Enterprise Size and Public Cloud Usage and Preferences

Situation

By all accounts, Public Cloud (SaaS, IaaS, and PaaS) revenue is growing at ~25$ annually and will represent ~7% of Worldwide IT Spending in 2015. Users are looking at entry strategies for IaaS and providers are trying to map offerings and market strategies to a market that is in the early adopter phase today, but rapidly closing in on the early majority stage. As this Public Cloud market overall begins to take a clearer shape, it’s important for prospective users and providers to unpack differences in patterns of use, beliefs, strategies, and goals as a function of the size of an enterprise. Some questions we often encounter include:

- Do Small, Medium, and Large Enterprises differ in their current and projected use of Public Cloud applications?

- Do they hold different attitudes and expectations about the use and overall direction of the Public Cloud?

- Do they differ in their valuation of the attributes of providers of Public Cloud offerings?

- Do they use different Public Cloud offerings … and for what?

- What are their opinions about the leading Public Cloud vendors today?

Drawing on data from 301 Public Cloud users (http://premium.wikibon.com/wikibon-iaas-survey-q1-2015/), this report compares the opinions and usage profiles of Small, (<1000 employees), Medium (1,000-10,000), and Large (>10,000 employees) enterprises on the above questions.

Executive Summary

For many enterprises (both large and small), adoption of Public Cloud solutions appears to require crossing a chasm (real and/or imagined). Wikibon’s research suggests that the leap across may be easier than many believe.

The path to the Public Cloud for an enterprise often begins with cloud-friendly apps such as Email, Web-based apps, and increasingly robust SaaS and PaaS offerings from reliable vendors. Our research suggests that the greater the reported experience with Public Cloud in general (IaaS, SaaS, and PaaS), the greater is the level of satisfaction with the Public Cloud providers used, regardless of enterprise size. So the message is “Jump in. The water is fine.”

That being said, Wikibon has found that Public Cloud growth expectations, attitudes, strategies, vendor preferences, and workload profiles do differ somewhat as a function of enterprise size. Examining these differences will assist large and small enterprises who are sitting on the fence today to move more aggressively to take advantage of Public Cloud offerings for appropriate workloads for them. Public Cloud providers need to better understand the expectations, directions, and attitudes, as well as the unique requirements and barriers faced by each market segment in their journey to the Public Cloud.

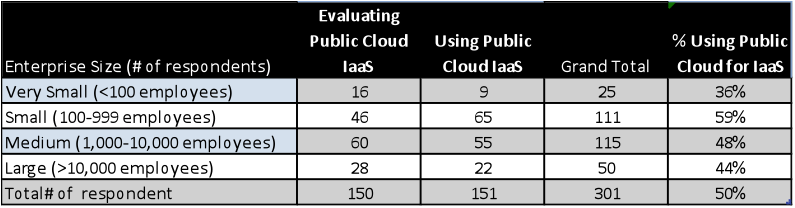

Enterprise Size and Use of Public Cloud for IaaS Today

One area of focus for our survey was Public Cloud use to supplement, augment, or replace IT Infrastructure today. As can be seen in Table 1, Small Enterprises (but not very small) tend to have higher utilization of Public Cloud for IaaS than those just evaluating Public Cloud for IaaS use. The combination of modest requirements and cost avoidance in an increasingly complex Internet and Mobile First world is a natural fit for Small Enterprises. Very small enterprises, however, have less technology depth and infrastructure needs and are therefore less likely to use Public Cloud for IaaS.

Table 1: Enterprise Size and Public Cloud for IaaS Status (Using vs. Evaluating)

Survey Question: What best describes your company’s status regarding the use of public cloud for your IT Infrastructure?

- Our enterprise is currently using public cloud offerings to supplement, augment, or replace our IT infrastructure.

- Our enterprise is currently evaluating public cloud offerings to supplement, augment, or replace our IT infrastructure.

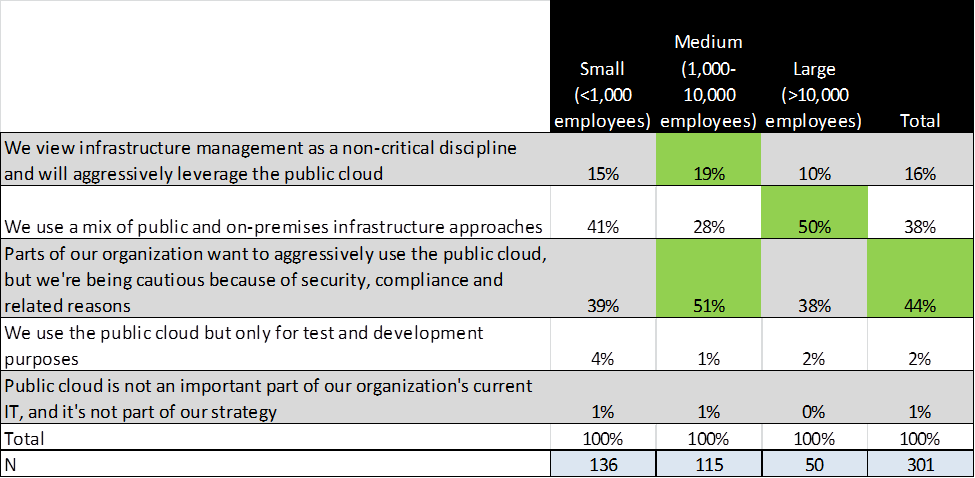

Enterprise Size and Use of Public Cloud for Infrastructure over the Next 12-24 Months

The single most prominent strategy for Public Cloud IaaS use reported in our survey reflects the ambivalence that has been characteristic of this market for the past 5 years – namely that some parts of the organization want to aggressively adopt Public Cloud for IaaS, but there is concern about security and compliance. The second most prominent strategy was its corollary – the use of a mixture of Public Cloud and on-premise approaches. But there were some telling differences between enterprises based on their size.

Large enterprises are likelier to use a mix of Public and On-premise approaches than Small and Medium enterprises. Their larger data centers (and sunk costs) and more complex infrastructure problems require the correct application of approaches based on many considerations. Medium enterprises have a more aggressive stance on Public Cloud IaaS than Large or Small enterprises. They want to aggressively pursue Public Cloud but are holding back because of Security and Compliance concerns. And they are also slightly more likely to embrace the most aggressive Public Cloud adoption strategy overall – viewing infrastructure management as a non-critical discipline and aggressively pursuing public cloud as a strategy. Fewer Medium enterprises embrace a mixed Cloud strategy – reflecting perhaps the pain of executing a deliberate and complex strategy with fewer technology skills and budgets to do it well. Cells highlighted in green identify differences worth noting.

Table 2: Enterprise Size and Public Cloud IaaS Strategy Over the Next 12-24 Months

Survey Question: Which of the following best describes your organization’s spending pattern with respect to infrastructure over the next 12-24 months? (Choose the ONE that fits best)

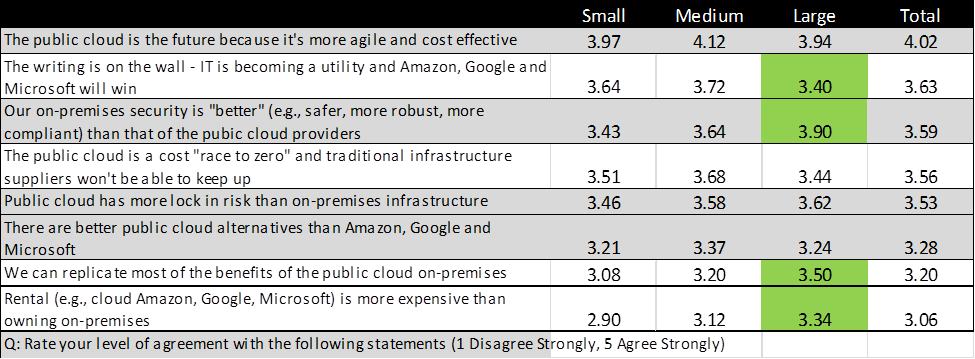

Enterprise Size and Attitudes About Public Cloud

Overall, attitudes about Public Cloud are similar for all enterprise sizes (Table 3). Large enterprises tend to differ from Medium and Small Enterprises in their recognition of the limitations of Public Cloud (security and cost) and their strong belief that they could replicate most of the benefits of the public cloud on-premises. They also don’t believe as strongly that IT was becoming a utility and the leading Public Cloud vendors wouldn’t necessarily win out overall. Cells highlighted in green identify differences worth noting.

Table 3: Enterprise Size and Public Cloud Attitudes

Survey Question: Rate your level of agreement with the following statements (1 disagree strongly, 5 agree strongly

However, those respondents who are actual users of Public Cloud today to supplement , augment or replace their IT Infrastructure tend to have a more positive view of Public Cloud for IaaS than those still evaluating it, especially among Large enterprises. For instance, Large users of Public Cloud for IaaS today agree more strongly with the statements “The writing is on the wall-IT is becoming a utility…”, “The public cloud is cost ‘race to zero…’” , and “There are better public cloud alternatives…” than their Large colleagues who were only evaluating Public Cloud for IaaS. Users are much less in agreement with the statements “Our on-premise security is better…” and “Public cloud has more lock-in risk…” than those currently evaluating Public Cloud for IaaS.

The Large enterprise users have likely found workloads and applications that fit well on public cloud and are looking to find more. Large enterprises that are only evaluating Public Cloud for IaaS and holding back adoption may be in industries or closer to workloads that have significant security and compliance hurdles to overcome. Large Financial Institutions, for instance, have significantly greater mandates about Security and Compliance than Large Manufacturers. While the sample size did not support a comprehensive analysis of cross industry differences, the requirements of an industry (as well as enterprise size) are important to consider when evaluating and adopting Public Cloud use for IaaS. However, an anecdotal reading of the survey data does suggest that it’s possible to deploy appropriate use cases and come around to a more sanguine view of the possibilities Public Cloud for IaaS offers, regardless of industry segment or enterprise size.

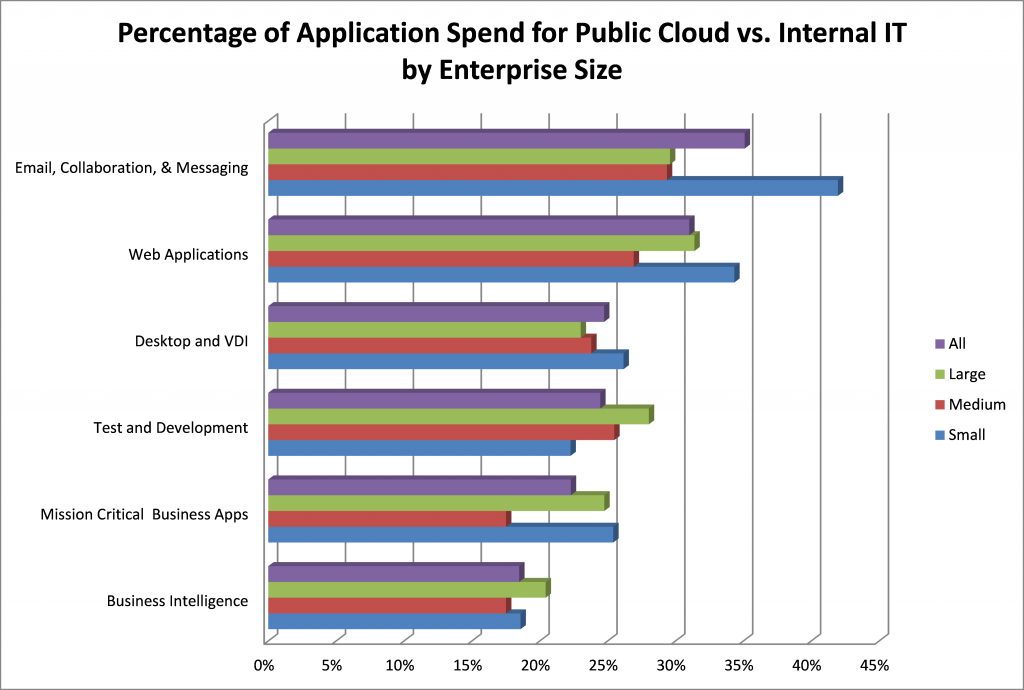

Enterprise Size and Other Public Cloud Applications in Use

Wikibon asked respondents to quantify the percentage of their current spending between Public Cloud and all other IT spending for each of the following workloads (Test and Development, Desktop and VDI, Web Applications, Email, Mission Critical, and Business Intelligence). Figure 1 shows that Email (35%) and Web Apps (31%) have the highest proportion of spending among the Public Cloud application categories. BI is the lowest (18%) today.

Small, Medium and Large enterprises have roughly similar Public Cloud application spending profiles. However, Small Enterprises spend more of their application budgets in the Public Cloud than others – committing significantly more of their Email, Collaboration, and Messaging spending to the Public Cloud vs. internal IT. Web Application spending in the Public Cloud is higher for Small enterprises as well, as is Mission Critical applications (representing higher levels of SaaS spending). They have the lowest levels of Test and Development Cloud spending . Large enterprises spend a higher proportion of their Test & Development and Business Intelligence budgets in the Public Cloud than the others. Medium enterprises tend to have slightly less spending overall in the Public Cloud, especially for Mission Critical Apps.

Figure 1: Percentage of Application Spend for public Cloud vs. Internal IT by Enterprise Size

Survey Question: For each of the following applications, please indicate the percentage of spending between internal IT (including private cloud) and Public Cloud – for both today and in the next 12-24 months

Our research also found that today’s Public Cloud users of IaaS to supplement, augment, or replace IT Infrastructure today tend also to have higher proportion of spending (5-10% percentage points more) for each of the six Public Cloud applications than those only evaluating Public Cloud for IaaS. This is the case for all applications for Large enterprises, but it is most significant for them for Test and Development, Desktop and VDI, and Web Applications. Medium enterprises with Public Cloud IaaS experience report a modestly higher rate of Public Cloud spending across all the applications. Small enterprises who are Public Cloud users of IaaS have a much higher proportion of Mission Critical spending in the Public cloud as well.

These results suggest that crossing the chasm to Public Cloud for IaaS is to be correlated with increased spending on Public Cloud for a variety of other Public Cloud applications. Basically, the message might simply be “Try it, you’ll like it”. This relationship appears to be most dramatic among Large Enterprises, and least dramatic among Small enterprises. The potential for Public Cloud growth would appear to be most fertile among the Large enterprises with the largest budgets.

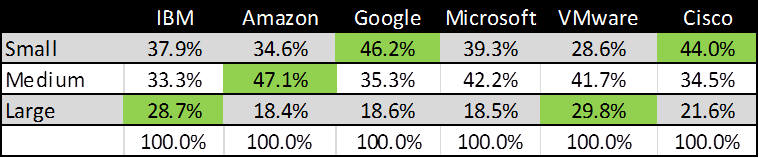

Usage of Various Public Cloud Providers by Enterprise Size

There were more Microsoft Azure users in our survey than any other Cloud provider, and they were distributed relatively equally (see Table 4) between Small, Medium, and Large enterprises. IBM’s users (as is the case with VMware) tend more frequently to be Large Enterprises. These data center leaders are familiar to and are trusted by Cloud decision makers – and their strength with large enterprises (with the largest budgets) bodes well for their future growth. Cells highlighted in green identify differences worth noting.

Amazon appears to have its strongest position among Medium enterprises. Google and Cisco Intercloud have strong positions among Small enterprises. Google’s Gmail and Web App offerings are a good entry point for these users and Cisco’s Intercloud partner strategy has appeal for smaller enterprises as well.

Table 4: Proportion of Small, Medium, and Large Public Cloud Users for Each Provider

Survey Question: For each of the Public Clouds, rate your familiarity. Respondents answering Use in Production or Pilot/testing are included in the data above.

Enterprise Size and the Relative Importance of Cloud Provider Attributes

In order to better understand the Public Cloud provider selection process, Wikibon asked respondents to rank the importance to them in choosing a Public Cloud provider on the criteria of Trust, Economics, Reliability, Speed & Agility, and Manageability (Figure 2). Trust and Reliability rank the highest in importance by far for enterprises of all sizes. Speed and Agility ranks 3rd with Manageability and Economics running a distant 4th and 5th. Small enterprises tend to rank Trust and Reliability higher – suggesting a higher degree of uncertainty and doubt with Public Cloud in general. Large enterprises tend to favor Reliability slightly more strongly than Trust, per se – suggesting that dependence on the Public Cloud for operational consistency is a little higher in importance for them. Medium enterprises tend to rank Speed & Agility and Manageability higher in importance – suggesting more focus on the ability of Public Cloud providers to support them in making their operations run more smoothly. This may reflect on the more difficult position of Medium enterprises which are likely to have more difficult obstacles in moving to Public Cloud than Small enterprises (with more sunk IT assets and more complex application environments), coupled with the need to compete more frequently with more sophisticated Large enterprises in a global market.

Figure 2: Rankings of Importance of Attributes of Public Cloud Providers by Enterprise Size

Survey Question: When choosing a public cloud provider, please list the following attributes in order of importance.

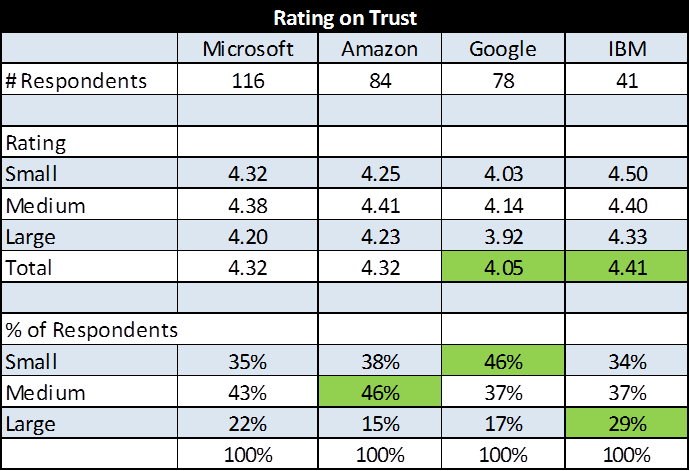

Enterprise Size and Rating Providers on Trust

Wikibon’s analysis of the rankings of cloud provider attributes indicates that Trust is a good proxy for overall satisfaction ratings for the actual public cloud users of each vendor. With ratings mostly 4 or 5 a 5 point scale, there was a high level of satisfaction in overall Trust for every Public Cloud vendor. However, enterprises of different sizes did rate the vendors slightly, but significantly differently.

Microsoft, Amazon, Google, and IBM were rated by the largest number of Public Cloud IaaS users, so their ratings on Trust are included below. Other vendors were not included in this comparison since there was insufficient sample size to draw fair conclusions.

Overall, Public Cloud users rate their providers very favorably. There are, however, some differences between the providers based on enterprise size. As can be seen in Table 5 IBM’s rating on Trust is slightly higher overall than that for the others. The data suggests that IBM has permission from Public IaaS users overall, and especially Large enterprises to be their leading IaaS provider. This is also the case for Small enterprises where the IBM brand perhaps creates comfort. For Medium sized enterprises, IBM, Microsoft, and Amazon had similar ratings on Trust. Google (with its largest segment being Small enterprises) had lower ratings overall.

Table 5: Ratings on Trust by Users for Cloud Providers by Enterprise Size

Survey Question: “For each of the following Public Cloud providers, please rate them on the following attributes. Use a scale from 1 to 5 where 1 means Very Unsatisfactory and 5 means Very Satisfactory.” Analysis Included only ratings where respondent designated the provider as “Used in Production” or “Pilot/Test”.

Conclusions

The Public Cloud market is still forming – but seems to be poised to soon enter the Early Majority stage of its development where user behavior, preferences, and strategies become more stable. While sharing many commonalities, enterprise size is a predictor of different requirements, drivers, and usage in the Public Cloud.

Large enterprises are more discerning of public cloud offerings. Test and development is a key entry point for them since scale, operational complexity, and security/compliance/regulatory demands require a more nuanced approach to Public Cloud for IaaS. However, there seems to be relatively higher trust among Large Enterprises for data center leaders such as IBM, Microsoft, and VMware. Amazon stands out as a significant partner for Large Enterprises for Test and Development workloads.

Small and Medium enterprises have the greatest need for Public Cloud and should consider well-established, lower risk entry points to Public Cloud like SaaS, Email, and Web Applications before venturing into Mission Critical and IaaS workloads to help them navigate an increasingly complex and costly IT infrastructure environment. They should look beyond economics and consider the actual functionality delivered before choosing a provider. Prospective Small and Medium Public Cloud users should take heart that their colleagues using Public Cloud today report high satisfaction with their current providers.

As Pubic Cloud adoption nears the Early Majority stage, providers will need to continue to grapple with the trust and reliability issue – as these are still uppermost in the minds of both users and prospects. This may be more perception than reality, but providers should take heart that the more users experience Public Cloud, the more they seem to like and trust it. Providers should also understand that there are significant differences in attitudes and usage of Public Cloud applications as a function of enterprise size and industry. Offerings need to be tailored to size and industry market segments to meet real (and imagined requirements) and capture mind share.