ABSTRACT: Here, we delve into the evolving dynamics of the virtualization infrastructure market, focusing on the strategic partnership between Dell and Nutanix and the implications of Broadcom’s acquisition of VMware. The Dell-Nutanix collaboration introduces groundbreaking flexibility in independently scaling computing and storage, leveraging Dell’s PowerEdge XC Plus and PowerFlex software-defined storage. This partnership not only enhances infrastructure modernization but also positions Dell and Nutanix as strong contenders in the hybrid cloud market. Additionally, the article explores how Broadcom’s acquisition of VMware is reshaping the competitive landscape, driving customers to explore alternative solutions. With an emphasis on the growing adoption of cloud operating models, this analysis provides critical insights for businesses navigating the future of IT infrastructure.

The landscape of virtualization infrastructure has once again become red hot, and strategic partnerships are more critical than ever. The recent developments between Dell and Nutanix, coupled with Broadcom’s acquisition of VMware, illustrate the shifting dynamics and competitive pressures that are reshaping the industry. We will explore these partnerships in depth, focusing on the technological advancements, business implications, and market driving these changes.

Dell and Nutanix’s Strategic Collaboration

Dell and Nutanix have recently announced a significant expansion of their partnership, which revolves around the addition of an out-of-the-factory deployable Dell PowerEdge XC Plus and the ability to integrate PowerFlex software-defined storage into Nutanix’s hyper-converged infrastructure (HCI). This collaboration, just the beginning in our view, is more than just a technological alignment; it represents a strategic move to capture market share in a highly competitive environment.

Technological Advancements: The Dell-Nutanix partnership introduces new flexibility and simplicity in deploying HCI solutions. Traditionally, customers looking to expand their infrastructure had to purchase both compute and storage resources simultaneously. This often led to inefficiencies, with either compute or storage resources being underutilized. Integrating PowerFlex into Nutanix’s platform changes this dynamic by allowing organizations to scale compute and storage independently. This separation is particularly valuable in scenarios such as AI and edge computing, where specific workloads may demand more storage without a corresponding increase in compute power.

Dell’s PowerEdge XC Plus server, now pre-installed with Nutanix’s cloud platform, further streamlines deployment, reducing the time to value for customers. This combination of hardware and software simplifies the initial setup and provides a scalable solution that can grow with the organization’s needs. The ability to scale out or scale up infrastructure based on specific workload requirements is a significant advantage, particularly as organizations look to modernize their IT environments and adopt cloud operating models.

Business Implications: From a business perspective, this partnership is a strategic win for both Dell and Nutanix. Integrating PowerFlex with Nutanix’s platform enhances Dell’s product portfolio, offering customers more choices and flexibility. This is particularly important as Dell seeks to strengthen its position in the hybrid cloud market, where customers are increasingly looking for solutions that bridge the gap between on-premise, edge, colo, and cloud environments.

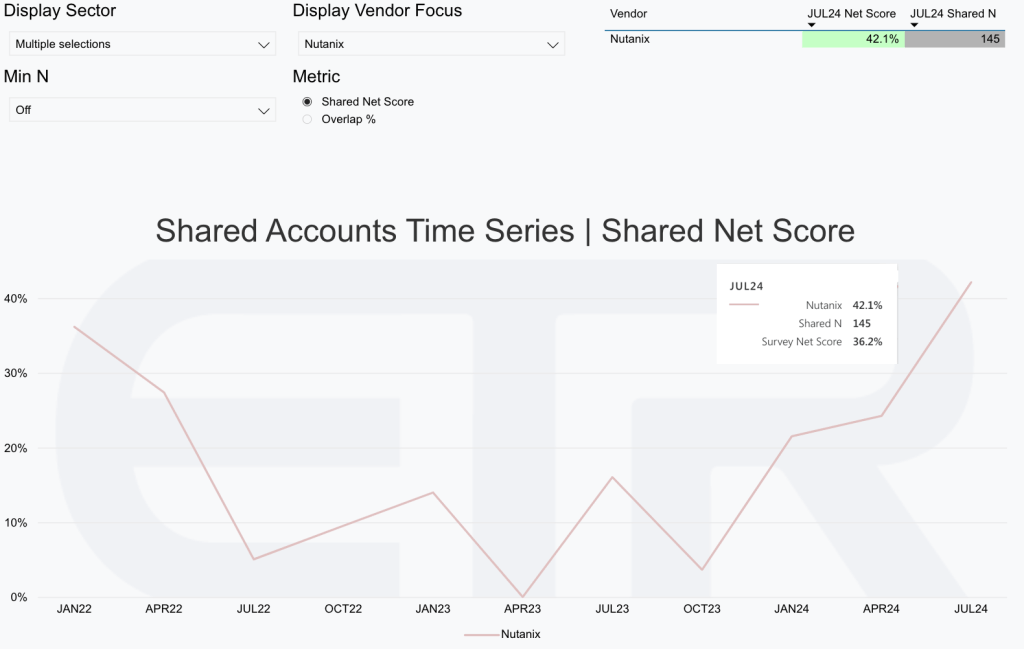

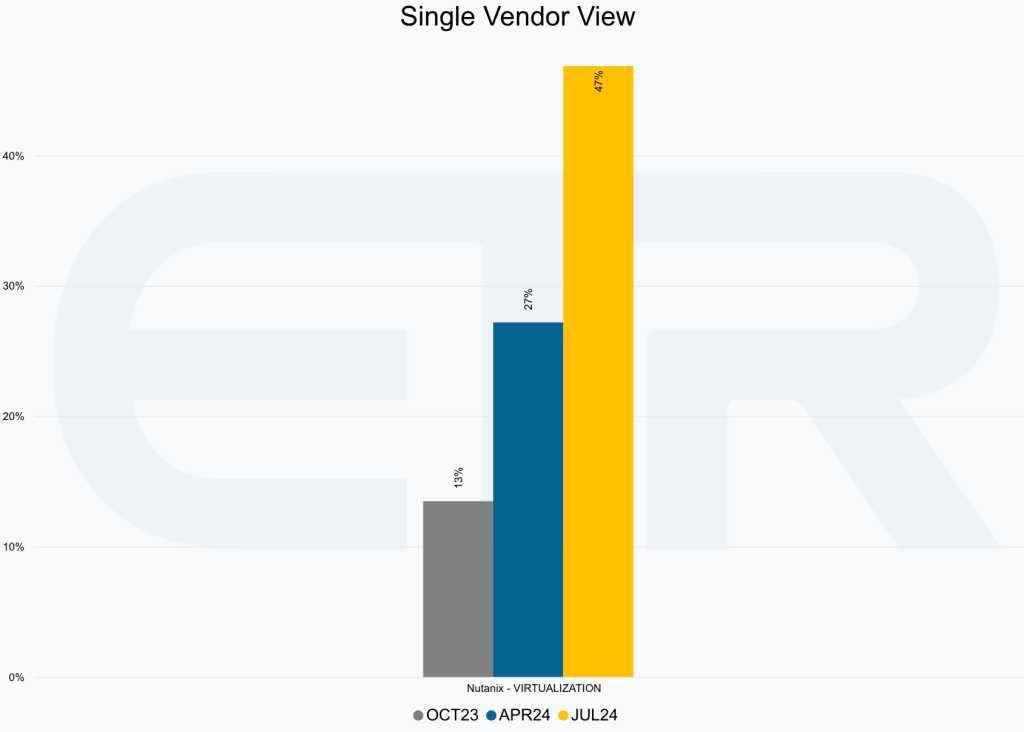

For Nutanix, the partnership with Dell provides access to one of the most powerful sales and service channels in the industry. This collaboration expands Nutanix’s reach and accelerates its market penetration, particularly in Dell’s extensive customer base. Nutanix’s recent growth within Dell accounts, as evidenced by a significant increase in its net score—a measure of customer spending momentum—highlights the effectiveness of this joint go-to-market strategy.

Broadcom’s Acquisition of VMware is a Catalyst for Change

While Dell and Nutanix are strengthening their partnership, the market is also being shaped by Broadcom’s acquisition of VMware. This acquisition has introduced a degree of uncertainty among VMware customers, many of whom are reevaluating their infrastructure strategies in light of the change in ownership.

Market Impact: Broadcom’s acquisition of VMware is a significant event in the virtualization infrastructure market. VMware has long been a dominant player, particularly in the enterprise space, where its virtualization software is deeply embedded in many organizations’ IT environments. However, Broadcom’s acquisition has raised concerns about the future direction of VMware’s products and services. These concerns are driving some customers to explore alternative solutions, creating an opportunity for competitors like Nutanix to capture market share.

Nutanix has capitalized on this uncertainty, experiencing substantial growth in market momentum. According to data from Enterprise Technology Research (ETR), Nutanix’s net score has more than doubled over the past year, indicating a strong increase in customer adoption. This growth is particularly notable within Dell’s customer base, where Nutanix has seen a significant increase in its presence.

Competitive Positioning: The acquisition has also had a broader impact on the competitive landscape. For Dell and Nutanix, it represents an opportunity to position themselves as a viable alternative to VMware, particularly for customers who are concerned about the future direction of VMware under Broadcom’s ownership. The Dell-Nutanix partnership, focusing on flexibility, scalability, and simplicity, is well-positioned to attract these customers, particularly those looking to modernize their infrastructure and adopt cloud operating models.

Moreover, the deepening collaboration between Dell and Nutanix is not just a response to the challenges posed by Broadcom’s acquisition of VMware, but also a proactive move to refine the market. By offering a compelling alternative that addresses the key pain points of traditional HCI, such as the inability to scale compute and storage independently. Dell and Nutanix are positioning themselves as leaders in the next generation of HCI.

Our Perspective

The evolving relationships between Dell, Nutanix, and VMware reflect broader trends in the IT industry, particularly the shift towards hybrid cloud and the growing importance of cloud operating models. And a cloud operating model is not a place but how you manage your infrastructure in a cloud manner. As organizations continue to adopt HCI, the ability to offer flexible, scalable, and easy-to-deploy solutions will be critical.

We believe that for customers, the Dell-Nutanix partnership offers a compelling integration of PowerFlex with Nutanix’s platform, and provides the flexibility to scale infrastructure based on specific use cases. At the same time, the PowerEdge XC Plus server provides a key HCI starting-point building block. This combination is particularly attractive for organizations looking to modernize their IT environments and adopt cloud operating models, whether on-premise, in colocation facilities, or at the edge.

For the industry, the deepening collaboration between Dell and Nutanix, combined with the uncertainty and potential response by VMware under Broadcom’s ownership, is likely to drive further shifts in market dynamics. As customers evaluate how they get to a cloud operating model and the supporting infrastructure strategies, the competition between these players will intensify, leading to continued innovation and the development of new solutions that address the market’s evolving needs.

Disclosure: This theCUBE Research Analyst Brief was commissioned by Dell Technologies and Nutanix, and is distributed under license from theCUBE Research. theCUBE Research is a research and advisory services firm that engages or has engaged in research, analysis, and advisory services with many technology companies, which can include those mentioned in this article. Analysis and opinions expressed herein are specific to the analyst individually, and data and other information that might have been provided for validation, not those of theCUBE Research or SiliconANGLE Media as a whole.