Heading into the second half of 2023, some investors felt that the semiconductor run up last summer was a harbinger for a broader tech rally. That thesis proved prescient and rewarded managers who took on risk at the time with leading firms in semiconductors, security and enterprise software. The question is, where do we go from here?

In this Breaking Analysis we welcome back Ivana Delevska, the founder and chief investment officer at Spear Invest, Nasdaq SPRX. Some have compared SPRX to a miniature version of Cathie Wood’s ARKK fund. However SPRX is more sector agnostic where Delevska focuses more broadly on growth themes such as her current emphasis on cybersecurity, semiconductors, and enterprise software.

Last time we Ivana on was August of 2023 and we asked her about NVIDIA. Here’s what she said:

Well, David, we still love Nvidia going into the next cycle. We believe we’re in the early innings of data center spending. So you’re just starting to see companies like Microsoft Meta and Google expand their CapEx budgets going into next year. So we believe Nvidia is going to benefit from that. –Ivana Delevska – 8/4/2024 on Breaking Analysis

That was pretty forward thinking and while it’s certainly not dollar for dollar, last quarter Nvidia’s revenue equated to about half of the CAPEX spend from the hyperscalers – so there’s a correlation there.

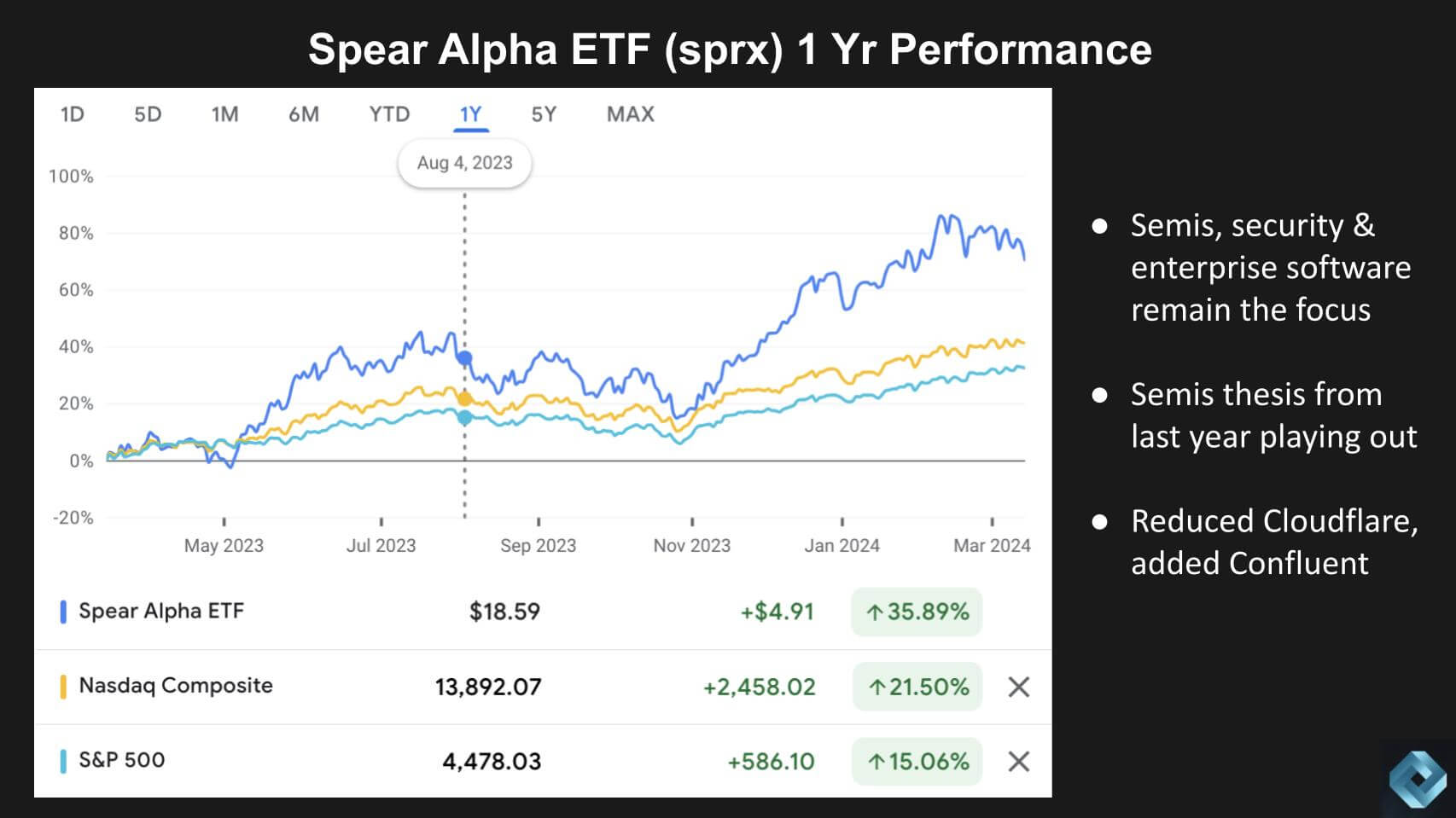

Premise has Paid off for Spear so Far

Delevska made the previous statement on August 4th and you can see below her funds performance relative to the Nasdaq and S&P 500.

Ivana told us at the time that she was fully invested and pretty “risk on,” setting up a good run in the second half and she was right on…the NVIDIA trade has powered a number of high flying companies beyond the Mag 7.

Q1. So the question is…”now what?” How are you thinking about the market going forward…the cloud hyperscalers have been loading up on GPUs, as is Meta to train Llama 2 and Llama 3. Cathie Wood trimmed her Nvidia holdings in 2023 and missed the recent move and other investors appear to be showing concerns about the inflated nature of Nvidia’s stock and possible over buying of GPUs. Although Piper upped its target price on NVIDIA Friday. You’ve done very well with the stock, what are your thoughts going forward? Are you taking some profits, holding firm? Looking to buy pullbacks what’s your thinking?

Well Dave, we believe we’re still in the early innings of this tech cycle and we just scratched the surface of the GPU opportunity. So we still see a lot more upside…several years actually of upside here. If you look at the earnings estimates for NVIDIA, while they’ve increased for the current year, if you look out to 2025, 6, and 7, the street is assuming less than 20% CAGR in the earnings for the data center segment versus the prior cycle, we saw over 40% CAGR for data center. So we still think that the street is underestimating the earnings potential. If you look at the valuation, it actually seems quite reasonable. NVIDIA is trading close to the middle to the bottom of the EBIT to EBITDA range on a one year forward basis. So this is really what we follow closely to assess whether we are at the peak of the cycle or we are in the middle of the cycle and right now it seems more like we’re closer to the middle or the beginning rather than the peak.

NVIDIA is at the beginning of the cycle according to Ivana Delevska.

Q1a. Many people are worried about overbuying GPUs. How do you think about the durability of these big CAPEX investments from the hyperscalers?

If you listen to how they’re talking about building out these GPU clusters, it’s not necessarily a one-time investment. This is an ongoing investment that will be needed by the hyperscalers and enterprises. So the large ones have really already gotten a headstart. Like Meta is one of the ones that’s the most heavily invested in GPUs, but there was just a blog post the other day about the new cluster that they’re building and you can, just by reading that, you can see that this is not a one-time investment. It’s something that will be ongoing as new models come to market and as inference and applications come to market. So I think back to my prior point, you really are seeing how this is just the beginning.

Q1b. What about this notion of training being a shot duration cycle versus inference which is more ongoing. Many people expect that NVIDIA will have a lot of competition for inference and because its GPUs are so expensive it will be challenged in that space. But Jensen on the last call said that inference was at least 40% of NVIDIAs business – how do you see it?

Well so that’s one very interesting thing that I think the markets misunderstand. People think that model training is a one-time thing and then it’s like okay, you’re done, you’ve trained the model, moving on to inference. Model training is actually an ongoing process. So the new information you are getting from the inferencing, you need to feed it back to the model and train the model and you need to constantly upgrade the models, right? So I think that goes back to the core of the misunderstanding of how this is not a one-time investment that needs to be made but an ongoing thing where you’re running the applications which gives you even more data to feed the models with.

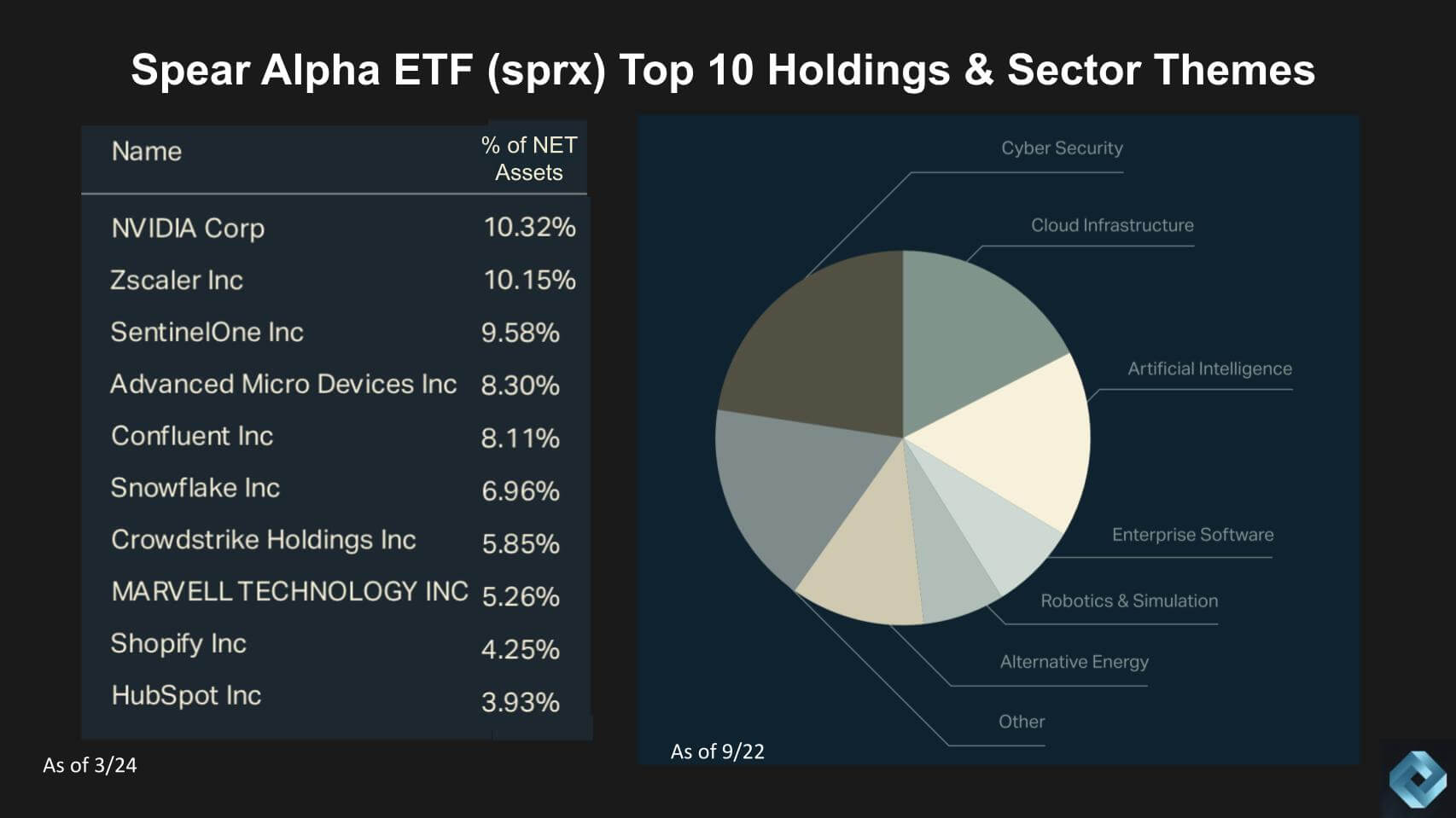

Spear Holdings – A Focus on Semis, Cyber & Enterprise Software

Let’s take a look at the Spear portfolio.

Nvidia’s run up has made it the #1 holding. AMD has bumped up on the leaderboard and Marvell rounds out the top holdings in semis. Spear also has taken on exposure in cybersecurity with ZS, SentinelOne and CrowdStrike; and some other enterprise software names that we’ve talked about before like Snowflake, Confluent is relatively new and Shopify and HubSpot round out the top ten.

We already talked about Nvidia…We have some survey data later where we’ve plotted many of these names so let’s keep this at a high level for now. The right hand side of this graphic is a bit dated but still shows Spear’s general approach in terms of sectors.

Q2. Ivana, how are you thinking about your portfolio mix and then we can get into some of the names in more detail.

We still see upside in hardware. So we still have a large position in the companies that you mentioned. We do as well have a very large exposure to cybersecurity. What’s been happening this year is we went towards the end of last year people, decided to take a lot more risk and they gravitated towards the higher valuation software stocks that ran up significantly into yearend. However, what we’ve seen this year is a pretty significant pullback. So when we’re looking for new opportunities, it’s really the software side where we are finding a lot going on, especially post this earning season when you had many stock just get completely destroyed on earnings.

So even though from high level perspective, it seems like the Nasdaq is near its highs, and the indices are near near highs; if you look under the hood, actually a lot of stocks have really sold off from the peak. It all goes back to interest rates. People are nervous now about the Fed and when they’re exactly going to cut and usually this sort of run up in interest rates creates very good entry points for technology. So while we still like hardware, I think that’s a still great place to have allocation going into 2025, there are a lot of idiosyncratic opportunities here post some of these earnings hits that we’ve seen.

The Impact of AI on Investing Strategies

Let’s talk about the AI effect and how to think about that.

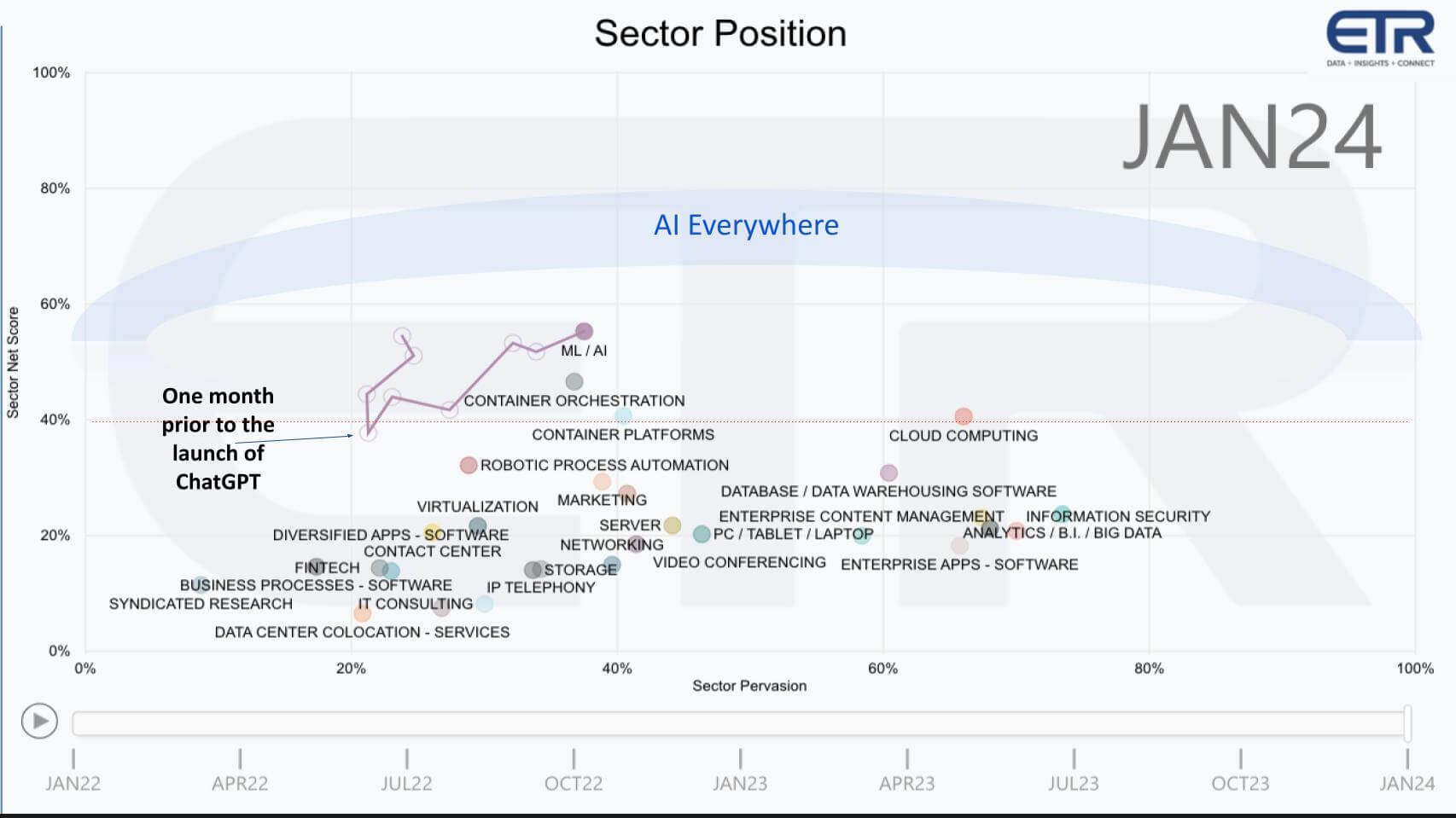

Below is a graphic from ETR that shows Net Score or spending momentum within a sector and on the X axis, the sector’s presence in a survey of more than 1,700 enterprise IT decision makers. The vertical axis represents the Net percent of customers in the survey spending more in the sector and the red dotted line at 40% indicates highly elevated spend velocity.

The first point is that AI momentum was showing signs of deceleration after exiting COVID and then has taken over the #1 position on the vertical axis since the announcement of ChatGPT. The data shows that 44% of customers say their Gen AI initiatives are being funded by stealing from other budgets. So in watching this data over time many, if not most of the other sectors, have see contraction on the Y axis.

OpenAI and Microsoft by Default have a Big Mindshare Lead

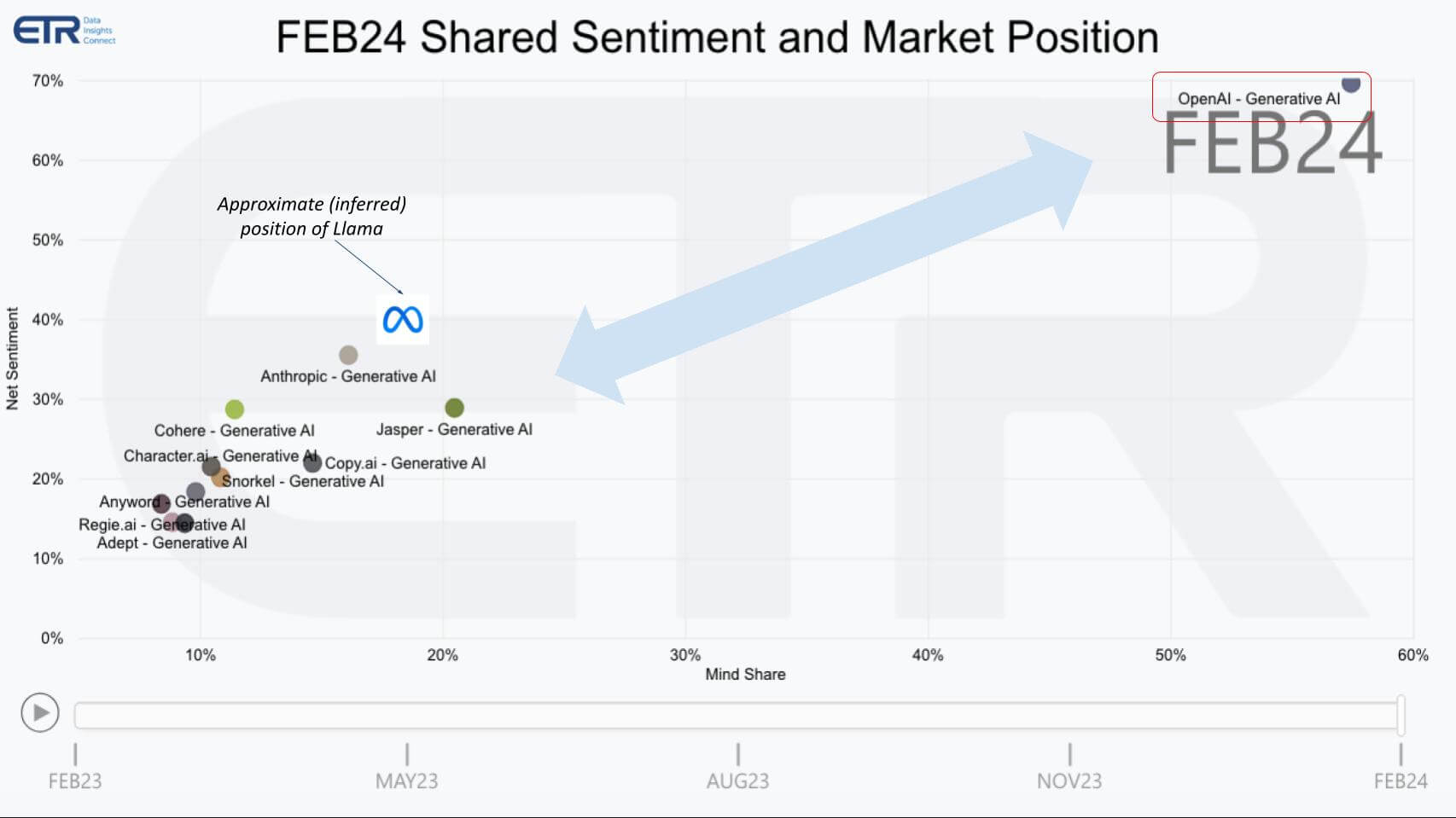

This next graphic shows the LLM innovators which are private companies and we’ve superimposed where the data suggests Meta’s Llama would fall on the spectrum. This shows intent to engage or Net Sentiment on the vertical axis and Mindshare on the horizontal plane.

And what you see in the upper right – it’s so far off the charts we had to highlight it – OpenAI is literally off the chart. And it has created a wide gap between itself and the rest of the LLM pack.

Q3. Ivana you have this situation where enterprises are experimenting on AI without a big payback yet. They’re stealing from other budgets to do so. Microsoft and OpenAI have taken the top position in mindshare – they have incredible momentum and the rest of the world is moving fast to catch up. How are you playing this AI wave?

Well I think your data is spot on with what we’re seeing in earnings that they’re getting reported right now. There is a lot of excitement in AI but not a lot of it is showing up just yet in the numbers. And the reason why is that, as you said, basically there is spending on AI but it’s getting offset by cuts in other spaces. So the overall spending that will come to a vendor may not look significantly higher than what it would’ve been without AI and a stable or accelerating macro environment. But the important thing to keep in mind for investors is that we are still in a very tough macro, right? So if you’re seeing companies still being able to grow 30 plus percent even though that may be a little lower than what you would’ve expected, those are still very solid numbers in light of the current macro.

AI is showing up a little bit. It’s basically adding few hundred basis points that are maybe now getting offset by what’s been taken out by macro, but if you’re a long-term investor and can step back, you are going to see as AI accelerates, you’re going to see it show up in the numbers. We’ve seen investors kind of like going all in on the hype but then once the numbers come through, not many patient investors are there to stick around and see the benefits.

The AI contribution is still not big enough to offset the macro headwinds.

Many of Spear’s Holdings Show Strong Spending Momentum

Let’s look at some of the companies that Spear owns and/or used to own and see what the survey data says about them.

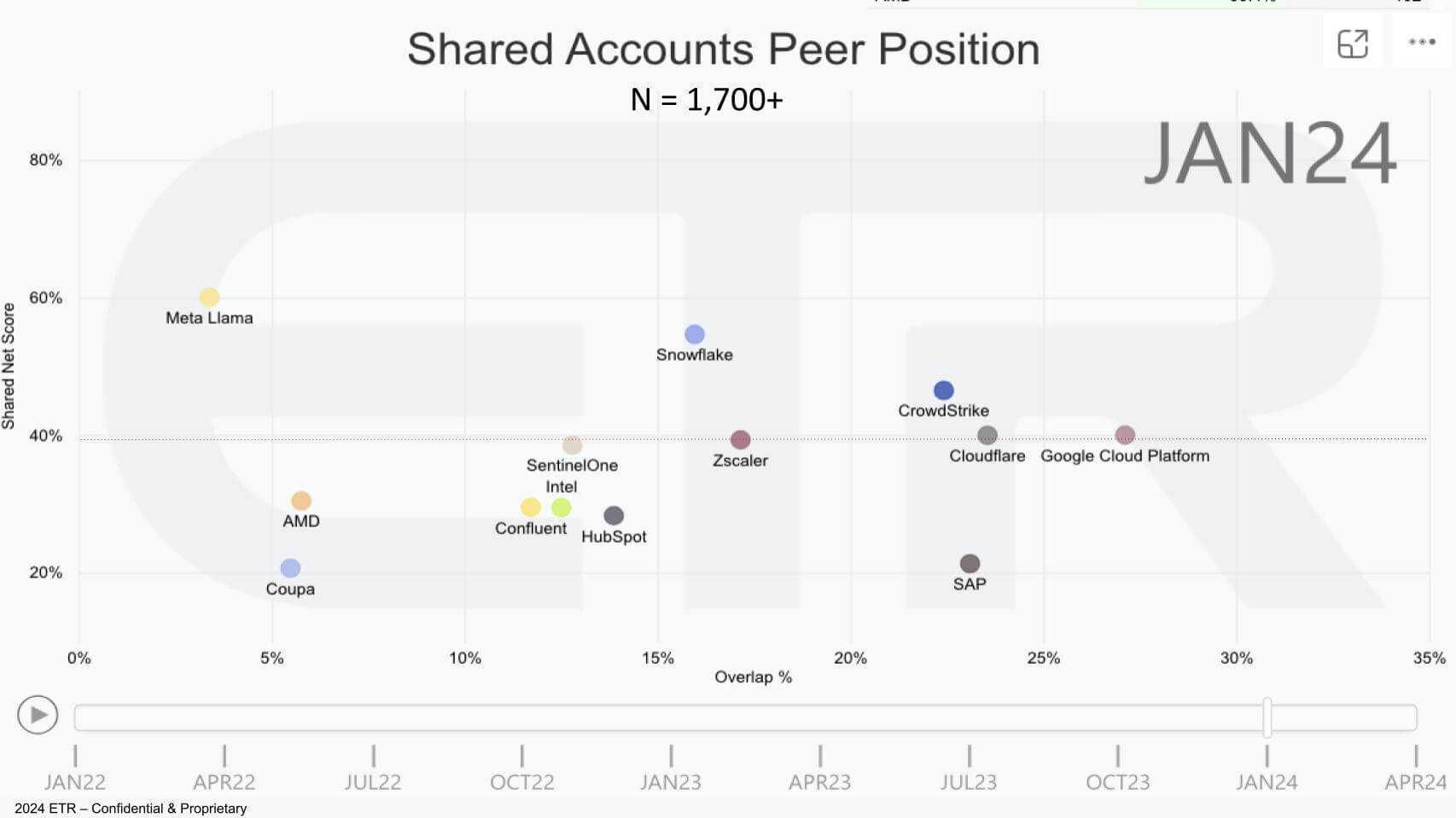

This chart from ETR, like the one we showed earlier, plots Net Score or spending momentum on the vertical axis and penetration into the data set on the X axis. And we’ve plotted many of the names Spear owns and some they’ve trimmed like Coupa and Cloudflare. And we’ve also put in some other names like Meta’s Llama, Intel and SAP just to balance out the chart. And we’ve purposely left off the hyperscalers because they are so dominant and skew the data.

First, many of the companies Spear owns are near or above the magic 40% mark – i.e. Spear owns firms with momentum from the customer perspective. But let’s start with the enterprise software players.

Snowflake, Confluent, Hubspot, Shopify

Q4. You’ve always been a fan of Snowflake. Frank Slootman stepping down as CEO spooked investors. What’s your position on Snowflake?

Well the original announcement when Frank stepped down was a pretty big surprise to the market and that’s why you saw the stock being hit so hard. However, if you step back and you look at Snowflake’s execution, they have been very slow in coming up with new products to the market. So if you look at the numbers, we would’ve expected the numbers to positively inflate. Last quarter but for sure this quarter and you really didn’t see that. You really didn’t see that show up in numbers and now they’re guiding to a little over 20% growth, which is not really all that great for a company with this type of positioning in the market, especially with what’s going on with with AI and all the products that they’ve been talking about.

I just attended a customer event yesterday for Snowflake, which was very interesting.

The products that they have been introducing to the market like Cortex, they talked about it yesterday and they did a demo of how easy it is to use. They’re actually super interesting. We’re just in this period of time where there is not enough demand because of these cloud optimizations to offset what’s new coming from this new products that they’re announcing which haven’t reached critical scale. But we’re still very positive on the company because as you look into second half, you will start seeing contribution from these new product announcements. So we’re actually, like after walking out of that customer event yesterday, I came out pretty positive. It’ll take some time for it to work itself through and get traction with these use cases but I still really like Snowflake.

Why Delevska still really likes Snowflake despite the recent concerns over Slootman stepping down as CEO.

Q4a. Ok what about Confluent. It’s a bet on real time streaming, built on top of open source Kafka. The stock has been kind of up and down what’s your angle there Ivana?

Well the stock really fell out of favor two quarters ago when they reported basically two customers left the platform and then people started getting all worried about that and then they said, oh well, one of the customers is actually moving from the cloud back to on premise which was like, oh my God, like maybe this is happening across the board. So digging into the details, we did not find the customer loss that significant. I think the stock was down over 40% that day. So it ended up being a very attractive entry point for us. And as we’ve learned more about the company, data streaming could be as big market as data at rest. So this is something that it’s a little bit more under the radar than data at rest and a little bit less understood.

But basically this could be a pretty significant market. And what they’ve done recently with this Flink acquisition is basically able to do real-time data processing. So I think a lot of the investors, even on the earnings call, they didn’t quite understand what this company does and how Flink will benefit it. So I think digging one layer deeper and understanding the size of the opportunity can really make a pretty big differentiation here in the stock price. I think data streaming will be a significant opportunity. They basically lower the cost to customers to do this [streaming]. It makes a ton of sense, especially the time where people are looking at ROIs and cutting down costs.So I think this company will do pretty well. Again, similar to Snowflake, they have had some execution hiccups, so they will need to prove out their business model and step up their growth from currently the twenties to 30%. So as these companies and basically, it’s interesting how Snowflake came out, it was a one-off, Confluent came out, it was a one-off, where like growth is slowing. But then if you look, you kind of see a pattern across the board where I think a lot of it is under the hood driven by tougher macro, right? So when you see the macro stabilize, I think a lot of these companies will be able to re-accelerate growth.

Q4b. Now you trimmed Coupa even before they went private…Shopify and Hubspot are now in the top ten and they’ve both done pretty well this year why do you like those two?

We’ve owned Shopify and HubSpot for a while. Yeah, we’ve owned those two and Coupa basically we exited a long time ago even prior to the deal as part of a risk management, like when things were selling off. So I think for HubSpot and Shopify, they’re going to be pretty significant beneficiaries of AI as they own just a ton of customer data, right? So we’re still at the early innings where we don’t exactly know how they’re going to be able to use this data and what they’re going to be doing with it. But they will basically benefit, they will be able to introduce tools that they can sell to their customers where the customers can use the data and be able to come up with predictive things.

So like HubSpot, I’m currently a user of it as well. And basically what it can do in the future is if AI can somehow help predict who are the customers that you should be calling on, right? That would be a pretty significant time saving for the users. And similarly Shopify just sees a ton of commerce data, right? So they’re kind of at the forefront of innovation so they’re going to be able to use these to develop tools that will leverage this data.

How Ivana Delevska is thinking about enterprise software plays – Snowflake, Confluent, Shopify and HubSpot

The Cyber Play – CrowdStrike, Zscaler, SentinelOne & Trimming Cloudflare

Q4c. Let’s talk about Cybersecurity and start with CrowdStrike, seems like people can’t own enough of that platform play. Zscaler is a bit of a head scratcher. They beat, raise and drop because the year is back loaded and skewed toward larger deals. And SentinelOne had strong earnings but a weaker than hoped guide. S is like a much cheaper version of CrowdStrike. Why do you like it these and why did you trim your Cloudflare position?

So honestly going into this year I think cybersecurity is going to be a pretty significant theme and the fact that the stocks have sold off so aggressively post this earning season is creating some very attractive entry points. Basically what’s been going on is the companies are coming out in terms of earnings pretty close to what they guided but they’re not really beating by significant amounts and the street, I don’t know if it’s because expectations got a little bit ahead of themself in December or is it the fact that interest rates are creeping up and that’s a pretty big headwind but basically when they report, there is zero valuation support so any small miss or comment really gets [attention]. So I think CrowdStrike obviously was probably the strongest report out of the three, but the stock is a lot more expensive than SentinelOne.

I thought the Sentinel One report was very strong as well. The company could have guided a little bit higher than what they did, but again it’s a tough macro and some of their new products are still kind of at a point where they haven’t reached scale yet. They did say that today cloud and data is about 30% of their bookings. So that’s pretty significant and that’s growing at 60, 70, 80% growth rate. So I think all three look very attractive and yeah, Zscaler to your point, people didn’t like that the guide was really implying a very strong fourth quarter but the company was pretty confident on the call, saying that they are seeing larger deals and they are seeing improved momentum. So if I had to say like out of the enterprise space, especially post this sell off here after Q1, a lot of these companies look very attractive.

And then CloudFlare is just more of a, we still really love it, I just spoke to them this morning. I think they have some really nice momentum on the zero trust side and and also on their workers and other platforms. It was more a matter of valuation and the stock is a little bit more expensive than the rest. But we would look to enter, basically any of these pullbacks I think are very attractive entry points for this space because as soon as you see interest rates stabilize or the narrative change back to cutting rates, I think you’re going to see these names hit new highs.

How Delevska sees the cyber trade playing out.

AMD and the Broader Semi Trade

Q4d. You own AMD which we show on the chart…we don’t really have data on Nvidia but how are you thinking about the semi trade going forward? How do you feel about Nvidia’s moat? What are your concerns?

So basically for NVIDIA the concern would be as we reach further into the cycle, you are going to see the numbers closer reflect reality, which I think we’re still a few years away from it now. What I would say though for NVIDIA specifically is that you can even own the stock through the next cycle because the data center side is going to be significantly less volatile than the traditional gaming side. Because data center is not sold through the channel, a lot of these GPUs are sold directly to customers. When you see pullbacks or if there is a digestion period, you’re going to see a one for one impact. What’s been historically very cyclical for semis is when you see impact on demand, you almost see a double whammy from the channel, right?

Because people are then going through a period of de-stocking. So I think what you’re going to see with NVIDIA specifically, it’s a lot more durable and less cyclical cycles going forward. So I think we’re comfortable owning it in the next two or three years because of the cycle but then forward even through a cycle, right? Maybe not at the current size that we currently have it, but I think you can comfortably hold something like this through a cycle.

AMD is actually, interesting if you look at their numbers, they’re closer to the bottom than the top right? So client is is really going through a down cycle and is just stabilizing and embedded is another segment that they have. These are chips that are embedded into industrial products. That actually went through an upcycle and now it’s kind of bottoming out. So that’s why if you look at valuation, AMD will screen a little more expensive and the idea is that that’s because the numbers are actually at a bottom. So I think even though it may not be obvious just by looking at the stock prices, I think we’re really closer to the bottom here than the peak in the semis.

How Ivana Delevska thinks about NVIDIA risks.

Final Thoughts – Outlook for Tech this Year

Ok let’s wrap with some final thoughts and get Ivana’s take on the market going forward.

Fed watching is still very important for tech stocks because if you can get 5% parking money that takes investments away from high risk stocks. But as we pointed out in our post comparing the AI wave to the dotcom, interest rates back then were 7-8% and tech stocks were booming.

The market has been trying to go higher and it has as it has shrugged of hotter than expected inflation data but earnings will continue to be a major driver – seems like company CFOs are being conservative with guidance due to the macro so maybe there’s some upside to earnings – although visibility remains a bit murky.

And the AI bet is that it will lift all boats and drive productivity and economic growth.

Q5. But Ivana the market has been hot, it has run up very nicely since your premise last summer so how do you play it from here?

So on the software side as we talked about, it’s a pretty significant pullback. So I think for investors that can take a slightly longer term and and I’m not talking about a 10 year view, right? I’m talking about six to 12 month view. Just to see this down cycle play out. I think software, we’re finding a ton of opportunities. As you said, people are just overly focused on interest rates but interest rates on their own don’t really have a negative effect on the technology sector. So what you’re seeing is a lot of times when there is volatility in rates, it creates this volatility in the stock prices and not the fundamentals, right? So they do end up being very attractive entry points. I do think right now, even though the cycle, even though the indices seem like they’re at their height, it is actually a pretty attractive entry point for investors that can take a little bit longer view.

And to your point, I think second half comps are going to get very easy just because of how tough fourth quarter was last year. So fourth quarter as a reminder now it seems like it was in a distant past but rates hit 5%, things came almost to a full stop from the economy perspective and a lot of the earnings that you’re seeing reported today or over the past few months really reflect the reality that is now a little dated. So I think comps will get significantly easier and the guides don’t seem very aggressive at all. So I think if you step back it’s a very good time to look at the tech sector.

Keep in Touch

Thanks to Alex Myerson and Ken Shifman on production, podcasts and media workflows for Breaking Analysis. Special thanks to Kristen Martin and Cheryl Knight who help us keep our community informed and get the word out. And to Rob Hof, our EiC at SiliconANGLE.

Remember we publish each week on theCUBE Research and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email david.vellante@siliconangle.com | DM @dvellante on Twitter | Comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail.