![]()

Premise

The transformation to digital business continues, but the target continues to move. Originally, digital business strategy was equated with e-commerce. Then, it morphed into a concern about being “Ubered.” Today, more firms recognize that digital business is focused on using data as an asset, but the adoption of process, people, and technology changes to achieve data supremacy remains slow.

Digital business remains a central boardroom conversation (and a favorite topic of analysts), but the concept remains elusive. For too many business leaders, digital business strategies are blown about by whimsy and fad. Wikibon, however, believes that digital business can be grounded in a simple, profound, and far-reaching definition: the difference between business and digital business is the use of data as an asset. While our clients generally agree with this approach to conceiving of digital business when it is presented to them, the notion of “data as an asset” itself can be problematic. Unlike other assets that follow the economics of scarcity, data’s value appreciates as it is successfully shared. Most business disciplines ignore this feature of data, which leads to a gross undervaluing of – and subsequent under-investment in – data assets in the business.

However, Wikibon believes businesses will accelerate efforts to specifically understand, capture, and act on data value in 2018. Moreover, we expect that an increasing number of businesses will explicitly make the connection between data as an asset and digital business. While multiple considerations propel our expectation, three stand out, which serve as our digital business predictions for 2018. They are:

| PROCESS | GDPR’s impact will extend far beyond the EU. |

| PEOPLE | The Chief Digital Officer (CDigiO) role will rise to a position of strategic and operational prominence. |

| TECHNOLOGY | Broader agreement on the importance of data value will spawn a new variable for technology decision making. |

|

Wikibon Prediction |

The European Union’s General Data Protection Regulation (GDPR) goes into full effect 28 May 2018 and will catalyze changes far beyond the EU’s borders. As many as 15% of global enterprises will adopt GDPR practices globally, especially those firms that operate mainly in B2B markets. By 2023, privacy and trust will be explicit features of B2B brands. |

GDPR is among a handful of regulatory regimes that address questions of data privacy, but it is the broadest and most invasive, by far. It provides far-reaching rules for data governance and extensive controls over data ownership, control, and processing. The regime is costly, mandating concrete edicts intended to ensure data portability, significant fines for non-compliance and breaches, strict disclosure rules, and new roles and practices for protecting data.

Companies with ad-based business models will be pressed to tightly segment data usage to both comply with GDPR and sustain profitable business practices. However, Wikibon believes B2B companies, which typically employ transaction-based business models, will be less pressed to comply with GDPR. Indeed, most B2B-company privacy officers that we’ve spoken with suggest that their firms will adopt GDPR across global operations. Two consequences of this adoption will be (1) data privacy and trust will become much more explicit considerations in contracting, ensuring that they become concrete features of B2B brands over the next few years (especially in tech companies); and (2) an expanded body of knowledge on how to both establish asset rules for data and price data value – which will lead to more optimum investment in data.

|

Wikibon Prediction |

The Chief Digital Officer (CDigiO) gains operational traction in business. Starting out largely as a strategy role, the executive suite begins to entrust more operational responsibility to the CDigiO. In 2018, 10% of enterprises will position the CDigiO above the CIO (technology), CISO (security), CDO (data and records), and CPO (protection and privacy). By 2022, that figure will grow to 40%-50%. |

One feature of GDPR mandates a “data protection officer” (DPO) at enterprises that, among other things, collect and process significant volumes of subject data (e.g., over 5,000 subjects per annum). Moreover, the DPO is expected to operate largely independent of other business agendas and report directly into the most senior management.

The DPO joins five additional “chief” roles involved in operationally achieving digital business objectives, including Chief Information Officer (CIO), Chief Data Officer (CDO), Chief Information Security Officer (CISO), Chief Technology Officer (CTO), and Chief Digital Officer (CDigiO). Additionally, as enterprise technology is extended to the edge, a variety of operational technology leadership roles become part of the digital leadership mix. This is a recipe for disaster. Aside from concerns about personal conflicts, each of these roles brings different perspectives and agendas to relatively common objectives.

Wikibon believes CEOs and COOs will be pressured to bring greater organization to this arrangement. Our prediction? We believe the CDigiO is ascending and will emerge as a group leader for digital technology, security, data governance, applications, and capabilities.

Today, the CDigiO typically is a strategy role, establishing desired digital outcomes, building consensus among leadership, documenting plans, and reporting results. However, in most enterprises, strategies are turning into operations to identify, define, monetize, and maintain returns on digital assets and capabilities, and our research suggests that CDigiO is being asked to transition into a leadership role.

Does this mean the demise of the CIO? Of course not. In some organizations, the CIO role will evolve into the CDigiO, especially in industries with a strong digital-native affinity (e.g., media, tech). However, in most organizations, digital transformation is leaving the station, and the CIO is not driving the train.

|

Wikibon Prediction |

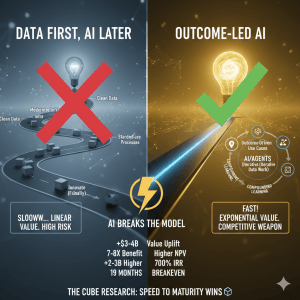

Heightened attention on data protection will catalyze intensive interest in better treating data as an asset. While this process will take years to mature, one near-term consequence will significantly affect industry dynamics: Users will start evaluating technology choices using an “options on future data value” approach. |

Data assets don’t follow the rules of scarcity. Machines, money, people, materials – each of these asset types feature asset specificities that tie them to specific uses. For example, a machine that stamps out chicken wire isn’t easily applied to manufacturing penicillin. While improving a machine’s programmability using data (perhaps in the form of software) might reduce the time, complexity, and risks of repurposing a machine to alternative uses, asset specificities rarely go away entirely for most assets; a chicken wire machine might be easily reprogrammed to produce wire for screen doors, but not penicillin.

Data is different. The same data can be applied to multiple purposes at essentially no cost. For example, the same customer record can be used to take an order, evaluate aggregate interests, segment profitability groups, or discern product requirements. In fact, one of the biggest challenges of managing data assets is to add asset specificities, typically through some type of data security or privacy regime, ensuring that your business, and only your business, successfully appropriates returns on your data.

What does this mean for technology selection? Different technologies make it easier or harder to appropriate streams of data value, and that increasingly will impact their enterprise attractiveness. For example, flash-based storage systems are more in demand today than most types of disk-based arrays because flash arrays reduce the barriers to data sharing better than disk technologies. To put it differently, flash arrays generate superior options on future data value than disk-based arrays.

Our conversations indicate that this already is happening; albeit perhaps using different terminology. But digital leaders are being asked to generate superior returns on data assets, and that expectation will flow directly into the roles and responsibilities of CIOs and IT leaders. What does it mean? Vendors that can’t answer the question, “how does your technology or service provide superior options on future data value” will find themselves falling behind competitors that can.

Action Item

Digital business is more than the sum of new digital channels, product strategies, or customer analytics. In 2018, business leaders will accelerate efforts to generate returns on data assets. This will require new practices and organizational structures designed in accordance with data’s complex dynamics.