With Andy Thurai, VP Constellation Research

Adobe Summit 2024 put individualized digital experiences on full display. Personalization at scale is exceedingly difficult. By applying AI, Adobe showed off its ability to bring custom experiences to the masses and do so with trusted, enterprise-grade content. Moreover, Adobe highlighted an expanded total available market for its three major business segments and is now pursuing a TAM approaching $300B. We believe Adobe represents a leading example of AI monetization beyond the two most commonly discussed segments – i.e. 1) The picks and shovels of silicon, LLMs and core AI infrastructure; and 2) Microsoft copilots. Its vision is to become a $30B revenue player, but the timeframe for such an achievement remains aspirational with no specific timeframe committed by Adobe.

In this Breaking Analysis we welcome our friend and CUBE contributor, Andy Thurai, Vice President and Principal Analyst at Constellation Research, to review the action from Adobe Summit and give our perspective on the prospects for the company.

Financial Snapshot

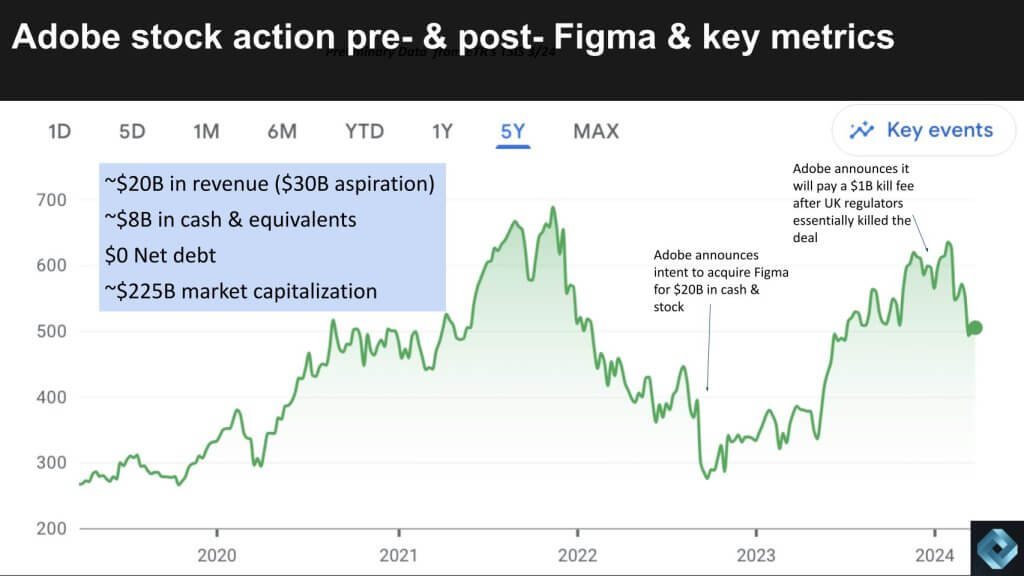

Let’s take a look at Adobe’s stock performance in recent years.

Adobe is a roughly $20B revenue company with nearly $8B in cash and equivalents on the balance sheet, no net debt and a more than 10X revenue multiple. Two months prior to the launch of ChatGPT, Adobe announced its intent to acquire Figma for $20B, split almost evenly between cash and stock. You can see the outstanding performance of Adobe coming out of 2022’s tech downturn. The Figma deal made some sense because Adobe was unable to compete with Figma with its own product. Whether $20B post ChatGPT was a good price was always a question but it didn’t matter because our the UK competition committee essentially killed the deal.

In a way this was a blessing in disguise. We asked Andy Thurai for his thoughts on the loss of Figma which we summarize as follows.

Thurai noted that Wall Street liked the deal and it would have been a good marriage in terms of the value Figma could’ve added to Adobe. Figma has strong collaborative tools and browser-based interfaces popular with creators, making it a valuable asset in any tech merger. Despite his initial shock at the $20 billion valuation, which seemed exorbitant to Thurai, the subsequent rise in stock price suggested the market saw things differently.

Survey Data Shows Portfolio Momentum

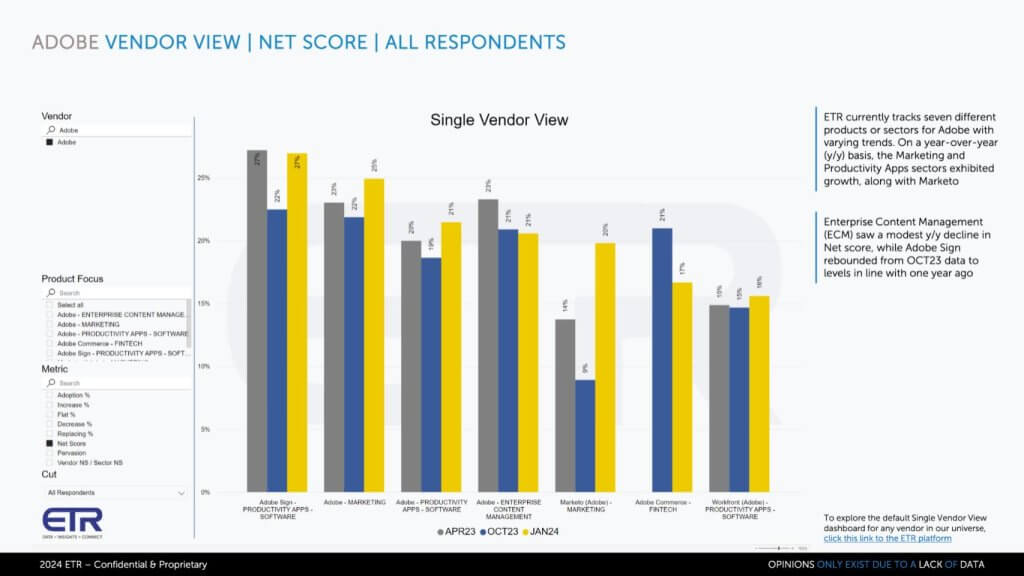

Let’s take a look at the ETR data to see how the spending momentum looks for Adobe across Adobe’s portfolio.

This is data from ETR’s TSIS survey and it shows the spending momentum or Net Score in three time periods – April 2023, October 2023, January 2024 in the gray, blue and yellow bars respectively. This is a survey of around 1,700 technology buyers and in the data set there are 872 Adobe customers, a significant N. You can clearly see the breadth of the portfolio across Adobe Sign which competes with Docusign, its marketing platform, content management, Marketo which Adobe acquired for almost $5B from private equity firm Vista, Fintech and Workfront, Adobe’s workflow management software. Remember, this data maps to the ETR taxonomy, not to how adobe views its business. But the point is there are a number of areas in the yellow that are showing accelerating momentum and / or are holding steady.

Most firms in the data set show softer momentum due to the macro headwinds.

Thurai’s comments on this data are summarized as follows:

Thurai shared insights from Adobe Summit where the focus was on Adobe’s position in the creators market. According to Thurai, Adobe demonstrated a strong foothold with creators and marketers. While it took some time to get traction with Firefly, Adobe’s Gen AI model, the conference celebrated Firefly’s one year anniversary and the product has significant momentum. The advent of OpenAI and other large language models (LLMs) posed a significant challenge to Adobe and the company has responded.

- Thurai emphasized that recent announcements from Adobe at Summit were not just for show; these developments are either already integrated into their products, will be soon, or are available for early adopters.

- This approach by Adobe signifies a shift towards immediate availability and utility of new features, contrasting with companies that announce future plans without immediate implementation.

Thurai highlighted the importance of Adobe’s strategy from an investment perspective. By ensuring that new features and tools are readily available or soon to be, Adobe not only retains its current user base but also attracts new users, thereby enhancing its monetization potential.

Bottom line, Thurai views Adobe’s recent moves as a strong response to the Gen AI opportunity. By swiftly integrating new, competitive features into its offerings and making them available to users, Adobe is not only addressing past criticisms but is also positioning itself for continued success in the highly competitive creative software market.

Top Highlights from Adobe Summit 2024

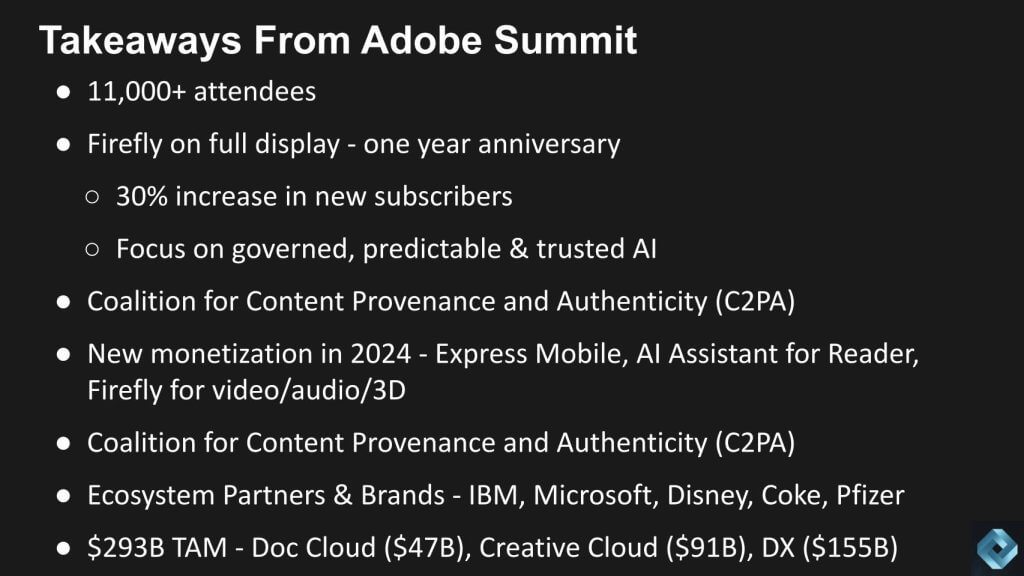

Let’s look at the takeaways from Adobe Summit. Below are the key points we discussed and a curation of the conversation follows.

Adobe Summit Insights and Firefly’s Impact

The Adobe Summit was attended by more than 11,000 people. During the event, a significant focus was placed on Adobe’s AI initiatives, particularly Firefly, which again, celebrated its one-year anniversary. Management indicated during its financial analyst meeting that Firefly was a key contributor to Adobe’s growth. The company claims it saw a 30% increase in new subscribers due to Firefly, which bolsters Adobe’s business model. This type of subscriber growth underscores a shift towards AI-driven value rather than its legacy credit-based model. Our analysis delves into several key aspects of Adobe’s strategy and product offerings based on the discussions from the summit:

- Adobe’s emphasis on responsible AI innovation, with Firefly comprising a suite of image generation models that prioritize ethical data use and customer-centric innovations.

- The differentiation Adobe creates through its licensed image repository, avoiding the legal exposures related to data scraping and copyright issues that have plagued other companies.

- The focus on aligning technology innovation with customer needs, shown by Firefly’s ability to map and adhere to brand guidelines and corporate edicts, supporting stronger enterprise adoption.

Bottom Line: We believe that Adobe’s strategic positioning of Firefly, along with its commitment to responsible AI and customer-centric innovation, has not only contributed significantly to its subscriber growth but also sets a strong example in the industry for ethical AI development.

Content Provenance and Personalization Strategies

Adobe’s efforts in promoting content authenticity and combating misinformation were also a major theme, highlighted by its lead in the Coalition for Content Provenance and Authenticity (C2PA). This initiative, aimed at establishing content provenance, is pivotal in the era of deep fakes and misinformation. Additionally, Adobe’s advancements in AI have enabled unprecedented levels of personalization at scale, through initiatives like GenStudio, which democratizes marketing across various channels.

- The significance of the C2PA coalition in establishing a standardized approach to content authenticity.

- Adobe’s push towards personalization at scale, allowing for marketing campaigns that are highly tailored to individual preferences and behaviors.

- Federated Audience Composition and advanced analytics enable a deeper understanding of customer preferences without compromising data privacy.

Bottom Line: Our opinion is that Adobe’s leadership in content provenance and personalization strategies not only enhances its product offerings but also elevates its role in setting industry standards for responsible and effective AI use.

Ecosystem Partnerships and Future Monetization

A critical component of Adobe’s strategy involves ecosystem partnerships and new avenues for monetization. Adobe’s collaborations with technology giants and brands, such as IBM, Microsoft, Delta, Pfizer, Coca Cola, Disney and others were on display at Summit, underscoring an integrated approach to AI. Specifically, Adobe’s tools are becoming deeply embedded in the operational workflows of its partners and customers. We see significant AI monetization opportunities for Adobe in the near-to-midterm, including mobile applications, AI assistants, and advancements in video, audio, and 3D content creation.

- The importance of ecosystem partnerships in extending Adobe’s technological capabilities and market reach.

- It’s use of a variety of industry AI tools from IBM with watsxonx, Google, NVIDIA, Microsoft Copilots and its own customer tooling.

- Adobe’s focus on new monetization strategies that leverage AI for content creation, personalization, and workflow optimization.

- The projected expansion of Adobe’s Total Addressable Market (TAM), driven by its diversified product portfolio and AI integration.

Bottom Line: In our view, the failure of the Figma deal has forced Adobe’s hand to step up its organic innovation. Generative AI presented a timely opportunity for Adobe to double down on key strategic partnerships and focused innovation initiatives in AI. These in our view will be key drivers for its future growth and expansion in the digital experience sector. The company’s ability to monetize AI technologies and integrate them into a broad range of products and services positions it favorably for sustained monetization and leadership.

Overall Analysis

Adobe’s strategies, as demonstrated during its conference, highlight a winning posture that embraces AI across its product lineup and operational philosophy. The company’s emphasis on responsible AI, content provenance, personalization at scale, ecosystem partnerships, and innovative monetization approaches are key indicators of its commitment to maintaining a strong position in the creative and marketing technology sectors. We believe that Adobe is well-positioned to capitalize on the opportunities presented by AI, driving both market growth and operational efficiency for itself and its partners.

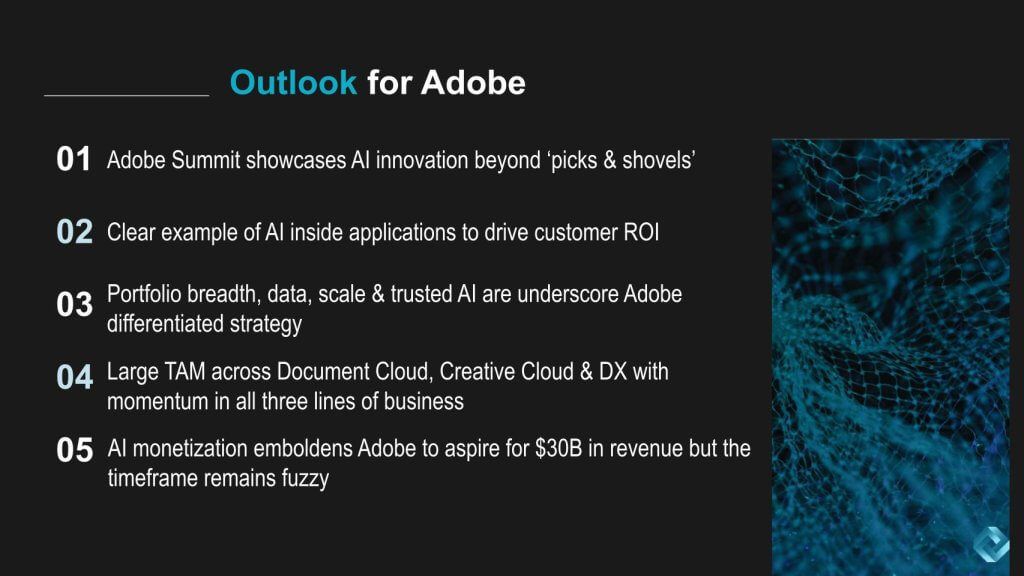

Future Outlook for Adobe Post-Summit

Let’s close by looking at how to think about Adobe going forward. The following summarizes the analysis we produced with Andy Thurai.

The Adobe Summit provided a clear illustration of Adobe’s market momentum with a differentiated strategy led by AI innovation. This wasn’t just about the technology itself but how Adobe embeds AI into applications to drive tangible ROI. A broad spectrum of consumption models, from freemium to paid services and layered tiers, highlights Adobe’s adaptability and its effort to cater to various customer types. This flexibility is crucial as Adobe aims for a significant revenue milestone of $30B.

- The Summit revealed Adobe’s focus on AI beyond traditional applications, showcasing real-world ROI from AI integration.

- Adobe’s diverse business model, including freemium and paid options, allows for flexible AI consumption.

- The company’s broad portfolio, trusted AI, and significant Total Addressable Market (TAM) underscore its industry leadership and momentum.

Bottom Line: We foresee Adobe’s continued leadership in integrating AI into its offerings, bolstered by diverse monetization strategies and a broad portfolio. These factors are pivotal in Adobe’s pursuit of $30 billion in revenue, marking a significant growth trajectory influenced by AI’s monetization potential. We’d note that no timeframe is being given to reach $30B and we’d like to see more clarity on this front.

Monetization Strategies and AI Innovation

Adobe’s path to increased monetization is potentially more signficant than previously appreciated. The company emphasized this point at its financial analyst event. The summit demonstrated Adobe’s unique position to capitalize on content creation and authenticity which will drive additional revenue streams through a variety of content verification services. Moreover, Adobe’s confidence in its AI models is underscored by its offer of full indemnity to customers using its models, a strong indication of its commitment to responsible AI use. We haven’t read the fine print and will but this is a step in the right direction.

- Potential for Adobe to introduce new revenue streams through content verification and authenticity services.

- Full indemnity offered by Adobe to its customers reflects supreme confidence in its AI models and responsible AI practices.

- The complexity of customizing user experiences through AI at scale is a major differentiator for Adobe in our view.

Bottom Line: The potential for new monetization vectors, coupled with Adobe’s strong stance on responsible AI and user support, suggests Adobe is not only innovating within its product lines but also exploring broader market opportunities enabled by AI.

Adobe’s Innovation and Market Expansion Post-Figma Deal

We discussed Adobe’s need for continued innovation, especially in the wake of the failed Figma acquisition. The loss of Figma has seemingly catalyzed a more focused Adobe with an aggressive innovation strategy, utilizing AI to distinguish itself and meet aspirational revenue targets. The Summit was filled with buzz and featured high-profile personalities like Shaq O’Neal.

- Adobe’s aggressive pursuit of AI innovation and application integration demonstrates its resilience and adaptability in the face of market challenges.

- The failed Figma acquisition and subsequent push for innovation underscore Adobe’s commitment to achieving a $30 billion revenue target through enhanced AI capabilities and market expansion.

- The excitement and positive reception from customers and stakeholders at the Summit highlight Adobe’s strong market position and promising future prospects.

Bottom Line: In our analysis, Adobe’s strategic pivot towards deeper AI integration and innovation signifies a robust pathway to achieving its ambitious growth targets. This strategic direction, amplified by market enthusiasm and Adobe’s commitment to expanding its AI capabilities, positions the company well for future success and market leadership. While Adobe provided no specific timeframe for its $30B revenue milestone, we believe it’s achievable before the end of the decade.