While the NASDAQ seems to reach new highs daily, enterprise tech spending remains persistently cautious at the macro amid continued market uncertainty. That’s not necessarily bad news but it can be disconcerting to decision makers. Often during transitional cycles, like the one we’re in now, executives don’t want to over-rotate on capital allocations that deliver outcomes, which could potentially be achieved much more cost effectively with emerging technologies like AI. We’ve seen similar patterns in previous waves. There was a period of “great softness” in enterprise IT spending when transitioning from mainframes and minis to the PC era, a huge backlash from overly exuberant Y2K and dotcom spending; and a steady deterioration of traditional enterprise tech momentum during the cloud, mobile, SaaS, social, big data era.

Each wave is different but two common themes remain: 1) strong conviction that a new era is here; and 2) fear of disruption, which sometimes leads to hasty decision making and waste. These countervailing forces seem to be in play today as 87% of enterprises report taking a cautious approach to AI investments. And that caution is showing up in the macro spend environment.

In this Breaking Analysis we take a look at the quarterly spending data from ETR and give you our take on what’s happening in the market at the macro and how the spending climate has changed. We’ll quantify the stubborn weight of uncertainty, both technological and policy-driven and convey how enterprises are responding.

January Enthusiasm has Turned to Caution

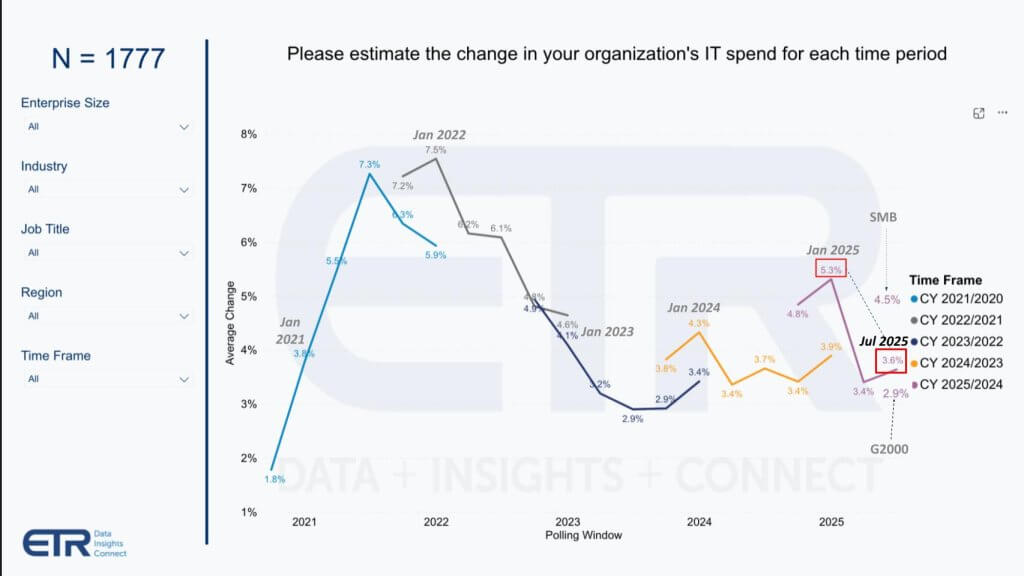

Let’s start with a look at tech spending sentiment going back to the boom times in 2021.

This data from ETR shows the quarterly expectations of annual IT spending growth from around 1,800 IT decision makers. As we’ve discussed in the past, we’re well off the halcyon high single digits from the isolation economy. Calling your attention to 2025 in the above chart, we entered this year with ITDMs expecting a healthy 5.3% increase in annual spending, which declined to 3.4% this spring and has slightly up-ticked in the July 2025 survey to 3.6%, still well off the January highs. Of greater concern is that large spenders, reflected by the G2000 data, expect a 2.9% increase with SMBs more optimistic at 4.5%.

The reason for the concern is small and midsized firms are more susceptible to policy shifts like tariffs and their ability to shield the hit is lower than large global firms.

Tech Spending Patterns Correlate to Fed Actions

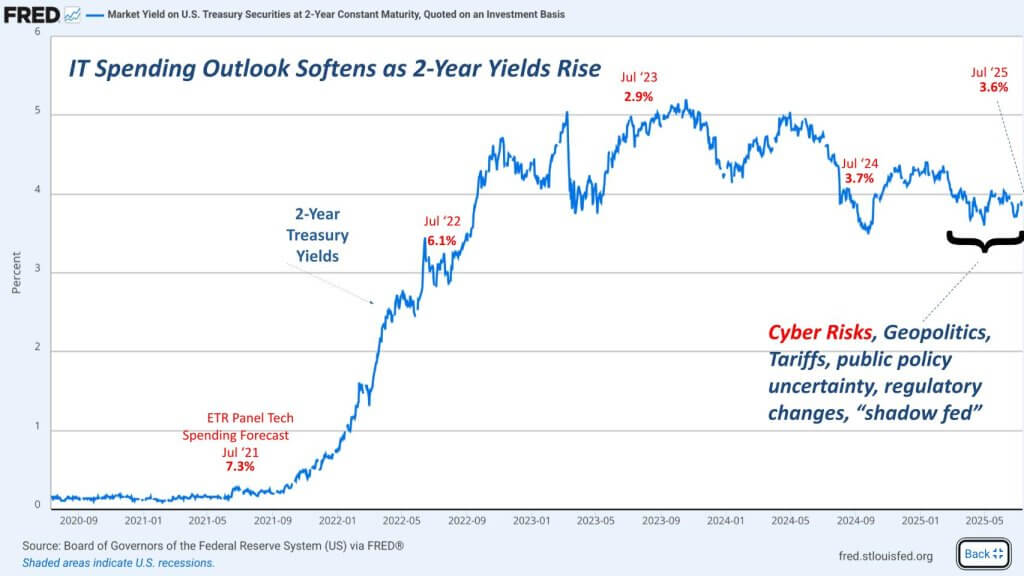

It’s interesting to plot the change in tech spending against the 2-year treasury as we show here.

The blue line is the price of the two year which is basically inversely proportional to the tech spend sentiment. In 2022 we still had the exuberance hangover from COVID and as interest rates spiked tech spending expectations slowly waned (from roughly 7% to 6%). But as reality set in you can see the July 2023 spending trajectory tanked to under 3% and has remained in the mid 3’s since.

In addition to the factors we mentioned at the beginning, cyber risks have escalated along with all the geopolitical gymnastics, leading to this persistent caution that we’ve cited.

Operational Resilience is Increasingly Vital in this Era

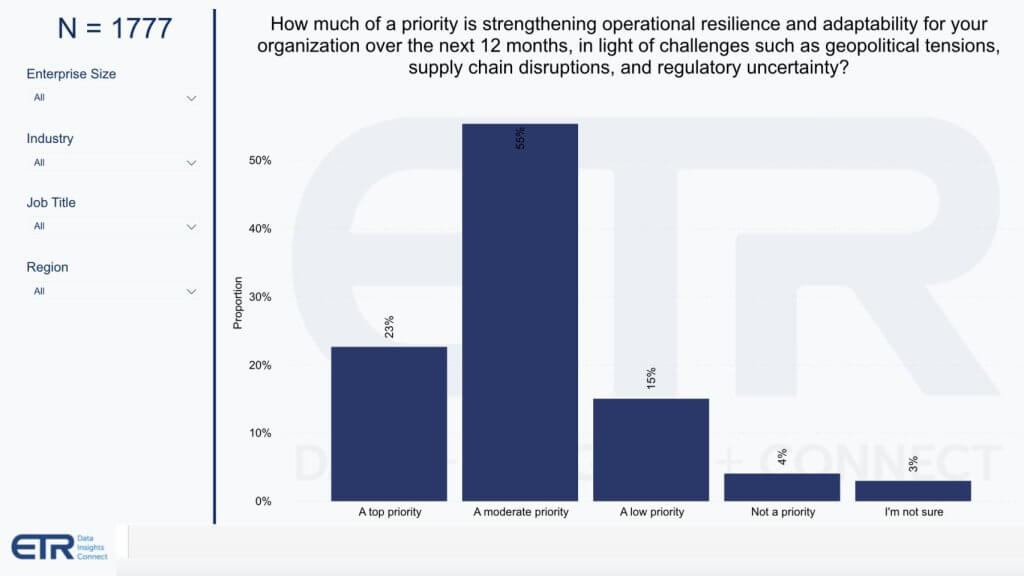

An interesting data point from a previous ETR Macro Survey is shown here – gauging the degree to which geopolitical and other concerns have affected organizations’ posture toward operational resilience.

We can look at this data as a large percentage of customers are making resilience a high priority. Are the ones on the right more exposed or are they more resilient already? We don’t know from this data other than it conveys resilience has become a top concern, which we’ve already known for quite some time.

Cyber Attacks More Disruptive Than Ever

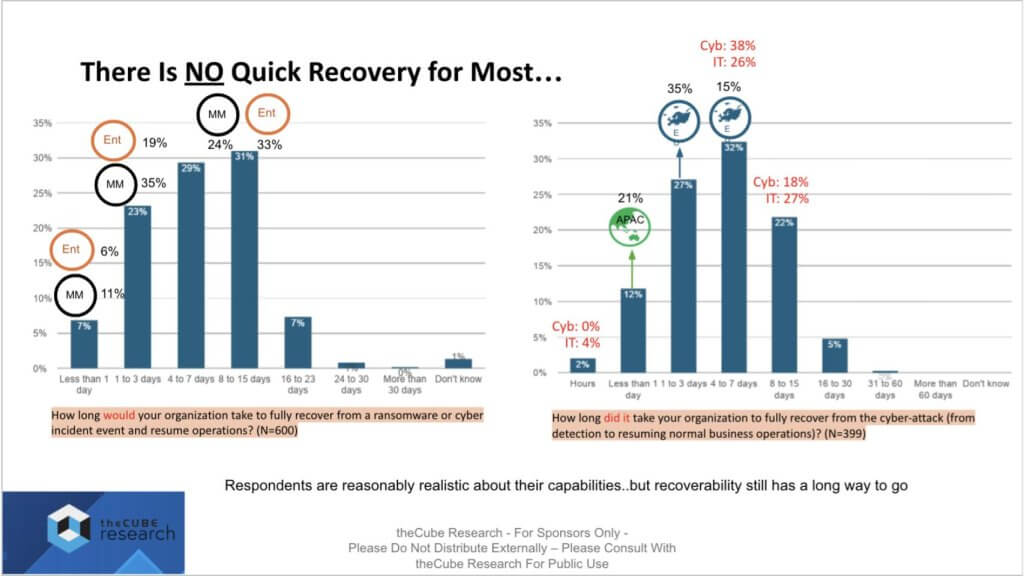

A main reason for this sentiment is with all the changes organizations are facing – geopolitical, the pace of AI, policy uncertainty, etc., – cyber risks are cited by ITDMs as their #1 concern. And perhaps the most difficult to address. The urgency is shown below in this graphic from a recent study by theCUBE Research, led by Christophe Bertrand, quantifying the time it takes to recover from a cyber attack.

The leftmost data asks 600 organizations to estimate how long it would take to recover from an attack and the rightmost chart asks those who actually experienced a cyber attack how long recovery took. On the right – those who have experienced an attack – only 2% can recover in a matter of hours and only 12% less than a day. The majority of respondents in both data sets face multiple days to recover.

Christophe’s research quantifies the cost of such disruptions and there are many studies that do so as well. But the key points are: 1) the productivity hit of an attack is many days or weeks of lost productivity; and 2) organizations are beginning to understand the realities and are generally realistic about their capabilities.

The other factor to call out is that budgets aren’t unlimited . In addition to keeping the lights on and running the business, organizations have to grow and transform the business. So they have to fund new LOB initiatives, fund AI and keep iterating on cyber. All of these factors weigh into the macro spending data we shared earlier.

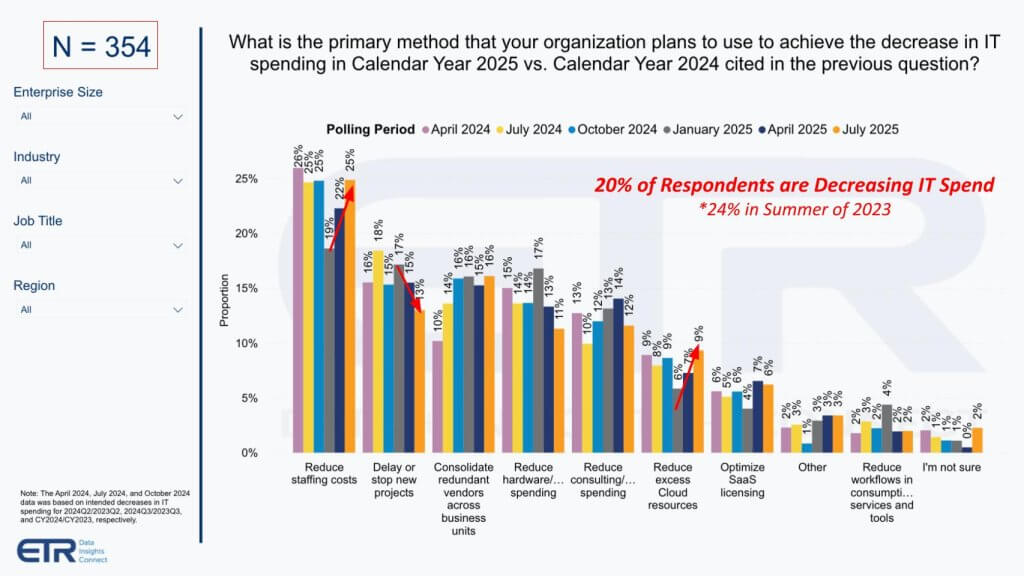

Methods Organizations Use to Cut

For those organizations feeling the budget pressures and decreasing spend, how are they doing that? The following data depicts the approaches used.

On balance, only twenty percent of organizations in this study are reducing their IT spending. That’s down from 24% two years ago, which is a positive. And they’re doing it by cutting staff as you see on the left most set of bars. That approach is back to the highs of last fall. And you can see new projects getting delayed. While this is the second most common technique, it is declining in popularity. Further to the right you can see reducing cloud expenses is picking up steam.

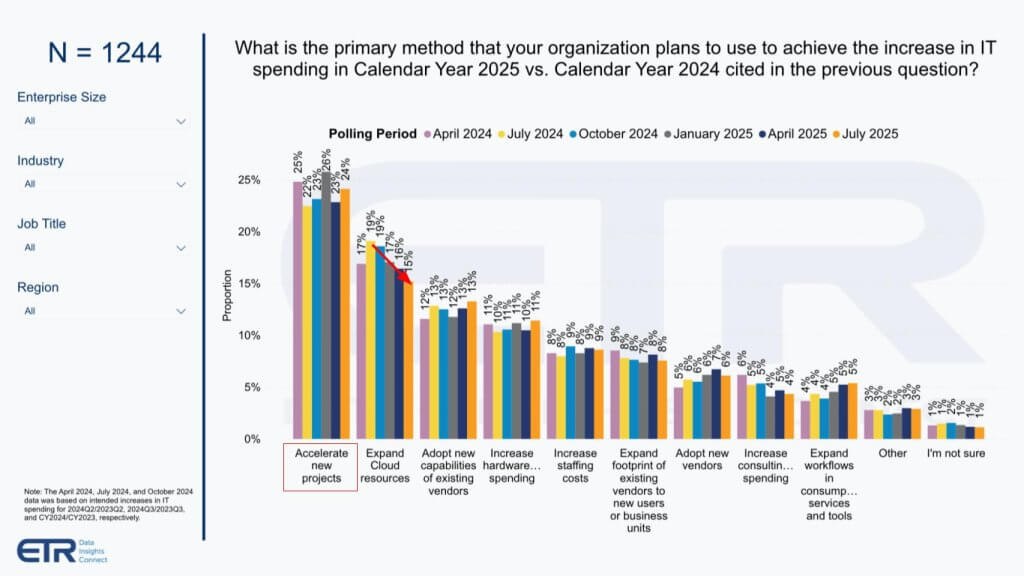

Methods Used to Accelerate Spend

Let’s dig into this a little more deeply and look at how organizations approach increasing their IT spending shown below.

New project acceleration remains the top appraoch. Expansion of cloud resources, while still number two is in decline.

So based on this and the previous data you may surmise that the cloud is under pressure.

Cloud Spend Continues to Outpace Other Sectors

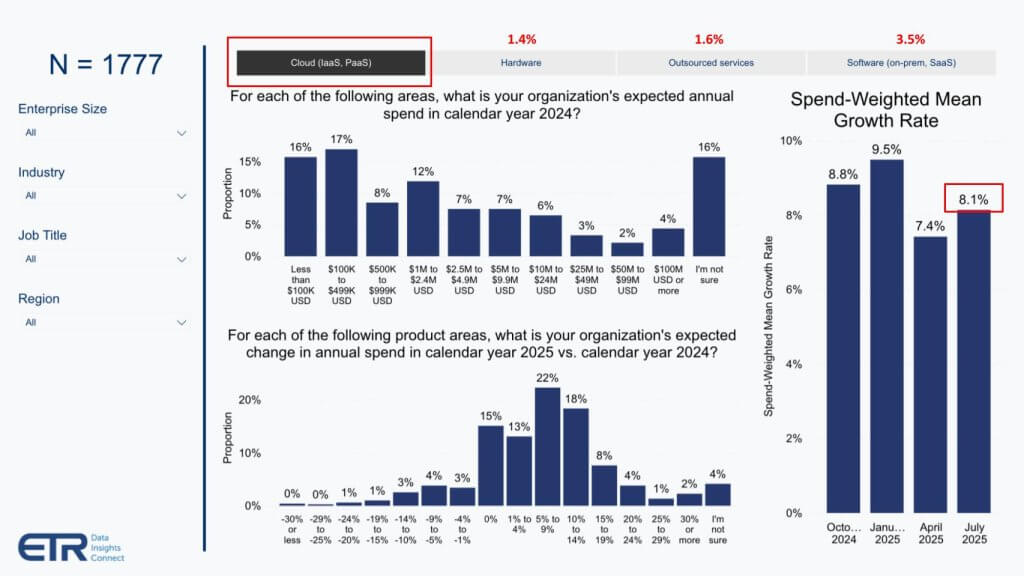

The data below shows spending by category – Cloud, Hardware, Outsourcing and SaaS.

While the previous data could be interpreted as negative, the cloud still far outpaces the other broad areas shown, with 8.1% annual growth, more than double the macro average, and far above hardware, outsourcing and SaaS, which are all in the low or lower single digits.

Remember, cloud revenue for just the big 3 hyperscalers plus Alibaba will surpass $250B this year, growing revenue in the mid 20’s for the group – so still very strong and outpacing other sectors. Cloud is being propelled by AI, a strong base of existing workloads that continue to grow and a flywheel of ecosystem vendors the like of which doesn’t exist on-premises.

Anticipating the AI Productivity Boom

Let’s close with a view on what the outcomes are that organizations are seeing from their AI spend. The vendor narrative at conferences is that we’ve exited the experimentation phase for AI and we’re entering deployment at scale. We don’t quite see it that way. Most customers continue to tell us that their AI is nascent and largely experimental with uncertain ROI. This in many ways is good news in that the potential for increased value is enormous – if you believe (as we do) that AI is a durable trend.

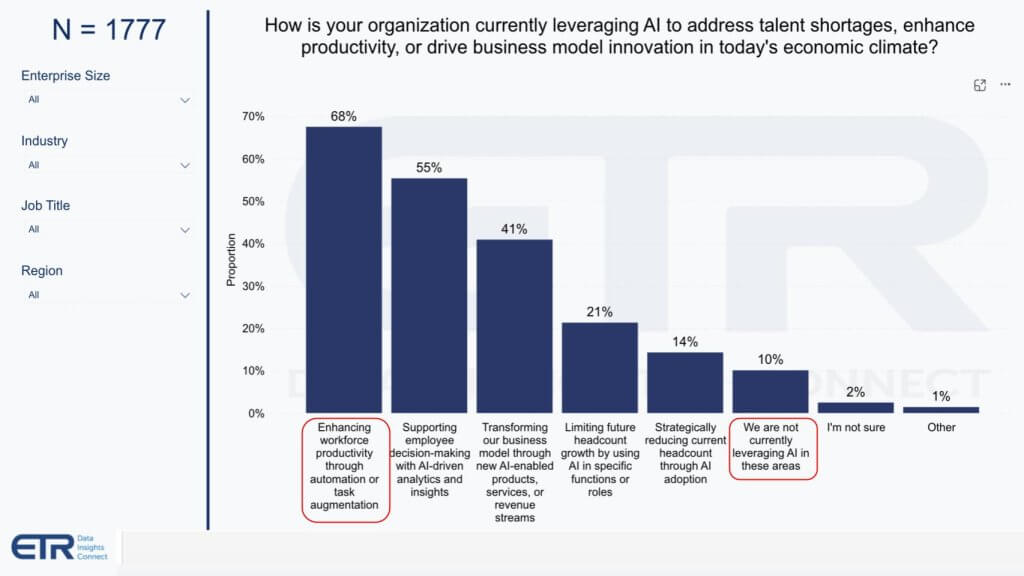

The data above shows that AI is most typically being used to enhance productivity and augment mundane human tasks. Supporting better analytics is sort of a no brainer. When you have good analytic data – for example in Snowflake or Databricks or a cloud warehouse/lakehouse – bringing AI into the mix makes a lot of sense, is less risky and represents low hanging fruit. The third bar above – i.e. transformation with new revenue streams – will take more time in our view but the NPVs will be much larger than we’re seeing today with early AI experiments. The drop off to #4 is notable – i.e. headcount avoidance or reductions – but it’s real and tangible that AI will affect jobs. And surprisingly, or not, 10% still are really not going after AI in these stated areas. Our interpretation is they’re waiting for the pioneers to take the arrows.

Imagine A 10% Productivity Boost in a $100T+ AI Economy

Let’s come back to the point on productivity. As we’ve shared in previous Breaking Analysis segments there have really only been two sustained decade-long productivity booms since WWII. The first was in the post war era with a massive increase in manufacturing in the United States. This spurred a consumer buyer flywheel that drove productivity in the late 50s into the 60s. The Second major uptick was due to the PC productivity boom in the 1990s. Many – us included – believe that we are on the cusp of another sustained period of productivity growth, globally.

Let’s think about this for a moment. VC investments in AI were around $50B in 2023, more than doubled last year and are on pace to increase this year. The big three hyperscalers plus Meta will spend well north of $300B this year on CAPEX. So let’s round way up and say $500B is being spent on AI, with – as we said – limited return on capital at the moment. Sounds like a lot right? Half a trillion dollars for a marginal return?

But let’s step back. The annual global economy is north of $100T. People are talking about 10, 20, 30% improvements in productivity. Let’s take 10%, which by the way would be a massive positive to the economy. That’s a $10T annual increase in productivity. So taken in that context, $500B maybe isn’t that outrageous and perhaps is even conservative.

The question for you is should you dive in or wait? There are many examples of where fast followers have thrived in these new waves. Facebook wasn’t the first social media company. Dell wasn’t the first PC maker. Google wasn’t the first search engine. So over rotating on capital allocation early in a cycle can be dangerous. At the same time, not participating will almost certainly leave you behind.

So our advice is:

- Pick the right spots in your business – i.e. start with business value;

- If you have a choice between high value and easy wins – pick the easy wins first;

- Get the culture behind the idea that a new wave is coming and they must ride the wave or end up as driftwood

- Use this mindset to build muscle memory and then let the distributed/decentralized organization build value throughout the system organically.

Those your organization will know where to deploy the agents. Your job as an executive is to provide the north star direction, a foundation of a solid data strategy and the tools and resources so they can make it happen.

We’re very excited about the future as I’m sure you are too. The macro uncertainties are always there – even when things are booming, there are blind spots around every corner. So hopefully our data and your knowledge of the market can help you navigate the unknown. We’re looking forward to being on the journey with you.