Wikibon VMware Storage Survey

In 2010 Wikibon performed a meta-analysis on IDC and ESG data to look at the fast-growing area of storage on VMware. Wikibon members were uncomfortable with the small size of the ESG survey (n=102), and with the level of knowledge of the respondents on storage issues.

This year Wikibon has done its own much larger survey and ensured it was aimed on VMware experts. The main metrics of the survey are:

- The survey was run using Survey Monkey from April 12-24 2011;

- The survey was sent to thousands of Wikibon members via email;

- The survey was blogged about by VMware Storage luminaries at EMC, NetApp and HP;

- There was extensive social media distribution (Twitter, Facebook, LinedIn) about the survey from Dell, EMC, NetApp, VMware and Wikibon;

- The total number of survey starts was 817;

- The number of survey completes was 437;

- 76 completes with a storage vendor as a company and with key data missing were excluded from the analysis;

- The final sample was 361;

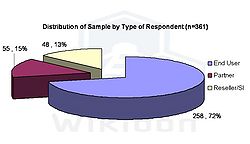

- The distribution by type of respondent was 258 end-users, 55 partners, 48 resellers/SI (see Figure 1);

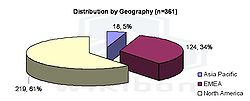

- The distribution by geography was 219 from North America, 124 from Europe and 18 from Asia/Pacific (see Figure 2);

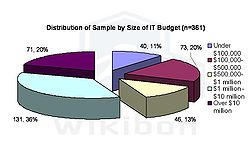

- Distribution of the respondents by IT budget is shown in Figure 3;

- The knowledge of the respondents is very high – for example, the quality of suggestions for peers and for vendors were numerous, detailed and authoritative;

- There was an incentive of an entry into a draw for an iPad, which was won by a lucky end-user in Melbourne, Australia! The iPad is on its way;

- 3PAR and Compellent were not on the pull-down list for vendor selection. There were five (5) respondents that wrote in Compellent in the other box,and six (6) that wrote in 3PAR. These were added to the HP and Dell tallies as appropriate.

- The questions relevant to the analysis in this research are given in the notes 1. The two key questions analysed are:

- Who is your primary storage vendor for VMware environments? (radio – Dell, EMC, Hitachi, HP, IBM, NetApp, Other; if Other, please list

- Who do you believe has the best storage solutions for VMware environments? (radio – Dell, EMC, Hitachi, HP, IBM, NetApp, Other; if Other, please list)

Figures 1, 2 & 3 show the distribution of the survey sample by type of respondent, geography and IT budget.

A number of tests were performed on the final data sample to check the validity of the data:

[one_half]

- There was very little variability of the data within type of respondent; all types of respondent were included in the data;

- Wikibon was concerned that the media promulgation by vendors would introduce a bias into the sample. A longitudinal (time) test was performed to check whether there were spikes of completes choosing a specific vendor as their primary VMware platform or as their best VMware storage platform that coincided with social media coverage. We did see that the number of vendors completing surveys increased when vendor social messages went out, but these surveys were excluded from the sample. We could not detect any pattern of response that indicated any bias. It seemed that the community being tapped was very VMware- and storage-savvy and were looking for information from any source to help them with their job. We also checked to determine if there was any difference between respondents who left contact information and those that did not; none was found. We will be carrying out a survey within the survey to further check for any “gaming” of the survey.

- Wikibon observes that although very large customers were included in the survey, VMware was used mostly for midrange (Tier-2) rather than very large (Tier 1) storage and storage arrays. This probably reflects the fact that mission critical workloads requiring Tier-1 storage are not a major component at the moment of VMware workloads.

- The results are within a 5% margin of error for the sample as a whole.

[/one_half]

[one_half_last]

Source: Wikibon Survey April 2011, n=361

Source: Wikibon Survey April 2011, n=361

Source: Wikibon Survey April 2011, n=361

[/one_half_last]

Survey Analysis

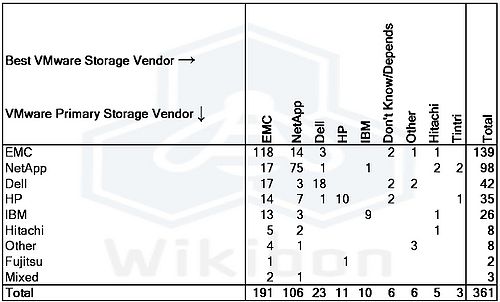

The raw data looking at VMware storage installed base penetration and and mindshare is shown in Table 1.

Source: Wikibon Survey April 2011, n=361

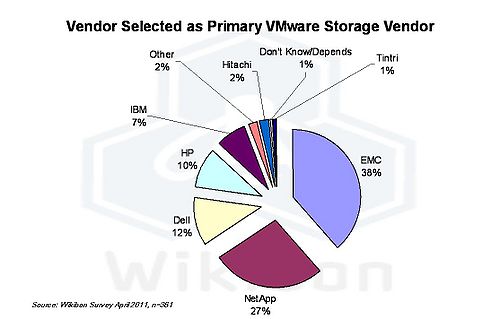

Data on vendors selected as the primary VMware storage vendor (the right-hand column of Table 1), is presented in Figure 4. Customers overwhelmingly cited that EMC and NetApp were the dominant installed VMware storage platforms combining for 65% of the responses.

Source: Wikibon Survey April 2011, n=361

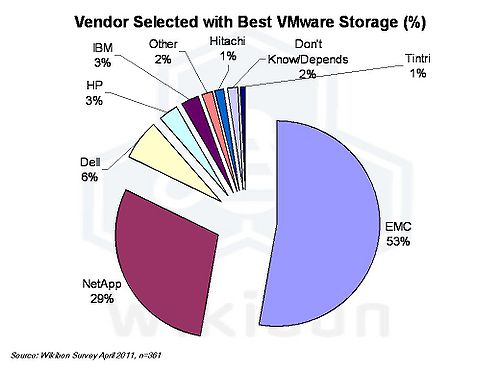

Analysis of vendors selected as the best VMware storage (the bottom row of Table 1) is presented in Figure 5. It shows that EMC and NetApp are even more dominant, with 82% combined mindshare.

One interesting result is the inclusion of Tintri in the table . This vendor was not included in the survey pull down; the respondents had to add the name in an “other” field. This is a remarkable achievement for a very new company.

Source: Wikibon Survey April 2011, n=361

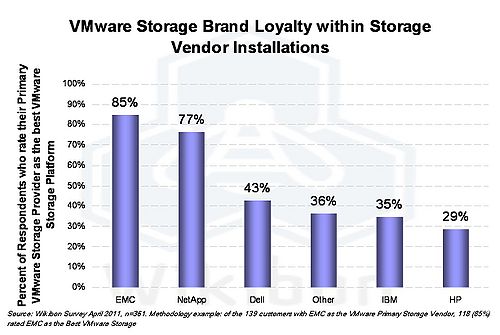

Figure 6 shows the brand loyalty of VMware storage vendors. Brand loyalty is measured as the percent of the users who select a vendor as the primary VMware storage provider who also select the same vendor as the best VMware storage vendor. EMC and NetApp have outstanding brand loyalty for VMware storage, with 85% and 77% brand loyalty respectively.

Source: Wikibon Survey April 2011, n=361. Data taken from Table 1. Methodology example: of the 139 customers with EMC as the VMware Primary Storage Vendor, 118 (85%) rated EMC as the Best VMware Storage

Limitations of Survey

The primary limitations of the the survey and analysis are as follows:

- The audience attracted to answering the survey were followers of Wikibon, and followers of social media leaders. The respondents were very competent, as shown by the quality of suggestions they made. Wikibon believes that the respondent set were opinion makers within the community, and with well above average competence.

- The respondents were VMware technical staff, and although they were strong influencers, they probably did not have direct budget responsibility for VMware storage.

- The sample was not weighted for IT budget size to normalize market-share.

- Although we did not detect any bias from vendors promoting the survey, there is a possibility of skew in the sample towards the companies that used social media most effectively.

- Although we did not use completed surveys that came from vendors, there maybe some entries that were entered by people who were trying to “game” the survey process.

- The survey asked for the primary VMware storage vendor. However, significant portions of the installed storage may not be from the primary storage vendor.

- The margin of error is just less that 5% for the survey as a whole. While there is high confidence in all data from the leading vendors, the number of data points about vendor shares in the tail is low. This in itself his highly significant, but care should be taken with secondary analysis of the data (e.g., vendor loyalty metrics) for non-leading vendors, as the number of data points can be low.

Wikibon members should use this data as showing trends; the qualitative aspects of the survey maybe more valuable to readers that the pure qualitative aspects.

Conclusions

Figure 7 shows the comparison between the estimates of overall market share for external storage provided by IDC and the VMware storage installed base penetration and mindshare found in the Wikibon survey (see limitations section for further discussion and caveats). It shows that EMC and NetApp have significantly more VMware storage market-share and mindshare than competitors overall. Wikibon believes that success in VMware storage is a leading indicator of success in the storage market as a whole. Both EMC and NetApp have the ability to make significant increases in market-share if they retain their lead in VMware storage mindshare and brand loyalty.

![Table 1 – IDC 4Q 2010 Market share numbers for External Disk Storage Sources: Wikibon Survey April 2011, n=261; IDC Press Release 3/4/2011 download 4/25/2011 from [1]](/wp-content/uploads/IDCMarketShare.jpg)

Sources: Wikibon Survey April 2011, n=261; IDC Press Release 3/4/2011 download 4/25/2011 from [1]

The user feedback from the survey is that VMware storage is still complex, and it takes a lot of hard work to make VMware bulletproof operationally. Users were expressing a need to move to a more VM-centric view of the world. Storage is simple to VMware, but storage arrays make this complex.

The bottom line is that storage sucks on VMware, as the hypervisor introduces another layer into the stack, and the storage provisioning, management, and problem determination become more complex. Currently VM Admins, DBAs, server and storage administration staff need to communicate about storage. In the event of a problem, storage will be assumed to be guilty until proved otherwise.

Wikibon believes that solutions to this problem should focus on the VMware administrators and should provide them with a complete set of tools to manage provisioning and management of VMware storage.

Wikibon believes that there will be significantly more innovation in the area of VMware storage, and that the easiest solution will win in the long term. Vendors should focus on ease of use. As previously mentioned, new entrants like Tintri are offering a new approach with an emphasis on ease of use. Users are hoping for a simplicity disruption.

Action Item: Users should focus on the ability of vendors and their partners to provide storage that is well integrated with VMware. They should ensure that good implementation services and documentation is available. Most of all, the storage should be easy to manage, and provide all the performance and usage metrics in a way that directly relates to the VM machines and storage. There is still time for disruptive innovation in this storage sector.

Footnotes: Related information: VMware Storage Integration Wikibon Research

1 Questions asked using Survey Monkey relevant to the analysis were:

- Geography: NAM/ EMEA/ ASP/ LAM

- Size of IT budget:Under $100,000/ $100,000-$500,000/ $500,000-$1 million/ $1 million – $10 million/ Over $10 million

- My company is: User of VMware technologies/ Reseller/integrator of VMware technologies/ Partner of VMware

- Who is your primary storage vendor for VMware environments (choose 1 radio button – Dell, EMC, Hitachi, HP, IBM, NetApp, Other; if Other, please list)

- Who do you believe has the best storage solutions for VMware environments? (choose 1 radio button – Dell, EMC, Hitachi, HP, IBM, NetApp, Other; if Other, please list)

Open questions (optional)

- Any tips or best practices that you would share with fellow practitioners about storage deployments in VMware environments?

- What in your opinion is needed to make storage in VMware environments better (either general or for a specific storage device)

- Would you be willing to be contacted for follow-up regarding this research?

Contact information to be eligible for prize

- Name

- Company

- Phone

Other questions were asked in the survey about storage implementation with VMware, and will be analysed separately.