IBM’s acquisition of HashiCorp presents a pivotal moment for multi-cloud and hybrid cloud deployments. With a focus on aligning missions and accelerating growth, IBM intends to operate HashiCorp independently, akin to the Red Hat model. Synergies in product offerings, particularly Terraform and Vault, promise enhanced cloud operations. Financially, increased investment in R&D and cloud-hosted solutions is anticipated, leveraging IBM’s extensive customer base. Licensing discussions hint at potential adjustments, reflecting industry trends. Amidst integration challenges, preserving HashiCorp’s culture remains paramount. With implications for the cloud operating model landscape, including OpenShift versus VMware, the acquisition signifies a transformative phase for cloud infrastructure providers.

The acquisition of HashiCorp by IBM is one of the best outcomes for HashiCorp and multicloud and hybrid cloud deployments. IBM’s acquisition of HashiCorp will lead to aligning missions and the potential for accelerating growth of both the HashiCorp portfolio and adjacent technologies from IBM and Red Hat. IBM has stated that it plans to follow the Red Hat acquisition model, allowing it to operate many of its R&D and product functions independently of the other organizations in IBM. There was some immediate rationalization of products on the storage side, with the Red Hat storage technologies, such as Ceph, moving to IBM storage.

In a briefing, IBM announced that it aims to accelerate and expand HashiCorp’s mission by investing in R&D and leveraging IBM’s go-to-market distribution and channel ecosystem. This brings us to the first set of synergies and rationalization. We believe that IBM will rationalize HashiCorp’s back-office operations immediately after the acquisition closes. This will include some reorganization of the sales force as IBM and Red Hat have spent a considerable time finding the synergies in the selling motion, which are far more complimentary between HashiCorp and Red Hat than IBM proper. However, it is this work that IBM and Red Hat have put in on the non-product side that we believe will make this acquisition accretive for IBM.

Product Synergies

On the product side of the house, we see a ton of synergies and very little overlap in the product sets, and where there is overlap, it will be a chance to bring two products or technologies together to build a better one or rationalize. The main product customers are using is Terraform, which is outstanding for day zero operations, those operations for getting services up and running, configuring cloud services, and ensuring that configurations don’t drift. This is highly complementary and often leveraged by Red Hat’s Ansible for automation or day-one operation and day-two operations are provided by the IBM portfolio of observability platforms, such as Instana, Turbonomic, and Apptio. The next big product from HashiCorp is Vault, which provides secrets management capabilities.

Financial Opportunities

The often-sighted benefits of the acquisition include increased reach and trust with large companies and the ability to invest in HashiCorp product innovation at a rate greater than its current R&D. Year over year, HashiCorp grew its R&D expense by 12% to $222,553,000, its Sales and Marketing expenses rose by 4% to $369,164,000, and total operating expense grew 6% year over year to $728,716,000 for FY 2024. What is important to note is that these are where they intend to increase investment in R&D and find synergies and savings in the combined entity that will significantly reduce the $506,163,000 operating expense excluding R&D from FY 2024. What is also very interesting and a place where there are synergies between the Red Hat and HashiCorp models is HashiCorp’s transition to cloud-hosted solutions and support as a growth engine. With license sales only growing yoy at 5% and the support services growing at 17% yoy, the cloud-hosted grew 38% and eclipsed license revenue for the first time.

OpenShift + HashiCorp + Ansible = cloud operating model leader

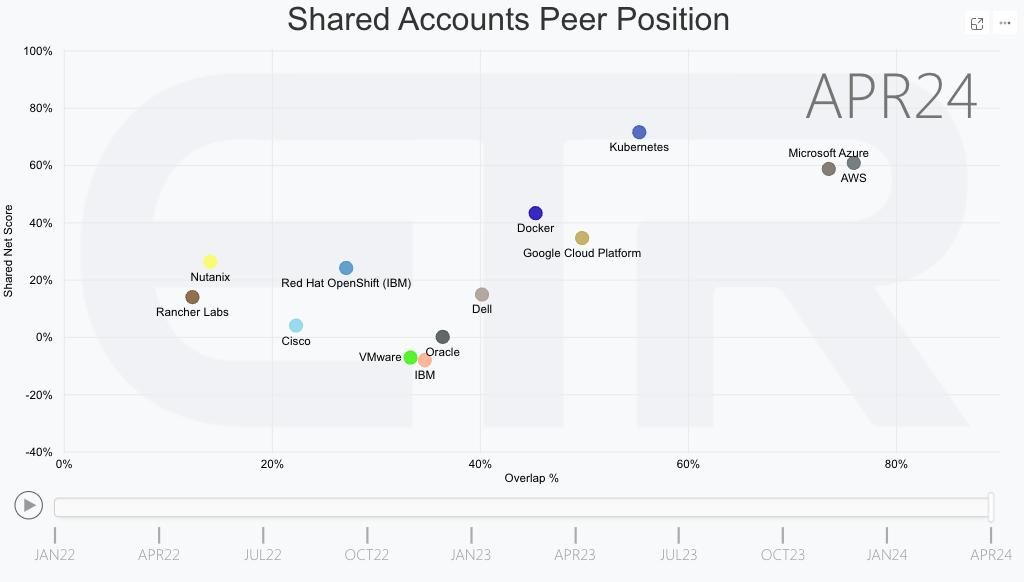

All three companies have built strong relationships with the Hyperscale cloud providers. HashiCorp has been seen as a way to increase hyperscale cloud consumption by making it easier to configure and deploy cloud-based services and build cloud-native applications. Both the Terraform and Vault are seen as early investments in cloud infrastructure, with Boundary being the privileged access management offering to provide identity-based user access to hosts and services across environments, which commonly includes on-premies and cloud deployments. Analyzing data from our partner Enterprise Technology Research (ETR) we can look at the Shared Accounts Peer Position for HashiCorp’s 291 customers that show up in the latest April 2024 tracking data. While the percentage overlap increases across the hyperscale clouds, like AWS, GCP, Azure, and Oracle, the shared net score decreases across the board. However, we also see a significant shared account and shared net score spending momentum affinity for AWS, Azure, GCP, Docker, and Kubernetes. IBM, VMWare, and Oracle have the least shared spending momentum in terms of shared netscore inside HashiCorp accounts.

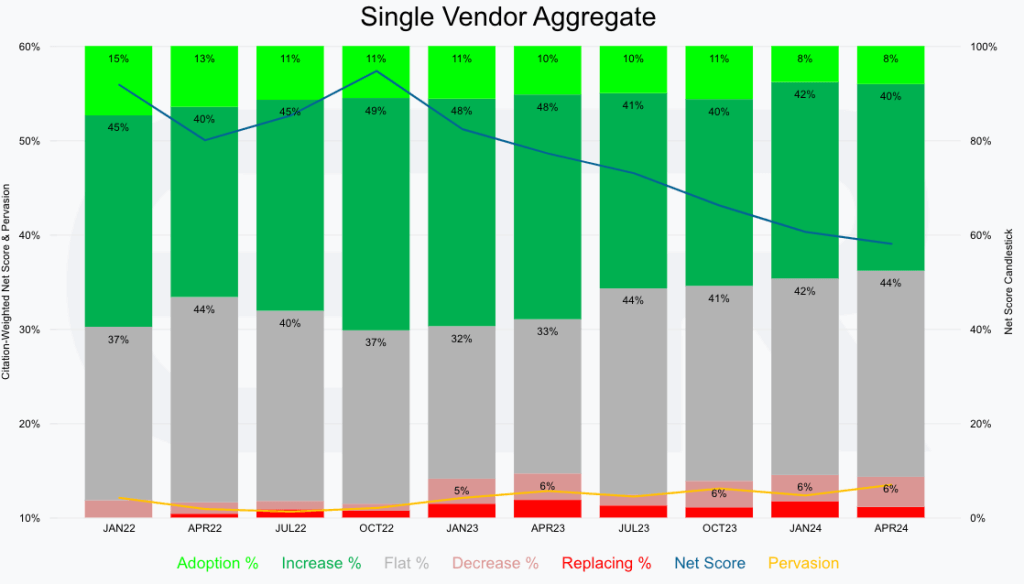

This is indicative when you look at HashiCorp individually from a net score and pervasion across the over 1700 organizations sampled by ETR. In this figure below, we see that growth inside HashiCorp accounts is has slowed over the last 2 years although at the same pervasion across the sample has stayed relatively the same. Meaning that once HashiCorp is in an account the are very sticky but may not grow fast. This is spelled out by a robust net score of 39% spending momentum in the latest sample from April 2024.

In the April 26th analyst discussion with David McJannet, CEO of HashiCorp, and Rob Thomas, Senior Vice President, Software and Chief Commercial Officer at IBM, it was noted that IBM boasts relationships with over 2000 Fortune 2000 commercial customers; compared to HashiCorp’s 500, the acquisition promises greater access to a broader customer base and enhanced geographic scale.

Elephant in the Room, Licensing

An essential aspect of the discussion revolves around licensing, with inquiries raised about potential changes post-acquisition. In that same April 26th analyst discussion with David McJannet and Rob Thomas, the significance of open-source licensing models in enabling business operations was acknowledged. They point to precedents set by other industry players changing from fully open licensing models to more restrictive private licensing. McJannet highlighted the need for rational licensing decisions to support the evolving market landscape. While no concrete announcements are made during the call, the executives indicate a nuanced understanding of the licensing dynamics, hinting at possible adjustments aligned with industry trends and business imperatives. Terraform was a Mozilla Public License (MLP) before going to a business source license (BSL), to solve for the weak “copy-left” permissibility of MLP. Having examined this for companies, what McJannet said about percentages of contributions from your organization versus those from outside organizations is critical. When organizations are producing more than 95 percent of the code, ignoring documentation contributions, you have to ask yourself if you really are an open source or a commercial software company with a very permissive “freemium” model. That being said, you can have a community license that has exclusions. This usually means restrictions around other organizations making the software available for a distributed software product, a software-as-a-service, a platform-as-a-service, an infrastructure-as-a-service, or other similar online service that competes with any products or services the originating company offers. The trick is that if your entire product is licensed in this manner, you are saying it is commercial software with a freemium model to try it or for organizations using it as intended internally. This can be limiting from a total addressable market (TAM) perspective for the company, with large companies rolling their own and hiring their maintainers, but this is usually not an issue.

Post-acquisition integration

One piece to watch is how the culture of HashiCorp is preserved during the integration time frame post-acquisition closure. Having been acquired a few times and been a part of making acquisitions, it is a super important time for setting the proper cultural expectations. There is no way to preserve all the cultural aspects of the previously independent company.

Our Perspective

Leading into Red Hat Summit and Ansiblefest this week, we expect to hear nothing about this formally. What will be very interesting are the hallway conversations with customer and their views on what this might mean for them. We believe that IBM, Red Hat, and HashiCorp have a chance to continue growing into a formidable option when organizations are determining their cloud operating model with the changes going on at VMWare by Broadcom.

ETR notes that “among the 850 customers citing a spending intent on VMware in this sector, Red Hat has an almost 29% shared customer overlap percentage, whereas HashiCorp has about 19% share in that same respondent sample. However, HashiCorp’s spending intentions are materially higher among VMware customers than they are with Red Hat, with a 43% shared Net Score versus 34% for Red Hat. Both are healthy Net Score levels, but HashiCorp’s 40%+ shared Net Score shows particular strength and demonstrates the opportunity to take any share in this market that becomes available due to the VMware acquisition by Broadcom and additional channel partnership turmoil that has happened” in their blog about the deal from April 26th.

While we think it is early days for re-platforming from ESX to OpenShift Virtualization via the KubeVirt project, we expect this to continue to be a thorn in VMWare’s side. But we expect some very large customers to be on display this coming week at the Red Hat Summit. One of the pieces that was missing for Red Hat and IBM was the day 0 operations. And HashiCorp absolutely plugs that hole and more. IBM has really focused on becoming the software and services cloud-operating-model arms dealer across all clouds, be it hyperscale, hybrid, or private.

We are in “wait and see” mode regarding licensing, and we would say that most HashiCorp customers will be, too. We see both sides of the argument but do expect some changes. We doubt that Terraform will go back for MLP or to an Apache license that would be required for entry into the CNCF. That being said, we believe there will be changes here, and some parts may return to a more permissive open-source license, just not everything.

Here is a video of us discussing the HashiCorp acquisition during a recent AnalystANGLE during the IBM: Future-Ready Storage launch cast.