Earnings reports from the big three cloud players disappointed investors this week. All three US hyperscalers fell a bit short of consensus for their cloud revenues in the December quarter and investor reaction has been negative. But squinting through the data, there’s a lot to like about the position of AWS, Google Cloud Platform and Microsoft Azure. In particular, the IaaS and PaaS revenue alone for the Big 3 approached $200B in 2024 and grew 25%. All three cited capacity constraints and, along with Meta, are committing more than $300B in CAPEX spend this year, most of it to support current and future AI demand. As is often the case, when a new wave hits, it tends to be overhyped at the beginning of the cycle and underestimated at the eventual steady state. In between points A and B we often see blips and bumps that represent opportunities for long term investors.

In this Breaking Analysis we review the latest quarterly reports from the cloud giants and update our 2024 market data for IaaS and PaaS. With some survey data from ETR that shows Google making strong progress in AI, despite concerns from investors.

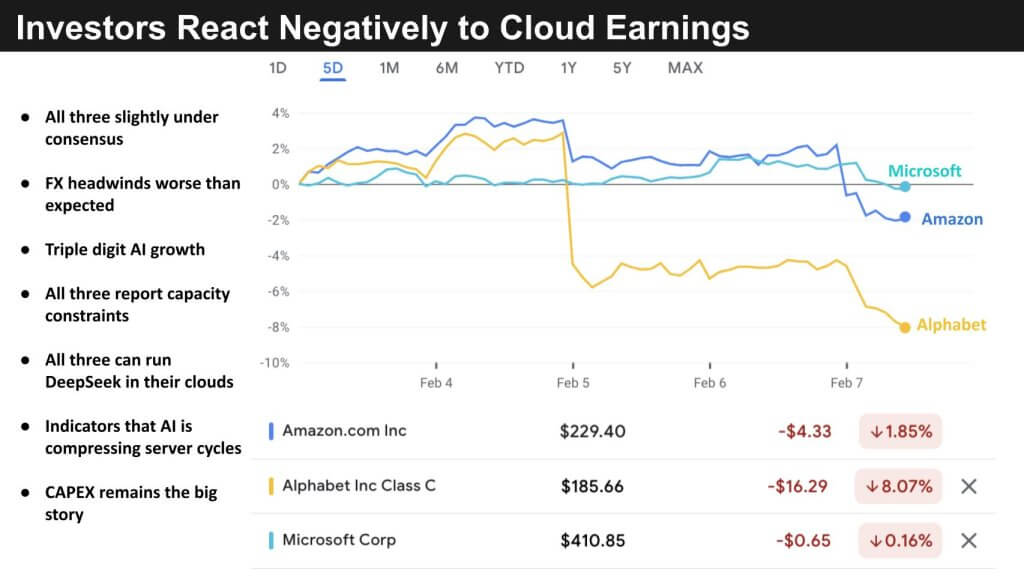

Cloud Momentum not Enough for Wall Street

Let’s start with a quick look at the reaction investors had to earnings prints from Microsoft, Alphabet and Amazon. Below is a five day price chart for those three firms. By no means were these bad reports. But all three came in slightly under consensus for their cloud businesses. At the same time, all three were hit with higher than forecasted currency headwinds.

As an example, we tweeted out Thursday morning our expectation that Amazon would report $29.1B in AWS revenue. They came in at $28.8, just under our forecast. But if you adjust for FX headwinds we estimate the number was right on our forecast.

Notably, all three cloud firms are experiencing triple digit AI growth and each company cited capacity constraints. Not surprisingly, all three can now run DeepSeek in their clouds.

You may recall last year, we posited that AI would compress server cycles and Amazon reported that AI is accelerating server cycles and will make changes to its depreciation schedule and shorten the useful life of certain equipment from six years to five years, which will negatively impact the income statement.

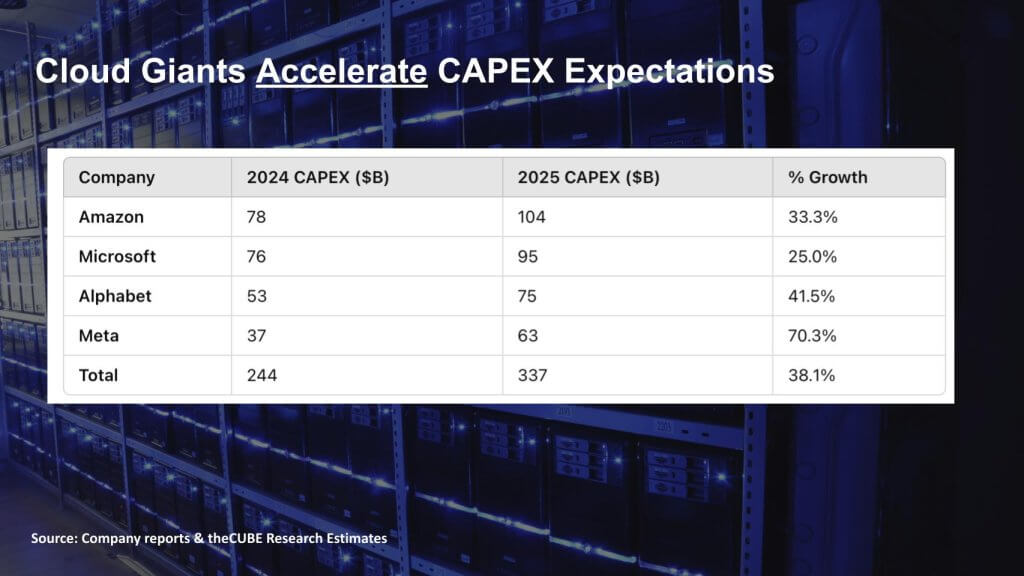

It’s all About the CAPEX

But the big story remains CAPEX. Short term traders don’t like when companies spend gobs of money for long term benefit. They want it all now. They want trees to grow to the moon and they want CFOs to beat and raise every quarter. Well markets don’t work that way. They’re choppy, sometimes ugly and often unpredictable.

With that said – Sundar, Satya, Andy and Zuck are ignoring the market reactions and doubling down on their CAPEX spend this year. Just look at the forecast for spending in 2025 compared to 2024, which was enormous in its own right.

As shown in the table above, In 2024 these four firms spent nearly $250B in CAPEX and are increasing that by 38% collectively this year. Despite all the concerns about DeepSeek, these companies are loaded for bear in a high stakes poker game that they believe is not a winner take all scenario.

Is the market’s reaction to DeepSeek wrong? Or do these CEOs, all of whom clearly buy into Satya Nadella’s spot on tweet about Jevons Paradox, see the world differently. Consider this…In a recent ETR Flash Survey, 68% of respondents said if AI tools were less expensive their organizations would be investing much more.

In a recent ETR Flash Survey, 68% of respondents said if AI tools were less expensive their organizations would be investing much more.

ETR Flash Survey, February 2024

History in tech tells us that 68% is conservative.

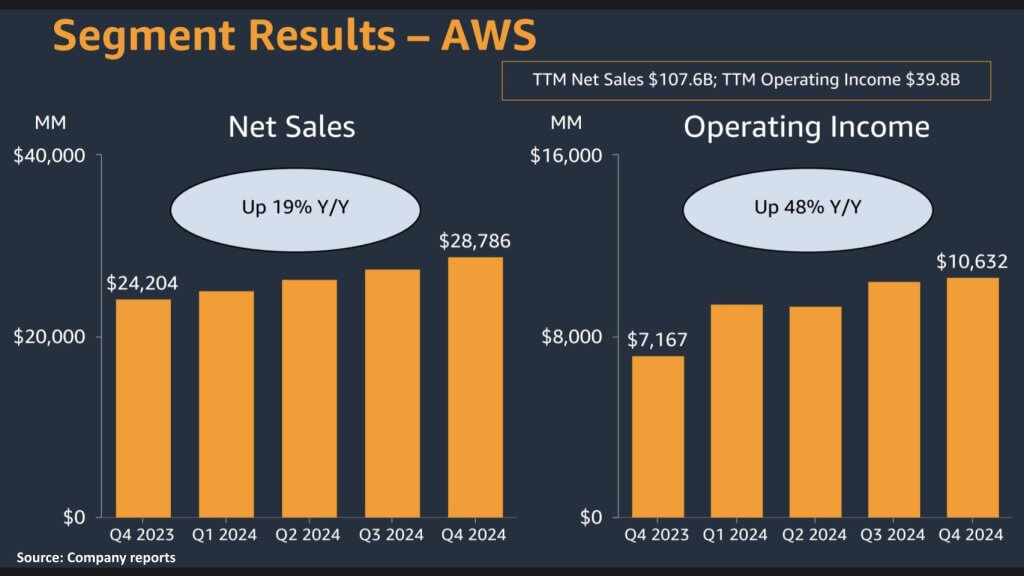

The Cloud is Highly Profitable at Scale

What’s more is the cloud is throwing off cash. Even Google Cloud, which was burning cash until last year, is showing progress on the bottom line. Just look below at AWS’ results to see how profitable the cloud is at scale.

AWS’ Operating profit last quarter was $10.6B or 38% of revenue. Up from $7.2B or 30% of revenue a year ago. A nearly 50% increase in operating profit. That’s on a business running at $115B annual rate. And to reiterate, AWS along with the other two US hyperscalers are capacity constrained by chips and certain other components.

A $210B+ Market Grew at a 28% CAGR Since COVID

The Hyperscaler Market Will Double by the End of the Decade

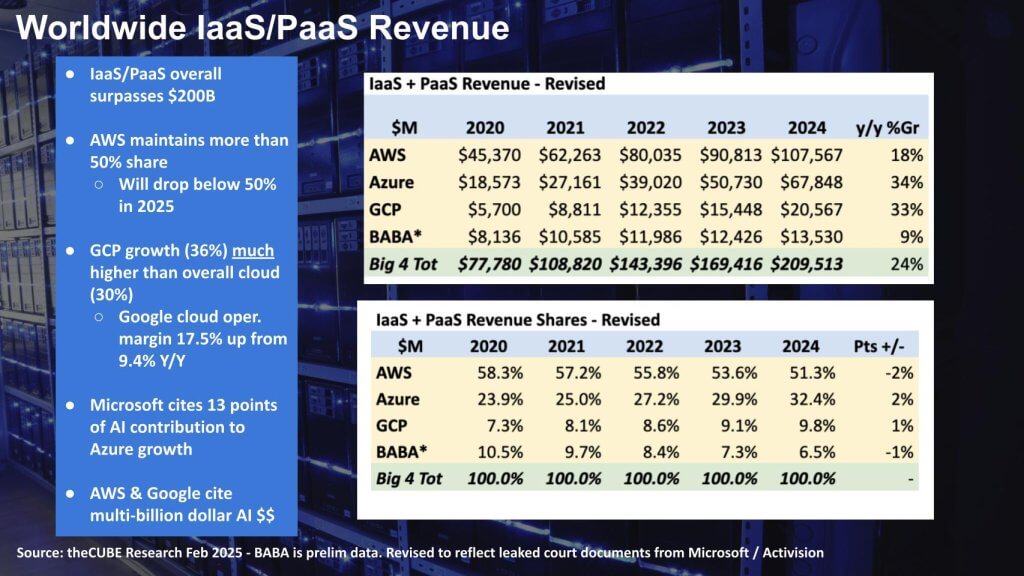

Let’s look at the numbers in more detail. Below is our annual look at the IaaS and PaaS markets over the last five years.

We’re showing the big 3 US players plus Alibaba accounted for $210B in revenue in 2025. That’s 24% growth on a $200B market, with Azure and GCP growing in the mid 30’s. As you may recall, in 2023, we adjusted our Azure figures to strip out some of the non-cloud revenue. Then Microsoft restated its definitions in 2024 which we account for here. AWS has maintained 50% of the market in this view but will drop below 50% this year.

We’ll be sharing our 2025 forecast in future Breaking Analysis Episodes but if you assume a 15% CAGR for these four players the market will approach $425B by the end of the decade.

The hyperscale cloud market will approach $425B by the end of the decade.

theCUBE Research, February 2025

Google Cloud Growth Disappoints Investors but GCP Momentum is Strong

Now a note on GCP. Google cloud overall grew at 30% in the quarter but we had GCP growing at 36%, much higher than Google cloud overall. This is based on statements made by Google and our own estimates. Remember, Google doesn’t report a GCP revenue or growth number, we have to deduce from breadcrumbs, surveys and other research. Same with Azure in a way. Microsoft reports Azure growth rates, not absolute dollars. They both do this because they don’t want to concede anything to AWS. The other key point on Google is its cloud operating margin is now approaching 20%, whereas a year or so ago it was bleeding cash.

Our estimates show GCP growing at 36%, much higher than Google cloud overall…

Microsoft, AWS and Google all report multiple billions off dollars in AI Revenue. So it’s understandable that three firms spending more than $200B in CAPEX last year to capture the AI opportunity and are “only” generating multiple billions from that investment has the market a little freaked out.

Big 3 Players Have Momentum and a Large Base to Sell AI Services

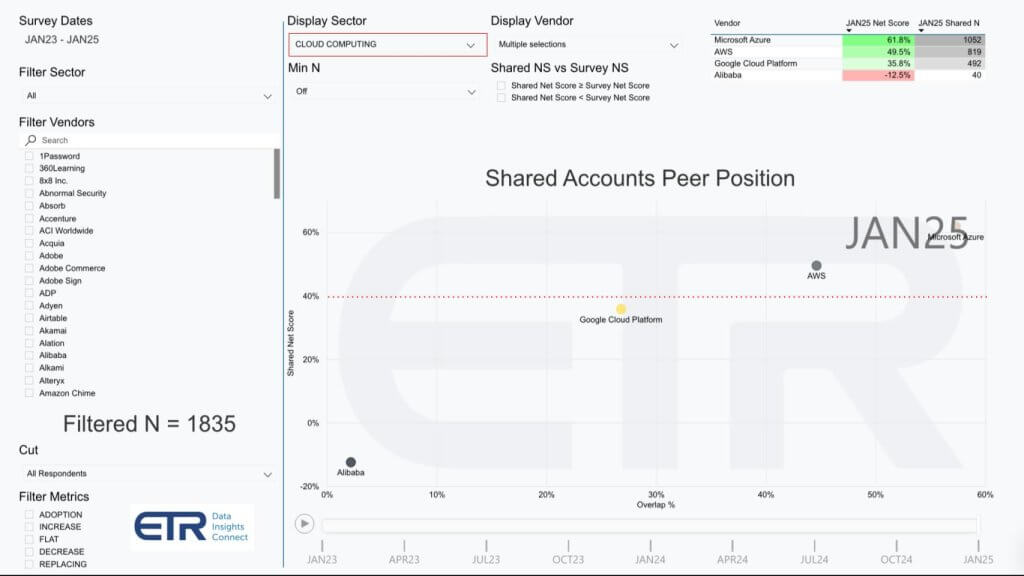

Let’s go to some ETR data. Below we show an XY view that we like to share with you our audience. The vertical axis is Net Score, and that’s a measure of spending momentum. On the horizontal axis it shows Overlap. That’s the penetration in the data set of 1,835 accounts. Below we show the big four. Microsoft Azure in the upper right, AWS, Google Cloud, and Alibaba. Now, you might be wondering…you just showed us that AWS is larger than Azure, why does Azure show a higher penetration.

The main reason is the ETR data shows account penetration with no indicator of dollars spent. Because Microsoft is ubiquitous it shows up on this chart as more highly penetrated.

A couple of other points are relevant.

That red line at 40%, that indicates a highly elevated spending momentum. In the upper right, you can see the Net Score and the Ns. That’s what informs the dot plot. We don’t put too much weight on Alibaba here because we only have 40 N, but the other three, we weigh heavily given the larger samples.

Microsoft and AWS are far to the right, Google Cloud Platform kind of hovering on that red line.

Google’s AI Momentum is Notable – Closing the Gap on AWS

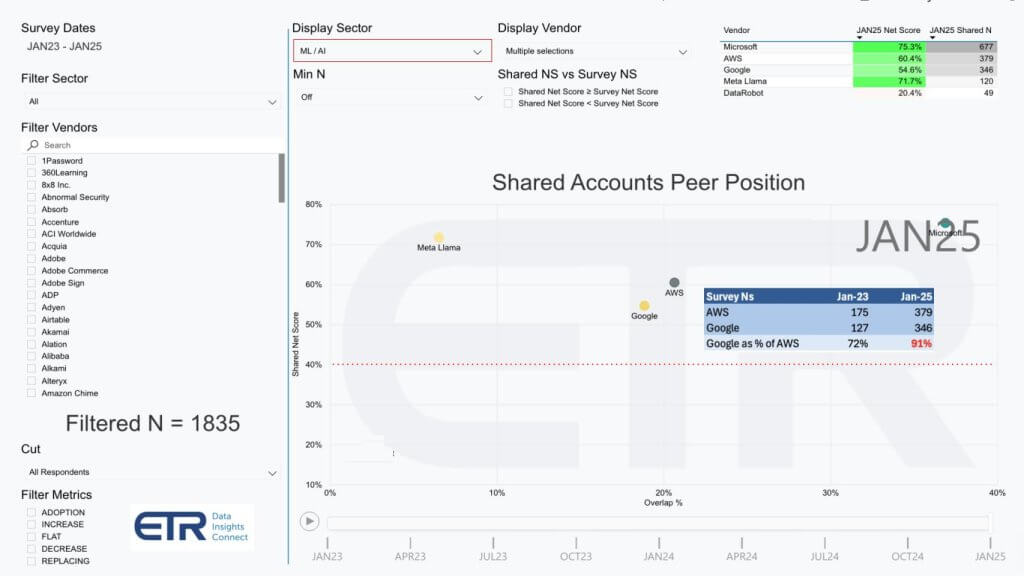

The data below filters on just the machine learning and AI sectors This is the same XY dimensions as above (Net Score by Penetration). What you see however, is that AWS and Google are much closer here than they were on the previous chart. We’ve also added Meta Llama to this view and you can see Meta is way up on the vertical axis. Note that all of these players are well above the 40% line.

But what’s even more interesting is look at that table that we inserted comparing AWS and Google. It shows survey Ns, and we went back to January 2023 and looking at January 2025, look at how Google is closing the gap in AI on AWS. Back in January 2023, AWS had 175N to Google’s 127 or the bottom line there, the bottom row, Google as a percentage of AWS at the time was 72%. A couple of things happen as we go out two years. The Ns dramatically increased. AWS is now 379 and Google 346, but Google is now 91% of AWS. So it’s closing in on its AWS competitor. So that just underscores Google’s strong position in AI.

And look, Google cites its strong tech stack, which we’ve always said it has. And so Google, again, this is not a winner-take-all market. It’s very rare that markets have three leading companies like we have today, but because the markets are so large, three companies can dominate and make a lot of money. Normally, the leader makes all the money. Number two, makes a little bit of money, and number three barely breaks even or gets out of the market. It’s the old Jack Welch. You got to be number one and number two in the markets. When the markets are this large, that’s not the case. You can come up with highly differentiated strategies. As for instance, you can see now from both Oracle and IBM, both have clouds. Both are in the game. They’re not at the same scale as the big three hyperscalers, but they have highly differentiated strategies that are winning.

So you can essentially got five companies and more, add onto that Snowflake and Databricks. So these markets are just so enormous. So when we think about the negativism from the last earnings prints, just think in terms of the future size of the market. And this is why these three or four firms are spending so much money on CapEx because the opportunity is so large.

The following key points assess the competitive position in ML/AI using ETR survey day, comparingAWS and Google. The data tells us, in terms of account penetration, Google is closing the gap with AWS. That said, we emphasizes that multiple major vendors—including AWS, Microsoft Azure, and Google—can thrive due to the sector’s scale, with additional players like Oracle, IBM, Snowflake, and Databricks carving out meaningful niches. Despite intermittent negative earnings sentiment, the overall opportunity remains significant, underpinning continued high levels of capital investment among leading providers.

Key Points in the Data

- AI Competitive Gap Narrowing: Data from January 2023 to January 2025 shows Google moving from 72% of AWS’s total accounts in the sector to 91%, reflecting a substantial acceleration in Google’s AI penetration.

- Not a Winner-Take-All Market: We note that, unlike typical market scenarios where a single leader dominates revenue, three major hyperscalers can simultaneously generate strong returns, supported by the market’s vast size.

- Differentiated Strategies: Oracle and IBM are examples of other providers that, while operating at smaller scale than the leading trio, maintain profitable niches through offerings that are differentiated.

- Multiple Growth Paths: The market also accommodates specialized firms such as Snowflake and Databricks, which can build on top of the cloud, further reinforcing the flexibility and breadth of the cloud ecosystem.

- Positive Long-Term Outlook: Recent earnings concerns do not diminish the future potential of the cloud and AI sectors, as evidenced by substantial ongoing CapEx investments from the top players.

The data indicates that Google is rapidly closing the AI gap with AWS when measured in account penetration, underscoring Google’s strong technology platform. At the same time, the exceptionally large cloud market allows multiple companies—big and small—to succeed with focused, differentiated strategies. Despite any short-term earnings headwinds, sustained capital expenditure across the industry is a strong indicator of confidence in the long-term growth trajectory.

Closing Thoughts

The current environment is marked by short-term skepticism toward cloud investments, yet executive teams are doubling down on AI-driven strategies with the expectation of massive future returns. Despite concerns around high CAPEX, the potential payoffs and efficiency gains offered by AI are compelling, pushing CEOs to avoid missing what many view as the greatest opportunity in tech history. Cloud maturity, combined with next-generation AI, will continue to redefine competitive advantage, and leading firms are racing to be at the forefront. While financial headwinds like foreign exchange (FX) might temper enthusiasm, they have the effect of sharpening AI-centric initiatives. As seen in Microsoft’s latest earnings call, this focus on AI can sometimes distract from traditional workloads, reflecting a broader industry transition. Nevertheless, the foundational infrastructure of the cloud will remain critical to enabling future AI innovations, and cost reductions in AI tooling—evidenced by DeepSeek—are likely to accelerate adoption.

Key Observations

- Strategic Realignment

Executive teams continue to invest heavily in AI despite lukewarm investor sentiment on cloud spending, viewing AI as both an innovation catalyst and a path to substantial new revenue streams. - Cost vs. Opportunity

Although soaring CAPEX raises caution among investors, AI’s upside—especially in driving operational efficiencies—is too significant for CEOs to overlook. Management teams recognize that failing to act risks missing the largest growth driver in tech. - Competitive Edge

As cloud services mature, the next wave of AI capabilities emerges as the leading differentiator in the market. Firms are compelled to move aggressively, anticipating that AI leadership will be essential to sustaining long-term relevance. - Market Catalysts

Short-term financial pressures (including FX concerns) may dampen cloud spending enthusiasm, yet they also intensify AI investment focus. Organizations see AI-first initiatives as a crucial means to deliver transformative, long-term value. - Long-Term View

Regardless of near-term market sentiment—whether investors lean in or pull back—cloud infrastructure remains vital for powering AI. Entities that invest prudently in both cloud and AI today are positioned to realize outsized gains in the future. - Lower Costs to Deploy AI

The ongoing evolution of AI solutions, exemplified by the DeepSeek experience, indicates that lowering deployment costs will ignite broader adoption. The emerging consensus is to prepare for significant surprises as this technology evolves rapidly.

Bottom Line

Despite the current skepticism toward cloud spend, the imperative to capture unprecedented AI opportunities drives continued high levels of investment. Firms that successfully manage near-term cost concerns while positioning for AI dominance stand to reap substantial rewards, validating the cloud’s indispensable role in the AI revolution.

How do you see it? What’s your reaction to the market reaction? Is the market signaling “icebergs ahead” or is this an opportunity for long term thinkers and investors?

Let us know your thoughts…