Time to Spin Out Intel’s Foundry Business

The time for Intel to shed its foundry business is now. While former CEO Pat Gelsinger made a persuasive case for U.S.-based advanced semiconductor manufacturing, his vision was flawed from the start. Intel’s foundry operation, like IBM’s Microelectronics business a decade ago, is an asset with negative value. Yet, its strategic significance for U.S. competitiveness in the AI semiconductor race cannot be overstated. If financial institutions are deemed too big to fail, then Intel’s foundry represents a similarly critical infrastructure for U.S. national interests.

Key questions about the future of Intel Foundry Services (IFS) demand answers:

- Is U.S.-based advanced manufacturing vital to national security and global competitiveness?

- Does this manufacturing need to be controlled by a U.S.-headquartered company?

- How can a spinout of Intel’s foundry operation be effectively funded?

- What stakeholders are essential for the long-term success of a spun-out foundry entity?

- How long will it take for the new entity to become competitive in the market?

This special Breaking Analysis outlines a bold plan for spinning out Intel’s foundry business, relying on multi-stakeholder investments from tech giants, private equity, and government funding, coupled with strategic partnerships with industry leaders like TSMC or possibly Samsung. Because only TSMC (or Samsung) has the necessary expertise to design, build and operate modern foundries and get to profitability in a reasonable timeframe.

The Case for Spinning Out Intel’s Foundry Business

The rationale for divesting Intel’s foundry business is rooted in harsh economic realities:

- Market Dynamics:

Intel’s x86 business, the core driver of its wafer volumes, is in long-term decline. By contrast, wafer demand for Arm processors, dominated by TSMC, is at least tenfold greater. Intel lacks the scale to compete in advanced manufacturing. - Wright’s Law and Cost Challenges:

According to Wright’s Law, manufacturing costs decline as cumulative output increases. Intel’s lower wafer volumes result in manufacturing costs that are at best 30-35% higher than TSMC’s. Compounding this, Intel lags TSMC by approximately a year in achieving competitive yields for each new process node. - Unsustainable Losses:

Intel’s foundry operations are bleeding cash. In April, the company reported a staggering $7 billion operating loss on $19 billion in revenue, with a 31% revenue decline year-over-year. This financial trajectory is untenable. - Erosion of Competitiveness:

As process nodes become more expensive (e.g., $25,000 per wafer at 2nm), Intel’s ability to remain competitive is shrinking. Without intervention, the foundry will remain a drag on Intel’s broader business, which in our view has great potential to flourish.

How to Save U.S. Advanced Semiconductor Manufacturing

Key Assumptions

- U.S.-Based Manufacturing Is Vital:

Domestic semiconductor manufacturing is essential for national security and economic resilience. - U.S. Ownership Matters:

A U.S.-headquartered entity ensures control over critical intellectual property and mitigates geopolitical risks, such as a potential Chinese takeover of Taiwan.

Proposed Solution

Intel’s board must recognize the negative value of its foundry operation and act decisively:

- Spin Out IFS as a Joint Venture:

Partner with TSMC (or Samsung) to leverage their expertise in advanced manufacturing. - Engage Strategic Stakeholders:

Secure investments from major U.S. tech companies, including Alphabet, Amazon, Apple, Meta, Microsoft, and NVIDIA, as well as from private equity firms and public funds under the CHIPS Act. We believe Elon Musk should also participate in the initiative. - Redirect CHIPS Act Funding:

Reallocate $8-10 billion earmarked for Intel to a joint venture with multiple stakeholders to ensure the long-term viability of advanced U.S. manufacturing. Redirect other Chips Act funds toward the JV.

Funding the Spinout: A Multi-Stakeholder Approach

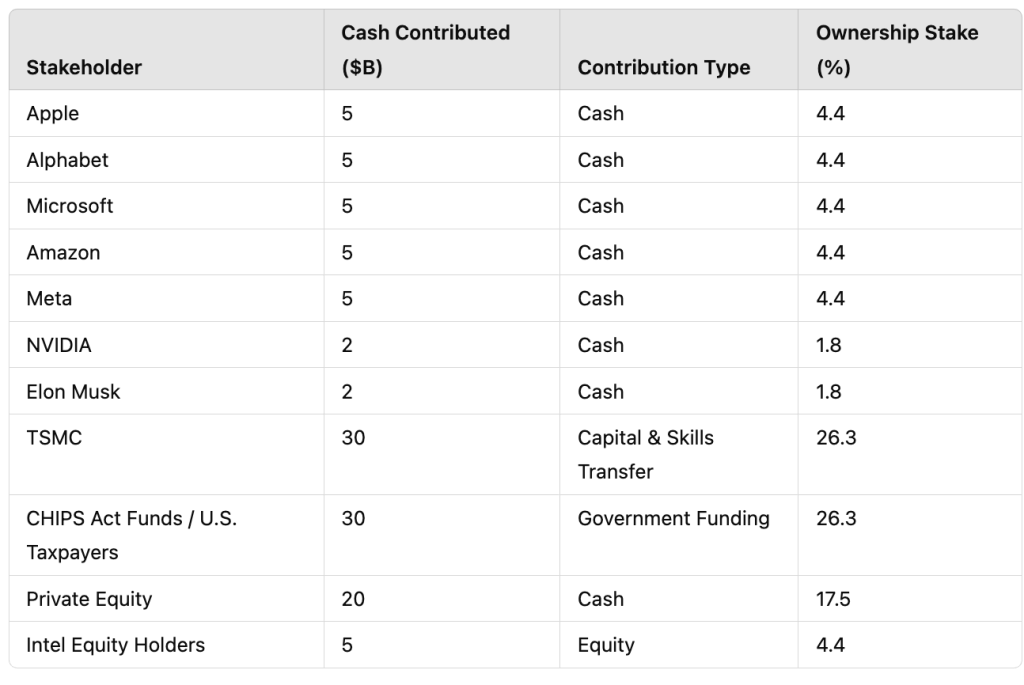

The spinout would require contributions from diverse stakeholders, as outlined in the Table below:

Note: Apple, Alphabet, Amazon, Microsoft, Meta and NVIDIA combined currently have more than $500B on their balance sheets in cash and liquid securities.

Conclusion

Intel’s foundry business represents a critical yet unsustainable operation for the company with negative net worth. The solution is not to abandon it but rather transform Intel Foundry through a collaborative approach. A spinout supported by strategic investments from tech giants, private equity, and the U.S. government will create a competitive and independent entity capable of safeguarding U.S. semiconductor leadership.

Such a venture, anchored by partnerships with TSMC (or Samsung), ensures the expertise needed to succeed while reducing Intel’s financial burden. This path not only salvages a vital national asset but also aligns with broader industry and geopolitical imperatives. Failure to act decisively risks bankruptcy for Intel and an end to achieving our leading edge U.S. semiconductor ambitions—a risk that is too great to ignore.

FAQ

- Why would Intel give away its manufacturing facilities for a minority stake in the new venture?

- For the same reasons IBM made this decision in 2014. Because Intel’s foundry business is a drag on the company and it will go bankrupt in our view trying to compete with TSMC for advanced manufacturing volumes. Every day that goes by risks losing more money and delays the resurgence of a more focused Intel. The company simply doesn’t have enough cash or time to compete in advanced manufacturing without a radical change. Moreover, its investments in advanced technology and manufacturing are of negative value and declining in our view because the cost to build and run fabs are so exorbitant. Intel cannot sustain the six years it will take to be competitive with TSMC and ten years to start making any profit.

- Why would the U.S. government support this initiative?

- Because its current plan is too reliant on a doomed Intel foundry and spreads the CHIPS Act funding too thin to have a sustainable impact. This approach dramatically increases the chances of success in our view.

- How long will it take for the JV to be competitive in the market?

- More than a decade. We think it will take at least three cycles of advanced fabs. The first factory will provide an entry point, the second will get foundry to a steady state and the third plant will cross over break even. Each cycle will last at least two years plus another year and half or two years to get acceptable yields. Our best case estimate is that it will take ten to twelve (10-12) years for the JV to become a viable competitor.

- Why would the tech giants be interested in investing in the joint venture?

- Two reasons: 1) To have a viable second source on US soil; and 2) In return for their support, the US government will agree to reasonable consent decrees for each firm and stop trying to break up the companies. It’s a small price to pay to get the U.S. government off their respective backs.

- Why would TSMC be interested in this venture?

- Three reasons: 1) TSMC would be the largest shareholder in the venture; 2) It hedges the looming threat of China; and 3) It would win favor with the US government and broader technology ecosystem.

- Why would private equity be compelled to fund this venture with such a long time horizon?

- Firms like Apollo and Brookfield have invested billions in Intel foundries that could become worthless. Other private equity firms with an appetite for long term investments and investments in other tech firms may also be interested in coming into the deal to protect their investments and secure a US-based supplier. Perhaps Softbank with its recent promise of investing $100B and Trump’s urging to make it $200B would be an excellent candidate for such a speculative, long term investment…especially given the Arm connection.

- Why Would Elon Musk be interested in investing in the JV?

- Elon of all people understands that the future of technology is dependent on a stable silicon supply chain. He can afford it, his firms, Tesla in particular, have an interest in semiconductor design and it would be a small price to pay to further cement his legacy of solving hard problems.

- Should the U.S. government hold such a large equity position?

- No. The U.S. government should divest its position over time and give the proceeds back to taxpayers in the form of debt reduction.

- Are there other stakeholders that should or could be involved.

- Yes, potentially. Given IBM’s situation with Global Foundries and its deep research and development expertise it has a lot to add to the future of this venture. IBM should be encouraged to participate.

- What about Global Foundries (GF) or other U.S. fabs like Texas Instruments (TI) or Micron, should they be involved?

- Probably not. The Mubadala Investment Company, a sovereign wealth fund of the United Arab Emirates, is the largest shareholder of GlobalFoundries and probably is too controversial to be included. As well, GF and TI are focused on less advanced silicon process technologies and are doing well within their focused market segments. Micron’s fabs are focused on memory, including high bandwidth memory (HBM), another critical component of AI but not critical to the venture.

- What about Broadcom and other key players like the EDA firms?

- Possibly but these firms don’t have the balance sheets of the largest tech firms mentioned above.

- What about the U.S. Department of Defense and Nato, should they contribute to the JV?

- Yes. We believe that would be a productive use of funds.

- Why not just start from scratch with a blank piece of paper and create “U.S. Semiconductor, Inc.?”

- Because in our view this would double the time it would take to achieve competitiveness and breakeven. Intel has the physical plants and it has approximately $100B of plant, property and equipment (PPE) on its balance sheet. To recreate those assets from the start would be significantly more expensive. Despite Intel’s troubles it has made major progress toward advanced manufacturing and it gives the initiative a good head start.

- Given Intel’s PPE contribution, shouldn’t it have a greater stake in the new entity?

- Probably. The real value to Intel is getting its shedding its foundry baggage so it can singularly focus on innovation in design. Much like AMD, when it shed its foundry, Intel will be a formidable force in semiconductor design. But it should receive residual benefits in the form of priority access to fabs and preferred pricing for some time in exchange for its contributions.

- What will be the governance structure of the new entity?

- In our view there should be a balance of power both for the operational makeup and board level presence. TSMC is contributing critical IP so it must have a say in how the entity is run. At the same time the entity will be a U.S.-based firm and it must have an executive team and independent board that is dedicated to the mission of returning U.S.-based manufacturing to competitive prominence. No individual stakeholder should be able to carry so much weight so as to alter the trajectory of the JV from its important mission.

Photo: Intel