Executive Summary

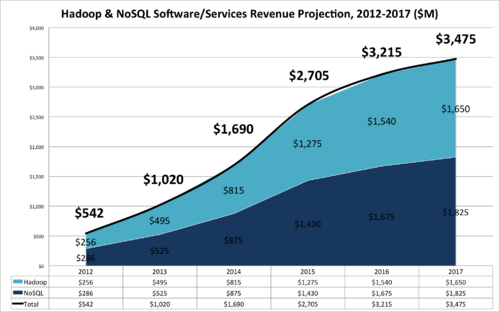

The market for Hadoop/NoSQL software and services topped $540 million in 2012 as measured by vendor revenue. Over the next five years, Wikibon forecasts this market to grow to nearly $3.5 billion, a compound annual growth rate (CAGR) of 45%. This forecast does not include related hardware revenue.

This is a faster rate of growth than the Big Data market overall during this period. Demand for new approaches for processing, storing, analyzing and delivering value from Big Data is the main catalyst driving the Hadoop/NoSQL software and services market.

While demand for Hadoop and NoSQL software and related products will grow as the volume of multi-structured data increases dramatically over the coming years, market growth could be tempered by a lack of skilled Big Data practitioners who allow enterprises to derive maximum value from the technology. Any weakness in software-only revenue is likely to be made up by interest in both Hadoop/NoSQL software appliances and cloud-based services, however.

Hadoop/NoSQL Software and Services Market Forecast, 2012-2017

The Hadoop/NoSQL software and services market reached $542 million in 2012 as measured by vendor revenue. This includes revenue by Hadoop and NoSQL pure-play vendors – companies such as Cloudera and MongoDB – as well as Hadoop and NoSQL revenue from larger vendors such as IBM, EMC (now Pivotal) and Amazon Web Services. Wikibon forecasts this market to grow to $3.48 billion in 2017, a 45% CAGR during this five year period.

Of the two market sub-segments, NoSQL is the slightly larger. Revenue for NoSQL software and services made up $286 million in 2012 and is forecast to reach $1.825 billion in 2017. The Hadoop market reached $256 million in vendor revenue in 2012 and is forecast to grow to $1.650 billion in 2017.

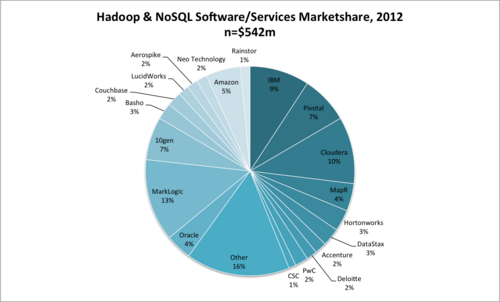

Market Share

Indicative of a young market on the verge of significant growth, no fewer than six vendors have 7% market share or more. The three top market leaders as measured by market share are MarkLogic (13%), Cloudera (10%) and IBM (9%).

| Vendor | Market Share |

| MarkLogic | 13% |

| Cloudera | 10% |

| IBM | 9% |

| MongoDB | 7% |

| EMC (Pivotal) | 7% |

| Amazon | 5% |

| MapR | 4% |

| Oracle | 4% |

| Hortonworks | 3% |

| DataStax | 3% |

| Basho | 3% |

| Accenture | 2% |

| Deloitte | 2% |

| PwC | 2% |

| Aerospike | 2% |

| Neo Technology | 2% |

| LucidWorks | 2% |

| RainStor | 1% |

| CSC | 1% |

| Other | 16% |

What’s particularly interesting is the diversity in the balance of software versus services revenue among the many market participants, the different business models, and the range of vendor size and age.

Mega-vendors IBM and EMC, for example, priced their respective Hadoop software products extremely aggressively in 2012 to spur the sale of related database products and professional & support services, the latter of which accounted for the vast majority of each vendor’s Hadoop-related revenue. Others, such as Aerospike and DataStax, derive the majority of their revenue from software sales with relatively little revenue coming from consulting.

From a business model perspective, most vendors in this market provide free core open source Hadoop/NoSQL software monetized by subscription management software/support services and consulting/training services. But some, such as Hortonworks, strictly adhere to an “all open source” strategy, while others, such as MapR, include proprietary value-add software to a core open source distribution. There are also professional services-only vendors, such as Accenture and PwC, and cloud vendors – Amazon – rounding out the market.

The oldest vendor in the Hadoop/NoSQL market in 2012 was 165 years old (Deloitte) and the youngest was just over a year old (Hortonworks.) The largest by employee size has over 434,000 employees (IBM), while dozens of vendors have 100 or fewer employees when “other” is taken into consideration. The majority of “other” is made up of hundreds if not thousands of ‘mom-and-pop’ consulting shops.

Market Drivers

The market is being driven by the growing enterprise demand for more flexible, scalable and affordable data management solutions (both analytical and transactional) than currently offered by the relational database management market, which is dominated by Oracle, and the data warehouse market (itself a sub-segment of the RDBMS market), the traditional stronghold of Teradata.

While Hadoop and NoSQL commercial offerings have yet to take significant market share from Oracle and other relational database vendors, Wikibon is aware of a number of Hadoop and NoSQL customer wins that are direct replacements of traditional relational database systems. In some cases, the results were multi-million dollar lost accounts for the incumbent relational database vendors.

The technology itself is also becoming increasingly mature, as enterprises demand better security and management capabilities. Enterprises reluctant to invest in Hadoop and NoSQL technology one or two years ago are beginning to do so, including companies in industries with significant compliance, regulatory and security requirements such as financial services and healthcare.

Adoption Barriers

Despite the remarkable growth prospects for the Hadoop/NoSQL market, there are still considerable adoption barriers that could derail its ascent. According to feedback from the Wikibon community, many enterprises are reluctant to invest in commercial Hadoop and NoSQL technology due to the lack of trained administrators and developers to both manage/optimize the technology and (in analytic use cases) to derive insights from Big Data.

And while vendors are quickly adding enterprise-grade features, some CIOs and IT Directors still feel the technologies are not ready for primetime. There is also trepidation due to the state of market participants as noted above.

Finally, while Hadoop/NoSQL vendors provide technology that makes up a platform for Big Data, there is still a need for more Big Data applications – both packaged analytic and transactional “out-of-the-box” applications and application development tools that allow enterprise developers to build custom Big Data apps – to enable enterprises to extract the full value of Big Data.

Wave of Consolidation

Wikibon believes the success of Hadoop and NoSQL pure-play vendors and subsequent pressure they are putting/will put on industry mega-vendors will lead to a wave of consolidation in the next one to three years. Vendors like IBM, Teradata and Microsoft have already established strategic partnerships with key Hadoop and NoSQL vendors, a harbinger of acquisitions to come.

This inevitable consolidation will have both positive and negative consequences for enterprise customers. A vibrant ecosystem of independent if relatively immature pure-play vendors provides enterprise customers numerous choices, deployment models, and capabilities. However, navigating such an ecosystem, which is rapidly evolving and interconnected by complex partnerships and reseller arrangements, can be challenging and make roadmap planning uncertain.

As the industry consolidates, this complexity will be lessened. Mega-vendors will begin to better integrate Hadoop and NoSQL products with legacy data management and IT infrastructure, as well as add ever more mature security and management capabilities.

Those Hadoop/NoSQL pure-play vendors that are not acquired may attempt to go public. Both Cloudera and Hortonworks have stated publicly their intent to go public in the next 12-to-18 months.

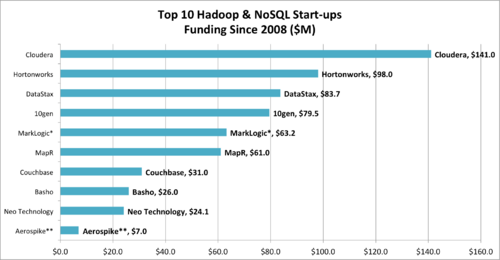

Hadoop/NoSQL Start-up Ecosystem

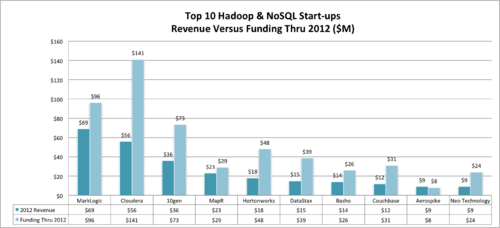

The Hadoop/NoSQL start-up ecosystem is the focus of much attention from venture capitalist on both coasts. Based on Wikibon’s analysis, the top ten Hadoop/NoSQL start-ups as measured by revenue (see full vendor revenue figures in “Big Data Vendor Revenue and Market Forecast 2012-2017”) have raised a collective $607 million in venture funding since 2008.

The top recipients of venture funding over the past five years are Cloudera, Hortonworks and DataStax.

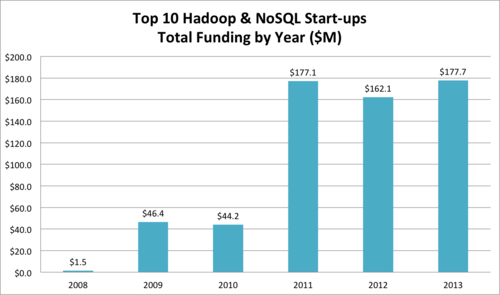

The $607 has been unevenly distributed during this five-year stretch. In particular, funding for the top 10 Hadoop/NoSQL start-ups jumped from $44 million in 2010 to $177 million in 2011, a 300% increase. 2011 was the year Hortonworks came into existence and the Hadoop wars essentially kicked off. During that year, Hortonworks raised $48 million, Cloudera $40 million and MapR $20 million. 2013 promises to be the largest in terms of venture funding yet, having already topped the high-water mark of 2011 in just 7+ months.

Wikibon also compared total funding to annual revenue for each of the ten top Hadoop/NoSQL start-ups, as well as revenue returned per dollar of venture funding. The average of the ten vendors is a revenue return of $.51 (based on 2012 revenue) for every dollar invested between 2008 and 2012.

While Wikibon does not believe the Hadoop/NoSQL market is over-funded at this time, it is in fact close to reaching that point. Ultimately, however, Wikibon believes venture funding for Hadoop and NoSQL start-ups will likely peak in 2013, followed by a gradual tapering as the market consolidates. An increasing percentage of venture funding will shift to the Big Data application market during this time.

Action Item: As with any young and developing market, enterprise CIOs and Big Data practitioners should closely evaluate not just technology requirements but also each Hadoop and NoSQL vendor’s business model, commitment to open standards and long-term viability. Expect significant market disruption over the next one to three years in this space. Hadoop and NoSQL start-up vendors should be as transparent as possible with customers on these points.