Data from recent surveys shows that the scenarios we’ve been putting forth throughout 2024 continue to be in play. Specifically, we cite three main dynamics affecting the tech spending climate, including: 1) IT budgets continue to be constrained as; 2) GenAI is being funded by stealing from other budget buckets; and 3) The ROI for AI initiatives remains tepid, as expectations for break even continue to be pushed out to the right. Nonetheless, customers remain highly optimistic about the prospects for AI driving productivity improvements. Moreover, the cloud remains a key ingredient in supporting AI workloads.

In this Breaking Analysis we update you on the macro spending picture in IT, and we’ll revisit the GenAI impact on that spending with some fresh survey data from ETR. We’ll also examine customer expectations around cloud workload allocation and specifically look at the cloud and its role in supporting AI initiatives.

IT Spending Remains Constricted by Uncertainty and the Dilutive Effects of AI Funding

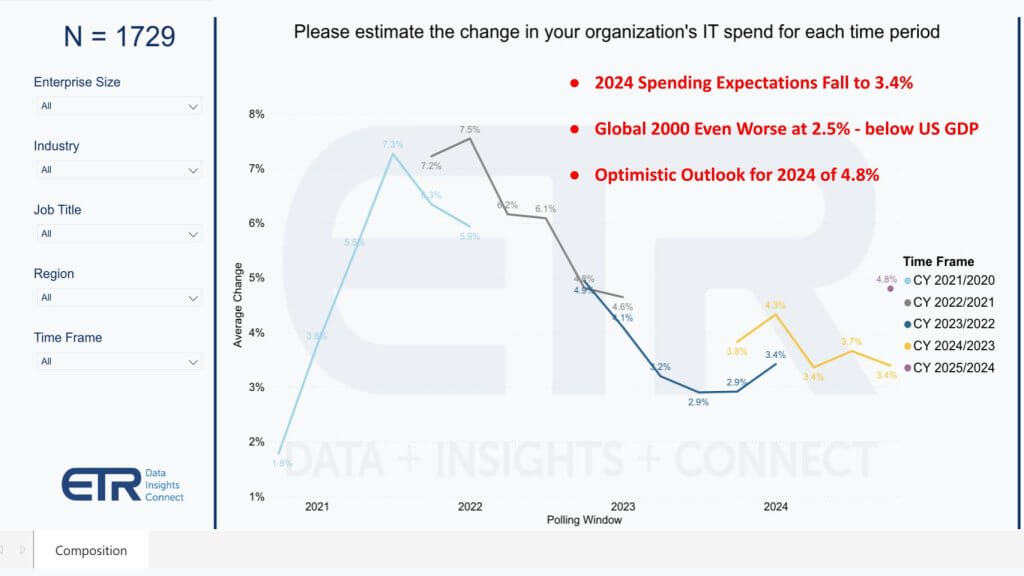

In the chart below, we show the expected annual IT spending growth rates for a given year over time. ETR’s latest macro drilldown survey polls 1,729 IT decision makers. If you go all the way back to the COVID era, we exited 2021 with a very optimistic 7.5% increase in expectations for top line IT spending growth in 2022. The war in Ukraine, Fed tightening and aggressive spending during COVID caused expectations to steadily decline until the Fed stopped tightening in late 2023.

Coming in 2024, we see a reversal but that was back-loaded. We can see above, earlier in this year IT decision-makers expected a 4.3% increase for the year. That actually dropped down to 3.4% in the spring survey then became more optimistic in the summer and bumped up to 3. 7%. This latest survey shows expectations are back down now to 3.4%. Notably, in the Global 2000 the expectations are even worse at 2. 5%, which is below recent GDP forecasts. Despite the variability in expectations, IT spending overall remains range bound.

Our assertion is part of the constraint comes from the fact that AI initiatives are still not self-funding and are constricting budgets as many organizations are funding AI initiatives by stealing from other budgets. We’ll share data on that in a moment.

Vendor Consolidation is Back in Play but Hard to Achieve

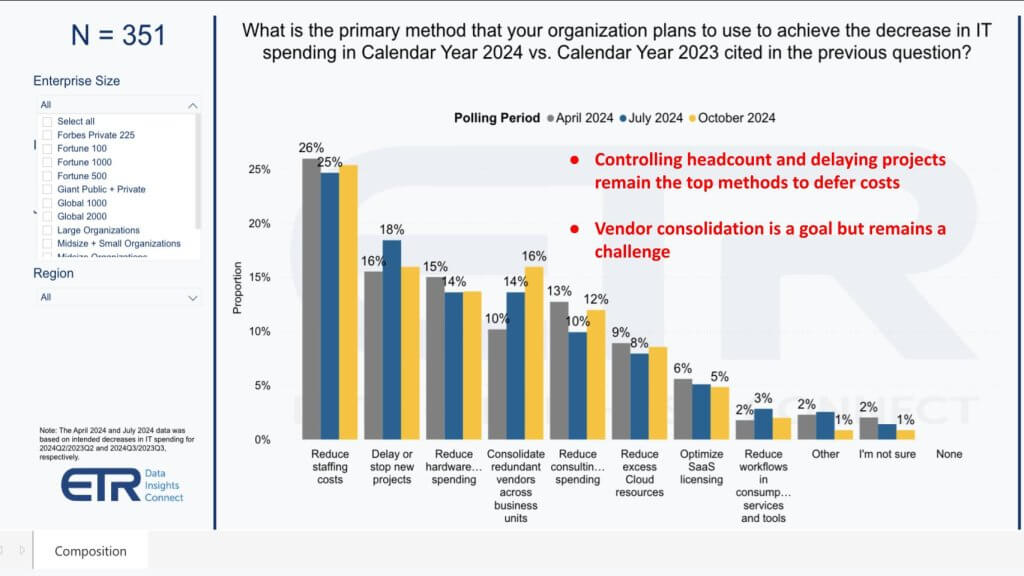

Let’s take a look at the next data point below that shows us how people are thinking about saving money. ETR asks: What’s the primary method that your organization is using to achieve a decrease in IT spending this year versus last year?

You can see above that controlling headcount and delaying projects are the top two methods to defer costs, then hardware spending cuts. But vendor consolidation really popped up here. You can see it was 10% in the April 2024 survey, so it was fairly benign back then, now it’s up to 16%.

While vendor consolidation is a goal, as we’ve reported, particularly in the cybersecurity sector, it’s difficult for organizations to consolidate tools, products and vendors. As an example, prior to RSA ETR surveys showed that only 9% of the customers in that sample were successfully reducing their vendor count in their security stacks. So we’re seeing an increase in that strategy but we’ll see if in fact it comes to fruition.

AI is Still Diluting Other IT Spending Categories

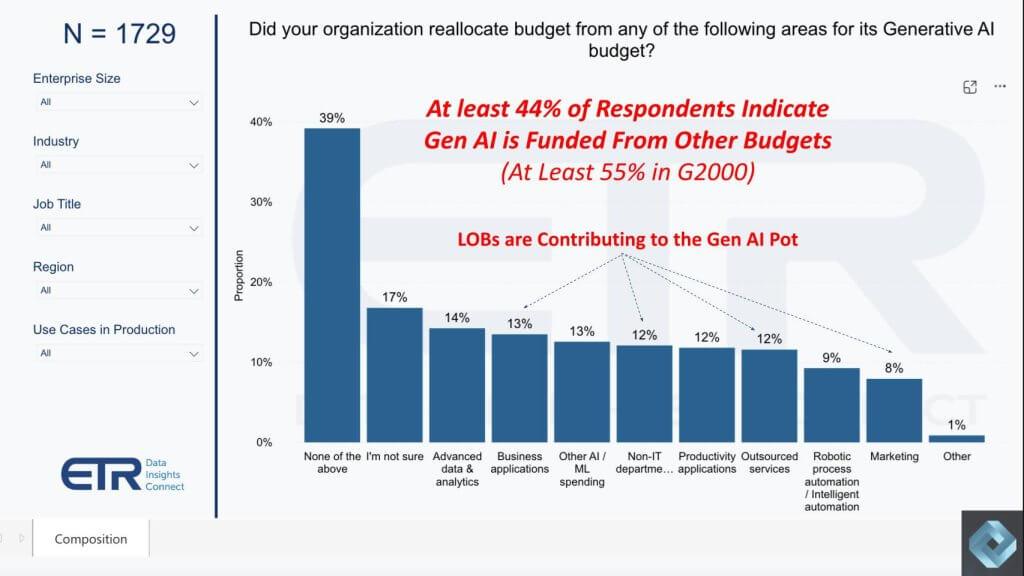

Below we show one of the major factors affecting the overall macro. In this survey of more than 1,700 IT decision makers, ETR asks: Did your organization reallocate budget from any of the following areas for its GenAI budget?

As we show above in red, at least 44% of the respondents indicate that GenAI is funded by stealing from other budgets. We’ve seen that number hover around 40 to 42% in previous surveys, and it pops up to at least 55% in the Global 2000. The reason why we say “at least” is because we took None of the Above and added the Not Sure respondents together. So the percentage of customers stealing from other budgets to fund AI could be much higher – perhaps over 60%.

Lines of Business are Chipping in for AI Initiatives

The other interesting new data point shown above is that the lines of business are contributing to that GenAI spend. You can see business applications at 13%, non- IT departments 12%, outsourced services at 12%, and then marketing departments at 8%. So these budgets are coming from other places and the line of business has skin in the game.

The implication is that AI investments are going to have to start throwing off positive cash flow or business line managers will be under pressure. That pressure will ripple through the organization and cause a potential backlash. The reality is the super high value AI projects will take many more months or even years to pay super large dividends at most companies. While technology progresses quickly, organizations’ ability to absorb it broadly is not trivial. As such the macro picture won’t see the effects of AI for 12-18 months at least and there could be some pain in the meantime.

Most Organizations Spend Less than $500,000 on AI Annually but Big Spenders Skew the Data

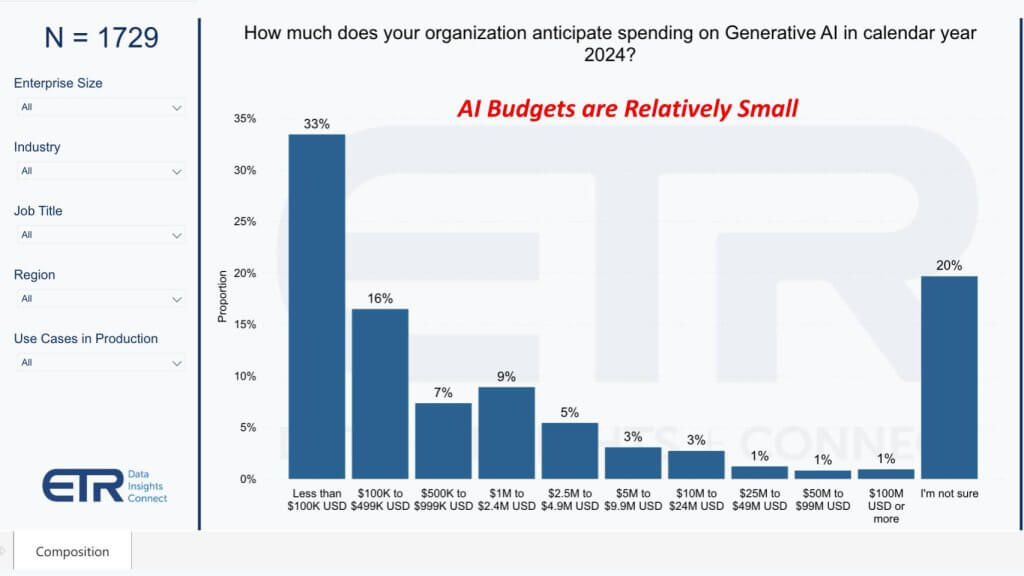

Let’s look at the AI budget distribution in this next chart below. Here ETR asks: How much does your organization anticipate spending this year on GenAI?

As you can see above, the number one response, 33% of the 1,700+ say less than a hundred thousand dollars annually. This is interesting because you see some big spenders out to the right, spending 2.5 to 5 million, 5 to 10 million and 6% of customers spending more than $10M annually. These big spenders skew the data and we’ll touch on that in a moment. But generally, IT budgets allocated for AI are still relatively small.

Cloud Adoption Continues to Steadily Advance…Repatriation Still not Thwarting Cloud Growth

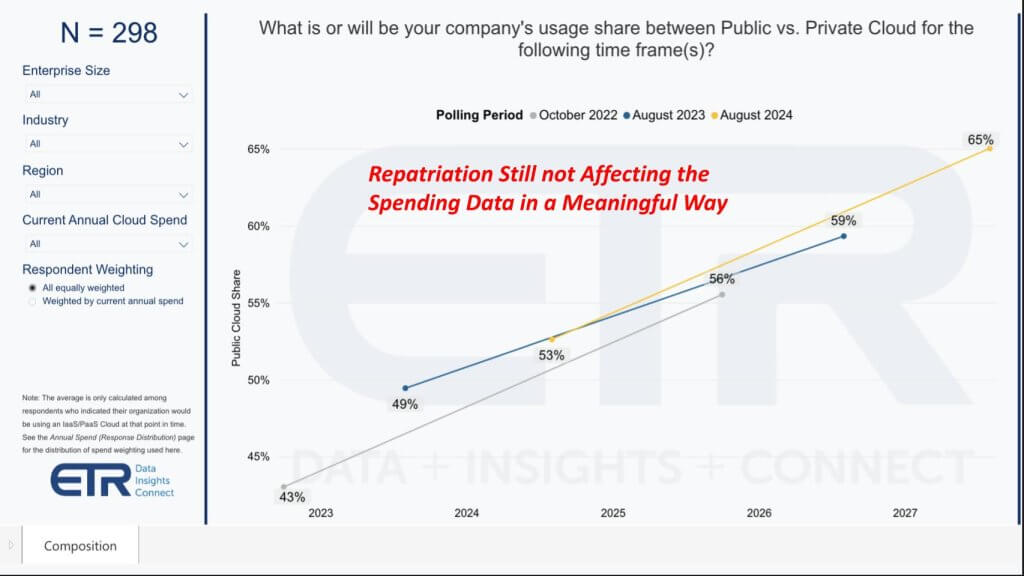

Before we dig into the AI spending skew, let’s take a look at some new data on cloud adoption. Below we show cloud adoption trends. ETR asks: What will be your company’s usage between public and private cloud for the following time frames?

Above we show data from three survey periods, October 2022 (gray line), August (blue line) and the most recent October survey (yellow line). As you can see the cloud expectations continue to improve. This is a smaller sample of 298 decision makers but still, meaningful.

While we know from anecdotal conversations that there is definitely some repatriation happening, with customers complaining about cost in particular. Nonetheless, it just doesn’t show up in the macro numbers.

Cloud is Fundamental to Organizations’ AI Plans but the ROI Math is Still Elusive

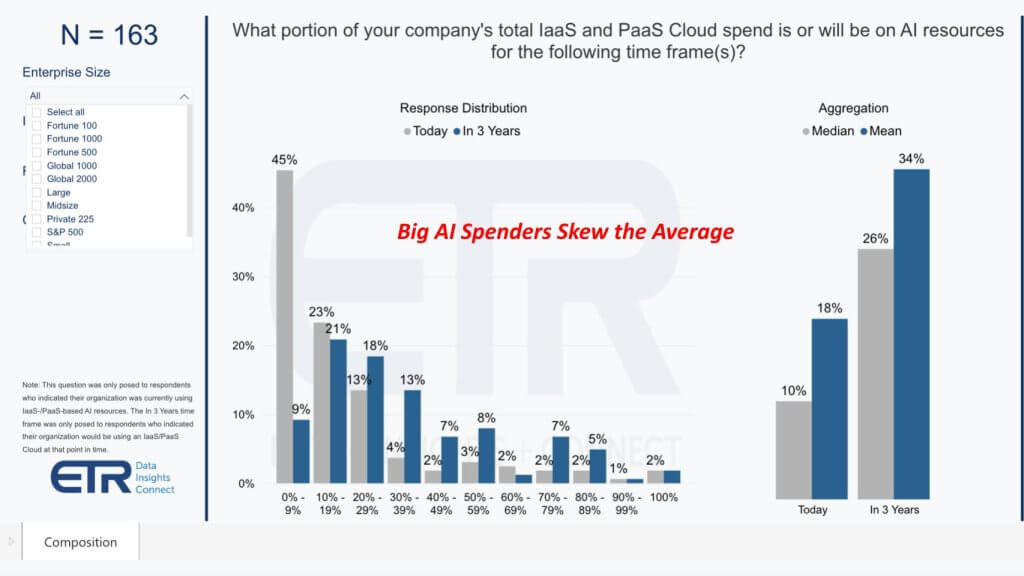

Below we show the proportion of a firm’s total cloud spend that is being spent on AI resources. Again a smaller N but this graphic shows the distribution on AI. The gray is the median or midpoint and the blue is the mean or average.

Look at how the companies leaning into AI skew the average above. You can see, for instance, if you look at the proportion that is spending zero to 9%, the median is 45%. The mean drops down to 9%, indicating that the big AI spenders skew the data. You can see as you get to the rightmost portions of this chart, the 20 to 29% pops up to 18% of the sample and that’s where the blue bar becomes dominant.

If you go all the way to the far rightmost section of this chart, you can see today the median or midpoint is 10%, the mean is 18%, and that grows to 26% and 34%, respectively, three years out. Now, if you think about the amount of CAPEX, the hundreds of billions, that is being spent on AI right now by hyperscalers, and you compare that to the cloud revenue it’s a little scary in that the customer expectations are not justifying the massive cloud spend in the next three years.

Take, for example the big four cloud revenue of around $200 billion in 2024. And let’s say it’s going to grow within three years to about $300 billion. If only a third of that is really going toward AI, you’re talking about big numbers, 100 billion. But it pales into comparison to what’s going to be spent in that timeframe on the AI buildout. Now, the caution I would say is that a lot of that spend is going to be on embedded AI inside of infrastructure, inside of software buried inside of all kinds of automation tools. So the numbers could be much higher than our simple math suggests.

So you have to be a little bit careful in interpreting that data. But nonetheless, we would like to see a little bit bigger numbers as it relates to that AI ROI.

Things to Watch Near and Far

Let’s look at where we’re focused in Q4 and beyond. We have a lot of external factors going on this year. The election, at least two hot wars, potentially three. The dockworkers strike seems to be settling but we’ll see how that shakes out and its impact on inflation. Jobs reports and ultimately the Fed’s actions on interest rates, which has impacted IT spending for the past two years. Obviously these are things are out of our control, but they’re definitely important factors.

AI ROI, we like to say it’s hitting singles. We’re not seeing the big giant NPVs or net present values. A lot of people get confused around ROI. They throw that term around. In fact, it’s probably worth talking about it a little bit. So when you think about, ROI it is the percent return on an investment. So think of ROI as a very simple calculation. The ROI is benefit over cost. So if you can lower the cost the ROI increases. That’s why so many CFOs want to lower the cost because it lowers the denominator and increases their return. But ROI is just a percentage. It doesn’t give you any indication of the size of that return.

That’s why we like to look at the NPV and run a discounted cash flow. So what would you rather have? Would you rather have 100% ROI on a hundred dollars, or would you rather have a one tenth the ROI on a billion dollars? You see the difference? Big percentage ROI with small returns or small ROIs with big dollars.

Then there’s the concept of break even. Break even is the it takes after you put in all the resources to get the project started (i.e. the initial investment) to make your money back. What is that crossover timeframe?

The fourth above, we’ve been talking a lot about agentic models in AI going beyond a single agent or single co-pilots. And the initial agentic models that we’re seeing such as those shown at Dreamforce. We’re going to see more at Microsoft Ignite. Hopefully even more at AWS re:Invent. The initial models, along with low code, are going to accelerate that payback period with increased productivity and better processes with existing workflows. Sometimes, we talk about paving the cow path. It’s sort of a pejorative, but if we apply AI to existing processes, that is going to make things better. It’s a good turn of the crank, but it’s not going to give you, if you go to the last point on this slide, that 10X productivity improvement that David Floyer is always talking about.

Longer term, these mature multi-agent systems that we’ve been talking about that have a harmonization layer and can connect to back-end legacy applications that contain a lot of the data, the metadata, the business logic, etc. If you can connect to those and have two-way interaction between the agents and that harmonization layer, pushing updates into those back-end systems and in real time looking at the digital representation of a business. And very importantly, an agent control framework that can enable these agents to be governed to work together in concert, and interpret top-down goals, top- down metrics, and organizational objectives to execute on a bottoms-up outcome. It’s important to remember that this is going to take a long time. This is years away before we reach this nirvana. So in the meantime, we’re going to see an S-curve emerge.

And you know what those look like. It takes a while to get things going. And we’re in the flat part of the S-curve right now. Some people will call it the disillusionment period. But really they’re talking about S- curves that haven’t yet kicked in.

We’re excited, but we really haven’t hit the steep part of the curve. And when that happens, for very little effort, you get a big return. That’s when everybody gets reignited. And so we really think that that agentic framework that we’ve been putting forth has great potential, and that’s something that we are really going to keep doubling down on.

So what do you think? What are you seeing for spending? What are you seeing in terms of AI stealing from other budgets? What are you seeing for returns on the AI investments? Let us know.