The Microsoft OpenAI partnership has catalyzed a massive CAPEX buildout and a run on GPUs. To give you a sense of the scale, last quarter alone, AWS, Google, Microsoft and Meta allocated around $40B in CAPEX specifically for cloud computing buildouts – much of it for GPUs and related AI infrastructure. To date, enterprise Gen AI adoption has taken place as useful but mostly “chatty” experiments, dominated by activity in the public cloud.

But just as cloud-first remains “hybridized” – i.e. a more balanced approach between on-prem and public cloud workload placement, we believe a similar pattern will emerge with AI and more specifically what we’re calling hybrid AI. To be clear, our data shows that public cloud growth for AI workloads will continue to expand at a significantly faster pace than those on-prem workloads– perhaps triple the rate. But data locality, data sovereignty, legal, compliance and privacy concerns, combined with a capable and trusted group of traditional on-prem players, creates an AI workload tug of war that will allow the hybrid plays to capture their fair share of AI momentum.

In this week’s Breaking Analysis, ahead of IBM Think and Dell Technologies World, we shine a spotlight on these two firms as leading examples of hybrid AI players that we believe will benefit from the AI wave that is upon us. And of course we’ll share several survey data points from ETR to support our assertions.

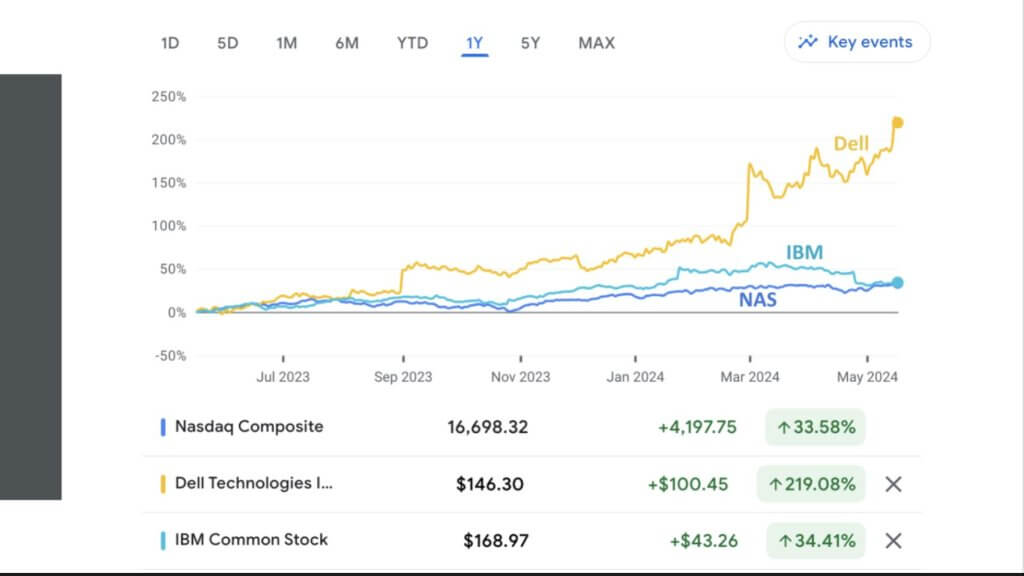

Dell has Become a Hot Stock and IBM is Outpacing the Nasdaq

Let’s look at the stock performance of Dell, which has been remarkable and IBM, which has kept pace with the tech-heavy NASDAQ in the past 12 months.

If you blinked you might have missed the run up on Dell’s stock. Don’t look now but with the recent rally in the market, Dell is worth more than $100B and finally has a valuation that’s more than 1X revenue. It wasn’t that long ago that Dell was trading at 25 cents to the revenue dollar. The company has made incredible progress and despite revenue contraction, its cash flow has been stellar. Dell has been hitting estimates and guiding strong while at the same time aggressively returning cash to shareholders. That combination along with its AI positioning has been a winning hand for the company and its investors as its stock price has more than doubled in the last twelve months. This despite the fact that Dell remains largely a hardware company without a substantial contribution from high margin software.

IBM had been significantly outpacing the Nasdaq up until its last earnings release when it missed its revenue forecast and grew in the low single digits. IBM had been consistently beating and this past quarter was a disappointment to investors. But the company affirmed its free cash flow guidance of $12B this year and stated a Gen AI backlog that is over $1B.

Historical Spending Patterns on IBM Platforms Have Tracked Company Performance

Let’s look at IBM in a historical context and share some ETR data on the subject.

After IBM’s earnings disappointment, this author put out a statement on LinkedIn citing continued enthusiasm about IBM’s prospects. The company’s focus on hybrid cloud and hybrid AI with a strong software contribution, a successful acquisition of Red Hat along with several other solid acquisitions, (most recently HashiCorp) and an R&D pipeline that is much more aligned with product output, makes us more optimistic than we’ve been in a decade. The tepid outlook from consulting is a bit of a concern for investors but in our view it is one of IBM’s massive advantages – especially as we’ll talk about later when applying domain-specific AI within industries.

Below we look at at ten years of ETR survey data from ETR on IBM.

This data above shows the Net Score granularity for IBM’s entire portfolio going back to January of 2014. Net Score is a measure of spending momentum. Within the latest ETR survey, for example, there are 994 IBM customers. Net Score calculates the percent of those customers that IBM is adding as new (lime green), the percent spending 6% or more (the forest green), the flat spenders (the gray), those where spending with IBM is down 6% or more (the pink) and the bright red is containment or churn of IBM platforms. Subtract the reds from the greens and you get Net Score which is that blue line, which Nets out in the latest survey to a less than steallar 9.6%. That means on balance only 10% of those 994 customers are spending more on IBM’s platform when netting out those that are spending less. That blue line underscores the trajectory of IBM’s overall performance for the past ten years. But, its momentum from a customer spending perspective appears to have bottomed and is headed in the right direction where both the tops and bottoms are higher. We’ll of course have to wait and see if this trend holds but we believe it will.

The yellow line is Pervasion in the survey – i.e. the 994 divided by the total survey N of more than 1,800 respondents. That’s a huge market presence, reflecting IBM’s large installed base of customers.

IBM’s major business challenge in our view remains the pace at which it can modernize its portfolio. It has a lot of legacy baggage that puts downward pressure on revenue and the growth portfolio isn’t yet big enough to offset that. As the growth areas catch up we expect the substantially better customer focus will pay off for the company.

In our view, there are three keys to IBM’s modernization: 1) M&A that fills gaps and can help pick up slower growth areas; 2) Leveraging Red Hat OpenShift and RHEL across its portfolio where it makes sense to modernize assets; and 3) Turning organic R&D into product innovation and getting to market in a timely manner. We believe IBM management is highly motivated and focused on these priorities along with an improved execution ethos at the company.

Diamonds in the IBM Portfolio

To highlight the point that growth parts of IBM’s portfolio are showing promise and supporting the premise we laid out above, we cherry picked the ETR data focusing on areas that have spending momentum. Take a look at the data below. This is the same methodology as the previous chart but isolates on Red Hat offerings, Apptio, Turbonomic, watsonx and some other growth areas. Note that IBM’s Net Score doubles from 10% to 20%.

Unfortunately, IBM can’t cherry pick like we can – it has to report on its entire portfolio and because that portfolio is so large it will naturally ebb and flow. It’s almost impossible to see a company of this size with such diversity firing on all cylinders. So that is both a blessing and a curse in that if one part of the business is underperforming another can pick up the slack. But the reverse is also true.

By the way – if we were to add in HashiCorp to the mix it would add 300 accounts to the story with a Net Score of almost 40%, which is a highly elevated figure. So that acquisition both fits IBM’s hybrid infrastructure strategy and provides an accretive growth cog in the IBM engine. We like the move.

Premise: Hybrid Cloud Momentum Translates to Hybrid AI

The topic today is hybrid AI. Below is some ETR data that shows how the big spenders in the Fortune 100 are rethinking their cloud workload placements.

The N is small at 32 but we’re talking about 32 in the Fortune 100. We use this as a proxy for big spenders and while the data is a year old, we have published many times data showing the percent of customers that are hybrid. About 86% of organizations in the ETR sample manage hybrid environments. This data shows a meaningful shift in the out years with respect to expectations of where work will get done; as forecasts for public cloud use drop from 70% in 2026 to around 60%.

It’s worth noting that the overall survey shows the same percentage of customers – 59% in the out years and that is both slightly higher than the overall survey and up from around 43% today. As such we don’t want you to be misled – this is not a repatriation story. It’s one of balance and specifically in our view, the fossilization of mission critical workloads running Oracle, IBM mainframe transactions and core on-prem apps – those are still not moving to the public cloud in a meaningful way. They’re largely staying put and spending on-prem for those workloads will continue.

Given the likelihood that hybrid cloud is a fact of life and will continue to be the dominant trend, we expect firms to bring AI to the data within those on-prem workloads and as such, AI will follow similar patterns to hybrid cloud. The action will start in the public cloud where experimentation is simpler. Public cloud AI growth will be higher. But domain-specific AI will begin to emerge and much of that will be on-premises.

IBM’s Hybrid Gen AI Offerings

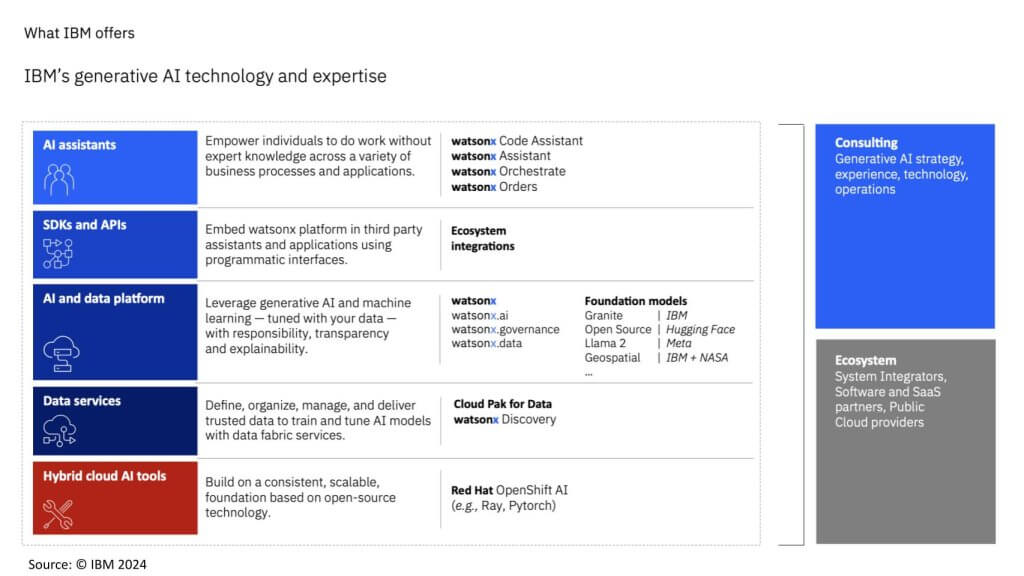

Coming back to hybrid AI generally and IBM’s Gen AI story specifically, here’s a picture of the company’s AI capabilities as depicted by IBM.

The bottom layer comprises core infrastructure built on open source with Red Hat OpenShift, Enterprise Linux and Ansible. We would also consider IBM’s Z AI capabilities and the firm’s relationships with public cloud providers as part of the core infrastructure story.

Moving up the stack to watsonx with .ai, .governance and .data. In our analysis IBM has a strong story with “Watson 2.0” that it will infuse both within its portfolio and throughout its customer and partner ecosystem. The chart above also depicts SDKs and APIs for watson that can power third party apps. But remember too that IBM has its own fairly massive SaaS portfolio that it has built up over the years, much of it through M&A, in areas like supply chain, governance, finance, analytics, statistical analysis, business process and so forth. All of these will be injected with AI.

At the top of this chart are watson copilots or what IBM calls its AI assistants – things like coding assistance. And not shown here but overlaying all of this picture are IBM’s consulting services. This is a unique differentiator for IBM in our opinion. IBM is really the only firm on the planet – or at least in the US, with the type of R&D capabilities IBM possesses, combined with truly world class services that can compete with the likes of Accenture and the leading GSIs.

Remember too – while IBM shed its microelectronics fabs it still has major silicon design capabilities in AI and Quantum computing, which must be considered in its asset stack.

In our view these capabilities will support domain-specific models that will start to take hold in the market later this year and into 2025 and beyond.

Shining the Light on Dell and its Hybrid AI Prospects

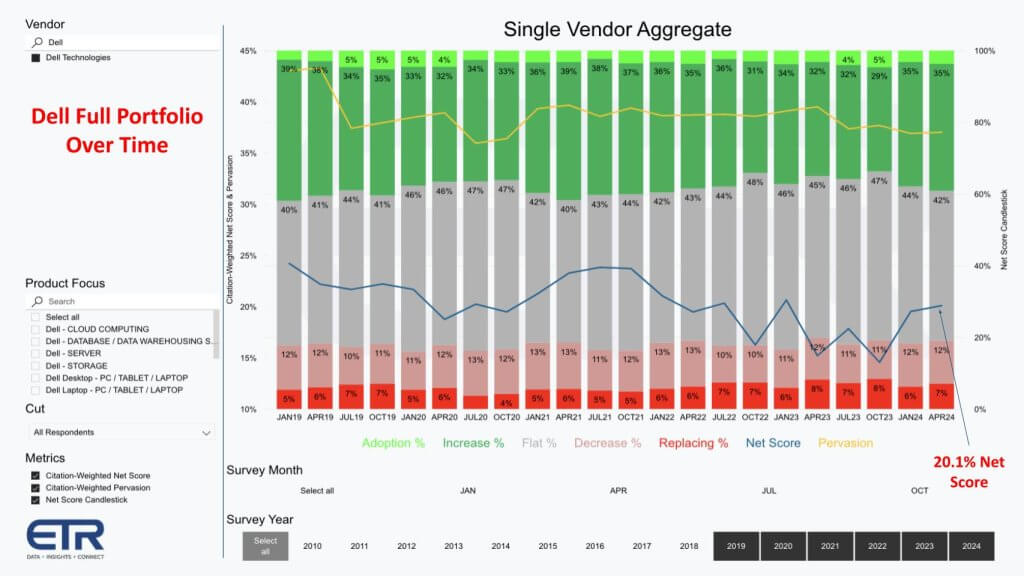

Let’s shift gears and talk about Dell. Below is a similar look at Dell’s Net Score or spending momentum profile over time.

We won’t go as far back as we did with IBM because the EMC acquisition skews things a bit. But Dell is a completely different animal than IBM from the standpoint of its product portfolio. Dell is a product company first with services that are designed to accelerate adoption of its products, but the company is not a global GSI with deep industry expertise. It has some but also partners extensively with GSIs for depth.

You can see above, the blue line bumped up during COVID because of remote work and the need for laptops. Dell’s legitimate claim is they are really the most capable end-to-end infrastructure technology company from laptops to servers, storage with a large portfolio that stretches from data centers to the cloud and all the way out to the edge.

The company’s overall Net Score for its portfolio is 20%. Again that means 20% of the 900 Dell customers in the ETR survey are spending more when you subtract out those spending less. And you can see the downward pressure coming out of COVID as demand for PC’s waned but you can also see the uptick from a combination of an expected Windows refresh, AI PCs, AI servers and an tailwind in storage performance.

Almost overnight, Dell has become an end-to-end AI infrastructure play. That is fantastic positioning.

However, Dell has a similar challenge to IBM in that it has a large legacy installed base which pressures revenue growth. Unlike IBM, Dell is also highly susceptible to fluctuations in PC demand. But Dell has a much less complicated portfolio than IBM and one that COO and Vice Chairman Jeff Clarke took to rationalizing years ago after the EMC acquisition.

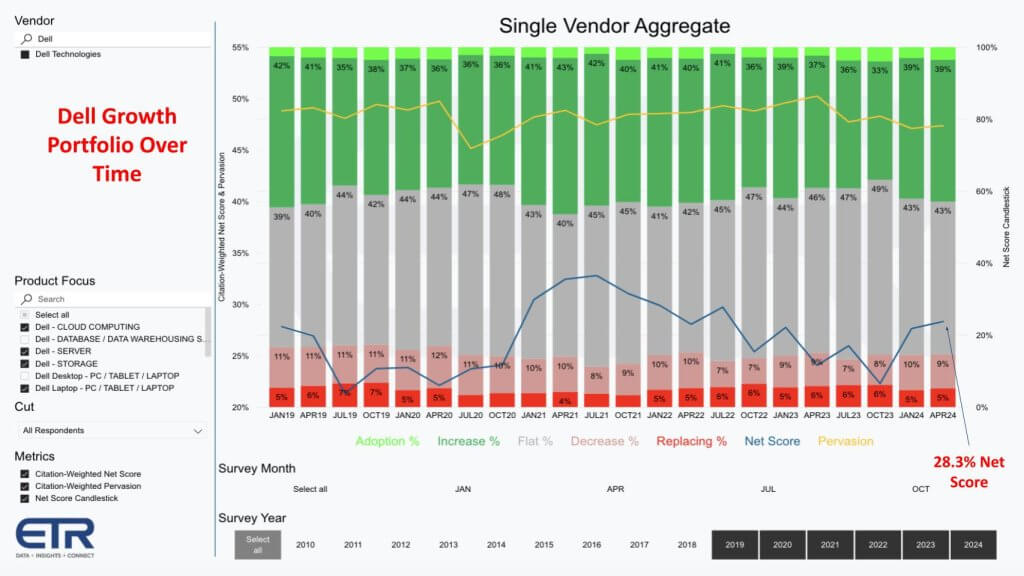

Examining The Performance of Dell’s Growth Portfolio

Like the IBM example we shared above, when you cherry pick the ETR data in Dell’s portfolio you get an uptick in spending momentum on Dell’s platforms.

You can see above the Net Score jumps from 20% to 28%. The decline coming out of the isolation economy appears to have bottomed and is headed in a positive direction, similar to IBM’s trajectory but for different reasons, most notably a Windows refresh. We’ll see going forward if this trendline holds. But our expectation is that it will with the AI tailwind coming out of NVIDIA GTC, which should power AI servers, a PC refresh and storage product momentum.

Dell is Doubling Down on NVIDIA

Remember Dell got a big stamp of approval from Jensen at GTC when he anointed Dell as the best end-to-end technology infrastructure player. It was a remarkable moment and huge commercial for Dell that has given the company AI momentum and an imprimatur from the leading AI chip company.

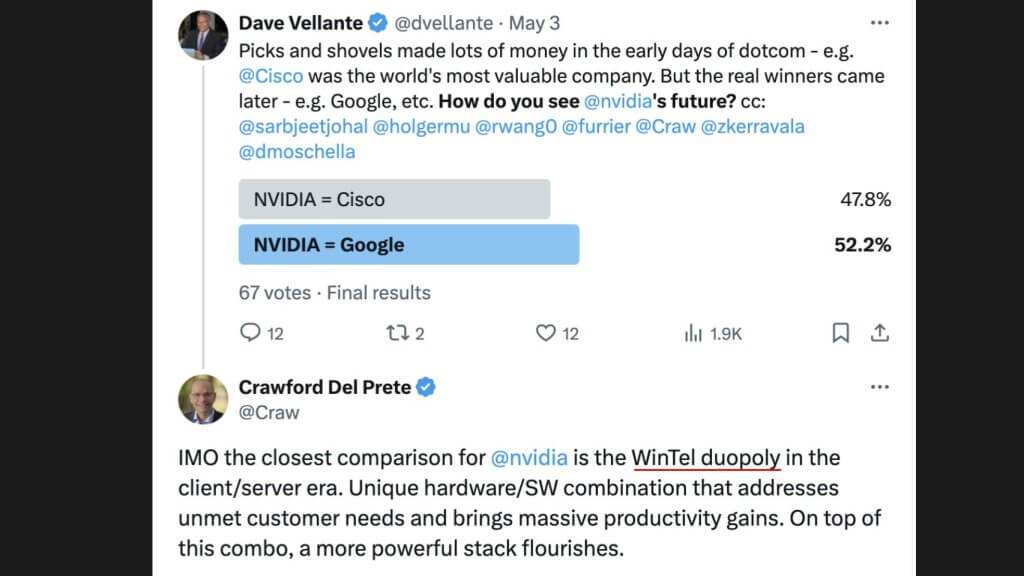

As a fun little aside…earlier this month we put out a poll asking our community is NVIDIA the Cisco of AI (remember Cisco was the most valuable company during the dotcom boom); or is NVIDIA Google, a company that really ascended after the dotcom bust.

The consensus from the community was almost a 50/50 split. But Crawford Del Prete, the CEO of IDC, had the top comment when he said the best comparison with NVIDIA is the WinTel duopoly with a unique hardware and software combination that changed the productivity game. The difference is that was a virtual monopoly whereas NVIDIA is a single company.

What Does This Have to do With Dell?

Well just as Michael Dell bet his company on the WinTel standard, he and Dell are betting big on NVIDIA. The big news for Dell out of NVIDIA’s GTC conference was the Dell AI Factory with NVIDIA.

AI Factory is a term Jensen coined. It implies that traditional data centers will all shift toward accelerated computing. Every device, every server, every piece of software running in cloud data centers, on-prem in colos and at the edge will be AI infused. And this becomes a virtual AI Factory. Jensen is essentially giving this term to Dell for its marketing. This is a genius marketing play in our opinion and makes Dell relevant in the AI conversation as the leading end-to-end infrastructure player for AI.

This stack diagram above shows end-to-end infrastructure from core to edge to cloud. With compute (lots of GPUs from NVIDIA), networking, storage, PC’s and presumably APEX is the as-a-Service subscription piece. Then NVIDIA’s software on top – i.e. the AI operating system if you will…like Microsoft’s OS. Then services above that with use cases on the very top focused on getting your data house in order, training, inference, retrieval augmented generation (RAG), etc.

Now this is not to say that Dell is dumping Intel or AMD or Microsoft. By no means. It’s adding to its capabilities but Michael Dell has “cut the line” in the AI race and is going all in with NVIDIA. This is a great move in our view to leverage Dell’s size, scope and supply chain prowess to increase its relevance to customers…and use the concept of the AI Factory as a marketing framework that resonates with customers.

We’re super curious to see how Dell positions the AI Factory at Dell Tech World next week and what additional features, capabilities and/or partnership details it adds.

Premise: Gen AI will Become Increasingly Specialized

Now coming back to hybrid AI. Let’s revisit the Gen AI Power Law put out last year by theCUBE Research team.

You may remember the concept shown above. The dimensions of the graph show size of model on the Y axis and model specificity on the X axis. The point being that we see the big CAPEX companies spending on GPUs but over time industry specific smaller models will be applied on-prem and out to the edge. Bringing AI to the data as the buzz phrase goes. The value prop being control, governance, lower cost inference and lower latency for industries like those shown above.

The other interesting piece of the Gen AI power law is the wide availability of and innovation around third party and open source models. Meta being one of the biggest wildcards but others jumping in – like Databricks with DBRX and Snowflake with Arctic. We’ll see if these two have the stomach to compete in that space long term. And we expect lots of shake outs as the capital requirements to compete in this space are daunting. But the point is Gen AI will be applied in more specific ways and much of that will occur where the data lives on-premises – supporting our hybrid AI hypothesis. Moreover, the likes of IBM, Dell, HPE, Oracle, Cisco and others will be driving products and services into the hybrid AI mix.

This is Not a Repatriation Trend

We’re not predicting repatriation here. The cloud players have the capital, the partnerships, scale, LLM optionality, AI tooling, core IaaS and PaaS infrastructure. They have major assets that will confer strategic advantage and the they will have a dominant position in the AI race. But not the only position. Traditional / legacy players have a presence in AI accounts and will compete for business.

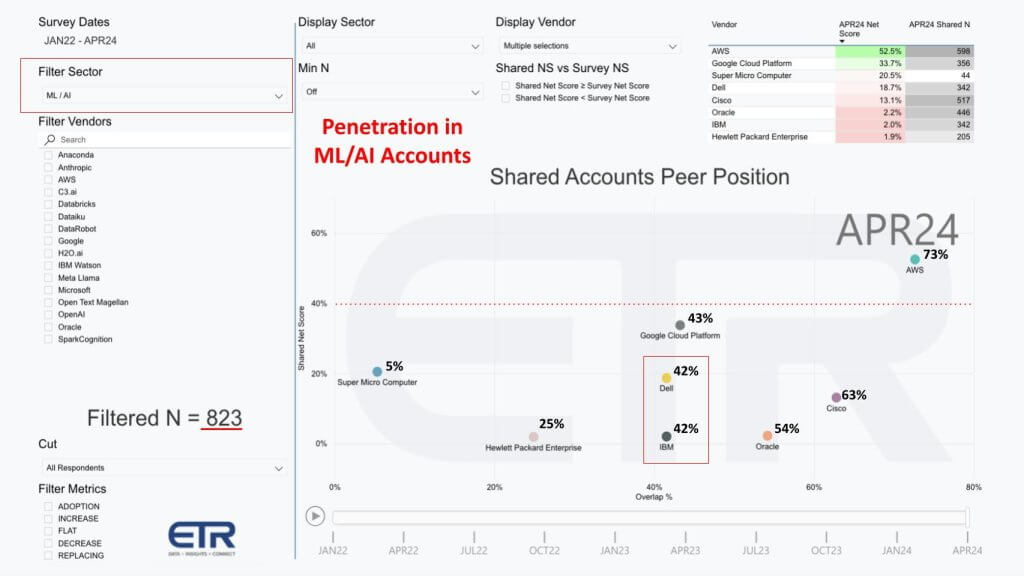

Let’s take a look at some ETR data in this regard.

Above we show a two dimensional view where we’ve filtered on 823 ML/AI accounts. The vertical axis is Net Score or spending momentum. The horizontal axis shows account penetration or Overlap in those 823 AI accounts. We plot SuperMicro with a 5% account penetration, HPE at 25%, Google Cloud at 43%, Dell and IBM at 42%, Oracle at 54%, Cisco at 63% and AWS at a whopping 73% overlap. Note the table insert in the upper right which shows Net Score and the Ns in the ML/AI sector for each company.

We don’t show Microsoft on this slide because they are so dominant it skews the data. Microsoft is ubiquitous.

Remember this data represents all products and services, not just AI products. The data here depicts presence in the AI accounts. The key points are: 1) AWS and Microsoft have a very strong presence inside of the ML/AI accounts today and that will continue; 2) Google is behind those two but other data we’ve shared shows Google gaining ground in the AI sector when evaluating specific AI product momentum; 3) The on-prem players, including IBM and Dell, have a major presence in leading AI customer accounts and will vie for a piece of the pie.

What We’re Looking for at IBM Think

Let’s close with what we’re going to be watching at both IBM Think and Dell Tech World.

IBM Think 2024

Hybrid AI. First, with the Red Hat acquisition, which was led by Arvind Krishna, IBM is All in on hybrid. We expect this positioning to translate into hybrid AI. The mindset in cloud has shifted from cloud first to phrases like cloud-balanced, cloud smart, or…hybrid cloud. We expect a similar balanced mindset in hybrid AI, with the proviso that the likes of IBM, Dell and others must keep pace with LLM optionality, surrounding infrastructure, partnerships and the like. The on-prem firms don’t have to copy the cloud players but they have to have enough innovation in their portfolio to compete. Otherwise the lower TCO argument and the FUD of privacy concerns will give way and the public cloud players will dominate.

Open. IBM is also all in on open source, and we expect IBM to build on the momentum coming out of Red Hat Summit. In Denver, Red Hat touted RHEL AI and brought together IBM’s open source-licensed Granite LLM and InstructLab model alignment tools. Expect IBM to build on that news and demonstrate its synergies with and contributions to the open source community.

Trust and AI ROI. We expect IBM, along with other hybrid AI players, to feature their plans to take customers beyond the experimentation phase into substantive ROI…along the Power Law of Gen AI curve. We’ll be watching for real world examples of domain specificity.

M&A Showcase. We expect IBM to showcase some of its recent acquisitions and how they’re driving customer value – Apptio, Turbonomic and of course HashiCorp and others – demonstrating how to drive automation and inject AI into core IT ops with these offerings.

Ecosystem. Finally, IBM must in our view, continue to expand its ecosystem partnerships with cloud players and importantly SaaS vendors and other partners leveraging watsonx tooling.

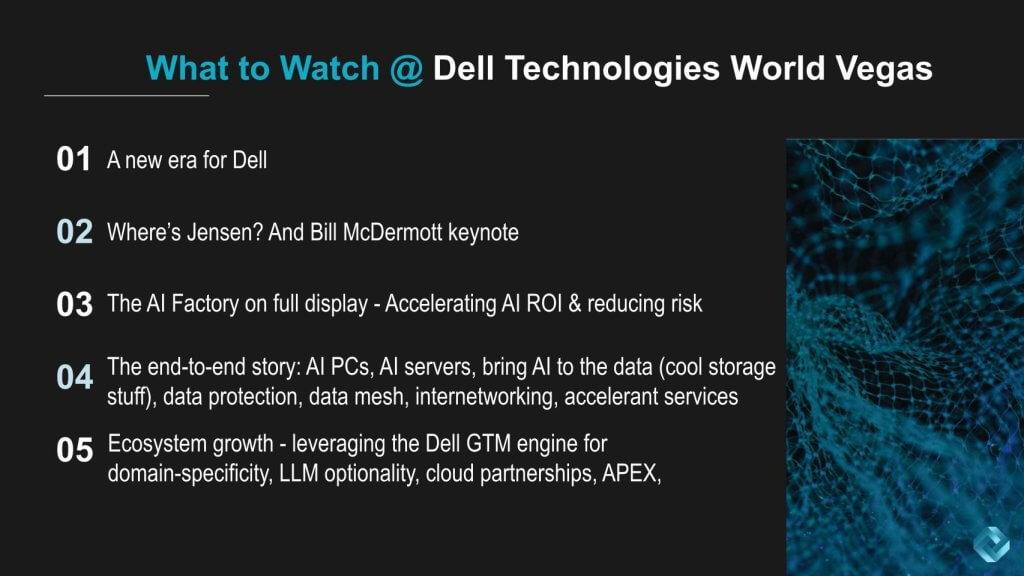

Dell Tech World 2024

New Era for Dell. Dell in our view is entering a new era of relevance to customers. Its EMC acquisition and financial leverage gained from VMware have been one of the most remarkable transformations in the history of enterprise tech. The AI era opens a new chapter and in Dell form its founder is leading them into this new world with a bold stake in the ground.

Where’s Jensen. Jensen is speaking at DTW – it’s always interesting to see if he does so in person – and Bill McDermott is part of the keynote – ServiceNow’s CEO – what’s that all about? Is it a partnership? Are they a two way customer? Is there a big automation play there? We’re going to find out.

The AI Factory. Dell is going hard after the AI Factory messaging and will likely be touting how they are the safe and trusted bet to drive ROI and lower risk. It’s unlikely that Dell will alienate its other silicon partners including Intel, AMD and Broadcom. Broadcom’s Charlie Kawwas is one of the keynote speakers. Broadcom provides critical silicon glue to bolster Dell’s interconnect story as it builds out large GPU clusters. Not only does AI need GPUs but it needs a way to connect all these components together at high speeds. Moreover, Dell in our view must show examples of solutions and not only showcase the tech but also how to apply the technology.

End-to-End AI. The end-to-end story will be on full display – AI PC’s, servers, bringing AI to the data, new storage announcements, data protection momentum around cyber resiliency, data mesh with the Starburst partnership, server-led internetworking to support AI workloads, simplifying RAG and other AI innovations.

Ecosystem. As with IBM, partnerships are critical. Both those that are selling through Dell’s channel and also helping Dell keep pace with the cloud players in AI. Capabilities like LLM optionality, cloud partnerships, driving domain specificity along the Gen AI power law notion and delivering it all as a service will be important items to watch at DTW this year.

It’s going to be a big week for theCUBE. We’ll be broadcasting from both IBM Think in Boston. Think used to be a giant event – it’s been substantially scaled back and is much more intimate now with a few thousand attendees.

Dell we expect to be bigger. In 2023 we’d estimate around 7,500 people attended and we expect with Dell’s momentum this year’s event will be over 10,000 attendees.

We’ll also be at Informatica World so check out all the action on thecube.net. John Furrier, Savannah Peterson, Shelly Kramer, Bob Laliberte, the SiliconANGLE journalists and our social media team. And Rebecca Knight with Rob Strechay at Informatica World. Yeah big week.

Are you going to these events? Stop by theCUBE and say hello.

How do you see hybrid AI playing out? Let us know your thoughts and thanks for watching/reading and engaging.

Image DALL-E