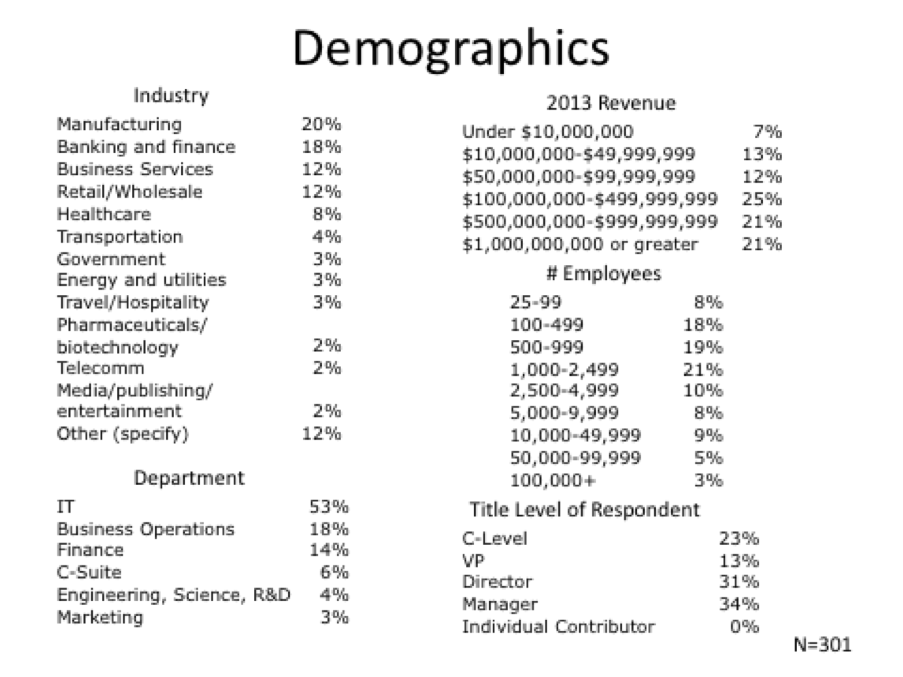

Wikibon conducted a web survey of 300 North American enterprises that have either used or are evaluating public cloud for IaaS in December 2014. The following is a first-pass frequency analysis of the survey responses. In the coming months, Wikibon will examine IaaS adoption, the market landscape of existing solutions and create a forecast for this space.

Methodology and Respondent Profile

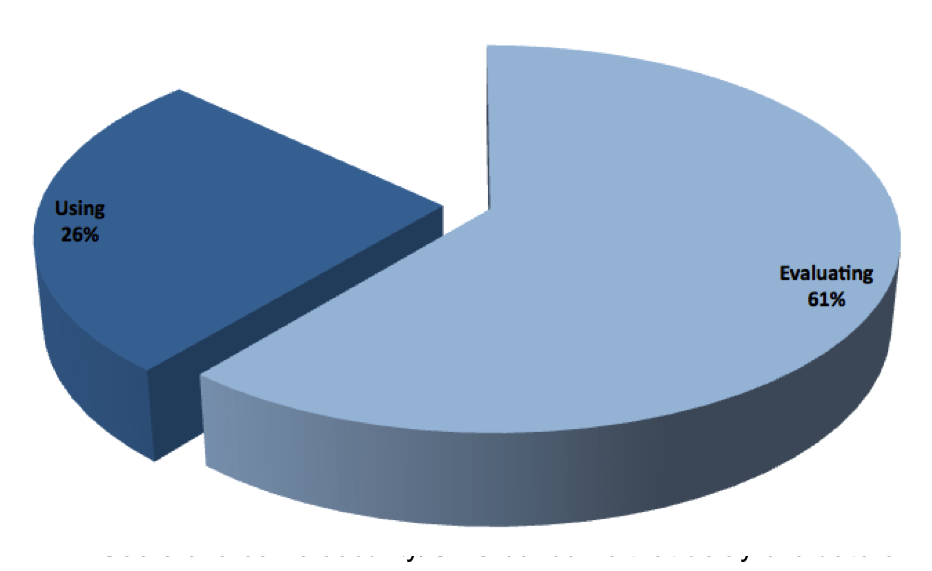

This study focused only on end-users that are either using public cloud today or currently evaluating public cloud.

- 151 (24%) using Public cloud for some IaaS today

- 150 (23%) evaluating Public Cloud for some IaaS use currently

- 242 (38%) evaluating Public Cloud for some IaaS use in next 12 months

- 100 (16%) not interested in Public Cloud for IaaS

Users that were not yet evaluating public cloud (the “in the next 12 months” or “not interested” choices) are not part of the remaining items in the rest of this document.

We obtained a wide distribution across industries and size; Figure 1 shows the demographics of the 301 users.

Respondents of this survey play a significant role in the purchasing or decision making of cloud (public and private) solutions – on a scale of 1-5, 62% gave a 5 (very involved), 29% a 4 and 9% a 3. As shown in the demographics, individual contributors were not targeted, nor were roles outside of those listed (such as sales or legal). All responses came from North America with the following mix: US (California) 16%, US (East Coast) 49%, US (Other) 32%, Canada 3%.

Conditioned Response – How Cloud Fits in IT Strategy

In order to understand the user’s mindset about cloud, users had to choose a single response from the following choices:

- We view infrastructure management as a non-critical discipline and will aggressively leverage the public cloud (16%)

- Parts of our organization want to aggressively use the public cloud, but we’re being cautious because of security, compliance and related reasons (44%)

- We use a mix of public and on-premises infrastructure approaches (38%)

- We use the public cloud but only for test and development purposes (2%)

- Public cloud is not an important part of our organization’s current IT, and it’s not part of our strategy (less than 1%)

Top Conditioned Response (#1 for evaluators, #2 for users)

While it is well documented that security and compliance are top concerns for adopting cloud computing, it was notable that evaluators of cloud were more than twice as likely to choose this compared to those who have already deployed cloud. Security and governance is be an initial barrier to entry with cloud computing, while it is important once deployed, the risk/challenges are understood and managed.

Hybrid is the current state of cloud

As shown in Figure 3, hybrid cloud is the choice for cloud deployment today. While the definition of hybrid can be debated – is it a mix of options (choosing from a menu of private cloud, public cloud and SaaS offerings) and/or the federation of applications between on-premises and public cloud – customers rally behind the statement that they will keep infrastructure in-house while also trying a variety of solutions in SaaS and public cloud.

The most dramatic difference between evaluators and users of public cloud is users are 3-times more likely to state that they are aggressively pursuing cloud (Figure 4). As Alan Nance, VP of Technology Infrastructure at Royal Philips, said on an interview on theCUBE, 85% of his IT spend was non-differentiated and therefore he moved to all consumption-based services.

Since those that completed the survey are all using or evaluating cloud, it is not surprising that very few felt that IaaS is only for test/dev (2%) or not important to strategy (less than 1%).

Figure 5 shows a slice of the data from the conditioning question by industry. Heavily regulated industries like banking, telecom and government leaned towards security as a top concern.

Attitudes About Public Cloud

In addition to the conditioning question, there were a series of 8 questions about public cloud (Figure 6 shows the high level responses):

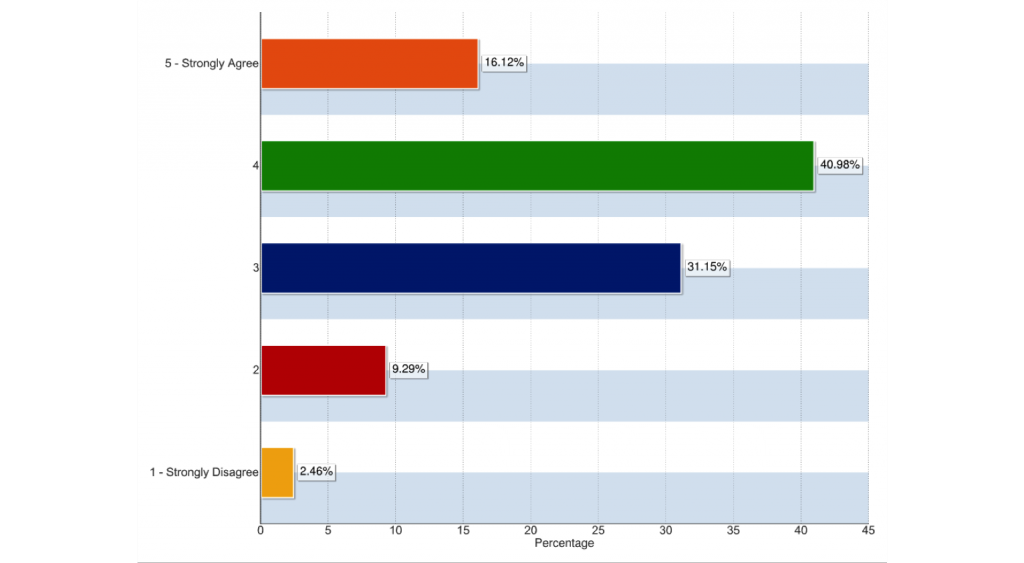

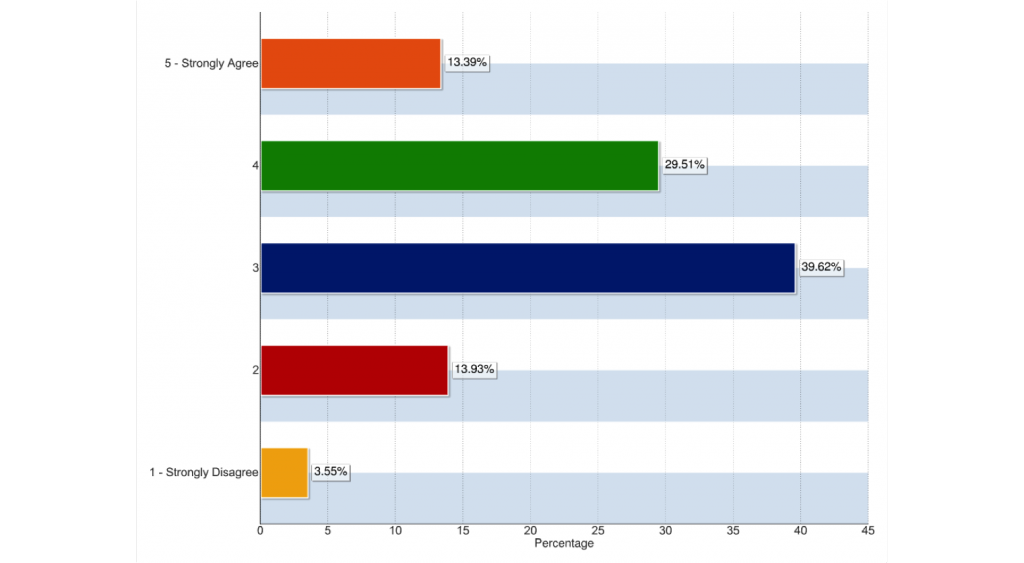

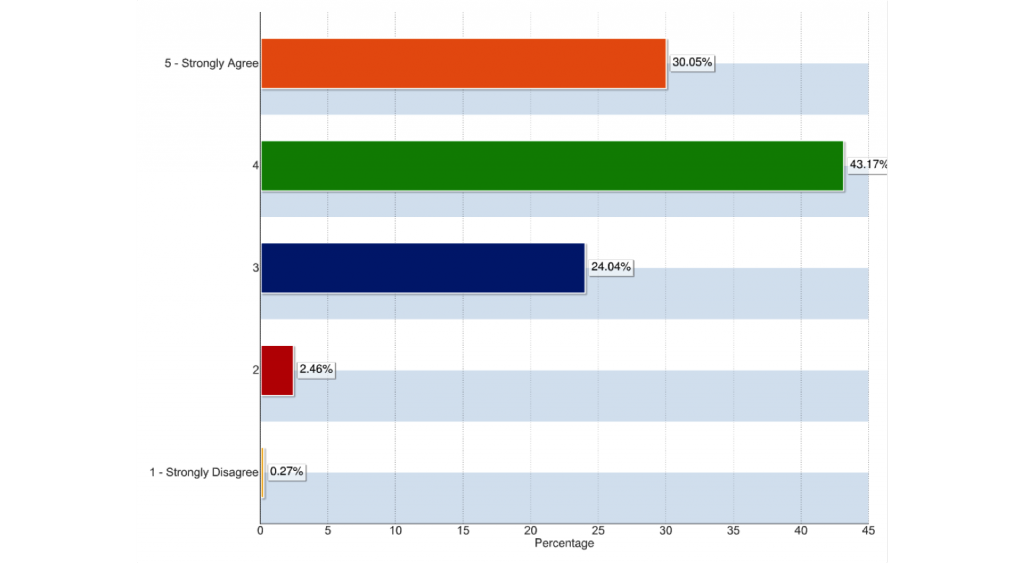

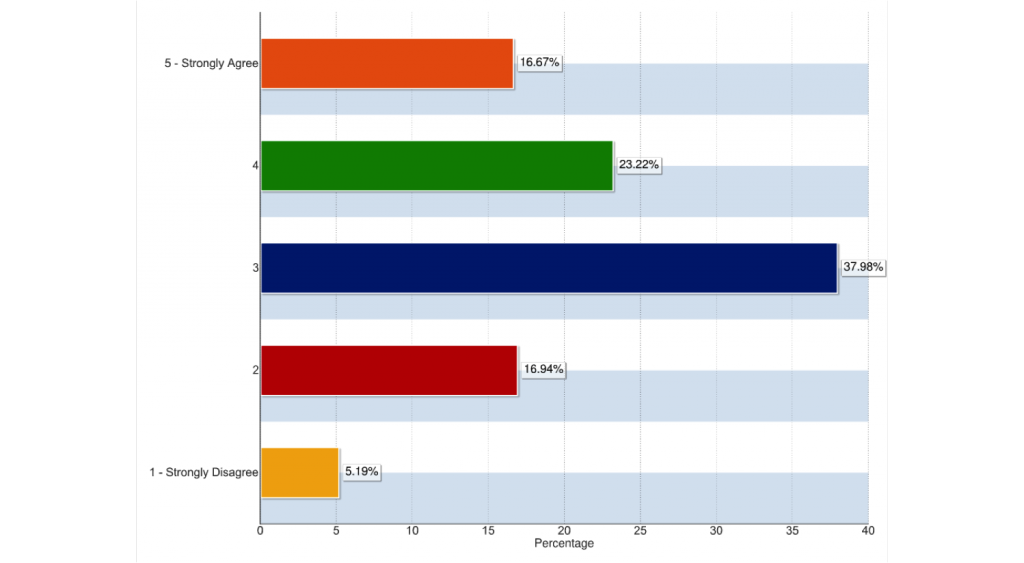

On a scale of 1-5, most of the responses ranged from neutral (3) to agree (4). The strongest agreement (4.02) was for “The public cloud is the future because it’s more agile and cost effective” and the most neutral response (3.06) was for “Rental (e.g. Amazon, Google, Microsoft) is more expensive than owning on-premises”.

Full results from these questions are below (Figure 7-14):

Public Cloud Workloads

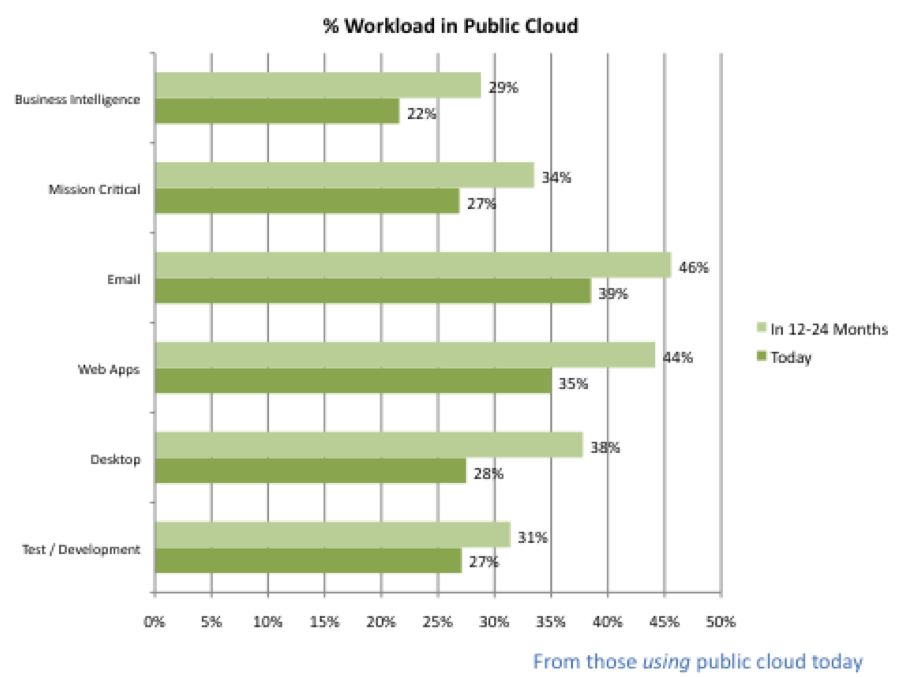

Public cloud decisions, like infrastructure decisions, are led by the application requirements. A primary focus of the survey was to investigate the state of application deployment today and in the near future (12-24 months out).

At this point of the survey, responses were not limited to only IaaS; email responses included Gmail and Office 365. While test/dev may have been an early use-case for Amazon Web Services (AWS) public cloud, all other categories (except business intelligence) had a higher adoption rate. The “Mission Critical” category was defined as including ERP, database, etc. Desktop is also End-user Virtualization (including VDI and Desktop as a Service). For each application category, users had to choose the primary provider of that service. A breakdown of primary cloud choices by workload is in Figure 16.

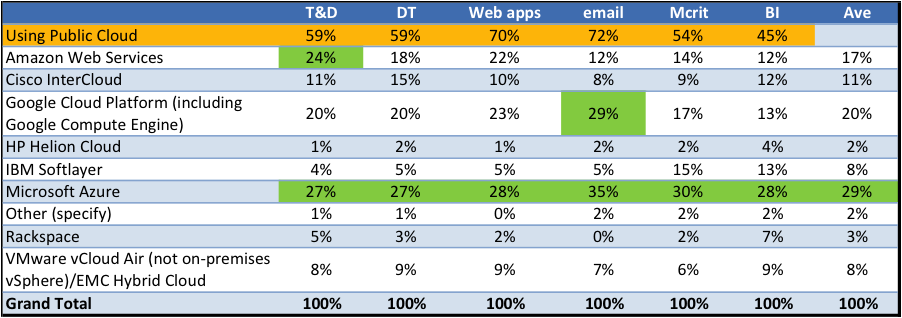

Microsoft Azure was the leader in all workloads. Web-applications and Email most frequent workloads in Cloud, with strong leads from Microsoft & Google. AWS is strongest in test/dev and Web applications. VMware vCloud Air has a balanced performance across all workloads. The survey took pains to note that it is asking about VMware vCloud Air specifically and not VMware vSphere or any other on-premises VMware solution. It seems a bit anomalous that Cisco InterCloud had such a high response for a new service; it is likely that the Cisco responses represents network component of cloud services being used and not the brand new InterCloud offering itself.

Of the users that have public cloud in production, most are using more than one provider. Almost half (49%) are using Microsoft Azure. Market leader AWS is second with 34%, which is only slightly ahead of Google Cloud Platform at 32%. As mentioned earlier, these results are not limited to IaaS, so responses listing Microsoft Azure clearly include Microsoft Office 365 and Google Cloud Platform includes Google Drive/Gmail.

Characteristics of Public Cloud

The next section of the survey examined the characteristics that users value when choosing a supplier for public cloud. They were asked to rank (not specific to any supplier) the characteristics. Figure 17 shows that the results came out in three primary groupings:

- Trust and Reliability came out in a near-tie for most important

- Speed/Agility, followed by Manageability were the second tier

- Economics was clearly the bottom choice

The survey then asked that for each vendor that the user is using or evaluating that they rate each of these characteristics.

All of the vendors scored quite highly in aggregate; every vendor had an average over 4.0 out of 5. IBM Softlayer received the highest scores overall with Microsoft Azure in a close second. Being the most important criteria, Trust and Reliability are table-stakes for any viable cloud solution. Cisco, VMware and Google have a cost perception issue, although economics is the lowest priority and economics were the lowest scores across all suppliers. Apart from Economics, satisfaction ratings are similar across the vendor, so overall brand preference and existing relationships will have influence on the purchasing decision.

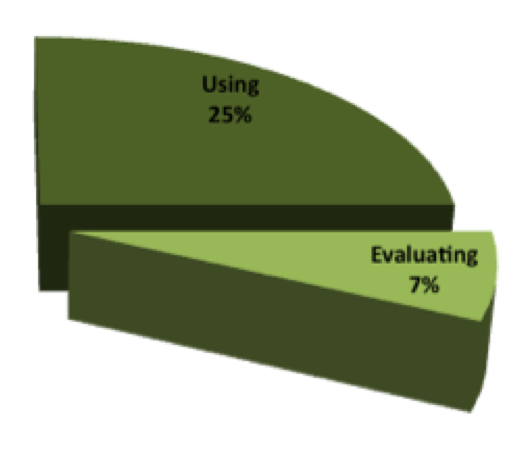

OpenStack and Big Data

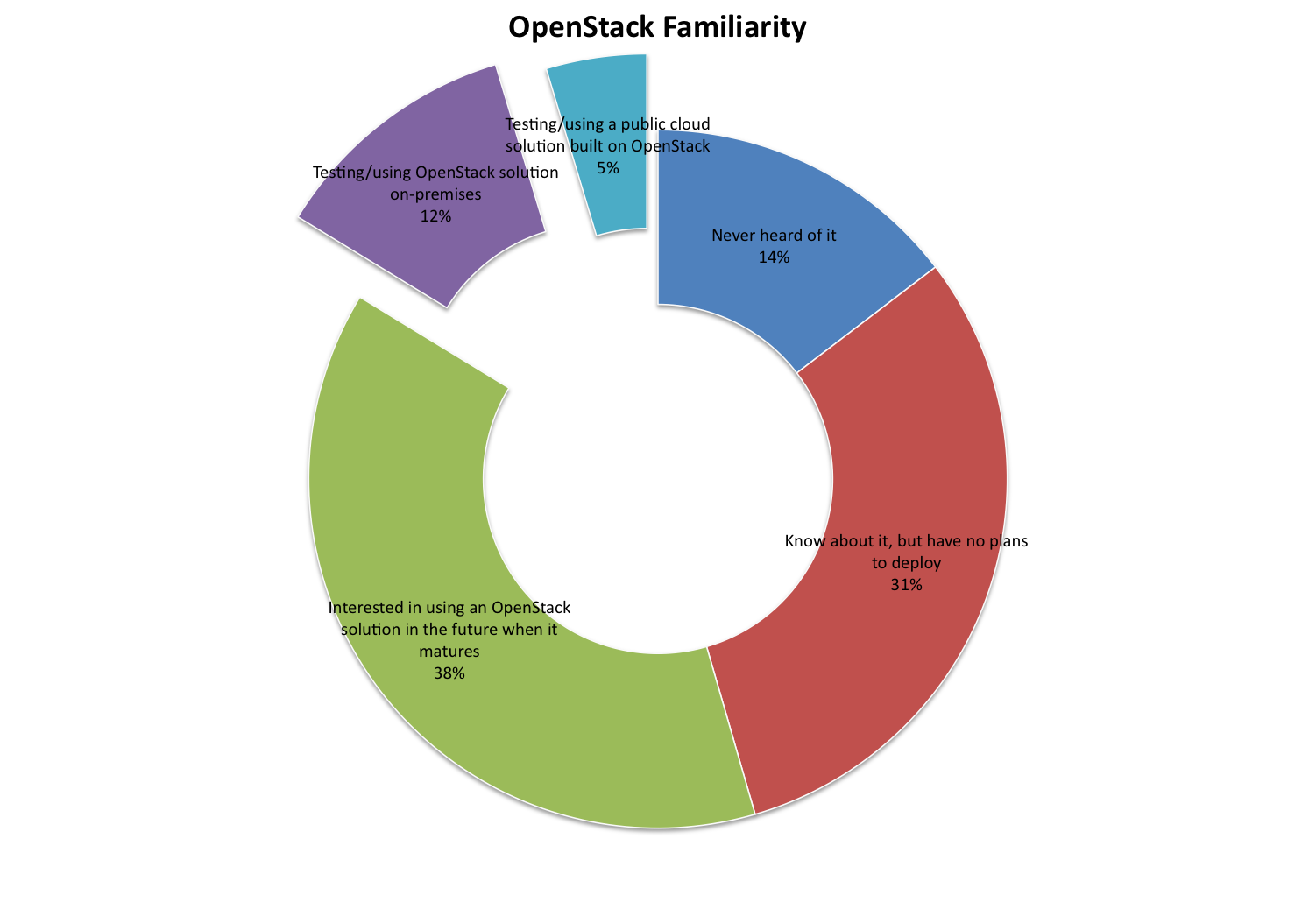

Following up from other Wikibon surveys, this group of cloud users were asked about how OpenStack and Big Data fit into their deployments. The results of this OpenStack question (Figure 19) are very similar to those from VMware users in 2012 (see OpenStack Familiarity/Usage chart in that article).

In 2014, Wikibon did an extensive survey of Big Data practitioners (see the premium report: Big Data Analytics Adoption Survey) where 58% of those surveyed were using public cloud for some part of analytics projects (and another 26% were planning to do this soon). The results of cloud users with analytics applications (Figure 20) are a bit lower than the previous survey.

Conclusion

Users are choosing a diverse set of solutions that encompasses both hybrid cloud and multi-cloud deployments. While there are clear leads by the largest cloud providers – namely Amazon, Microsoft and Google – users are open to options from incumbents, startups and a wide spectrum of offerings. Microsoft Azure is rapidly gaining on AWS leadership. The journey to Public Cloud is beyond test/dev phase and is rapidly moving to higher value workloads and new opportunities for business value creation. It is still early days in IaaS – lots of innovation and disruption to come.