In our view, IBM delivered one of its strongest quarters in recent memory, reinforcing a narrative we’ve tracked for some time – i.e. the pivot from legacy to a modern, AI-driven hybrid cloud company is finally showing up in the numbers. The company beat expectations across revenue, profit, margin, and free cash flow, and perhaps more importantly, demonstrated credible traction in software, AI, and infrastructure innovation.

But investors remain concerned about the trajectory of IBM’s software business and have concerns because they’ve seen this movie before. The difference this time, we believe, lies in execution. With a software mix approaching 45% of revenue, a $7.5 billion AI book of business, and early success with the new z17 cycle, IBM is in position to continue its durable growth story through 2026 and beyond.

Key Takeaways

- Broad-based outperformance: IBM delivered Q2 revenue of $17B (+5% cc), with software up 8%, infrastructure up 11%, and operating EPS of $2.80. Adjusted EBITDA grew 16%, with margin expanding 200bps.

- Software traction builds but mix impact concerns investors: Red Hat grew 14%, OpenShift ARR is now $1.7B, and Automation was up 15%, aided by HashiCorp integration. Despite these bright spots, Transaction Processing remains a drag in the near term, down 2%.

- z17 cycle starts strong: IBM Z revenue jumped 67% YoY. We expect customers to embrace IBM;s embedded AI-at-the-core strategy. Its new Telum II chip promises to enable in-line inferencing with millisecond latency, obviating the need for off-platform compute.

- IBM touts its AI book – looks like real revenue: GenAI software and consulting bookings north of $7.5B. AI now represents 10%+ of Consulting revenue. IBM is embedding AI across internal workflows and positioning watsonx as a full-stack, multi-agent, enterprise platform.

- Consulting stabilizes: Flat YoY, but backlog grew 8% with 13% growth in net-new client signings. IBM’s Consulting AI pipeline now exceeds $6B, with >3pt margin premium. IBM signaled that cautious optimism is warranted given macro and discretionary spend pullbacks.

- Raising guidance selectively: IBM lifted its free cash flow guidance to more than $13.5B for FY25 and now expects 5%+ revenue growth, citing improved mix and productivity gains. Software is tracking toward ~10% growth despite headwinds from Transaction Processing.

Strategic Commentary

For more than a decade, IBM has been synonymous with deep R&D, industry vertical depth and dependable cash flow, but has struggled with stagnant revenue growth and difficulty commercializing R&D. The Arvind Krishna era has largely addressed these shortcomings and was defined by strategic clarity, strong M&A moves to shore up the software portfolio (Red Hat, HashiCorp, Apptio, Datastax) and a clear focus on hybrid cloud and AI. We believe Q2 2025 represents a culmination of that strategy and is hitting a good stride.

The pivot to a stack model around watsonx is especially notable. Unlike hyperscalers who emphasize massive foundational models, IBM is doubling down on what we call “enterprise AI” – i.e. smaller, domain-specific models governed and delivered as part of a broader automation and orchestration portfolio. With over 150 prebuilt agents and tight integrations with third-party ecosystems (Oracle, Salesforce, Box, AWS), IBM is aiming to make Orchestrate a real platform, not a collection of point products.

We believe the company’s approach to AI reflects its strengths – i.e. ability to work with complex workloads, regulatory environments, and deep entrenchment in mission-critical IT. IBM is avoiding the consumer battles and continues to rely on Red Hat to gain developer mindshare. Regardless, the enterprise continues to be IBM’s wheelhouse.

On the infrastructure side, the overall business grew 11% on the strength of the new z17 cycle. Distributed Infrastructure, comprising storage and Power11 faced headwinds and was down 17%. Both of these areas are off cycle. The recent Power11 announcement should stem the bleeding and storage should benefit from the z cycle.

But Z is the real story for infrastructure. In our view, the z17’s native inferencing capabilities give IBM a clever angle to keep mainframe clients sticky while tapping into the GenAI wave. Telum II could become a differentiator for real-time financial, insurance, and telecom workloads where latency and reliability are non-negotiable.

HashiCorp’s integration also deserves credit. We view the combination of Hashi, Red Hat, and IBM software as a modernized offering that gives IBM a credible story in multi-cloud, platform orchestration, and secure automation.

Software Growth Skepticism: Short-Term Volatility vs. Long-Term Transformation

Despite a beat across the board in Q2, IBM shares were under pressure, down 7-8% the day after its earnings print and another 1% the following day. Wall Street is fixated on a deceleration in organic software growth and its implications for margin sustainability. In our view, this reaction overlooks the structural improvements IBM has made to its software mix, operating leverage, and strategic focus over the past five years.

The Bear View: Margin Compression and Slowing Organic Growth

- Investors point to decelerating organic software growth – estimated between 3%–4% in Q2 – as a warning sign, despite headline software growth of 8% (14% Red Hat, 15% Automation).

- Transaction Processing revenue declined 2% and remains a drag, as clients prioritize spend on z17 hardware early in the cycle.

- Gross margin improvements from a higher software mix notwithstanding, analysts are questioning whether IBM’s software expansion is sufficiently high-margin and recurring to justify a premium multiple.

- Concerns persist around execution risk in scaling GenAI offerings, integrating recent acquisitions, and sustaining growth, post-peak hardware refresh cycles.

The Bull Case: IBM has shifted from a Services- to a Software-Led Company – A Major Structural Shift

- In our opinion, these concerns miss the forest for the trees. Software now represents ~45% of IBM’s revenue base, with ARR growing 10% YoY to $22.7B, driven by high-retention, multi-year contracts.

- Red Hat, OpenShift, and HashiCorp are foundational to modern hybrid cloud and automation architectures. These are not outdated middleware assets, they are an infrastructure layer that can be positioned along with watson for AI-era apps.

- IBM’s fastest-growing software segments are Automation (+15%) and Hybrid Cloud (+14%). These are expanding faster than the broader IBM portfolio, fueled by AI and multi-cloud demand.

- The slowdown in Transaction Processing is a concern but likely cyclical, not structural. Historically, TP spend lags hardware adoption by 1–2 quarters, and IBM is already guiding for a rebound in H2.

- Gross margin improvements of +230bps this quarter, and the company raising its full-year pretax margin expansion underscore the shift in mix toward software.

We believe the Street’s reaction to the IBM earnings print under-appreciates the degree to which IBM has remade itself into a software-first company with a more durable recurring revenue model and better clarity from a go-to-market standpoint. IBM has a playbook for monetizing AI at the platform level. While short-term volatility around growth mix is real, the long-term setup is substantially improved relative to previous IBM regimes.

IBM Z: Early Cycle Strength and the Multiplier Effect

In our view, the launch of z17 represents a strategically important milestone for IBM’s infrastructure and software franchise; and the first in the AI cycle. Not only did IBM Z deliver 67% revenue growth in Q2, but this momentum is landing at the very front end of the platform cycle, which sets the stage for broader revenue and margin gains through 2026.

For IBM, this is not just a hardware refresh it should be a platform moment that cements its largest and most strategic customers. While hyperscalers like AWS target mainframe migration, IBM must defend its base and attract enhanced workloads by simplifying on-prem AI.

Why It Matters

- IBM Z is foundational. It sits at the intersection of hybrid cloud and AI. With the new Telum processor, IBM is positioned to deliver high volume AI inference operations at sub-millisecond latency on key transactional workloads. This eliminates data movement, lowers costs, and potentially unlocks new automation use cases for regulated industries.

- IBM claims that more than 70% of Z clients are maintaining or expanding MIPS capacity, underscoring the platform’s relevance. Several years ago, z17 was suffering from a shrinking base. Today it is building on top of a resilient foundation which should continue in our view.

The Multiplier Effect in Action

- The Z platform is unique in IBM’s portfolio for its “stack economics.” For every $1 in mainframe hardware revenue, IBM typically pulls through $3 to $4 in associated software, storage, services, and support over the cycle.

- We are still in the earliest innings. As indicated, historically, Transaction Processing software trails hardware deployment by 1–2 quarters. While TP was down 2% in Q2, IBM is signaling a return to low single-digit growth in H2 as customers ramp usage on newly deployed capacity.

- IBM’s broader software stack, including watsonx Code Assistant for Z, Vault, Concert, and watsonx.data, is increasingly being deployed directly onto z17. The platform is no longer a fenced off silo, rather it’s more closely integrated into the AI and hybrid cloud value proposition.

- IBM also claims Consulting engagements benefit as clients modernize core workloads and seek help integrating AI into mission critical systems. IBM guided that it is already seeing increased GenAI project activity tied to Z upgrades, and the upcoming Spyre Accelerator card is designed to extend watsonx agent orchestration into Z environments.

We believe the market’s reaction underestimates the catalyst that Z cycles play in IBM’s financial model. z17 is not a one-off bump, rather it’s an ignition point for a higher-margin, multi-year upgrade and modernization wave that touches nearly every corner of IBM’s stack. That said, it is subject to cyclicality and often major swings. The early signs are highly encouraging, and in our view, this cycle has significantly more runway.

Parsing Analyst Sentiment – Confidence in Strategy, Caution on Execution

While IBM delivered a strong operational quarter, the tone of analyst questioning on the earnings call shows a persistent undercurrent of skepticism around the sustainability of the company’s software growth narrative. Some analysts feel they’ve been burned by IBM in the past and there’s understandable caution. Wall Street’s focus wasn’t on the headline numbers, which IBM clearly beat, but rather the core software business.

The most consistent concern raised during the Q&A centered on organic software growth. Despite reported strength in Red Hat, Automation, and the integration of HashiCorp, analysts pressed IBM on what appeared to be a third consecutive quarter of underlying deceleration. The Street is watching closely to see whether IBM’s mid-teens growth in high-profile categories can offset weakness in more mature segments like Transaction Processing and data infrastructure. There’s concern that M&A-driven gains are masking a slower organic trend, raising questions about the true momentum of IBM’s software engine. Our view is it doesn’t matter if IBM can rapidly integrate and leverage its consulting business to accelerate adoption and time to value.

Margin dynamics were another point of concern. Analysts acknowledged IBM’s productivity gains and upward revision to operating margin guidance, but there were doubts about whether these improvements are sustainable beyond the current product cycle, particularly as the initial z17 hardware lift moderates and consulting remains pressured by the macro and the uncertainty around AI changing the business model. Many analysts are skeptical that IBM can turn that into an opportunity.

Some analysts also pushed IBM to clarify its outlook amid shifting macro conditions. While management struck an optimistic tone on global demand trends, particularly in Asia and the Middle East, analysts remained cautious on the potential for further delays in enterprise decision-making, especially in North America and Europe.

In short, analysts appear to believe that IBM’s strategic direction is sound, but they are looking for more clear, sustained proof that software-led growth can deliver at scale without relying heavily on acquisitions or hardware cycles. Until that conviction builds, the stock may continue to face pressure even in the face of strong execution.

ETR Spending Check: IBM Portfolio Momentum: Software Contribution is a Strategic Imperative

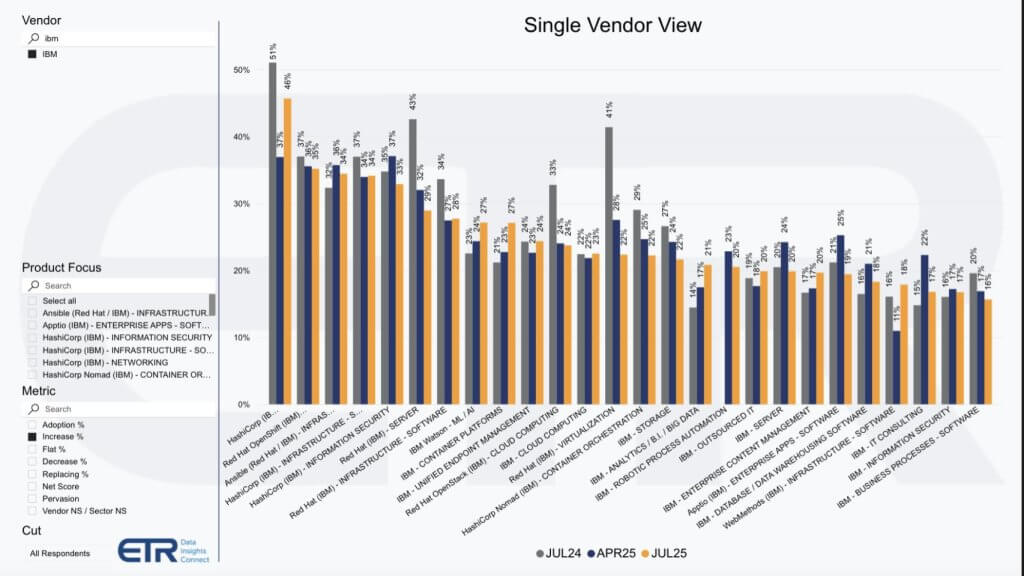

New ETR data tracking nearly 900 IBM customers offers a customer view into where IBM’s transformation is showing the most traction. The data below isolates the subset of those customers increasing spend by 6% or more year-over-year. By looking at those customers spending more, we get a clearer signal of where customers are accelerating adoption across IBM’s portfolio.

While many continue to question the durability of IBM’s software growth, this view highlights a company with momentum in the areas where it has bets – i.e hybrid cloud infrastructure, AI, automation, and security.

At the top of the list are HashiCorp and Red Hat OpenShift, two platforms central to IBM’s infrastructure-as-code and multi-cloud orchestration story. Over 46% of IBM customers report spending more than 6% YoY on HashiCorp, while 37% report similar increases on OpenShift. Both signal strong integration success and growing dependence on IBM as a core platform provider.

Watson AI, long seen as a narrative-heavy and execution-light effort, now shows 34% of IBM customers meaningfully increasing spend. That number has held steady across recent quarters and aligns with IBM’s reported $7.5B GenAI book of business.

Also worth highlighting:

- Ansible and Red Hat infrastructure software: 35–36% of customers are increasing spend, showing automation and open source remain compelling areas of growth.

- IBM Information Security and Unified Endpoint Management: both report meaningful customer spend increases, validating IBM’s play in trust and resilience.

Lower in the chart, however, IBM’s legacy application and data businesses – analytics, BI, database, and IT process software – show far less momentum. Most of these categories hover in the 15–22% range for increased spend, suggesting limited headroom and intensifying commoditization. WebMethods, for example, sits near the bottom at just 18%, reflecting its marginal role in the portfolio today.

This underscores IBM’s challenge balancing the half empty with the half full glass.

Still, the broader message is that IBM’s updated software stack – built around OpenShift, HashiCorp, Watsonx, and Red Hat’s developer ecosystem – has become the engine of customer value creation. These products are seeing sustained investment even as budgets tighten and enterprise buyers scrutinize spend.

In our view, this level of focus, consistent and concentrated customer expansion is more indicative of durable growth than quarter-to-quarter fluctuations in headline prints. The market may still be processing the transition, but customer behavior is signaling belief in IBM’s direction.

Still Questions Remain

The core question now is whether IBM can sustain this performance. Software organic growth is decelerating – something the company attributes to the z17-induced Transaction Processing pause. Consulting is showing early signs of a rebound, but remains sensitive to discretionary cuts. Moreover, consulting businesses overall are going through a major transition with AI potentially compressing revenue but elevating profit margins. And while AI bookings look strong, we’ll be watching closely for customer adoption at scale in the enterprise, not just pilots or experiments in the clouds.

We believe IBM’s story is shifting from promise to proof. The strategic thesis is intact. What matters now is whether the flywheel Arvind Krishna described – client trust, open platforms, sustained innovation, domain expertise, and ecosystem leverage – can keep spinning.

If it does, IBM may finally shed its legacy shadow and emerge as a durable compounder in the era of agentic AI.

And then there’s Quantum Computing…