The observability market is rapidly evolving, and Dynatrace’s recent announcements at their conference, Perform 2024, have set a new course for Dynatrace and cemented the industry direction. As an analyst deeply immersed in this sector, I’m excited to unpack these developments and share my perspective, complemented by the latest data from ETR’s October 2023 Observability survey and January 2024 Technology Spending Intentions survey.

Dynatrace Acquires Runecast: A Strategic Move

Dynatrace’s intent to acquire Runecast is a significant stride in enhancing its platform’s security capabilities. This acquisition promises to integrate Runecast’s security posture management into Dynatrace’s existing framework, offering a more holistic approach to security and observability.

Our view is that the potential here is immense by bringing together and correlating security compliance, vulnerability assessments, and configuration management seamlessly with the data Dynatrace already collects. This could be a game-changer in how Dynatrace customer organizations approach security in their observability strategies.

Acquisitions and the Observability Market

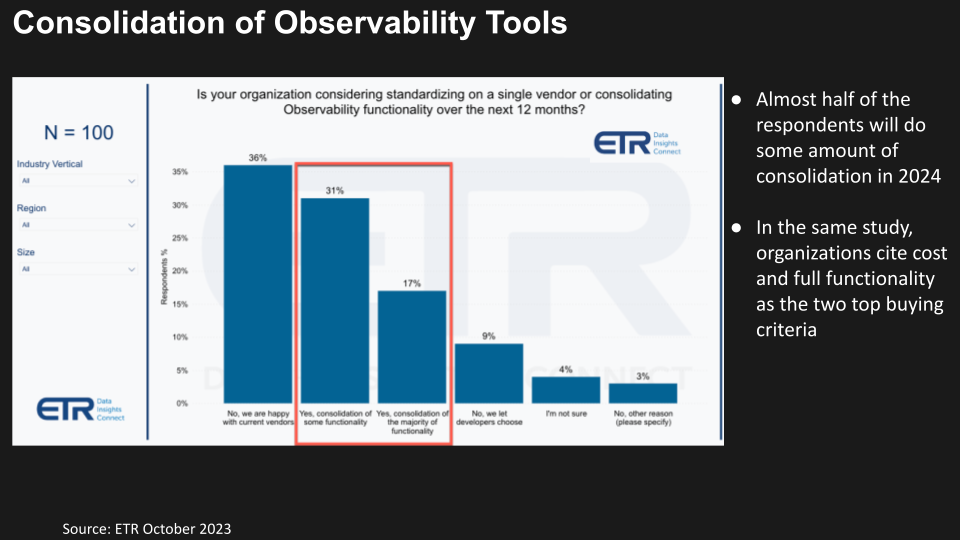

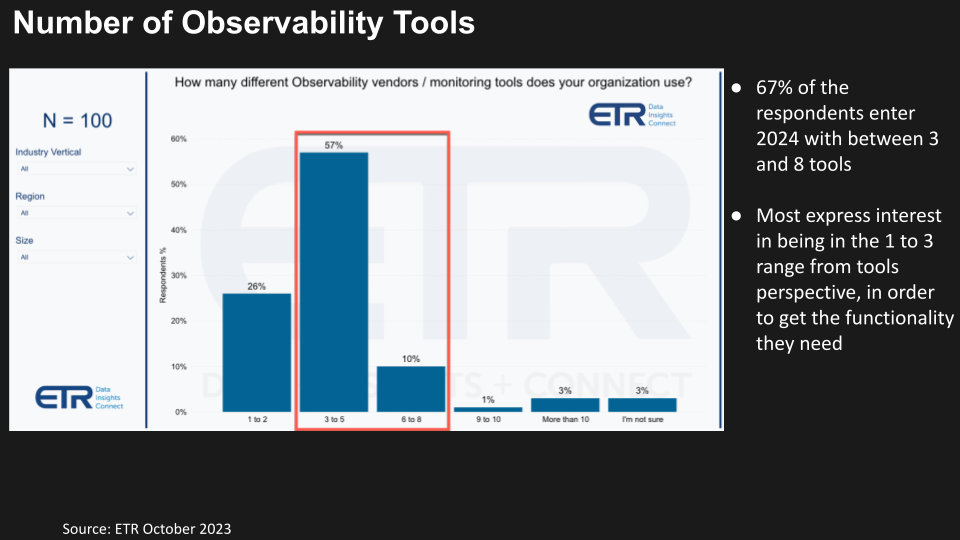

Looking at our partner ETR’s October survey, on the Observability market, sheds light on a growing trend in the observability market: consolidation. Almost half of the respondents are looking to consolidate their tooling in 2024.

This drive towards consolidation stems from two primary factors: cost efficiency and the quest for full functionality. With 67% of respondents currently juggling between 3 to 8 tools, with the desire to streamline to 3 or fewer.

Dynatrace’s moves align well with this market sentiment, potentially positioning them as a go-to provider for comprehensive observability solutions.

Dynatrace’s Foray into AI Observability

The announcement of AI Observability for Large Language Models (LLMs) and Generative AI by Dynatrace opens up new frontiers. This initiative focuses on ensuring the observability and security of AI-powered applications across all infrastructure layers. As Large Language Models (LLMs) and Segmented Language Models (SLMs) become increasingly integral to business operations, the need for robust observability of these AI applications escalates. Dynatrace’s commitment to ensuring the availability, performance, cost, and security of these applications is crucial. There also is a sustainability aspect to this announcement, where you understand the impact of training a model, fine-tuning a model, and using the model to actually do the work. It is not clear how this will be materialized beyond some FinOps-related performance versus cost calculations, such as running it faster at higher resource utilization so it is shorter use but costs more. This is a place where the Runecast acquisition could play a pivotal role in safeguarding these AI pipelines against threats like false data injection.

Introducing OpenPipeline: Tackling Pipeline Sprawl

Dynatrace’s OpenPipeline is a response to the growing challenge of ‘pipeline sprawl’ in observability environments. This new technology offers a unified solution for managing large-scale data ingestion, a move likely to attract customers seeking an integrated observability platform rather than a collection of tools. With OnePipeline, the data is able to be ingested at petabyte scale into the Dynatrace Grail Lakehouse platform.

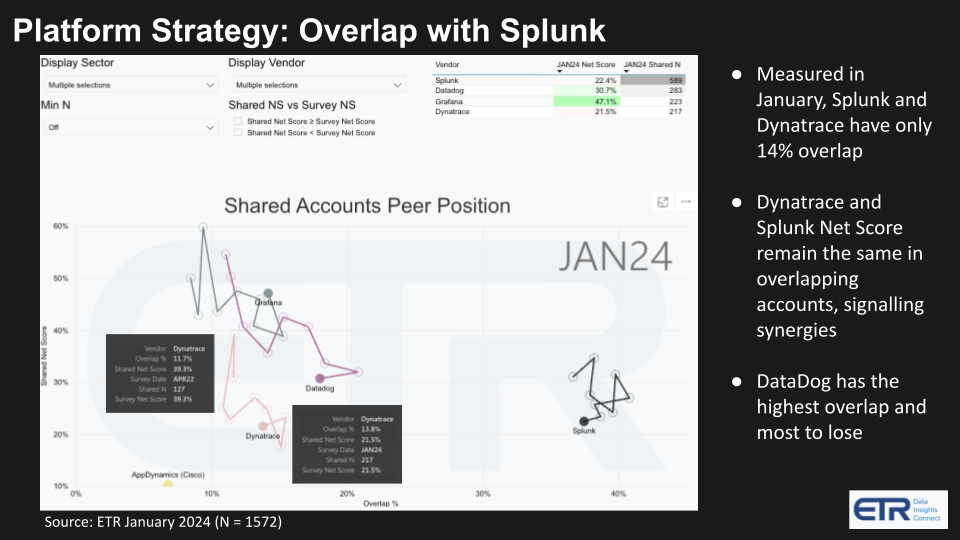

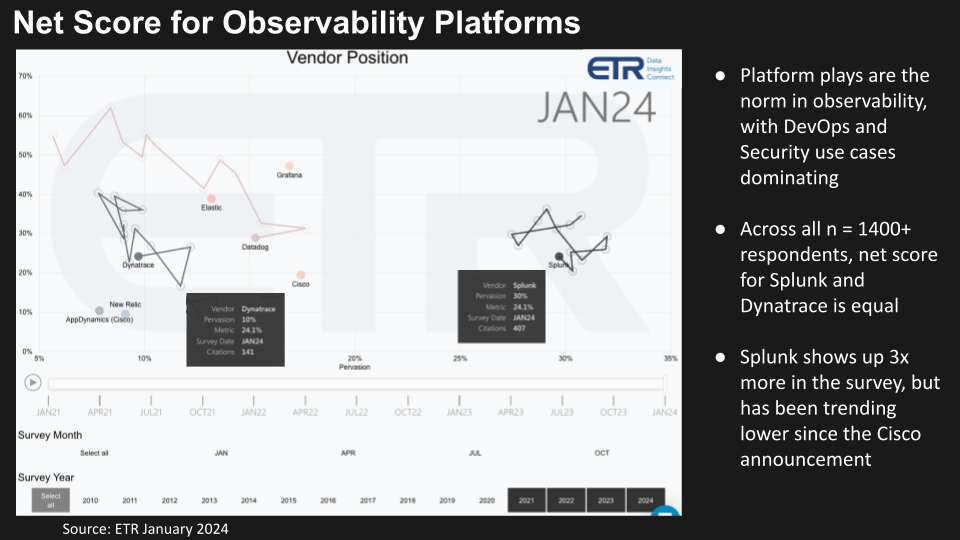

Above, we see the ETR data that indicates a shrinking overlap with major players and the 800-pound gorilla, Splunk, suggesting a shift in the market dynamics that are fueling these announcements and acquisitions. Dynatrace and Splunk have a 14% overlap, and Dynatrace’s spending momentum, ETR Net Score, remains the same, speaking to the synergies in the platforms and that in those accounts, organizations plan to keep both for the time being. However, we expect the size of the overlap to shrink as Dynatrace executes its platform strategy. We believe that at this moment, DataDog has the most to lose with the Splunk acquisition by Cisco and the observability trend towards a “platform-centric” approach.

Dynatrace’s AI-Driven Approach

Dynatrace’s AI-powered Data Observability for Analytics and Automation Platform is another leap forward. Building on the OneAgent technology, this feature allows for the quality assurance of data collected through various means, including OpenTelemetry, logs, and APIs.

Our view is that Dynatrace is providing assistance to organizations that are developing “data products” by enabling them to ingest custom data from their applications and pipelines. For example, if using OneAgent for logs you want to ingest via API, some configuration steps are necessary. After that OneAgent log data is automatically contextualized and connected to the related application, infrastructure components, and transactions.

Dynatrace is promising to help organizations gain a better understanding of new data-based applications by utilizing the predictive and causal machine learning, what they call Hypermodel AI, capabilities of the Davis AI combined with the ease of use of LLM based prompt and response.

Our Angle on the Race for Ultimate Observability

The observability market is more competitive than ever. With a net score equal to Splunk across 1400+ respondents in the January 2024 ETR survey, Dynatrace is demonstrating some strength in the market. Taking aim at the shifting Splunk market share is a good target, as Splunk is three times as pervasive in the responding organizations as Dynatrace.

The technology landscape is constantly evolving, particularly with the emergence of startups such as Chronosphere. They have joined forces with cybersecurity giant Crowdstrike and plan to purchase Calyptia to enhance their open-source pipeline Fluent Bit and Fluentd. This move will put them in direct competition with Dynatrace OpenPipeline. Additionally, new players like Riverbed, who come from the network optimization domain, are also making their presence felt in the industry.

2024 is shaping up to be a landmark year in the observability space. Dynatrace’s strategic moves, reflected in their recent announcements, are in line with where we see the market is going: a platform-centric observability market. As we continue to monitor these developments, it’s clear that the race for the ultimate observability platform is far from over.