Introduction

As companies approach what Dell refers to as “multicloud by design”, meaning the purposeful adoption of multicloud, not something done by accident, they increasingly look for platforms that simplify their cloud operating models. With solutions like Dell APEX Storage for Public Cloud Family and APEX Navigator for Multicloud, organizations have more ways to deploy multicloud technologies on-premises and in the hyperscale cloud to leverage the people, processes, and technologies that are familiar, with a more predictable cost structure.

Have we reached equilibrium?

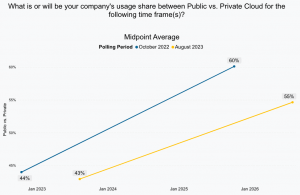

The usage of public and private clouds is still shifting, but recent data shows that the market is becoming more balanced. We explored survey data from ETR, which tracks IT spending intentions quarterly. We specifically investigated firms in the S&P 500, a large portion of the market, and a bellwether segment. The following findings were notable:

- The percentage of public cloud usage is expected to grow from 43% today to 55% by January 2026.[1]

- The 55% target is five percentage points lower than the prediction ten months ago.

We believe this trend indicates the market is becoming more stable as workloads are being distributed more evenly between public and private clouds. The growth in cloud usage is primarily due to new workloads being added to existing cloud platforms rather than a lift and shift away from on-premises deployments.

In addition, our research indicates that private clouds are closing the operating model gap with hyperscale clouds. As it becomes easier to manage on-premises or private clouds, net new cloud-native applications are being deployed in private clouds at a higher rate than previously anticipated.

Increasingly, while we continue to expect hyperscale clouds to grow faster than on-prem deployments, we believe customers are taking a more balanced approach to workload placement.

Rather than a cloud-first mindset, organizations are aligning workload and platform characteristics to optimize cost, flexibility, service level, and governance objectives.

A rapidly emerging trend we see gaining momentum is the need to balance the location of AI and data. This involves either bringing the AI to the data or bringing the data to the AI. If the latter requires time-consuming or expensive data movement, the former is preferable. As organizations attempt to balance cost with functionality, many large organizations, using the S&P 500 as a proxy, understand what it takes to build and service cloud-native applications. They increasingly look at the economics and financials of doing “as-a-Service” themselves, either in owned data centers or colocation data centers.

What was announced, and what is the impact on customers?

Dell announced the expansion of the APEX storage for public cloud family offering with the introduction of Dell APEX Navigator for Multicloud. Dell’s “Ground-to-Cloud” concept is delivered through two components: the APEX Storage for Public Cloud Family and Dell APEX Navigator for Multicloud. The first component offers a universal storage layer where organizations can have storage endpoints in the public cloud that are combined with consistent and centralized management across a comprehensive set of storage services, such as block, file, and data protection.

These cloud-based storage services are designed to provide extreme performance and scalability, enabling organizations to confidently run mission-critical applications and workloads in the cloud that they may not have previously moved. The second component brings centralized management and seamless integration, allowing for seamless data mobility and the ability to move data from on-premises up into the cloud and vice versa. This is where Dell APEX Navigator for Multicloud brings on-premises and cloud together. The way Dell APEX Navigator for Multicloud achieves this simplicity is through the following:

- Emphasis on Security: Security is a central aspect of the product design, ensuring safe and controlled operations in a SaaS environment. This includes full control over users, roles, permissions, groups, certificates, and keys, which is vital for IT operations.

- API-First Approach: The product is designed with an API-first perspective, facilitating integration with automation tools like Ansible or Terraform. This enhances data mobility and operational efficiency.

- Identity and Access Management: The product allows organizations to integrate their own identity and access management systems, streamlining the user experience without the need for additional single sign-on configurations.

- Efficient Deployment: The deployment process is simplified into a four-step process, accommodating various storage types and cloud environments. This includes options for single or multiple availability zones and is backed by seamless provisioning and software deployment in the cloud.

- Integrated Management and Monitoring: Post-deployment, the product offers integrated management tools and single sign-on capabilities, allowing for efficient day-to-day operations. Monitoring is enhanced through CloudIQ, providing insights into the health, performance, and capacity of storage endpoints, both in the cloud and on-premises.

- Data Mobility and Flexibility: The product addresses key customer pain points regarding workload migration and data mobility, using native replication technology. This enables seamless movement of workloads between cloud and on-premises environments, catering to changing business strategies and requirements.

Conceptual TCO for Dell APEX

Dell hired Silverton Consulting, Inc. to benchmark Conceptual TCO for APEX block storage for public cloud offering with Navigator against native public cloud storage. Through this study, the Dell solution was able to deliver up to 87%[2] cost savings compared to just a standalone native public cloud storage offering. This translated into $14 million worth of savings over the five-year TCO and a positive cash flow by year two.

The benefits to the customers are control, visibility, and management of that universal storage layer via a SaaS control plane for managing on-premises and cloud-based storage. This provides operational consistency, which is essential to a cloud operating model, from on-premises to public cloud.

Our Perspective

We believe that the cloud operating model will be the dominant way organizations will procure, deploy, and manage infrastructure well into the future. They will focus on partners that can deliver a Platform-as-a-Service (PaaS) )-like environment across public cloud, on-premises, colocation, and edge. Dell Technologies is bringing a PaaS layer that extends across all the different deployment models of public cloud, colocation, and on-premises, and integrates with the storage that is already deployed.

While other PaaS layers are simply a redeployment of on-premises technology to the public cloud, we believe that Dell Technologies has spent time reimagining this layer, bringing more value to its customers. Dell Navigator for Multicloud is a critical component of this strategy, providing the security, DevOps API-first, and integrated management that is key to a cloud operating model for storage.

[1] ETR.ai Cloud ’23 Drill-Down Report, August 2023

[2] Dell commissioned Silverton Consulting, Inc. to benchmark a Conceptual TCO which can be found at https://www.delltechnologies.com/asset/en-us/solutions/apex/industry-market/apex-storage-for-public-cloud-conceptual-total-cost-of-ownership-whitepaper.pdf

Disclosure: This theCUBE Research Analyst Brief was commissioned by Dell Technologies and is distributed under license from theCUBE Research. theCUBE Research is a research and advisory services firm that engages or has engaged in research, analysis, and advisory services with many technology companies, which can include those mentioned in this article. The author does not control any equity positions with any company mentioned in this article.

Analysis and opinions expressed herein are specific to the analyst individually, and data and other information that might have been provided for validation, not those of theCUBE Research or SiliconANGLE Media as a whole.