Executive Summary

The definition of the Industrial Internet includes two key components:

- The connection of industrial machine sensors and actuators to local processing and to the Internet;

- The onward connection to other important industrial networks that can independently generate value.

The main difference between the consumer/social Internets and the Industrial Internet is in how and how much value is created. For consumer/social Internets, the majority of value is created from advertisements. The value created from the Industrial Internet is much greater from the same amount of data, and has three components:

- The value of increased efficiency of the industrial plant equipment and long-term maintenance and management of the equipment. In our research this was found to be always above 10% and as high as 25%.

- The value contribution to adjoining Industrial Internet networks, such as balancing short-term positive cash flow against additional long-term equipment costs such as maintenance.

- The value contribution of disruptive new business models is a wild-card that could, in a few cases, be dramatically high, or in most cases moderate or zero.

More detail on the differences is given in the “Industrial Internet Examples & Metrics” section below.

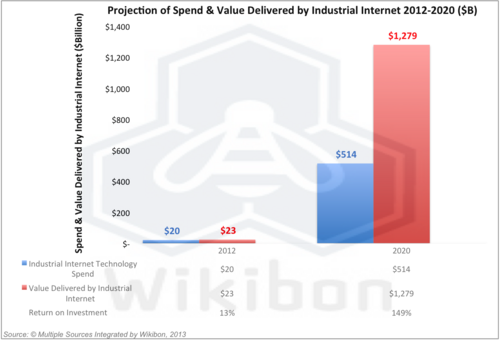

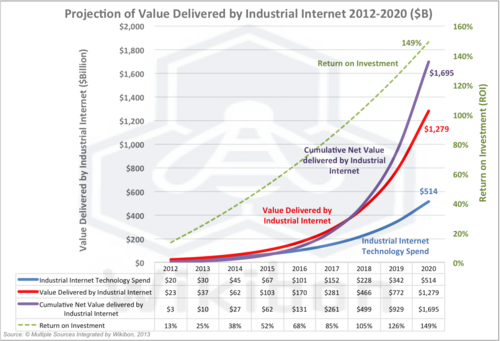

The sizing research findings are summarized in Figure 1. The spend on the Industrial Internet is projected to grow from $20 billion in 2012 to about $514 billion in 2020. The value created is expected to grow from $23 billion in 2012 to about $1,279 in 2020. Figure 2 in the body of the report shows that the cumulative net value created is projected to be $1.7 trillion by 2020.

Big Data And The Consumer Internet

The amount of data created and stored in the world is growing exponentially, both because of the decreasing cost of storing data (about 35% per year) and because of the reduced cost of implementing and maintaining hyperscale storage systems based on open software. Most of the current IT storage technologies have their origins in technology designed for the consumer. The emergence of low cost disk drives, flash technologies, and the use of Intel x86 architectures as the default server platform for all volume systems have their origin in consumer products such as PCs and iPods.

Most of the data on the Internet today was created by consumer products, especially picture, audio, and video files. Social media companies such as Facebook and Twitter have been another source of data creation. Much of this data is held at low cost in vast corporate databases owned by Google, Yahoo, Microsoft and other country-specific search companies. Apple and Facebook-based content is also growing quickly.

Most of the value created by this data has been in consumer advertising. It is somewhat sobering to reflect that IT’s best minds are currently focused on improving the speed and quality of these advertisements.

The Industrial Internet

The creation of business value from IT technologies generally follows about two-to-four years after the initial introduction in the consumer space. EMC announced flash drives in enterprise storage systems in 2008, two years after their initial appearance in the Apple 2006 iPod Nano. The enterprise versions are more powerful, more resilient, and have higher cost-per-unit that the consumer versions.

The Industrial Internet has begun to connect industrial machines together, and extend them into other industrial networks. This can drive efficiencies in industrial machine operations but has potentially even greater value in contributing to the efficiencies of second-order industrial networks. For example, avoiding the cost of a single power-generation turbine failure can be significant, but this pales in comparison with the value of preventing a nation-wide outage of the electrical grid.

The fundamental drivers of the Industrial Internet include:

- Sensor technology advances:

- Physical, chemical and biological sensors are rapidly evolving towards autonomous analytical devices that perform sophisticated analytical processes, using (for example) nano-structured materials and nano-materials such as conducting polymers and composites. This rapid sensor improvement gives rise to additional types of sensors that are smaller, cheaper, and faster, with lower power consumption, and less overhead impact on the equipment being sensed.

- Network Advances:

- The advances and standardization in Internet network technologies allow rapid and low-cost promulgation of information from physical sensors to be combined with the avalanche of related business process and consumer activity data.

- Business and Governmental Understanding of Potential Benefit:

- Businesses are realizing that this data can be used to optimize cost and delivery of industrial services.

- Businesses are also beginning to see opportunities for disruptive changes in industrial business models. One example is the opportunity for aviation engine manufacturers to offer an inclusive rental program for equipment and servicing, based on the expectation that enhanced feedback from the network of engines would lead to improved design and reduced costs in manufacturing and maintenance. Early establishment of such an offering would lead to significant competitive advantage.

- Governments are supporting greater use of sensor data to avoid catastrophic failure of key infrastructure networks such as power, water, and transport.

The definition of the Industrial Internet therefore includes two key components:

- The connection of industrial machine sensors and actuators to local processing and to the Internet;

- The onward connection to other important industrial networks that can independently generate value.

Industrial Internet Examples & Metrics

Examples of the Industrial Internet include:

- Aircraft Engines: the connection of aviation engine sensors (both during and after flight) to the Internet, and the onward connection of these to other networks designed to:

- Predict catastrophic engines failure;

- Optimize maintenance of aviation engines on wear vs. traditional usage;

- Feedback from real-world environments into engine modeling and design

- Enable new business models for engine manufacturers on a rental total cost/hour basis rather than current purchase/maintenance model.

- Wind farms: the connection of wind turbine sensors to the Internet, and the onward connection to other networks that enable:

- Real-time optimization of profit based on potential power generation and the impact on turbine maintenance costs (the trade-off on $/Watt on the open market vs. longer-term impact of driving equipment harder on maintaining wind turbines located in harsh environments)

- Re-designing wind turbines to optimize on capital cost of components vs. long-term maintenance costs

- Providing resilience in the case of catastrophic failure of other parts of the power grid.

Wikibon discusses other examples of the Industrial Internet in The Industrial Internet and Big Data Analytics: Opportunities and Challenges.

Examples that would not be included as being part of the Industrial Internet are:

- Security system sensors in homes,

- Sensors in home appliances like refrigerators,

These and many other cases have no onward connection to significant industrial networks creating additional value.

The big data metrics of the Industrial Internet are similar to the Consumer Internet, but the level of importance of each metric is very different. The metrics include:

- Volume – the volume of actual data is higher in the Consumer Internet, but the percentage of useful data is much higher on the Industrial Internet. Particularly useful are the use of time-series (Historian) databases, which can compress the amount of data stored by factors of 80 or more.

- Velocity – the speed of data coming from a large number of sensors will be much higher at the point of encoding than that of most of the data in the consumer space. This will mean that particular attention will have to be paid to databases that can be updated in real-time with very high data velocities.

- Variety – the Industrial Internet will generally have more structured content than the Consumer Internet, and the variety of content will be less varied.

- Veracity – the importance of understanding and recording data provenance is much higher for the Industrial Internet. Even more important are the threshold levels for false negatives. A false negative in placing an ad is not in the same universe of consequence as a false negative in military or commercial jet engine failure.

- Value – There are three components of value created from the Industrial Internet:

- The value of increased efficiency of the industrial equipment and its long-term maintenance and management. In our research we found this to be always above 10% and as high as 25%.

- The value contribution to adjoining Industrial Internet networks, such as balancing short-term positive cash flow against additional long-term equipment and equipment maintenance costs. In our study there was agreement that this value was probably higher than the value of increased efficiency, but it was much harder to quantify.

- The value contribution of disruptive new business models is a wild-card that could produce dramatically high benefit to society as a whole rather than to just one specific business or business sector. One potential dramatic impact is documented in an earlier Wikibon study. This example shows that on-line automated patient symptom analysis could reduce the number of hospital visits dramatically and be worth a trillions dollars to the economy in general.

Constraints On Adoption Of The Industrial Internet

The Industrial Internet carries significant constraints to adoption. Some of them are legal, some cultural, and some technical. These include:

- The lack of data standards – Although some parts of the Industrial Internet have some data standards (e.g., PACS (Picture Archiving & Communication System) in healthcare), to a large extent these standards are proprietary, works-in-progress, or non-existent.

- Conservative Engineers – Successful companies that will be part of the Industrial Internet have influential engineers who are rightly risk adverse. Our interviews documented a large number of explanations and examples of the challenges to the Industrial Internet. To be successful, companies will need to identify key engineering influencers and ensure they buy into the corporate strategy early.

- Lack of an Industrial Internet Common Platform – This needs to be scalable, highly available, highly secure, based on flexible open standards, and must support automatic orchestration of platform components. The Industrial Internet and Big Data Analytics: Opportunities and Challenges research looks in more detail at the much more stringent requirements of the Industrial Internet compared with the consumer/social Internet. Security and the perception of security are particularly important to healthcare.

Sizing The Industrial Internet

Wikibon has projected the most likely progress of the development of the Industrial Internet using five metrics:

- The size of the current Industrial Internet Segment;

- The size and growth rate of Industrial Internet Technology Spend;

- The size and growth rate of Industrial Internet Technology Value;

- Return on investment (ROI);

- The cumulative net value created between 2012 & 2020 within the Industrial Internet segment, a metric derived from the other four.

The following assumptions were made in estimating the size of the Industrial Internet opportunity:

- The world-wide GDP is $83 Trillion (on a 2012 base).

- The Industry Internet Segment is 16% of the world-wide GDP (this is a conservative estimate based on using the manufacturing industry as an initial target, with some areas participating, and a compensating influx from other areas such as health-care and transportation).

- The annual growth of the world-wide GDP is assumed to be 1%.

- The current Industrial Technology spend (this does not include current spend on the Industrial Internet) is assumed to be 3% of the Industrial Internet segment. Currently IT spend is slightly less than 2%, but there is additional spend on sensors in point of production/generation and related technologies that gets this figure up to 3%.

- The annual growth of industrial technology spend is 2.5%. This is mainly driven by increased IT spend.

- The current (2012 base) of Industrial Internet technology spend is 0.15% of the Industrial Internet Segment.

- The growth rate of the Industrial Internet Technology is 45% from 2013 to 2020, which is in line with the growth of other areas of the Internet after initial seeding. The growth in 2020 will be high, and is expected to taper off significantly after 2020.

- The current value created by Industrial Internet technology spending is assumed to be 0.17% of the Industrial Internet segment. This is again a conservative assumption based on early investments having a poor return.

- Wikibon’s in-depth interviews indicate that the growth in Industrial Internet Technology value created will be in the range of 60%, a 15% uplift on the 45% growth in spend.

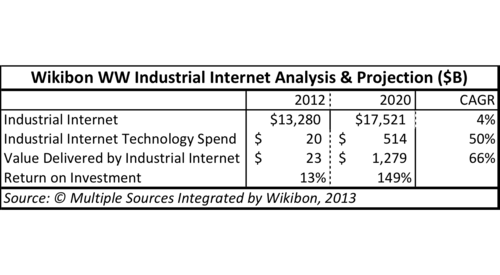

The size of the Industrial Internet Segment is shown in Table 1 in the footnotes to grow from $13.3 trillion to $17.5 trillion in 2020, against a global GDP of $83 trillion in 2012. The sizing research findings are shown in Figure 2. The spend on the Industrial Internet is projected to grow from $20 billion in 2012 to about $514 billion in 2020. The value created is expected to grow from $23 billion in 2012 to about $1.3 trillion in 2020. The cumulative net value created is projected to be $1.7 trillion by 2020. The ROI grows up to 149% by 2020.

Figure 2 also shows the current small spend on the Industrial Internet and the normal relatively small growth at the beginning of Industrial Internet adoption. This very rapid adoption is very common in technology adoption curves, and a slow-down in growth of the Industrial Internet would be expected after 2020.

Conclusions

The data and requirements of the Industrial Internet are very different from those of the Consumer Internet. Additionally, both are subject to very different drivers, forces, and constraints to adoption. While there are powerful drivers for the adoption of the Industrial Internet, the constraints will mean that widespread adoption will take longer than the Consumer Internet. However, Wikibon believes that the value created by the Industrial Internet will be high, and will grow over twice as fast as the value of the Consumer Internet.

Action Item: CXOs of industries that compete in the Industrial Internet space should create a strategic document outlining how the Industrial Internet will affect them, how to participate, and what the “wild-card” opportunities might be for them. Budgets should be adjusted to allow experimentation in Industrial Internet Analytics to gain experience and understanding of potential. A key engineering influencer to support development of the potential should be identified and brought on board early.

Footnotes: