater trust in brands affiliated with recognizable executives, customers, industry experts, or influencers.

Furthermore, 62% of decision-makers depend on industry news and editorial platforms to guide them through their challenges, highlighting the significance of thought leadership content. This ranks #2, only second to platforms that provide industry analysis.

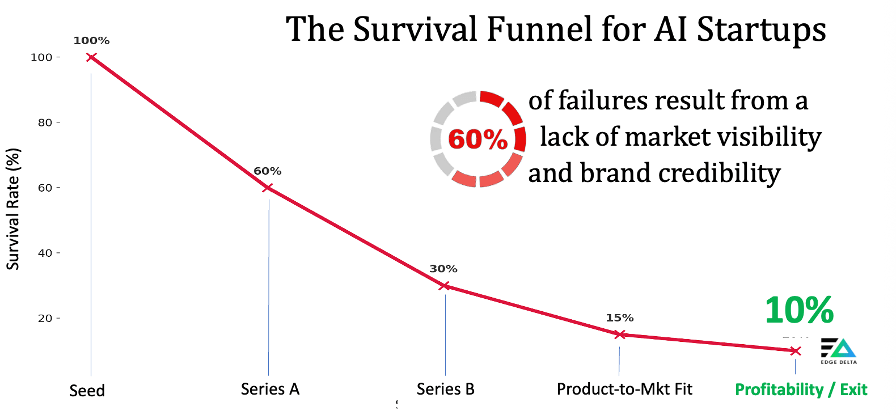

Due to these unprecedented market dynamics, approximately 90% of AI startups fail altogether or fail to scale because they are unable to emerge from a crowded marketplace with clear differentiation, according to Edge Delta.

Most of these failures are not caused by technical limitations, but rather by remaining unseen in a crowded market and lacking visibility as industry leaders. Without a recognizable brand and a compelling story, even groundbreaking innovations struggle to gain trust, attract talent, secure funding, or draw in ideal customers.

According to our research referencing multiple studies from CB Insights, Edelman, and ExplodingTopics, about 34% cite brand-related issues as a primary reason for failure. When considering secondary market-related issues, this expands to 60%.

Further supporting the importance of brand building, a recent qualitative research report on AI-native startup brands found that:

“Founders and execs must intentionally build brand equity through narrative framing that is distinctive, coherent, and trusted to overcome skepticism about their business.”

A study by Astner and Gaddefors in 2024 on ResearchGate emphasized this point by showing that a founder’s identity often becomes closely linked with the startup’s brand; when founders or executive leaders act as the face of the company, they infuse it with authenticity and personal values that boost recognition. Experts also note that startups that commit to building their brand tend to attract capital investment, which is a key indicator of long-term viability.

In a market where tens of thousands of AI ventures compete for attention and trust, brand clarity can turn fleeting noise into lasting presence. For early-stage companies, differentiation often comes as much from their story as from their software. A compelling narrative shows investors, customers, and partners not just what the product does, but why it matters—creating emotional resonance, accelerating trust, and catalyzing early traction.

From Clicks to AI Summaries

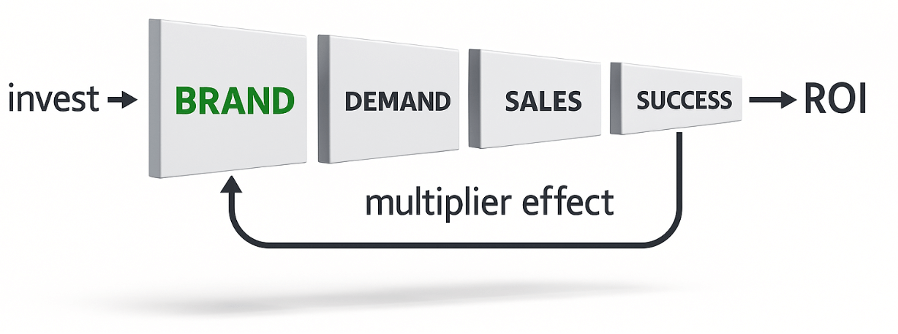

The modern digital go-to-market funnel best practice follows this lifecycle:

- Brand: Build visibility, awareness, and trust

- Demand: Attract interest and drive action from buyers

- Sales: Progresses interest & action into revenue

- Success: Fuels brand credibility and advocacy

However, too many companies underinvest in the first critical stage, building a brand. But brand equity influences whether your content gets clicked, your leaders are followed, your emails are opened, your website is visited, and prospects engage. It’s the multiplier behind every go-to-market effort. Without a trusted brand, even the best campaigns fall flat because buyers don’t engage with solutions they don’t recognize, remember, or believe in.

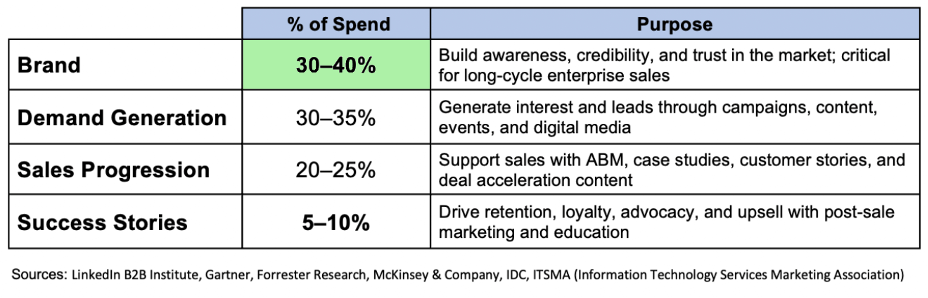

In the new world of digital and AI-guided buyer journeys, the consensus view among credible marketing consulting organizations, as shown below, recommends that enterprise tech companies spend between 35-50% of their marketing and comms budget on brand building and early-funnel tactics.

Why? Brand recognition, credibility, and trust have elevated to new levels of importance in the enterprise tech buying journey. Furthermore, fewer are relying on websites, keyword search, and traditional content. AI summaries are rapidly becoming the norm.

A recent study highlighted that 90% of B2B buyers surveyed, of which 58% had purchasing authority, are more likely to engage with brands they have heard of, underscoring the importance of brand visibility in attracting potential clients. Without this market visibility and credibility, demand generation becomes costlier and less effective.

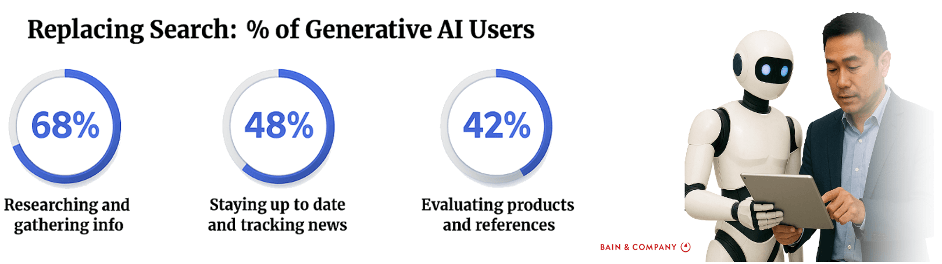

In addition, as Bain & Company points out, with the rise of AI tools like ChatGPT, buyers increasingly rely on AI-generated summaries and recommendations during their purchase journeys. This shift emphasizes the need for vendors to maintain a strong online presence and be included in AI-driven research outputs. Websites alone are now insufficient.

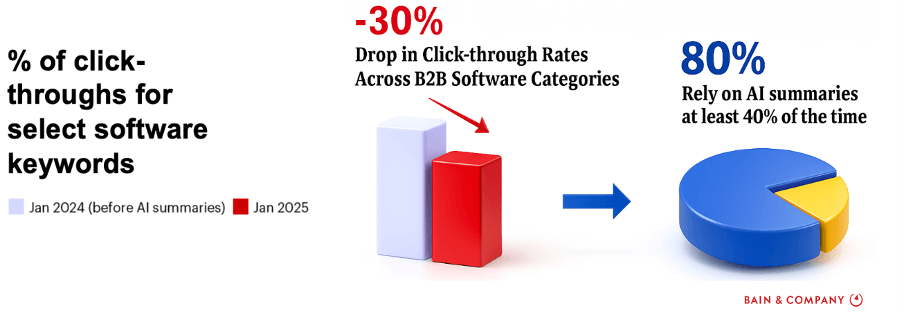

As AI-powered search and chatbots like ChatGPT increasingly dominate the B2B buyer discovery process, the traditional marketing funnel is fragmenting. Today’s prospects often receive AI-generated summaries that meet their informational needs without requiring a click, a phenomenon Bain & Company calls “zero-click” search.

Their research reports that click-through rates have dropped by as much as 30% in some B2B categories, including software. In turn, ~ 60% of searches now end without users clicking through to other websites, and 80% of users rely on AI summaries for at least 40% of their interactions.

As a result, this shift is sharply reducing the opportunities for brands to engage buyers during the early research and evaluation stages. Marketers are experiencing 15–25% drops in organic web traffic, especially in early-stage, non-branded discovery searches, key moments where brand signals traditionally drove consideration. Brands now need to adapt by optimizing for AI conversational readability, diversifying content types, and emphasizing topical authority over shallow keyword tactics.

Furthermore, Bain & Company finds that once a buyer enters the market, 85% of B2B purchases go to vendors on their “day-one list”, those already have visibility before the buying process begins. With AI agents acting as intermediaries, brands risk being excluded from consideration simply by not appearing in AI-generated overviews. In this new reality, visibility in AI channels, broader reach through independent platforms, and a strong third-party presence aren’t just nice-to-haves; they’re essential for survival.

To counteract this shift, vendor strategies must include providing AI systems with credible brand signals. This will help them become more visible in an AI-first buyer journey. Vendors need to adapt their approach to feed the systems shaping modern discovery. As enterprise buyers increasingly depend on AI-generated summaries and conversational tools to research solutions, traditional websites and gated content are often bypassed in favor of instant, synthesized insights. This change makes it essential for vendors to generate credible brand signals across high-authority, independent platforms.

As AI assistants increasingly determine which companies appear in answers and recommendations, organizations must understand the underlying mechanics of brand visibility inside LLMs. For a deeper explanation of how to optimize for this shift, see our cornerstone guide on AI Engine Optimization (AEO).

How LLMs Prioritize Brands

In the evolving landscape of AI-powered search (e.g., ChatGPT, Perplexity, Grok) and “zero-click” buying, independent, media-rich, community-based platforms are crucial for B2B tech vendors, particularly early-stage AI firms aiming to stand out in a competitive market. As enterprise buyers increasingly depend on AI-generated summaries and conversational agents, traditional websites and gated content are often sidelined.

To enhance visibility, flooding target markets with diverse, multi-channel content, such as video interviews, transcripts, third-party editorials, whitepapers, and social clips, is vital. This content fuels AI discovery systems, ensuring your brand is woven into the digital fabric that shapes early buyer journeys, countering the “day one list” effect.

This approach is key to thriving in a crowded market, amplifying your presence on high-traffic media channels and aligning with the AI-driven buyer journey. The shift to AI-conversational discovery prioritizes semantic embedding over traditional SEO, linking your brand’s narrative, products, leadership, and expertise to relevant queries.

In a future research brief, we will explore in detail how LLMs prioritize brands, solutions, and products in their responses. For now, we’ll focus on the importance of maximizing your chances of being included in AI conversational responses by making sure your content aligns with what theCUBE Research calls the CAAT Principles.

- Credible: Backed by verifiable facts, data, and reputable sources that can be explained, validated, and cross-referenced.

- Authoritative: Demonstrated domain expertise, reinforced by citations from independent expert voices.

- Authentic: Anchored in original insights and perspectives, resisting generic, recycled language and content.

- Trusted: Based on a consistent presence across multiple, reliable, well-trafficked contexts.

As AI assistants become standard tools for B2B buyers, the way users search, research, and evaluate solutions is evolving. Instead of keyword-stuffed queries, buyers now ask natural language questions, like “Which vendors offer AI-driven fraud detection for banks?” or “Who is recognized for best practices in AI for legal contracts?” Furthermore, these questions often turn into conversations that lead potential buyers further into the discovery process.

Content that mirrors these conversational patterns, while signaling CAAT attributes, has a higher likelihood of being retrieved and surfaced in AI-generated answers.

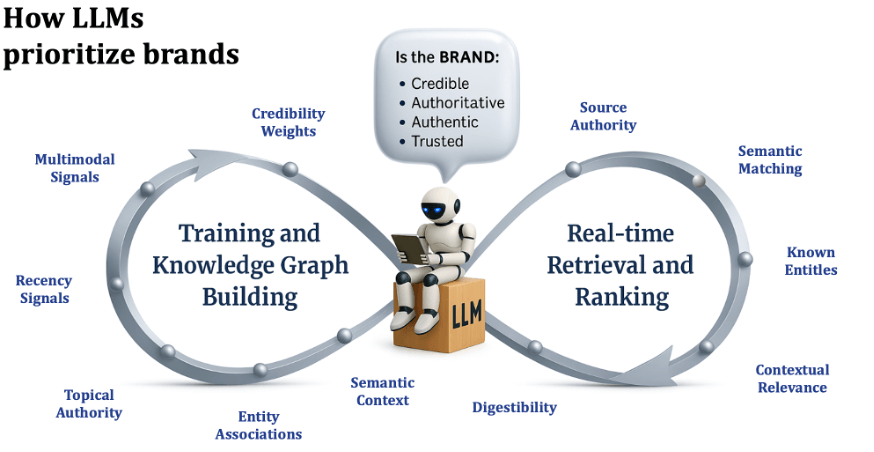

Large language models (LLMs) build their understanding of companies, products, and executives through two complementary processes, Training & Knowledge Building, which shapes their longer-term semantic memory, and Real-Time Retrieval & Ranking, which keeps their context fresh and up to date.

Training and Knowledge Building

In the high-stakes arena of AI-driven discovery, LLMs are trained and fine-tuned on vast, diverse datasets, including industry media like news articles and analyst reports, thought leadership such as whitepapers and conference transcripts, curated references like Wikipedia and topical databases, and community sources like blogs, forums, event coverage, and conversational media.

Through this process, the models identify companies, products, people, and industries, linking them to related concepts using probabilistic pattern recognition. This creates a dynamic semantic knowledge base represented in a multi-dimensional vector space, where the proximity and direction of embeddings define relationships. Unlike static databases, these structures act like knowledge graphs, enabling LLMs to infer connections, prioritize relevant context, and deliver accurate responses that can influence a brand’s visibility in a zero-click world.

The process involves:

- Creating semantic context: Understands intent, relevance, and meaning.

- Establishes entity associations: Connects info, concepts, data, people, etc.

- Forms topical authority: Repeated exposure in a domain strengthens recall.

- Priorities recency signals: Fine-tuning cycles help maintain freshness.

- Factors multimodal signals: Correlates content types, conversations, etc.

- Weight credibility signals: Trusted sources outweigh low-authority sources.

Together, these phases determine how LLMs build and reinforce your brand’s associations, importance, and relevance, shaping whether you are found, trusted, and chosen in AI-mediated discovery.

Real-time Retrieval and Ranking

While training builds the foundation, real-time retrieval keeps AI systems current. When answering a question, models often query external, high-authority sources to pull in fresh context before generating a response. The key factors in this process are:

- Source Authority: Reputable, well-indexed domains are prioritized.

- Semantic Matching: Meaning-based search replaces keyword matching.

- Known Entities: Fresh content strengthens known brand associations.

- Contextual Relevance: Ranking based on recency, quality, and topical match.

- Digestibility: Conversational content and clean metadata aid comprehension.

Retrieval-Augmented Generation (RAG), a cornerstone of modern AI assistants, ensures responses are fresh and accurate by integrating real-time data with pre-trained knowledge. When a question is posed, the system interprets its intent, retrieves relevant documents from trusted sources, ranks them based on recency, credibility, and relevance, and blends these insights with its existing semantic knowledge to generate a precise, contextually informed answer.

For brands, this means visibility hinges on having authoritative, accessible content in reputable sources; without it, your brand risks being overlooked in the retrieval stage. If your content is invisible or not trusted by LLM, it won’t appear in AI summaries.

Keeping your brand discoverable in an AI-driven, zero-click world isn’t a one-time SEO campaign; it’s a continuous process of maintaining relevance through both semantic embedding in model training and fresh, high-quality, retrievable content.

As Mick Hollison, founder of Red Line Advisors, stated:

“Your story is as important as your software. You can have a great product that solves a problem. But if Horton doesn’t hear a who, what difference does it make?”

Interviews: A Brand’s Secret Weapon

Buyers in enterprise tech are skeptical and risk-averse. They rely on trust signals, thought leadership, executive interviews, third-party validation, customer references, and credible media exposure before they even consider a solution. The implications are clear:

• Prioritize thought leadership by collaborating with industry influencers.

• Scale the visibility of your content beyond your web presence.

• Establish a credible presence for your executives, SMEs, and analysts.

• Leverage reputable digital platforms with established market reach.

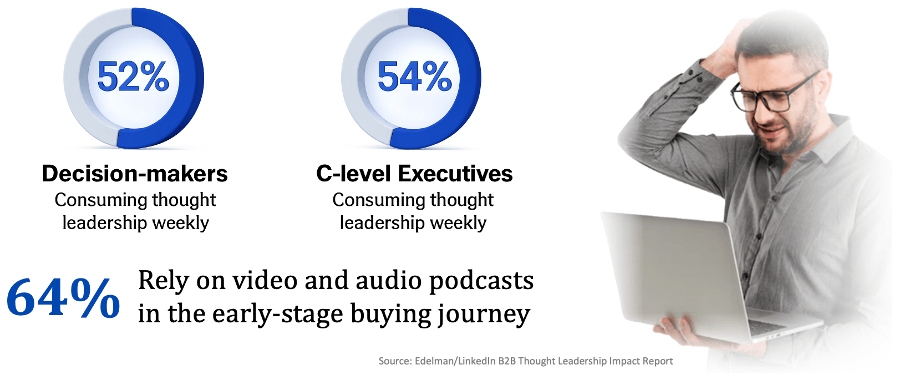

An array of recent research underscores the rising power of conversational video in shaping B2B buying decisions. For example, according to the Edelman–LinkedIn B2B Thought Leadership Impact Report, 73% of decision-makers say they trust thought leadership content more than traditional marketing materials, and 95% of “hidden buyers”, those not yet in active sales conversations, report that strong thought leadership makes them more receptive to outreach.

Complementing this, LinkedIn’s video engagement data shows that video-first content, including interviews, results in 5xhigher engagement and twice the click-through rates compared to static formats, with 80% of B2B leads on the platform driven by video. Furthermore, the Content Marketing Institute’s B2B Content Trends 2025 Report also showed that marketers rank video as the most effective format. With LinkedIn video seeing a 36% YTY growth rate, the message is clear. If video isn’t already central to your B2B strategy, you’re falling behind, especially as buyers increasingly engage via AI-assisted chats.

Other sources, including Wistia, Sarch Engine Journal, Khris Digital, and InEvent, support the trend that over 70% of B2B buyers now spend more time watching video content than other formats during their customer journey, and 9 out of 10 say video significantly influences their trust in a company’s ability to deliver. Among video content formats, interview-style content is emerging as the most impactful format for reaching B2B decision-makers and influencing their buyer journeys.

According to Edelman’s Research, 59% of business leaders listen to podcasts and video interviews during work hours, and 64%rely on them during early-stage buying research, underscoring their role in building trust and familiarity.

The rise of video podcasts is accelerating a significant shift in brand building, combining the authenticity of live conversation with the shareability of visual content across LinkedIn, YouTube, and other platforms. As trust in vendor websites and traditional marketing collateral declines, interview-style videos have emerged as a powerful way to shape perception and energize actions throughout the AI-guided buyer journey.

The conclusion is clear: thought leadership is now the primary driver of influence and credibility. Among content formats, interviews stand out for their ability to shape perception and deepen engagement. Audiences are increasingly motivated by authenticity, responding most strongly to content that feels genuine and trustworthy. In this environment, conversational formats play a central role in discovery—helping brands and leaders connect in ways that are more relatable, engaging, and accessible than ever before.

When done right, interviews deliver some of the highest ROI in brand building:

- High-trust format: Executives and product leaders explain complex topics in a human, conversational way, building authenticity and credibility.

- Targeted reach at scale: Engages enterprise buyers where they already are: LinkedIn, YouTube, and digital TV platforms.

- Evergreen, multipurpose content: Easily clipped into blogs, social posts, and highlight reels, multiplying reach and lifespan.

- Third-party credibility: Hosting on respected platforms with analyst participation amplifies trust.

- AI-powered discovery: Transcripts and clips feed AI/LLM knowledge systems, influencing intelligent search and discovery.

Placing high-credibility, conversational content on platforms with loyal audiences delivers higher ROI than traditional PR or paid ads, creating immediate impact and compounding returns. Interviews, analyst-led videos, and thought-leadership pieces can be repurposed into blogs, clips, and social posts, fueling AI-powered discovery engines that prioritize trusted sources while unlocking editorial coverage and syndication for lasting reach.

High-tech CMOs agree: it’s time to move beyond outdated brand-building models and use AI not just for automation but for brand activation. AI is reshaping every stage of the brand-to-revenue lifecycle, from discovery to trust to preference. By feeding AI systems credible brand signals and securing presence on high-authority platforms, companies increase their odds of making the “day-one list” that drives 85% of B2B purchases.

In today’s AI-powered marketplace, no brand means no demand. Brand is no longer a soft metric; it’s the visibility engine and trust layer that determines whether buyers see you, consider you, or choose you.

TheCUBE AI

theCUBE AI demonstrates how companies can boost their visibility in the age of AI-driven brand development. It leverages AI to organize and index thousands of on-camera interviews, panel sessions, events, transcripts, and analyst conversations from theCUBE, theCUBE NYSE Wired, and SiliconANGLE.

Unlike keyword-based search engines, theCUBE AI enables semantic, context-aware searches across a rich knowledge graph built from expert-driven discussions between vendors and industry influencers. Insights from interviews, podcasts, or live events become instantly discoverable, each appearance generating a semantic entity in a conversational AI index. This dramatically increases the chances that your brand’s message will appear in enterprise research tools, LLM outputs (e.g., ChatGPT, Claude).

In effect, theCUBE AI connects live broadcast media, AI knowledge, and the zero-click buyer journey, transforming real-time conversations into lasting, machine-readable visibility. Based on verbatim transcripts from thousands of expert interviews, it builds a searchable knowledge base that reflects real-world enterprise tech insights. By participating through interviews, analyst briefs, and event coverage, brands ensure their voice becomes part of the AI-driven framework shaping tomorrow’s buying decisions.

As AI agents increasingly draw from authoritative third-party content, visibility on platforms like theCUBE AI helps your brand story become part of the indexed knowledge base, increasing the chances of appearing in automated research, trusted summaries, and AI-powered recommendations. This isn’t just the future of search, it’s the entrance to the marketing cycle and the starting point for the modern B2B buyer journey.

Getting Started

In an era where AI-driven discovery and zero-click search define the buyer journey, brand visibility isn’t optional; it’s the deciding factor in whether you’re considered at all.

Video-first formats and thought-leadership coverage on trusted platforms like SiliconANGLE & theCUBE give enterprise tech and AI companies a decisive edge, combining editorial media, video storytelling, primary research, and analyst insight to reach both decision-makers and the AI systems guiding them.

With over 15 years of credibility, more than 100 annual digital events, thousands of interviews, and 1.3 million monthly unique viewers, these platforms connect your story to a loyal audience of executives, engineers, and innovators. They also embed it within the most trusted, authoritative content that AI systems rely on. By appearing alongside industry leaders like AWS, Google, IBM, Snowflake, and Deloitte, you gain more than just visibility; you build credibility that fosters trust and accelerates purchasing decisions.

This is the playbook for becoming top of mind, both with buyers and with AI agents.

Contact us if we can help you:

- Audit your AI-optimized (AIO) position: Assess how well your brand signals are currently captured, indexed, and surfaced by AI systems.

- Maximize launch impact: Introduce products, partnerships, or success stories with targeted coverage that generates both human and machine-readable brand signals.

- Break through market noise: Amplify your brand narrative across trusted platforms, creating content strategies that reach both humans and AI decision engines.

- Elevate executive thought leadership: Position your leaders in high-credibility interviews, panels, and analyst-led discussions to elevate your brand leadership.

- Digitally capture & syndicate events – Transform physical or virtual events into evergreen, AI-indexable contentthrough on-site or digital coverage.

theCUBE Research is built to help you make all this happen. Let’s put your story where it matters most. Don’t just compete in the market, own your position in it.

Watch the Podcast

In this episode of Next Frontiers of AI, host Scott Hebner is joined by Mick Hollison, founder and CEO of Redline Advisors, former CMO of CrowdStrike and Cloudera, and one of the industry’s leading voices on strategic messaging and brand elevation. Together, they unpack a pressing question: in an AI-first world where algorithms increasingly shape buyer discovery and decision-making, does brand still matter?