Executive Summary

Methodology

In May and June of 2012, the Wikibon community, in collaboration with SiliconAngle’s ServicesAngle, launched its inaugural IT Transformation Survey, targeted at a random sample of business technology professionals drawn from the Wikibon community. After an initial outreach to the Wikibon practitioner community via email, social media was used to solicit respondents. We received 261 responses, the vast majority of which came from the Wikibon email outreach. A number of respondents chose not to answer every question, and we have specified the number of responses for each question.

The survey was completed over the Internet using a SurveyMonkey Web questionnaire with an incentive drawing for an iPad. Thanks to everyone who participated and congratulations to the iPad winner, Oscar Abundes, an IT practitioner and Enterprise Systems Integration Engineer at a major U.S. energy company.

In the survey we frequently used a “conditioned response” methodology, asking respondents to address a ‘big picture’ question with a limited number of descriptive responses that forces them into a bucket. This technique has the drawback of minimizing nuance but the benefit of cleanly categorizing responses on key issues such as cloud computing and IT transformation. Specifically, multiple responses are not allowed in such a question. It is useful for comparing responses over time to assess adoption of a particular technology.

What follows is a basic frequency report and subsequent analysis of the results. It does not include detailed statistical analysis but rather is a simple first look at the survey answers. The analysis is based both on survey results and our own opinions based on hundreds of interactions with Wikibon community members and other research we’ve performed over the past 24 months.

After each section, we attempt to provide advice to practitioners through a single “Action Item.” This is our version of a call to action designed to focus our advice and summarize our takeaways.

Respondent Profile

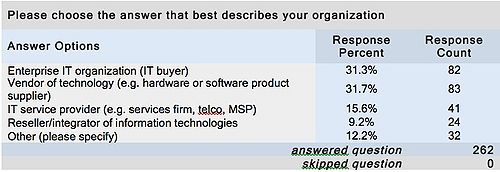

Table 1 shows the kinds of organization the respondents represent. A large portion of respondents are IT or business professionals inside technology companies, answering about their company’s IT organization. A cross tab excluding these respondents yielded statistically insignificant changes in the results, and we left these responses in the initial survey analysis.

The vast majority of the respondents -75%- were based in North America, with 17% from Europe, 7% from Asia/Pacific, and a very small contingent from the rest of the world.

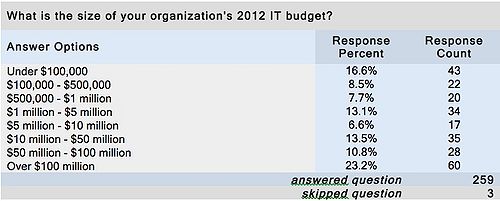

As shown in Table 2, the respondent base was split evenly among large, medium and small organizations. Approximately one-third of the respondent base has a 2012 IT budget of more than $50M with approximately one-third citing a budget of $1M or less.

Table 3 shows the breakdown of the survey by title. Twenty-nine percent have an executive management role (CIO or IT executive management). More than 23% of the survey base has an IT operational role, and about 24% are technical consultants. Approximately 20% of the survey base was representative of line-of-business management or business/IT analysts.

According to respondents, a significant portion of organizations have so-called “Shadow IT” groups with more than 60% of the survey citing some spending activity outside of a centralized IT group (see Table 4). Nearly 25% of the survey base indicates that 25% or more of the IT budget is managed outside of a centralized group.

IT Transformation Initiatives

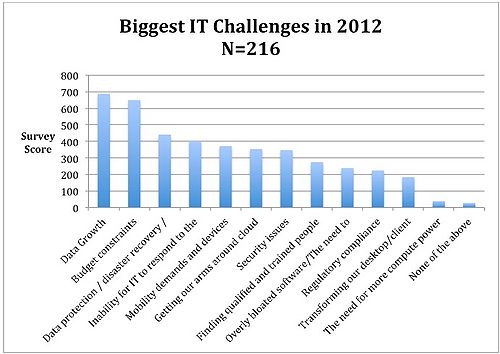

We asked respondents to cite their top three IT challenges for 2012. We then scored the responses, assigning 12 points for a first, 5 for a second, and 3 for a third place response. We then totaled these scores and sorted them as shown in Figure 1.

Data growth / excessive data growth, and IT budget constraints were the most significant problems cited by respondents of the survey. Data protection/ disaster recovery / business continuity were also cited as significant issues, as were IT mis-alignment, mobility, and getting a handle on cloud computing.

Data growth, data protection issues and budget constraints go hand-in-hand. Organizations have been struggling to keep pace with data growth and turning to storage optimization technologies, especially in backup and recovery use cases. Technologies such as data de-duplication have possibly allowed customers to keep pace but have clearly not solved the data growth problem. The one consolation users have is that without these technologies life would be even more challenging. However another possibility is that the adoption of storage optimization technologies is still limited. Nonetheless, it is unlikely that any single technology silver bullet will address both the budget and data growth issues simultaneously.

Action Item: IT organizations (ITOs) must find ways to extract value from data. By demonstrating that data has monetary value, ITOs will get required budget to both manage data and, more importantly, monetize data for organizational benefit.

Table 5 shows the responses to our IT transformation question. IT transformation initiatives in our survey base, while across the board, are mainly focused on two main vectors:

It is our view that the infrastructure transformation occurring within organizations is in lock step with cloud computing adoption, which we will analyze further in this study. Specifically, in a few short years the term cloud has gone from a pejorative buzzword within many IT organizations to a generally accepted approach to modern computing and the fundamental trend that is transforming IT infrastructure.

Many organizations are moving as fast as possible toward an IT-as-a-Service approach, offering service catalogues to users who can choose from a menu of offerings. The challenges of this approach are significant and predominantly business-model related (see Figure 2). Specifically, they involve changing the IT business model from a pure cost center to a service provider. At the same time, given budget constraints, many organizations are unable to fund this transition.

One caveat is our survey had minimal responses from the developer community and a developer-centric respondent base would probably be more focused on transforming the application development process.

Action Item: The vast majority (85%+) of IT organizations are going through a transformation process. These initiatives are designed explicitly to be more responsive to business demands. Organizations not pursuing IT transformation initiatives are likely to become increasingly less competitive to their peers.

Figure 2 shows the survey respondents’ challenges with respect to achieving IT-as-a-Service nirvana.

As indicated, the main challenges ITOs are having moving to IT-as-a-Service are business and process related. IT organizations are generally in the business of providing technology solutions on a project-by-project basis – versus delivering an ongoing set of services to the business that are flexible, re-usable, and can meet the changing needs of customers. Interestingly, respondents feel that skill sets are not the barrier, their biggest challenges are changing the mindset in IT to that of a service provider and developing operational processes that can align with business constituents.

Action Item: ITOs are competing for mindshare with cloud service providers (CSPs) that have a swipe-a-credit-card mentality for IT services. Unlike CSPs however, ITOs can’t just simply ignore the one-offs, rather they must service a variety of business needs that can often slow progress. Nonetheless, ITOs must develop a ‘default’ set of re-usable services for the business that follow an IT-as-a-Service model. While special cases will have to be accommodated for various reasons, starting with a baseline set of offerings (e.g. compute, block, file, SaaS) can allow ITOs to get a foot in the IT-as-a-Service door and evolve the business model over time incrementally.

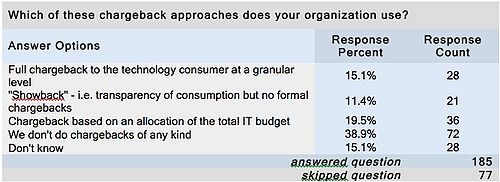

One clear example of the lack of true IT-as-a-Service capability is seen in Table 6, which shows that only 15% of ITOs surveyed do full granular chargebacks to the business. This figure has been stable over the past several years. However, the notion of “showbacks” – where chargebacks are not issued at a granular level but charges are transparent to the business – seem to be on the rise.

Action Item: Most CIOs believe chargebacks are not worth the effort. Nonetheless, organizations should consider so-called showback methods as a hybrid model that both supports an IT-as-a-Service mentality while at the same time respecting the practical realities of running an IT organization.

2012: The Year Of Cloud

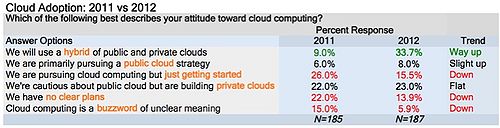

We asked respondents about their cloud computing strategies and compared the results to an identical survey we conducted in May of 2011 (see Table 7). The results are significant in that two factors stand out:

- The number of customers pursuing hybrid cloud has escalated dramatically in one year’s time,

- The number of practitioners who said cloud computing is a buzzword of unclear meaning declined substantially from 2011 to 2012.

The dramatic uptick in hybrid cloud plans is impressive. In 2010 and 2011, hybrid clouds were seen as new, untested, insecure, and risky. In 12 short months this attitude has flipped. Cloud service providers are teaming with IT suppliers to create more homogeneous environments for the enterprise, largely driven by VMware but also the adoption of other hypervisor management systems. Also, IT organizations are gaining visibility on public cloud activities within LOBs and are embracing these initiatives both as a means of advancing IT’s role and as a mandate from CIOs and a response to the challenges of risk management, compliance, and CISOs.

Action Item: By 2015, 95% of organizations will have a clear cloud computing strategy, and hybrid cloud deployments will predominate in mid-to-large companies. These organizations must urgently develop policies and procedures to manage hybrid clouds and involve legal, IT, risk management, compliance, security professionals, and business line management heads to ensure corporate edicts are met and unchecked “cloud creep” is minimized.

The Development Angle

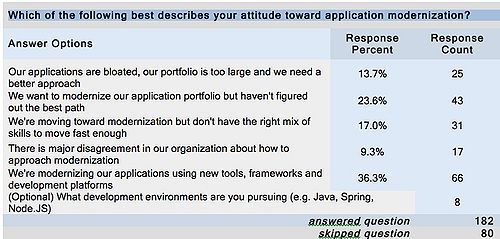

We asked respondents to comment on their application modernization initiatives (see Table 8). While our survey does not have an ideal representation from development companies, many respondents have visibility on application initiatives. Further, senior IT management respondents often have line-of-sight into major application development strategies.

Approximately 75% of our survey respondents recognize the need to modernize; however only about 36% have a clear handle on the best path to modernization and the requisite skills to succeed. New development tools and methodologies (e.g. DevOps) are increasingly providing competitive advantage for those organizations that can modernize.

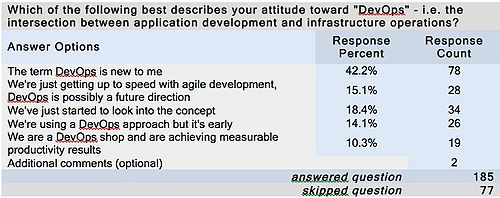

We also specifically asked respondents about DevOps, the intersection between application development and infrastructure operations. Organizations pursuing DevOps in the Wikibon community report achieving hyper-productivity using the methodology. While they cited caveats concerning moving too fast and risks associated with software quality, DevOps is becoming the new agile. Table 9 shows the responses:

Clearly, based on these survey results, DevOps is new to the Wikibon community practitioner survey base. Nonetheless, the DevOps movement has become popular among elite Web companies such as Google, Facebook, and Zynga. These Web giants tend to be five-to-ten years ahead of traditional IT in terms of adopting new methods of computing (e.g. cloud). Increasingly there are commercial examples such as Munder Capital where organizations are achieving incredible productivity gains through DevOps.

Action Item: The handoff from application development to infrastructure operations is slowing down IT and leading to chronic project delays. Infrastructure professionals hack development’s work product and ‘break’ the code, often returning it to development for repair. This back-and-forth is unproductive, and cross-training development and infrastructure operations professionals is becoming a proven method to accelerate deployment. Organizations should aggressively investigate DevOps and be careful to put in place procedures that both speed deployment while simultaneously preserving the integrity and quality that is requisite to infrastructure operations.

Big Data Challenges

Big Data is all the rage. Wikibon forecasts the Big Data market will exceed $50B by 2017. Our belief is that Big Data practitioners will actually create far more value than Big Data technology suppliers. As the saying goes, “data is the new oil,” and finding ways to tap data sources and package and monetize information will provide new sources of competitive advantage for organizations globally.

But practitioners currently are confused, as can be seen by the responses in Figure 3. We asked respondents on a scale of 1-5 (5 being most challenging) which of the following issues is the most difficult with respect to Big Data. We then scored each response by multiplying the number of responses in each category (1-5) to create a weighted average response. While dealing with the variety of data textures (structured and unstructured), exploiting value from data and the sheer volume of data were cited as the most difficult, statistically, practitioners are struggling with many more aspects of Big Data. It’s all difficult is the message practitioners are sending.

Big Data is a complicated situation for most ITOs. New technologies, lack of skills and a completely new business model are just some of the challenges. Not to mention most ITOs don’t have the funding to properly pursue Big Data.

Action Item: Practitioners should pursue Big Data initiatives by finding a line of business “sugar daddy” who has the authority and means to access, package, and go to market with data products. Technology professionals must learn the skills required and the processes needed to support the new data elite and evolve technology organizations to support these initiatives.

The Services Angle

As part of the ServicesAngle Partnership, Wikibon included a number of services-related questions. What follows is an analysis of the results of this section of the survey.

We asked each responded to list their primary service suppliers – Note: multiple responses were allowed:

Somewhat surprisingly Microsoft came out on top. We suspect that some respondents were answering the question from a technology supplier (versus pure service supplier) standpoint. Nonetheless, what is not surprising is that many respondents have a preponderance of Microsoft applications installed.

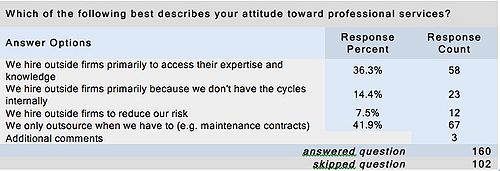

We also asked respondents why, when they outsource services, they do so. Two answers dominated (see Table 10):

- To get access to expertise,

- We only do it when we have to.

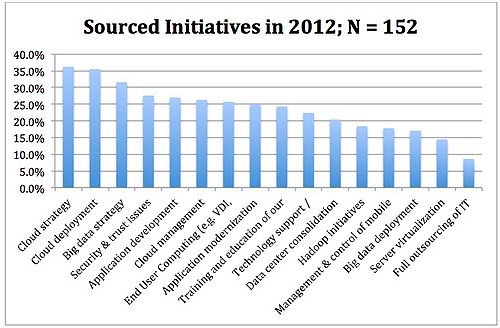

With regards to which services would be outsourced in 2012, Figure 5 indicates cloud strategy, deployment, and management are high on the list. Big Data strategy was also prominently cited, as users are trying to figure out what to do with large volumes of unstructured data. Noticeably, Big Data deployments are at the bottom of the list as is full outsourcing of IT, a practice that is losing favor.

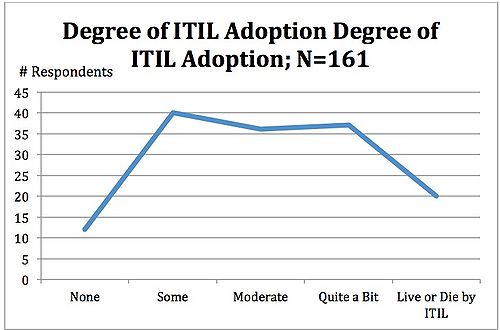

Finally, we asked respondents to comment on their use of ITIL and its importance to their services decision. Figures 6 and 7 show the results:

A crosstab of the data sources for Figures 6 and 7 shows a strong relationship between those clients who have adopted ITIL and the degree to which it factors into the decision-making process for outsourced services. Not surprisingly, the correlation between those who “live and die by ITIL” (ITIL mavens) and those who require ITIL from service partners is extremely significant, with 100% of the ITIL mavens citing it is a differentiator, major differentiator, or mandatory for service suppliers.

Conclusions

IT Transformation means different things to different IT organizations. The Wikibon practitioner community is focused primarily on infrastructure and moving toward IT-as-a-Service. Achieving ITaaS capabilities remains a challenge for organizations, as the business model of IT is still primarily cost-centric. Nonetheless, organizations are aggressively moving toward cloud generally and specifically hybrid cloud. Modernization of applications and development tools is a fundamental part of this transition, while Big Data remains in the early days. Services remain a critical part of the IT transformation journey although CIOs remain selective and are not likely to wholly outsource IT activities in the near term.

Action Item: 2012 is the year of the cloud, as IT organizations are under increasing pressure to compete with both Internet giants (from a simplicity standpoint) and cloud service providers (from a business model perspective). Organizations that do not adopt some type of cloud strategy – private, public or hybrid – will likely fall behind their competitors. CIOs must initiate efforts to exploit cloud adoption and identify services that should be sourced versus those that will be developed in house. As this equation evolves, organizations must re-skill to focus more on cloud facilitation and brokering than developing the plumbing for their companies.