There is little doubt that AI represents the transformative force of our time. This is why 9 in 10 businesses are accelerating spending, with a majority declaring it their #1 priority.

However, one of the most critical imperatives is sitting somewhere up in the “stratosphere” within most organizations, lacking the critical attention it needs. It’s the imperative to win the battle for the best PEOPLE.

theCUBE Research analysis of the AI talent marketplace indicates that it may get harder to secure the top talent as time passes. This research note will quantifiably examine AI jobs’ supply and demand dynamics, illustrating why you must act now, not later, to secure the best talent.

Market Overview

Simply put — organizations don’t do things; People do.

It has never been truer than with AI.

The most effective AI teams are those composed of multi-disciplinary skills that instill the ability to harness the “wisdom of crowds” to collaborate, innovate, and operate in unison. The most successful organizations will secure the top talent within a dwindling pool of skills and integrate this talent within a holistic business and technology strategy.

Despite this, only half (47%) of executives feel that the AI leadership role in their company is clear, according to a Heidrick & Struggles study on AI organization and compensation. As a result, only 37% feel their AI function is industry-leading.

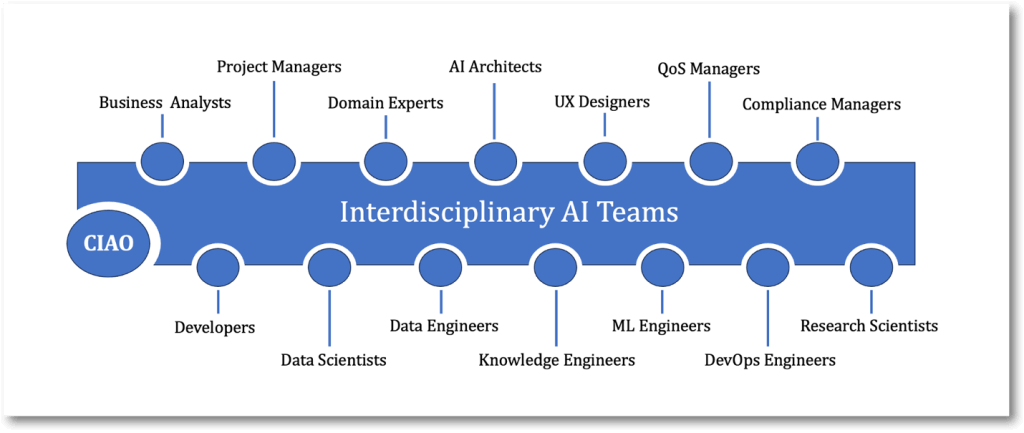

This is why, in part, we are seeing the emergence of a totally new C-suite role, the chief AI officer (CAIO). Their mission is to weave together a holistic, cross-company AI strategy and to create new organizational designs, talent pools, and interdisciplinary work cultures. The latter is critical, as AI is the ultimate “team sport” involving over a dozen specialized roles that must think and operate in unison.

The number of differentiated skills in a fully staffed AI organization can vary depending on its size, scope, and focus, but typically, a comprehensive AI team would include 8 to 12 key differentiated skills. These roles span technical, business, and operational areas to ensure AI solutions’ effective development, deployment, and scaling.

This is especially true as AI rapidly evolves into advanced domains, such as Agentic AI and Causal AI, which require additional teams of subject matter experts, not to mention those skilled at architectural design and implementation.

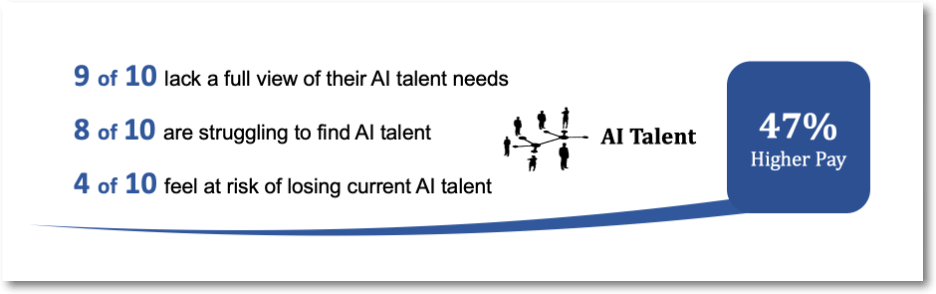

Yet, today, most businesses report a growing gap between AI investments and workforce readiness. A Pluralsight study of 1,200 decision makers found that only 10% fully understand their current or future AI skill profiles or even how to define those needs.

Furthermore, most are struggling to find AI talent and are facing an alarmingly high rate of employees considering leaving for new AI jobs. According to 800 C-suite executives (including 500 CEOs) who participated in an edX AI survey, 87% struggle to find the necessary AI talent. This is supported by the Heidrick & Struggles study, which reports that only 12% of executives are highly confident they will secure the AI talent they need.

Even more concerning is that only 38% of employees believe their company has appropriately invested in AI skill-building programs. Thus, nearly 40% of AI-skilled employees say they may leave for more committed or better-paying AI jobs.

This, in turn, is driving employers to pay an average of 47% more for IT workers with AI skills, according to an AWS/Access study of 1,340 organizations. It is also important to note that the higher pay extends into sales and marketing, finance, business operations, legal, risk and compliance, and human resources positions.

The supply-and-demand dynamic in the AI talent marketplace is a story of two colliding forces, creating tailwindsfor some and headwinds for the rest.

Consider an analogy: the polar jet — a condition that occurs in the jet stream when unusually warm and cold air masses collide in the stratosphere to produce intensifying winds. When flying into the headwinds, the journey will be four times more turbulent, 20–30% slower, and 50–60% more costly. Those in the tailwinds will experience the opposite.

Within the AI talent marketplace, accelerating demand is now colliding with limited supply to create a defining moment. Those who act quickly to secure the best talent will ride tailwinds to success, while the rest will face the headwinds of dwindling skill availability and growing acquisition costs. At stake is a smoother journey to AI, lower costs, and faster time to value.

Where are we today in the AI talent marketplace?

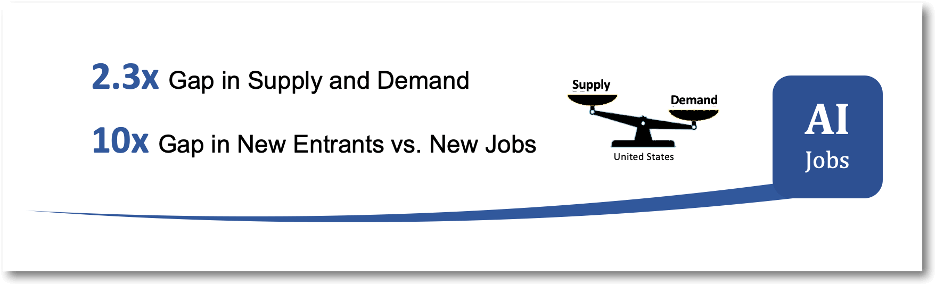

AI is the #1 job creation category as a fraction of overall employment, holding a 2.3% penetration rate, up from 0.5% in 2015 — a 5x expansion — according to the World Economic Forum’s Future of Jobs Report. This will only accelerate as businesses now rank AI as a top re-skilling priority, jumping 12 positions from last year.

In addition, the flow of new entrants into the AI labor force is not keeping pace with demand. According to StudyPortal, demand for an AI education is 3.4 times the capacity at U.S. universities and 2.6 times for data science programs. This represents a staggering 305% increase over the last many years. In addition, the National Center for Education Statistics reported that only about 10,000 new entrants per year from US colleges with AI skills are in the market.

Currently, LinkedIn has 67,607 open jobs for AI-related skills. TheCUBE Research suggests that another 200,000+ AI job openings will be added in 2025 in the United States. This will result in an expanding supply-and-demand problem for businesses trying to acquire AI talent and, in turn, increase salary demands when they do find them.

Clearly, the conditions have been set for a highly turbulent AI talent marketplace.

To further illustrate, let’s highlight the supply and demand dynamics within three success-critical skill categories – AI Engineers, AI Researchers (PhDs), and AI Executives

AI Engineers

For those who design and build AI models and apps:

- Demand has grown 75%YTY, while supply has only grown 40% — a whopping 2x gap. In addition, the US Bureau of Labor Statistics projects demand to expand by an additional 82% over the next three years. Overall, a projected 5x expansion.

- Generative AI is today’s accelerant. Upward reported a 450% increase in job postings, and Lightcase indicated a similar growth rate driven by 385,000 new US Generative AI job postings YoY. According to LinkedIn, there are 9,004 open jobs for generative AI skills, of which nearly 85% were posted within the last 30 days. That indicates today’s GenAI skills are going quickly.

- Causal AI is tomorrow’s accelerant as businesses drive the need for decision intelligence and autonomous agents. According to LinkedIn, 2,514 current job postings are looking for this skill set, more than four times what was reported six months ago. For those open jobs, 75% were added in the last 30 days, well outpacing the supply.

- Demand will drive a 20% compounded growth in salaries over the next three years. This is larger than all other occupations combined and represents a historic level of growth within the typical technology adoption curve.

AI Researchers (PhDs)

For those that architect advanced AI models and methods:

- AI researchers are the#1 job category being sought by employers among11 individual technologist roles tracked in a Foundry AI Priorities Study. Nearly three out of ten large businesses are seeking to hire this skill set as specialized models grow in popularity and company-wide architectures become more critical.

- Overall, a historic 15% of all AI jobs are in research compared to the cloud at 2%. As the National Bureau of Economic Research (NBER) points out — “AI is the only technology at the top in both number and percentage of research job postings.”

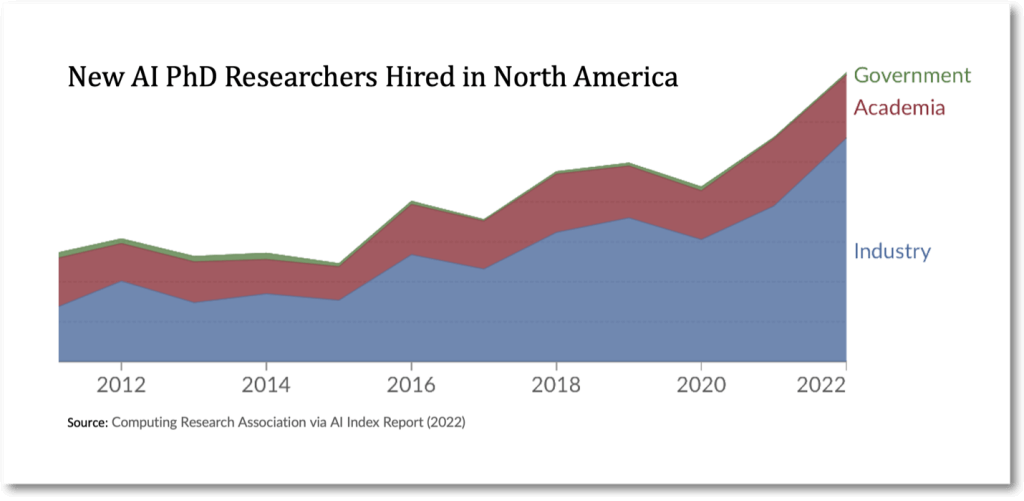

- AI researchers taking jobs in private industry have grown from 3.5x over the last decade to 70%. Overall demand will expand by 23%—2xall computer occupations. Yet, growth in supply will stagnate at 4%over the years ahead.

- This limited skill set drives explosive salary growth, as only about 20% of graduating computer science PhDs have specialized in AI. In the private industry, entry-level salaries have grown to $180K-$200 and are likely to grow at a compounded rate of 20% over the years ahead.

AI Executives

AI Executives

For those responsible for realizing the business impact of AI investments.

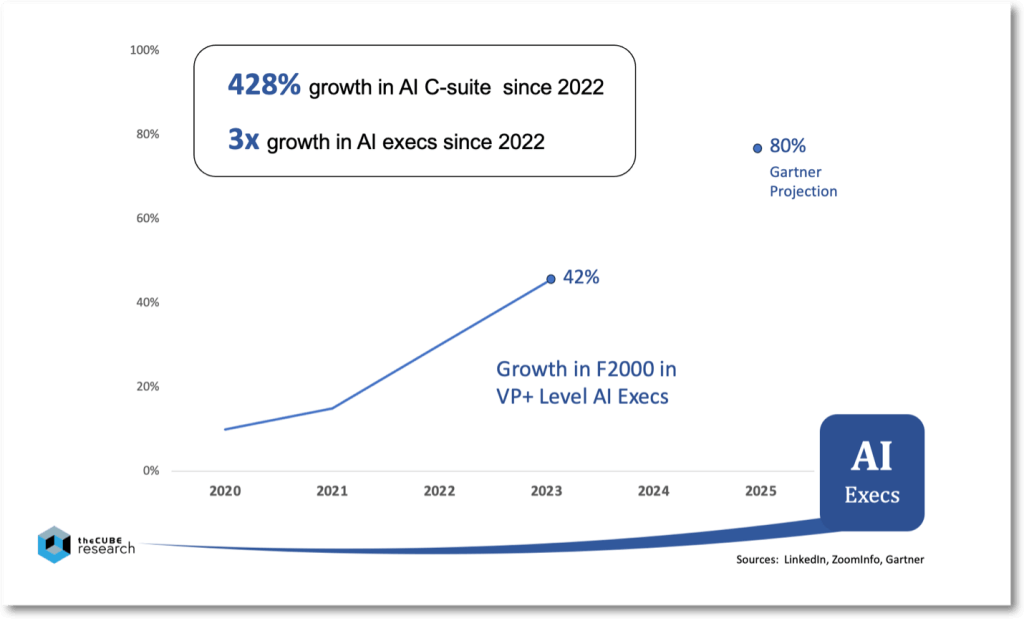

- The chief AI Officer (CAIO) is one of the hottest new roles being created by CEOs. According to research by Foundry, this new role which will triple to 32% in 2024. ZoomInfo reports a 428% surge since 2022.

- According to Gartner Group, the number of businesses that have hired VP-level AI strategy leaders within the F2000 will also surge to 80% in the years ahead, likely elevating lower-level executives that 54% of businesses have today.

- An edX AI Survey shows that supply is low, as 79% of current executives feel that they lack the AI skills necessary to be successful in the future. Nearly 6 in 10 of them believe that AI will become a required skill set in the near future. Over half of them fear they will be replaced, as they worry they cannot compete for AI executive roles.

- The surge in demand for AI-skilled executives has resulted in the rapid growth of compensation packages. A Heidrick & Struggles study on AI executive compensation in the United States reported an average yearly compensation of $1.34M, with the most senior AI executives (e.g., CAIOs) reaching $2.6M. This represents a growth rate in excess of 20%.

What To Do

We believe those who act quickly to secure the best talent will ride tailwinds to success, while the rest will face the headwinds of dwindling skill availability and growing acquisition costs. At stake is a smoother journey to AI, lower costs, and faster time to value.

We recommend you act urgently, as finding AI skills at reasonable costs will only become more difficult in the years ahead.

We’d recommend you:

- Hire aggressively and be willing to pay for good talent

- Double down on internal AI skill-building

- Ensure your AI skills are valued so you can retain them

- Evaluate the use of flexible AI talent-sourcing businesses

Note that more and more businesses (53% in a Deloitte survey) are turning to outside firms to help them with their AI development due, in part, to the shortage of skills and overall lower costs. According to Statista, this market is expected to expand at a 34.3% CAGR.

Contact us if we can help you in this must-win battle for AI talent. We can help you design a strategy and build partnerships with leading AI & software skill marketplaces.

Book a briefing here to learn more.

Thanks for reading. Feedback is always appreciated.

Follow me on LinkedIn or contact me at Scott@SiliconAngle.com.