As an American, you can’t help but root for Intel Corp. CEO Pat Gelsinger to succeed. His vision to bring semiconductor manufacturing leadership back to the United States is more than just a quaint nationalistic sentiment. Rather, it’s a strategic imperative for the country, its military, global competitiveness and access to future technological innovations in the AI era. But his strategy is dependent upon the success of Intel both as a designer and a leading manufacturer of advanced chips.

As such this choice puts Intel in a multi-front war with highly capable leaders in several markets, including names like AMD, NVIDIA, AWS, Google, Microsoft, Apple, Tesla and other chip designers…even perhaps OpenAI. As well Intel competes with with established manufacturers like Taiwan Semiconductor and Samsung. Moreover, Intel’s business model has been disrupted by Arm which has created a volume standard powered by the iPhone and mobile technologies. Finally, China, Inc. looms as a long-term competitor further underscoring the imperative.

But the trillion dollar questions are: 1) What are the odds that Intel’s strategy succeeds; and 2) Are there more viable alternative strategies for both Intel and the United States?

In this Breaking Analysis we try to address these uncertainties and to do so we welcome Ben Bajarin, CEO and Principal Analyst at Creative Strategies.

Watch the full video analysis:

AI Infusion

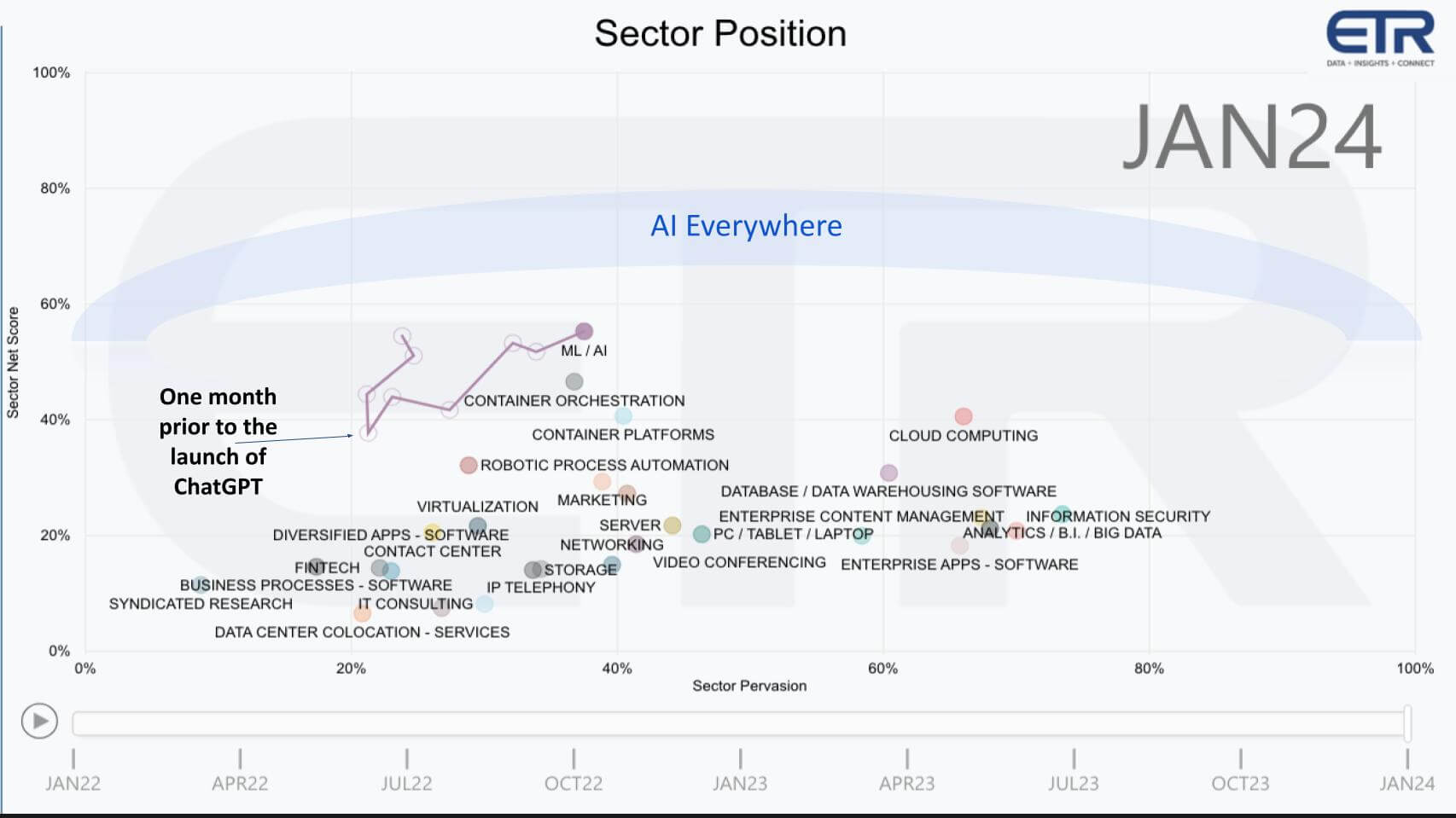

Before getting into the discussion let’s look at the broad enterprise technology market.

This ETR survey data comes from more than 1,700 IT decision makers and plots the Net Score or spending momentum of a platform on the vertical axis and its presence in the data set on the horizontal plane. The enterprise market accounts for a large and representative portion of the $4 trillion worldwide information technology space.

The graphic shows that AI has become the sector with the most spending velocity since the announcement of ChatGPT. But the real point is AI is not going to be a distinct sector. Rather it will be embedded everywhere in every sector from IT hardware, software, AI PCs, mobile devices, consumer electronics, autos…virtually every product will have AI.

And that AI will be powered by silicon chips.

Decades of Change in Semiconductor Market Forces

The market has changed dramatically over the past two decades. Firms like AMD and IBM got out of the foundry business. Arm capitalized on the smartphone revolution and completely disrupted established business models. When PC volumes peaked in 2011, Intel’s monopoly began to erode and TSM became the dominant manufacturer. Firms like Samsung rose up along with many others including a spate of novel chip designers like Apple, AWS, Tesla and many others.

Q1. Ben how would you describe the changes that have taken place in the market?

The following summarizes Ben’s analysis:

There have been pivotal transitions in the semiconductor industry, where Intel’s dominance in product design and foundry manufacturing process technology was overtaken by TSMC over the last decade. Intel’s failure to maintain pace with Moore’s Law, characterized by their shift from a “tick-tock” to a “tick-tock, tock, tock, tock” model, reflected challenges in innovation and foundry utilization. During this period, TSMC capitalized on a more predictable and conservative approach towards process development cycles, becoming the preferred option for major chip designers like AMD, Nvidia, Apple, Qualcomm, and MediaTek. TSMC’s strategy, focusing on stable process development without aggressive jumps, alongside its scale and capacity to serve as a reliable manufacturing partner, established it as the leader in process technology—a position previously held by Intel. These market changes highlight the importance of leading-edge process technology in attracting chip designers seeking competitive advantages for their products.

Key Points

- Intel was once the leader in semiconductor design and manufacturing but lost its edge due to its inability to keep pace with Moore’s Law and the adoption of extended development cycles.

- TSMC emerged as a more predictable and conservative foundry, which appealed to major chip manufacturers due to its stable process development cycles and reliability.

- Intel’s reluctance to serve as a third-party manufacturer, contrasted with its recent efforts, marked a missed opportunity to maintain its leadership and relevance.

- The scale of demand from companies like AMD, Nvidia, Apple, Qualcomm, and MediaTek required a foundry that could deliver millions of chips with leading-edge process technology, a role TSMC successfully filled.

- TSMC’s ascendancy to the forefront of process technology demonstrates the critical role of manufacturing capabilities in the competitive dynamics of the semiconductor industry.

Bottom Line

TSMC’s rise to leadership in process technology, overtaking Intel, underscores the strategic significance of innovation, predictability, and adaptability in the semiconductor industry. The ability to meet the demands of leading chip designers and manufacturers has been central to TSMC’s success, highlighting the ongoing battle for technological superiority in a highly competitive market.

[Listen to Ben Bajarin comment on the changing market forces].

COVID’s Wake up Call

People often talk about the global semiconductor supply chain. And it is comprised of companies in many geographies but it’s really not a global supply chain, rather its a supply chain highlighted by some very tenuous choke points as shown in the graphic below.

This graphic depicts just some of these bottlenecks.

Taiwan Manufacturing. Taiwan is the epicenter of advanced chip manufacturing and is on the razor’s edge with China threatening to reintegrate Taiwan. Apple and its customers (and other firms) rely on TSM for advanced chips.

Netherlands EUV Machines. ASML, a Dutch company, is the sole supplier of EUV lithography machines, which are required for manufacturing the most advanced chips. These machines cost more than $100M and comprise more than 400,000 parts. There is no second source to ASML’s EUV machines.

California EDA Software. Silicon Valley is the leader in electronic design automation software or EDA.

Japan Wafers and Thin Film Technology. Japan is where you get silicon wafers and other thin film technologies from a small number of specialized firms.

China Rare Earth Elements. China, which is currently enduring chip supply sanctions, is where critical rare earth elements are found in concentrated deposits, making that country the leader in global supply. These elements are critical in many phases of the chip manufacturing process.

Q2. Ben, how would you describe the current state of supply in semis. How should we think about these choke points and the challenges they present to chip supply?

Ben’s analysis can be summarized as follows:

The semiconductor industry is characterized by a lack of centralized control over silicon manufacturing. Suppliers are spread out across the globe with an intricate supply chain. This complexity is a source of concern and despite talk of doing so it’s basically impossible today to nationalize semiconductor production to meet all needs. The industry’s distributed global nature requires close collaboration to ensure a smooth supply chain. Disruptions having severe consequences, as observed in recent years with COVID. The management of supply chains, whether for leading or trailing edge technologies, is critical to minimizing risks amidst inherent challenges.

Key Points

- Semiconductor manufacturing lacks a central location for complete autonomy, underscoring the global interdependence of the industry.

- The idea of nationalizing semiconductor manufacturing is impractical, as no single country can satisfy all aspects of semiconductor design and production.

- Collaboration is essential for a seamless supply chain, with disruptions leading to significant industry-wide impacts.

- The industry faces constant risks, including geopolitical tensions and reliance on a limited number of suppliers for critical components like EUV machines.

- Despite potential diversification with companies like Intel and Samsung enhancing their foundry capabilities, geopolitical choke points and supply chain vulnerabilities will likely persist indefinitely.

Bottom Line

The semiconductor industry’s reliance on a globally dispersed supply chain presents key challenges, highlighting the critical need for international cooperation and effective risk management. Despite efforts to diversify and stabilize the supply chain, inherent vulnerabilities and geopolitical tensions continue to pose threats to the industry’s resilience and efficiency.

[Watch and listen to Ben Bajarin’s analysis on the global supply and demand equation].

[Every country, including China, will be challenged to create a national supply chain].

Unpacking Intel’s Strategy and Prospects

Let’s pivot to Intel’s strategy generally and its foundry prospects specifically.

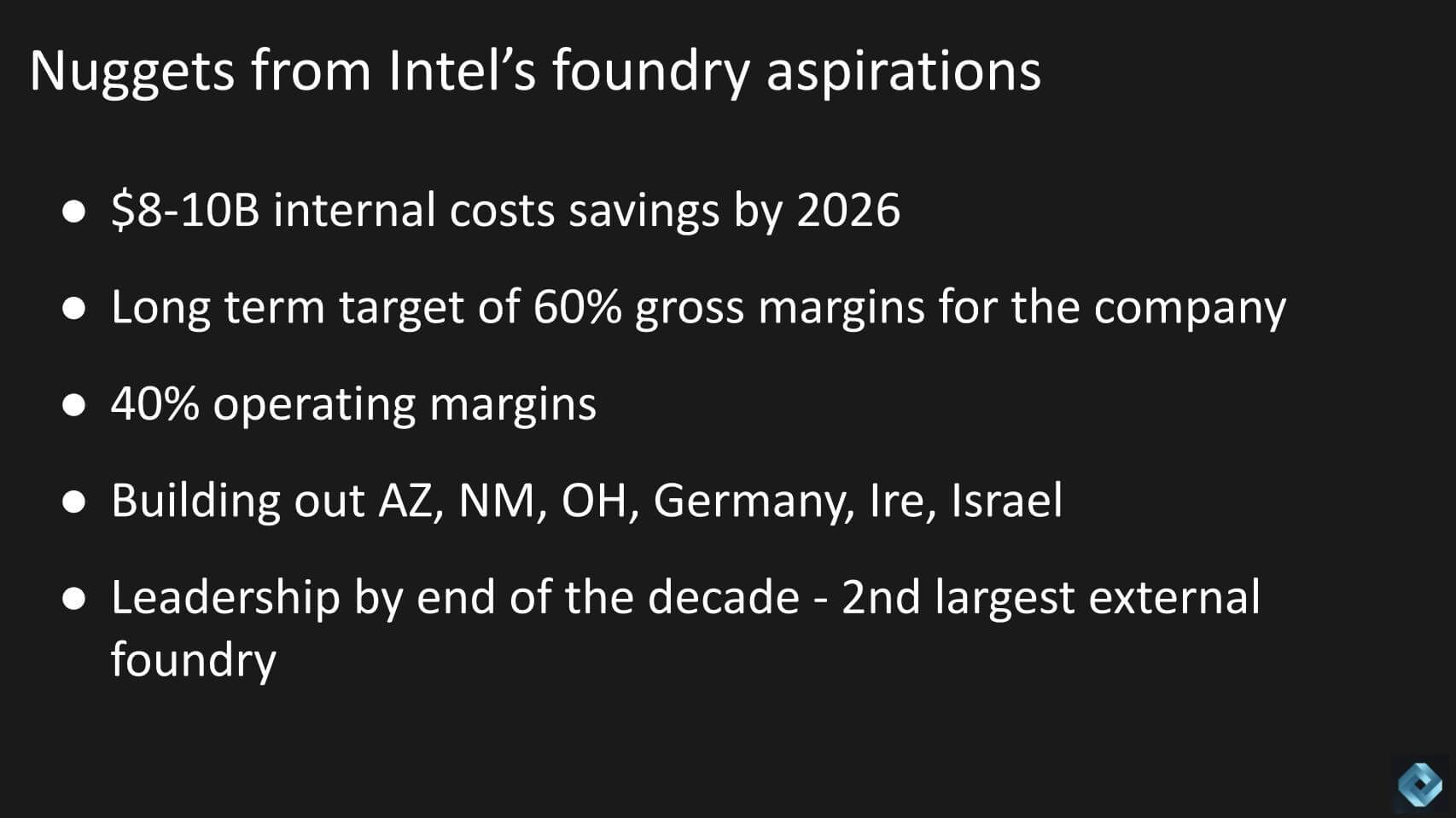

Above we show just a few of the relevant promises Intel has made to the investor community. Its IDM 2.0 strategy is designed to make manufacturing more competitive and efficient for both internal and external customers. Promising to save $10B by the time it exits 2025. The company used to have gross margins in the 60%+ range and is well below that today in the mid 40’s. Intel plans to get back there eventually with a very aggressive 40% long term operating margin goal. Intel is building out at least six new fabs by our count to support Pat Gelsinger’s vision of having 50% of global manufacturing outside of Asia.

The company’s objective is to return to process leadership and be the second largest foundry behind TSM by the end of the decade.

Q3. Ben, Pat Gelsinger called Intel’s first foray into foundry a “hobby.” Why do you feel or do you feel this time around it will be different?

The following summarizes Ben’s analysis:

According to Ben Bajarin, Intel’s initial forays into offering foundry services to other companies were half-hearted and marked by significant challenges, primarily due to the prioritization of their own product technologies over those of potential foundry customers. This approach led to a lack of trust and tense collaboration with other firms. Intel didn’t share its leading-edge technology and signaled to customers that it was not fully committed to the foundry business. This time around, Intel is structuring its foundry business separate from its core design organization and is learning from its past mistakes.

Key Points

- Intel’s earlier attempts at foundry services failed due to prioritizing its own products and technologies, and not sharing leading-edge technology with other companies.

- The lack of trust from potential customers stemmed from concerns over intellectual property and strategic information being shared with Intel, given its dual role as a competitor and service provider.

- Intel has since made efforts to establish clear divisions within the company, separating Intel product technology from foundry services to protect clients’ intellectual property and strategies.

- A significant shift in Intel’s approach includes improving customer service and being viewed as a partner, similar to TSMC’s model, which goes beyond manufacturing to include comprehensive services.

- Recent developments suggest Intel is gaining traction in the foundry market, with rumors of NVIDIA using Intel for advanced packaging and confirmed deals with other major customers, indicating a perception shift towards Intel’s foundry efforts as legitimate.

- Intel’s commitment to executing its roadmap, including advancing to 20A and 18A nodes predictably for customers, alongside improved customer service, marks a pivotal change in how Intel’s foundry business is perceived and operated.

Bottom Line

Intel’s transformation in its foundry business approach, from an insular focus on its own products to establishing a credible, customer-centric foundry service, underscores a strategic pivot essential for its success in the competitive semiconductor manufacturing sector. By addressing past shortcomings through clear operational divisions, enhanced customer service, and a commitment to technological advancement, Intel is making strides towards rebuilding trust and establishing itself as a legitimate player in the foundry space. This shift is critical for Intel’s ambition to compete with established foundries like TSMC and for the broader semiconductor industry’s health and dynamism.

[Listen to Ben Bajarin’s analysis of Intel’s strategy and prospects in foundry].

[How can Intel achieve 5 nodes in four years, something that’s never been done]?

Comparing Financial Models – How Does Intel Stack up To the Competition in Foundry and Design?

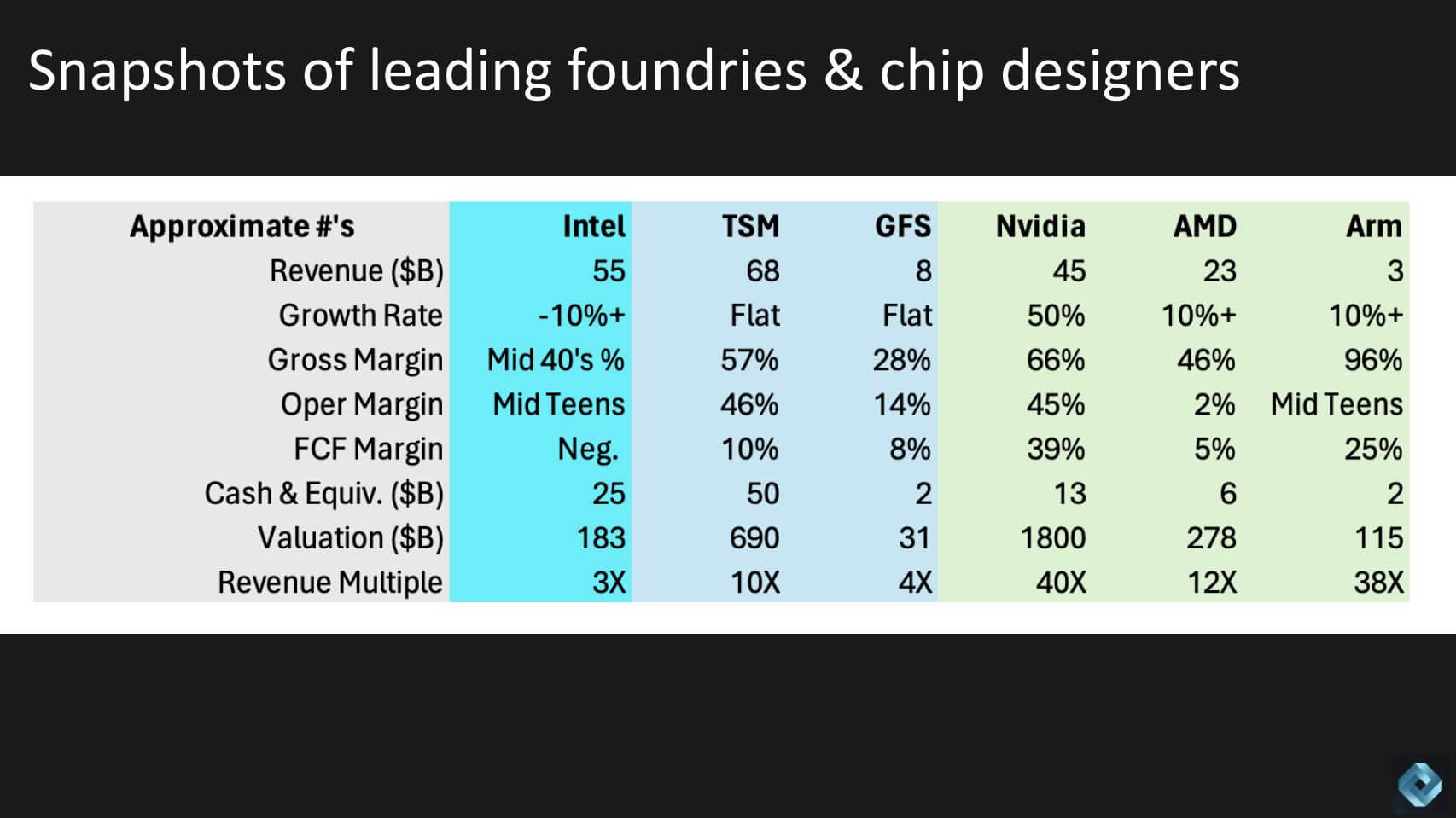

Below is a financial snapshot of selected chip manufacturers and designers compared to Intel. It underscores the multi-front war we discussed earlier. Just a caution these are rough estimates and not precise. For expediency and convenience we’ve sometimes used trailing twelve month revenue while at other times we’ve used run rate revenue. As well, growth rates in semis fluctuate wildly. Investors will use forward looking estimates but for our purpose we want to simply paint a picture of the relative quality of each company’s financials.

Intel’s revenue growth has been stagnant although it’s promising improvement. Its gross margins have been decimated along with its operating margin. Its balance sheet is not large enough to fund all those fabs we showed earlier and its free cash flow margin is drastically compressed. All this has crushed the company’s valuation. In 2000, Intel was worth around $500B and along with Cisco was one of the most valuable companies in the world. It’s now trading at a revenue multiple that is in the low single digits, trailing the others on the chart above.

Let’s start in the light blue above with two manufacturers, TSM and Global Foundries. TSM is the leader as you can see by its financials relative to GFS. Samsung is another large player but it’s a giant conglomerate so we can’t really compare it to the others. TSM is of comparable size and worth almost four times Intel. Global Foundries was formed by taking AMD’s manufacturing operation and later absorbed IBM’s Microelectronics division. It had a deal with IBM to manufacture 10 and 7nm technologies but it had to back out because it was too hard and too capital intensive.

Q4. Ben how do you see Intel Foundry Services stacking up today relative to these two and Samsung. Intel’s learning curve is steep. How do they effectively compete in foundry and how do they fund it?

Ben Bajarin’s analysis is summarized below:

TSMC is the best comparison to Intel given TSMC’s size and leading position in advanced process technology. Intel’s strategic moves towards leveraging leading-edge technology and its efforts to utilize depreciated assets in collaboration with UMC, mark a notable shift towards a new model for Intel, taking a page out of TSMC’s playbook. However there continues to be a scarcity of leading-edge manufacturing capacity, with Intel emerging as a viable alternative to TSMC for major tech companies seeking advanced semiconductor technology, despite Samsung’s involvement which is unclear to many observers.

Key Points

- TSMC is the industry standard for leading-edge semiconductor technology, with competitors like GlobalFoundries focusing on trailing-edge technologies.

- Major tech companies, including Apple, Nvidia, AMD, Qualcomm, and MediaTek, prioritize access to leading-edge technology, which is currently constrained by supply limitations.

- Intel’s recent collaboration with UMC on a 12-nanometer process and its strategy to utilize depreciated assets for profit mirror TSMC’s approach, marking a significant shift in Intel’s strategy.

- Despite the industry’s critical need for more leading-edge capacity, for reasons that are unclear, Samsung is not viewed by the industry as an ideal alternative to TSMC. This opens the door for Intel to emerge as an essential second source for advanced semiconductor manufacturing.

- Intel’s engagement with major customers for its leading-edge technology and advanced packaging solutions is a positive signal relative to its competitive positioning against TSMC, especially given the industry’s supply constraints.

Bottom Line

Intel’s strategic pivot towards embracing leading-edge technology, while leveraging older assets, is akin to TSMC’s successful model. These are necessary but insufficient steps in securing a strong position to capitalize on the industry-wide demand for advanced semiconductor manufacturing capacity. This shift, coupled with the industry’s pressing need for additional leading-edge suppliers and Samsung’s unclear strategy, are an opportunity for Intel to potentially emerge as a critical alternative for major technology companies. The focus on leveraging depreciated assets further enhances Intel’s competitive edge by providing a financial buffer. Questions remain as to whether it will be enough for Intel to achieve its objectives.

[Ben Bajarin analyzes Intel’s position relative to TSMC, the key benchmark in foundry].

Intel’s Position Relative to Leading Fabless Firms – NVIDIA, AMD and Arm

Coming back to that same chart above let’s look at the companies in green. These are a few of Intel’s chip design rivals, NVIDIA, AMD and Arm, which licenses its architecture. This is why Arm has nearly 100% gross margin. But all three of these firms have more attractive financial profiles, far better multiples and they don’t have to fund factories.

Q4a. Ben, Pat Gelsinger says it now costs $30B to build an advanced chip making facility. Can Intel throw off enough cash from its design business to fund its foundry aspirations and at the same time compete with the likes of Nvidia and AMD?

A summary of Ben’s response follows:

Bajarin’s analysis focuses on Intel’s strategic challenges and opportunities in financing and operationalizing its foundry business out of its core. A key issue for many investors is should Intel split the company to manage the high fixed costs associated with running foundries given the massive capital required. Intel’s approach, seeking co-investment for its foundries and leveraging government support, reflects the intensive capital needs of the semiconductor manufacturing sector. Despite the high costs, Intel’s strategy includes becoming a significant customer of TSMC, allowing designers to use outside manufacturing for parts of its chip production. This move, while beneficial for Intel’s product line, does not alleviate the broader industry’s capacity constraints at the leading edge. Intel’s long-term economic outlook hinges on its ability to keep foundries full and improve margins through efficient process technology and strategic customer engagements.

Key Points:

- Intel faces a significant challenge in funding its foundry operations out of its core business due to the high fixed costs and capital-intensive nature of semiconductor manufacturing.

- Suggestions to split the company raise concerns about the feasibility of securing adequate funding for the foundry segment. According to Bajarin, Intel has tried and the prospects were not encouraging, hence the integrated company strategy.

- Intel relies on leveraging government support and seeking co-investment to manage costs, while also becoming a substantial customer of TSMC for specific tiles for products like Meteor Lake and Lunar Lake in the future.

- The semiconductor industry’s capacity constraints at the leading edge underscore the importance of Intel’s success in its foundry operations to mitigate these challenges.

- Intel’s economic prospects depend on its ability to fill its foundries with volume production, maintain competitive process technology, and improve financial margins over a long-term horizon.

- Intel’s partnership with China’s UMC will not be a financial game-changer but it helps on the very long journey to leadership.

Bottom Line: Intel’s journey to monetize its foundry operations and improve margins is a complex, long-term endeavor that necessitates strategic co-investments, government support, and efficient use of existing capacity. While Intel’s role as a TSMC customer partially addresses its product needs, the broader industry challenge of leading-edge capacity constraints remains. The upcoming Intel Foundry Services (IFS) day will offer deeper insights into Intel’s strategy and financial model for its foundry business, important for understanding its potential to navigate the high fixed costs and achieve a sustainable turnaround in profitability and value creation.

[Ben Bajarin’s analysis of Intel’s moves to compete in multiple domains].

Sam Altman’s effort to raise between $5-$7 trillion underscores the need for wafer scale customers].

The Importance of Volume Economics in Semiconductor Manufacturing

Intel Needs Wafer-Scale Customers

Let’s revisit Wright’s Law. We all know Moore’s Law but the lesser known Wright’s Law becomes important in this discussion.

Theodore Wright was an aeronautics engineer and was famous for formulating Wright’s Law or the experience curve effect. It says basically, for any manufacturer, as the cumulative number of units produced doubles, the cost per unit goes down by a constant percentage. And this law is highly applicable to chip manufacturing because each new generation of technology initially costs more to build per unit than the previous generation. So when you start manufacturing a new process node you lose money.

Intel’s monopoly was won when it beat RISC. Our premise is that it did so because it became the PC standard and PC’s were the volume king until early last decade. And today, Arm-based designs have the volume advantage.

Q5. Ben, it’s estimated that Arm wafer volumes are 10X those of x86. Please share your scenario as to how Wright’s Law plays in this game of semiconductor manufacturing. How does Intel, whose volumes are basically flat, get to a point where it’s not bleeding money trying to catch TSMC?

Ben’s comments are summarized below:

Bajarin is emphatic that for IFS to succeed, Intel needs wafer-scale customers to sustain its foundry operations. The shift from Intel’s dominance in the PC industry means it has to find other high-volume customers. Historically, Intel filled its fabs with its own high-margin chip production. However, the landscape has changed, requiring partnerships with large-scale consumers like Qualcomm, Broadcom, Marvell, and potentially Tesla. Perhaps even Apple, despite its deep ties with TSMC. Intel’s ability to produce Arm chips for any interested party, including the possibility of serving Qualcomm and MediaTek for IoT and other applications, is a strategic opportunity assuming the company can provide a leading service. The potential collaboration with Qualcomm is of particular interest and could be a game-changer, given Qualcomm’s volume needs for leading-edge process technology to compete more effectively against Apple, which currently enjoys preferential access to TSMC’s most advanced nodes.

Key Points:

- Intel’s transition from self-sufficiency in chip production to seeking wafer-scale external customers is critical for its foundry business’s success.

- ARM’s public acknowledgment of a deal with Intel positions Intel as a versatile manufacturer capable of serving a wide array of clients, including those currently aligned with TSMC.

- Qualcomm, facing competitive pressure from Apple and limited by access to TSMC’s leading-edge technology, emerges as a prime candidate for Intel’s foundry services. This partnership could significantly alter the competitive landscape by providing Qualcomm with access to advanced process technology, assuming Intel can deliver.

- Intel has a long way to go but needs to offer a competitive process, a predictable roadmap, and customer-centric services to attract and retain such high-volume customers.

Bottom Line

Intel’s strategic pivot to serving wafer-scale customers is pivotal in leveraging its foundry capabilities to the fullest. By potentially partnering with companies like Qualcomm, Intel could not only secure the volume needed to sustain its foundry operations but also influence the competitive dynamics within the semiconductor industry. Such collaborations would affirm Intel’s process technology’s competitiveness and potentially shift market positions by enabling players like Qualcomm to challenge dominant forces such as Apple more effectively. Intel’s success hinges on its ability to deliver technological excellence and customer-focused services, marking a significant shift from its historical business model.

And it must somehow throw off enough cash and find funding partners to keep factories up to date.

[Ben Bajarin analyzes Intel’s wafer-scale volume prospects].

Handicapping Intel’s Likely Outcomes in Foundry

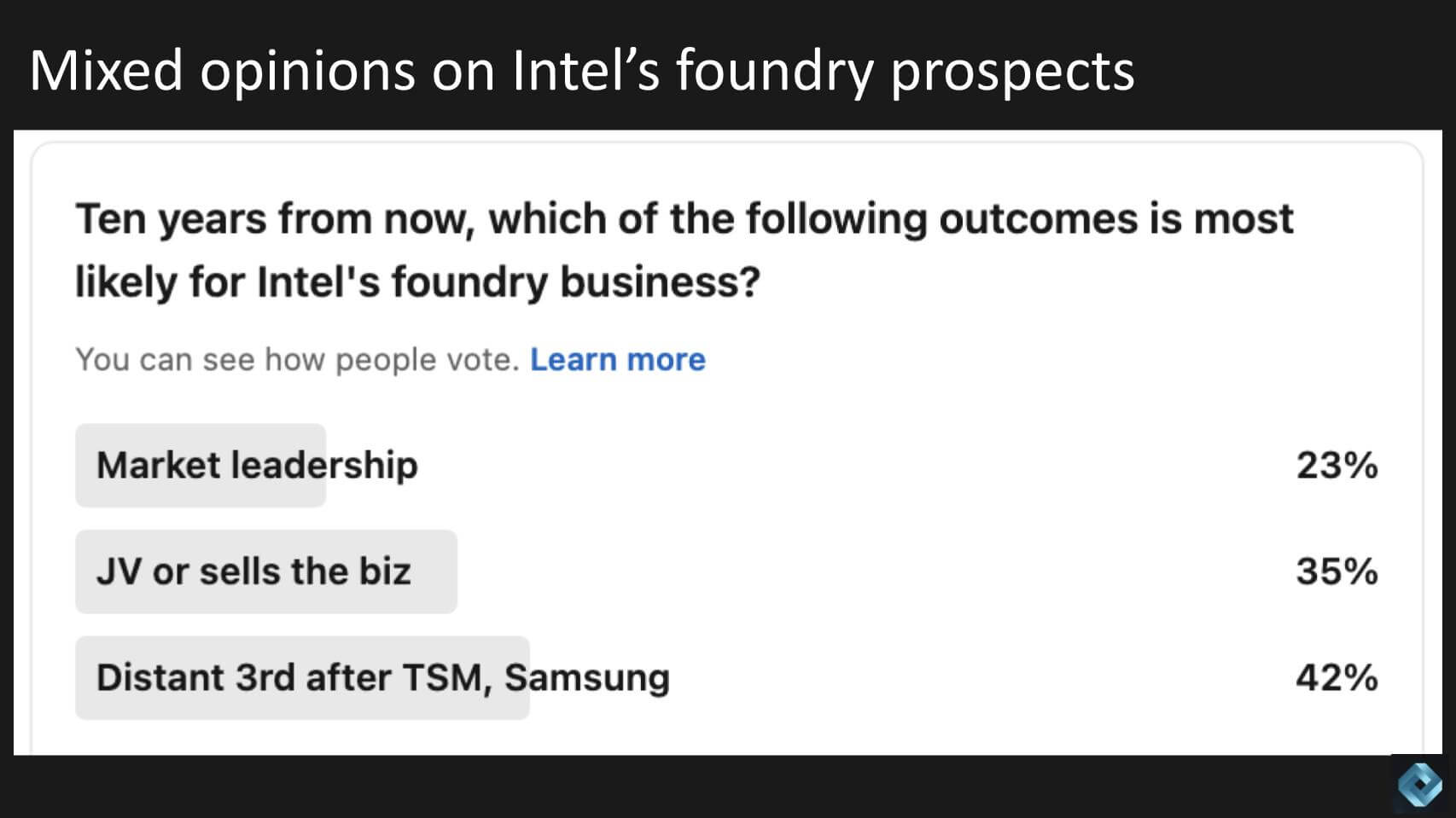

We put up a LinkedIn poll to capture the community’s opinion on the following three scenarios. Ten year from now will Intel’s foundry business: 1) Achieve leadership; 2) Be forced to find a partner; or 3) Be a distant third behind TSM and Samsung?

Three fourths of our small sample of 40+ respondents said the outcome would not be leadership.

Q6. Ben how would you respond and why?

A summary of Ben Bajarin’s analysis follows:

Bajarin looks at market leadership for Intel Foundry not in terms of technological dominance or surpassing TSMC in revenue. TSMC’s revenue is projected to surpasses $100 billion, a milestone Intel is unlikely to match in the foreseeable future. The focus for Intel is the strategic positioning of Intel Foundry, with an emphasis on securing significant capital investment and leveraging partnerships, akin to its collaboration with UMC, which, while not officially termed a joint venture, effectively functions as one. The necessity of Intel Foundry’s success is underscored by its critical importance to national security, which suggests that government intervention to prevent its failure is a potential scenario. The realistic ambition for Intel is to become the second-largest foundry by revenue, a goal Ben Bajarin believes is achievable within the next decade, contingent on Intel’s ability to attract wafer-scale customers and effectively compete at the leading edge.

Key Points:

- Intel leadership should be thought of as getting to number two in revenue, not surpassing TSMC in revenue or volume.

- The potential for joint ventures and capital influx from external sources, including government support, iscrucial for Intel foundry’s viability.

- Intel’s foundry efforts are important for national security and the US government has a vested interest in ensuring its success.

- Achieving the status of the second-largest foundry by revenue is the only realistic goal for Intel.

Bottom Line: Intel’s foundry path to market leadership won’t come from eclipsing TSMC in volume or revenue but by securing a solid second place in the global foundry market. This objective must be supported by strategic partnerships, capital investments, and the crucial role of government support in safeguarding Intel’s operations due to their significance to national security. The ambition to become a key player, alongside the goal of attracting significant wafer-scale customers, is where Intel’s foundry future lies.

Will History Repeat for Intel? An IBM Example

IBM was the dominant technology company prior to the ascendency of the microprocessor-based revolution. IBM’s mainframe business held a monopoly that far eclipsed the dominance of today’s companies. To give you a sense of IBM’s power, at one point in the 1970’s, IBM accounted for 50% of the industry’s revenue and 66% of its profits. That would equate to a company like Microsoft generating $1.5 – $2 trillion in annual revenue today. By current valuations that would put Microsoft’s market cap well over $10 trillion.

IBM was also the world’s leader in semiconductor design and manufacturing with, at the time, leading edge manufacturing facilities around the globe. In 2014, IBM inked a deal with GlobalFoundries where IBM essentially paid GFS to take its microelectronics business off its books. IBM took a pre-tax loss of almost $5B for the transaction. In exchange, GFS committed to providing IBM with leading edge process manufacturing capabilities. This proved to be too difficult and expensive for GFS and it backed out of that commitment.

Why this Matters

In the 1980’s, IBM unwittingly handed its mainframe operating system and hardware monopoly to Microsoft and Intel respectively. The latter became the hardware monopoly and enjoyed mainframe-like margins for decades. IBM’s unwillingness to quickly adapt to changing market forces was due to many factors but the two most relevant were: 1) PC’s were an unattractive, low margin business compared to mainframes; and 2) Hubris. It’s not easy to transition as a public company so managers often turn a blind eye to the realities of the market, buyback stock, raise their dividend and pass the baton to the next generation of leaders to figure it out. Pat Gelsinger is that next generation and our hope is it’s not too late. But the mountaintop of profitability for foundries is far off.

The IBM story is instructive and Intel’s path in many ways mirrors that of IBM’s. IBM couldn’t continue to fund its semiconductor fabs and had to pay GFS to take them. Intel is staring at hundreds of billions in CAPEX to build out its factories and will have to rely on its own free cash flow and government subsidies to pay for these fabs.

IBM, like Intel, lost its volume advantage and could never make semiconductor manufacturing profitable again.

The key question is can Intel achieve adequate profitability to succeed on its own. The key will be how much volume is enough to be profitable and we don’t have that precise answer but we know it’s substantial. The US government is awash in debt and future cash injections are far from assured. Sam Altman’s trillion dollar gambit is a potential savior but the path to viability remains unclear.

Ben Bajarin is optimistic on the future of Intel’s foundry business. He’s an expert in the field and has much deeper knowledge of the space than our team at theCUBE Research. For the sake of the nation and like-minded countries…we hope he’s right.

[Listen to our closing conversation – where does the cash come from to build Intel factories]?

What do you think?